Looking at the crypto market from the stock market: What can we learn from the uneven distribution of capital?

Text: Nic Carter

Compilation: Coin Trust Research Institute

Editor's Note: The original title was "Learned from the uneven distribution of capital"

As the cryptocurrency market continues to shift from a retail-focused, unrestricted global altcoin casino to a more constrained and regulated environment, it is necessary to narrow the scope and consider the long-term distribution results that may occur in the market. Cryptocurrencies are designed to allow the free flow of business and capital without being affected by human-set national borders. However, when it comes to securities, the state tends to intervene.

- In-depth exploration of Forbes blockchain 50 product data: Which two fields are most concerned about?

- TOP 30 series observations: Q1 average holding income range is 148%, halving the market shows power

- After bitcoin cash halved, the hash rate dropped and prices moved smoothly

There are good reasons for this: securities are high-risk markets that control the distribution of productive capital, and for the securities market to function, the country needs to enforce fairness, openness, and information symmetry. In fact, the best example I can think of in support of the securities law is the anarchy and massacre shown in the 2017 ICO boom. If the blockchain capital market matures from these early dilemmas, and some of these equity-like assets become viable, then they will definitely be linked to local jurisdictional rules. In terms of the degree to which tokenization and crypto-wrapped securities have become investable, I dare to take the risk that despite the global nature of the crypto industry, the US is preempted by competing issuers Took the lead.

Twisted map tells us about equity

It is often said that because of the crackdown on cryptocurrency projects, especially those that issue false equity in the form of tokens, the SEC is “pushing innovation abroad”. This may be true. This is also a reductive view. Capital will be gathered in jurisdictions that understand the rules, respect property rights, and properly distribute power between shareholders and directors in the legal system. Therefore, the implementation of various long-established rules—these make the United States the world ’s most active stock market in the cryptocurrency space—can be understood as hostility to issuers or asylum to investors. In the analysis of supervision, the latter point of view is completely ignored.

When issuing stocks, standardization is a godsend. If you work in a startup, you will probably understand the nuances of Delaware C corp or YC SAFE. When issuers choose these tools to raise funds, they choose a rule and legal environment that the founders, venture capitalists, and law firms can all understand. This usually only requires cheaper investigations and less legal fees. In fact, some venture capital funds only invest in Delaware C. This is just an anecdote, but it hints at a bigger picture: investors like predictable and understandable structures. They like to know where they are relative to the founder, and what recourse they have if something goes wrong. Globally, small differences in judicial predictability can lead to very different results.

You may be surprised to find that the United States accounts for 26% of global GDP, but accounts for a staggering 40% of global public equity capital. The use of statistical maps can best illustrate this point. The function of the statistical map is to keep the shape unchanged (or at least try to keep the shape unchanged) and assign weight to the land area through certain variables. Let's start with the basic map projection. Here, I use the Plate Carée projection (a variant of square projection). It looks like this:

Documents from countries around the world come from ArcGIS Hub (Source: https://hub.arcgis.com/datasets/a21fdb46d23e4ef896f31475217cbb08_1)

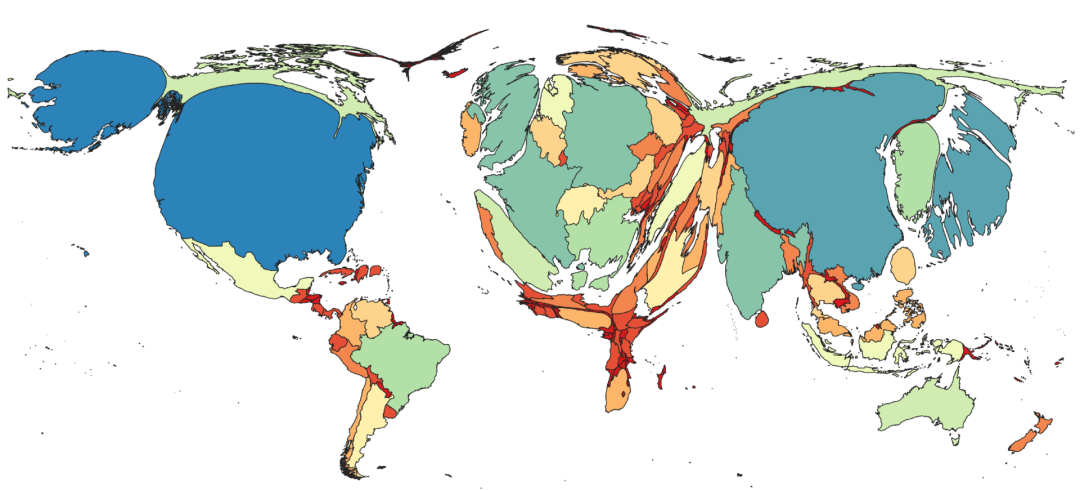

Now, we weight countries by GDP (2018) , which will give you an overview of global income distribution. This means that some more developed countries will expand, while less developed countries will shrink. But I will try to keep the overall shape of these countries so that the map is still clear and understandable.

Use Scapetoad (http://scapetoad.choros.place/) to draw a statistical map and visualize it in QGIS3.4 (https://www.qgis.org/en/site/). The 2018 GDP data in USD is from the World Bank (https://data.worldbank.org/indicator/NY.GDP.MKTP.CD)

I used colors to divide countries into different categories so that you can compare similar countries by GDP. For example, using this chart, you can judge that France (US $ 2.5 trillion), Germany (US $ 3.6 trillion), and India (US $ 2.9 trillion) are in a similar range. The same is true of South Korea (US $ 2 trillion), Brazil (US $ 2 trillion) and Italy (US $ 1.9 trillion). You can also say that Australia, Spain, Canada, and Russia have similar GDP, ranging from 1.3 to 1.6 trillion US dollars. You know.

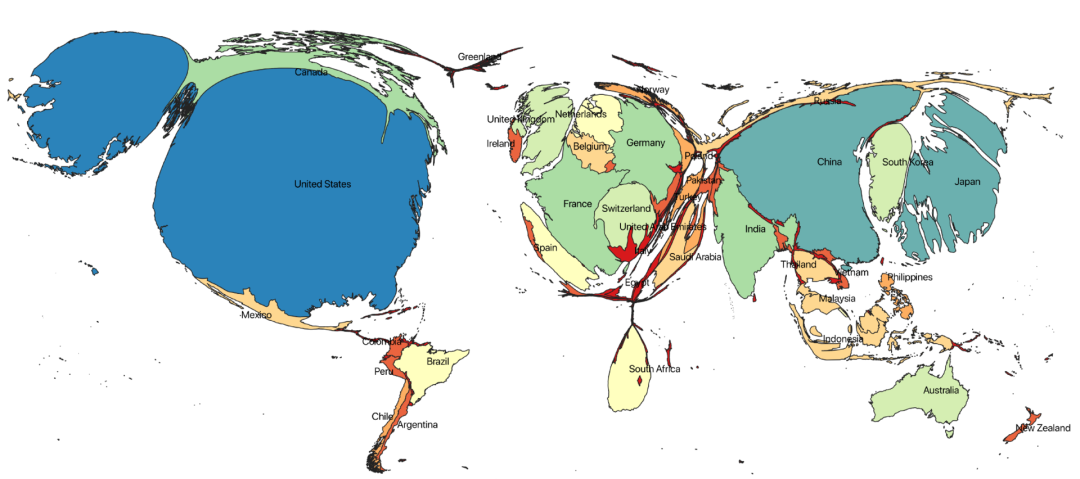

Now, if I want to ask you what the same map with domestic stock market values as the main variable might look like, you might guess it will be similar to the above. After all, the more GDP, the more money you can invest in the stock market. Interestingly, this is not the case. This is a map weighted by the size of the domestic listed stock market:

Statistical map weighted by the market value of domestic listed companies. The 2018 data comes from the World Bank (https://data.worldbank.org/indicator/CM.MKT.LCAP.CD)

Please note that there is no Hong Kong on this map, because unfortunately the open source vector file I used to build the country shape does not include it. On this map, Hong Kong accounts for approximately 50% of China. Comparing the public stock statistical map with the GDP statistical map, you will immediately notice the following points:

- Although the United States already accounts for a large proportion of global GDP, it accounts for more domestically listed stocks

- The capital markets in South America and Africa are underdeveloped, even relative to GDP

- China ’s stock market is important, but it ’s relatively small compared to its share of global GDP

- Niche / tax avoidance jurisdictions, such as Hong Kong (not shown), Luxembourg, Singapore, Switzerland, all have a large proportion

- Europe accounts for a large portion of the stock market, but below its expectations for its share of global GDP

Let's delve into the data and find the largest outliers in countries that exceed their weight from a stock market perspective.

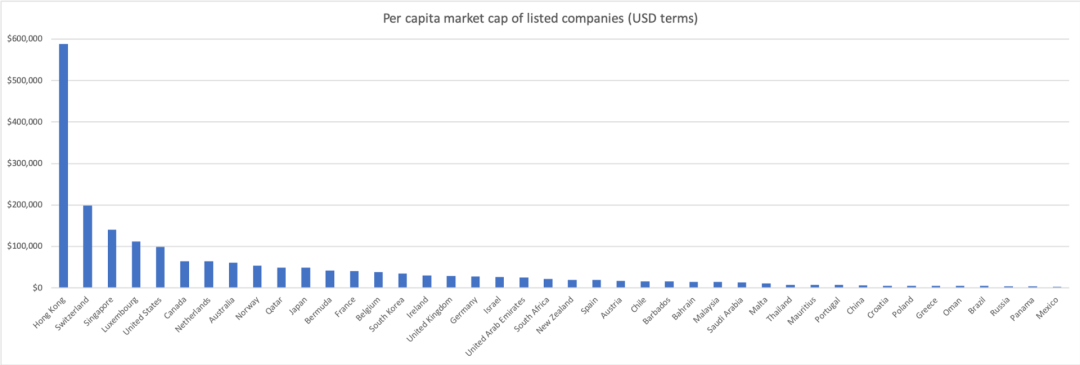

USD market value of domestic listed companies divided by population, World Bank data (https://data.worldbank.org/indicator/CM.MKT.LCAP.CD)

Surprisingly, the per capita market value of Hong Kong domestic stocks is US $ 588,000. This is unusual because many Chinese companies choose to list on the Hong Kong Stock Exchange instead of listing in Shanghai or Shenzhen. This is partly due to Hong Kong ’s less stringent listing requirements, partly due to Hong Kong ’s position as a financial center and closer relationship with Western capital markets, and partly due to Hong Kong ’s legislative, judicial, and attitudes towards property rights, which were influenced by its previous role as a British colony Influence of the status.

For more detailed information on why Chinese companies like to list in Hong Kong so much, Fanpeng Meng's "History of Chinese Companies Listing in Hong Kong and Its Implications for the Future" (https : //www.tandfonline.com/doi/abs/10.5235/147359711795344118) provides more background information:

Specifically, [existence in Hong Kong] some basic elements: a stable and sound legal system that highly respects private property rights; no exchange rate control using linked exchange rates; an efficient and advanced banking industry composed of the world ’s top banks; simple and low tax rates Taxation system, in which capital gains tax is not levied and income tax is levied geographically; and a relatively clean and transparent business environment strictly monitored by the government.

Relative to the entire China, Hong Kong ’s listed companies are of considerable size, amounting to approximately US $ 4.3 trillion, compared with US $ 8.7 trillion for the entire China.

Other countries with the highest scores in per capita market capitalization include tax havens such as Switzerland, Singapore, Bermuda and Luxembourg, and developed countries such as the United States, Canada, the Netherlands, Norway and Japan. Regional financial centers such as Qatar, the UAE and South Africa also scored high.

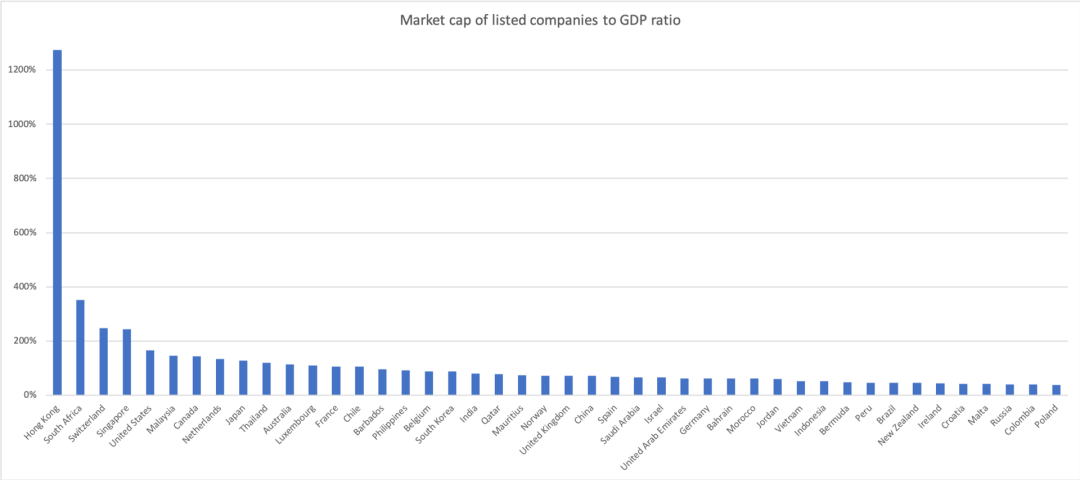

Another similar measure is the ratio of total market value to GDP. This combines the above two statistical maps, so you can find the largest outlier without looking at the map.

Ratio of USD market value of domestic listed companies to 2018 GDP, World Bank data (https://data.worldbank.org/)

Compared with the per capita indicator, this indicator is more suitable for selecting countries with a lower overall development level but still having a larger equity market relative to the economy. Hong Kong has once again become a prominent outlier. Surprisingly large stock markets also include South Africa, Malaysia, Thailand and Chile.

South Africa is an interesting case study. In Africa, there are only three meaningful local stock markets-Nigeria, South Africa and Egypt. South Africa, which has many British systems, is the bustling former British colony in history and the largest of the three countries. There is very little literature on the development of sub-Saharan African stocks.

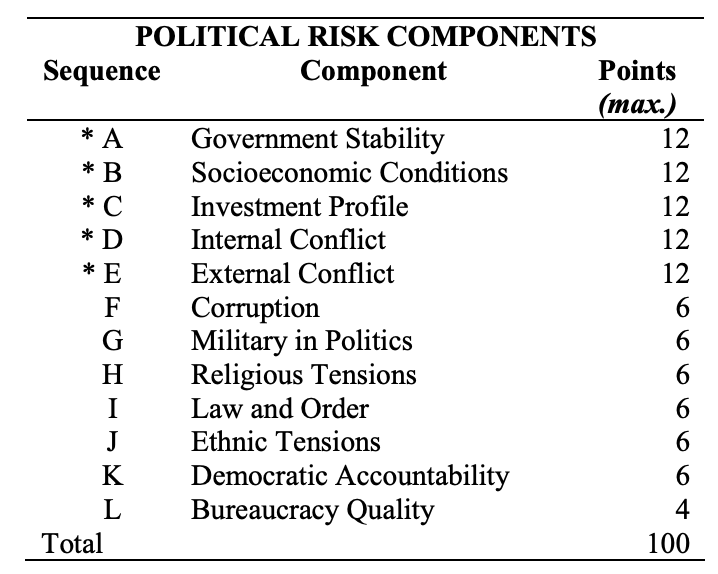

Determinants of political risk in the International Country Risk Guide Methodology (https://www.prsgroup.com/wp-content/uploads/2012/11/icrgmethodology.pdf)

Some answers can be found in the International Monetary Fund (IMF) working paper on this topic (Andrianaivo and Yartey 2009, https://www.imf.org/external/pubs/ft/wp/2009/wp09182.pdf). The author concludes from cross-sectional regression that, in addition to direct variables such as domestic savings and GDP per capita, the most important determinant of the development of African stock markets is political risk. This makes sense: if the military government takes over, the parliament dissolves, or the country experiences an armed uprising, the stock market will not develop. I inserted the political risk indicators that the author uses to tell you about the relevant standards. Historically, South Africa has historically been relatively free of conflict (their main conflict after independence was in the minutiae of Namibia and Angola) and has benefited from the stable rule of the ANC — despite the deterioration of political conditions in recent years.

My main reaction from these data is to observe that the formation of a vibrant stock market is somewhat unusual. There are a large number of factors that make it disqualified-a typical country does not actually have a liquid domestic stock market. So, what can explain the unbalanced development of the global public stock market?

Rules create markets

So why are certain jurisdictions predominant in the issuance of public stocks? Facts have proved that this particular issue has inspired incredible vitality. The basic paper in the field of definition is Law and Finance ( Law and Finance , https://www.nber.org/papers/w5661) written by La Porta, Lopez-de-Silane, Shleifer and Vishny.

If you have n’t read it yet, I strongly suggest you read it. This is one of my favorite papers in economics because its methodology is really simple: the author just studied the differences in investor protection in many countries and realized that the legal traditions of these countries can explain the large differences portion. That is, the legal tradition used in each country to stipulate the meaning of becoming a shareholder .

Specifically, the author divides the business law tradition in 49 jurisdictions into civil law and common law, and further subdivides civil law into German variants, French variants and Scandinavian Subvariant. Common law refers to the British tradition, which allows judges to shape the law through precedents. In civil law inherited from the Roman tradition, the law is usually created by the legislature, and case law (setting precedents through court cases) is secondary. .

As several authors have pointed out,

[Civil Law] originated from Roman law, using statutory laws and comprehensive regulations as the main means of collating legal materials, and relies heavily on legal scholars to determine and formulate its rules

More abstractly, you can think of common law as a bottom-up, adaptive method, and civil law as a top-down, stricter method. The corresponding differences between jurisdictions with different legal traditions are huge; in fact, there have been convincing arguments (https://www.claremont.org/crb/article/why-hasnt-brexit-happened- yet /) believes that Brexit is mainly due to disputes between legal traditions (the EU tried to impose civil law traditions on the common law of Britain, causing friction). In the words of The Economist (https://www.economist.com/the-economist-explains/2013/07/16/what-is-the-difference-between-common-and-civil-law) , "British lawyers are proud of the flexibility of their [common law] system, because it can adapt quickly to the situation without the need for parliament to pass legislation." In short, common law is considered to have a faster pace Strong adaptability is an ideal choice for the rapidly changing capital market.

Twenty-one countries in the sample inherited the French civil law tradition, many of which were conquered by Napoleon. Others are French colonies in Africa and the Pacific. Following the Spanish and Portuguese empires in Latin America, the French legal system revealed the structure of the post-colonial regime.

The British Empire led to the spread of the British legal system throughout the British Commonwealth. Surprisingly, hundreds of years later, the origin of these colonies seems to have a long-term impact on the future formation of equity. Several authors mentioned:

The laws vary greatly between different countries: an investor in France has very different legal rights than in the UK or Taiwan. In addition, a large part of this difference is due to differences in legal origin. Civil law gives investors less legal rights than common law. The most notable difference is the difference between common law countries and French civil law countries. Common law countries provide relatively strong protection for shareholders and creditors, while French civil law countries provide investors with the least protection.

Several authors listed specific shareholder rights from the mechanism, these rights to a certain extent illustrate the degree of protection of shareholders in the confrontation with directors. Some excerpts are listed below:

- One share, one vote : whether there is a law that binds shares to voting instead of double-class or non-voting stocks. The authors believe that jurisdictions with these laws are more friendly to shareholders

- Mail agent : Whether to allow shareholders to vote by mail (more obstacles in shareholder voting will weaken the power of shareholders, especially smaller shareholders)

- Regarding the mechanism of oppressed minority shareholders : Whether minority shareholders (with 10% or less of the share capital) have the ability to challenge the management ’s decision or require the company to acquire its shares in the event of changes such as mergers and acquisitions

- Pre-emptive right : Whether shareholders have the pre-emptive right to issue new shares

- Percentage of capital required to convene a general meeting of shareholders : the higher the required ratio, the less friendly the jurisdiction is to minority shareholders

Their conclusion, although simple from a statistical point of view, is instructive in the corporate governance literature. Several authors found:

Common law countries provide shareholders with the best legal protection in every respect. They allow shareholders to vote by mail most frequently (39%), they never block their participation in shareholders ’meetings, they have the highest incidence of laws protecting minority shareholders under pressure (94%), and usually require relatively little share capital (9%) to convene an extraordinary general meeting. The only aspect of common law countries that do not have special protection is the preemptive right to purchase new shares (44%). Nonetheless, in all legal systems, common law countries have the highest average anti-director rights score (4.00). Many differences between common law countries and civil law countries are statistically significant. In short, compared to the rest of the world, common law countries have a set of laws that have the greatest protection for shareholders.

Through further analysis, the four authors followed their seminal paper in the 1997 "Legal Determinants of External Finance" (https://www.nber.org/papers/w5879) This shows that not only do common law countries systematically provide better shareholder protection, but these investor protections are empirically reflected in larger and more robust capital markets.

The authors summarize the key findings:

As described in laws and regulations and their implementation, the legal environment is critical to the size and scope of a country ’s capital market. Since a good legal environment can protect potential financiers from encroachment by entrepreneurs, they have increased their willingness to exchange funds for securities, thereby expanding the scope of the capital market.

This seems simple: more guarantees for investors will result in more capital being used, but when you reflect on the fact that these guarantees can be traced back to the legal concepts that underpin the financial system, people will clearly realize The path to capital market outcomes depends. In short: the quality of the system determines the distribution result. The United States is not just the largest capital formation center on earth, it is disproportionately large. The system will generate extreme outliers, such as Hong Kong, Singapore or Luxembourg.

A related conclusion can be found in Hernando de Soto's book " The Mystery of Capital ". De Soto assessed the relationship between property rights and capitalism in many countries in the world, and concluded that for capitalism to function properly, capitalism must be placed on the cornerstone of property rights that have been incorporated into law in black and white. His reasons are as follows: The main form of personal savings worldwide is through property (especially real estate). The main method of small-scale capital formation is to convert it from pure instrumental assets (where it can live) to capital assets through the monetization of assets. An example is an individual who mortgages their house to borrow money in order to establish a small business. If a large number of savers can mobilize their naturally accumulated capital, then capitalism will flourish.

However, as de Soto discovered, especially in developing countries, a large portion of property is not well documented. That is, homeowners cannot prove that they have a contract for their own housing (the contract may not exist), and they may not have a reasonable way to formalize ownership. This completely inhibited their ability to monetize their property. Usually, this is due to dysfunctional bureaucracy or the inability of state institutions to provide a means to incorporate black / gray markets into the formal economy. My conclusion from this extraordinary book is that free market economy alone is not enough. They must be accompanied by sufficiently flexible laws and bureaucracy to enable property owners to transition from de facto to legal , and these rights must always be respected. To learn more about the application of de Soto's conclusions to Bitcoin, please refer to Allen Farrington's article on this topic (https://medium.com/the-capital/heterodox-economics-and-the-rise-of-blockchain- 592616eb48db).

Cryptocurrencies (probably more than any asset) alleviate these institutional restrictions. It does n’t make sense to prove to a third party that you own Bitcoin; self-regulation of this claim is meaningless, and the solution is physical and almost ultimate. Cryptocurrencies are monetary systems -the agreement sets out a set of rules for allowed behaviors that all participants must obey. This is why digital currency has such excellent global penetration: users know each other's position relative to the system and the established rule set, and believe that no extensive lobbyists can impose local policies on the system. This is what Nick Szabo refers to as social scalability (social scalability, https://unenumerated.blogspot.com/2017/02/money-blockchains-and-social-scalability.html)-this concept holds that if one The system standardizes behavior in a narrow field (for example, rules for effective transactions) while minimizing features and ambiguity (which would damage the reputation of the system), and can only be extended to serve millions of different users .

Don't count on America

In the crypto industry, the United States enjoys a reputation for having strict restrictions on the issuance of new crypto assets. Since the publication of the infamous DAO report in 2017, the SEC has made it very clear that ICOs are generally not unregistered securities issuances, and issuers should follow the same standards as regular securities issuers. In the United States, if you want to sell stock to the general public, this will require a lot of legal fees and high standards of transparency.

So far, few issuers in the crypto market have met this conventional standard (Blockstack is an exception, https://stackstoken.com/static/offering-circular-20190711.pdf). Moreover, we do not even know what information will be considered important for the issuance of new agreements or tokens. Brummer, Kiviat and Massari in their paper "What should be disclosed in the initial token offering?" "( What Should Be Disclosed in an Initial Coin Offering , https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3293311) convincingly pointed out that the various disclosure frameworks in the United States are not suitable for generation The reality of currency issuance requires the design of a more appropriate model.

A lot of noise in the crypto industry belies the reality of these markets: the vast majority of tokens sold to the public are worthless, and there is no investor protection. Even in cases where tokens are said to have benefits over regular issuances, despite the touted function of unlocking schedules implemented through algorithms, most of the time these soft terms are not actually implemented. Hoffman ’s “ Regulating Initial Coin Offerings ” (https://repository.upenn.edu/cgi/viewcontent.cgi?article=1061&context=pennwhartonppi) carefully studied the commitments made by the promoters. Can be implemented by algorithms. In a survey of the top 50 ICOs that raised a lot of money in 2017, Hoffman evaluated the actual implementation of the Commitment Code to Investors. These are divided into three categories:

- Commitment on supply restrictions

- Commitment regarding unlocking schedule and transfer restrictions that team members should follow

- Commitment to relinquish the power to modify smart contracts after deployment (many issuers claim they will eventually relinquish this power)

Not surprisingly, the authors examined the actual code written by the publisher and found that the vast majority of people did not comply with these relatively weak restrictions. Therefore, not only do issuers only provide extremely limited guarantees to buyers; but those issuers cannot even comply with their own voluntary standards !

Therefore, in this case, the vast majority of token issuances openly violated the law. The lex cryptographia is an inferior alternative to the law: the few guarantees that can indeed be written into a smart contract are only supported by good times. In this case, the US token issuance policy seems completely reasonable. Assuming that the main legal analysis of token issuance (mainly the sale of tokens by a single issuer to the public) as unregistered securities is correct, the fact that the issuance was conducted through a new technology medium is unimportant .

If you remove the technical flicker and (usually false) claims of "de-neutralization" and "unstoppable applications", the rest is that you can directly issue false equity to the general public. Anyone, even the most loyal cryptocurrency proponent, will think that the SEC is too blind to this practice. Gradually, the SEC has begun to consider this niche market. By becoming relatively harsh (but not too harsh), American regulators put their position on a middle line. Regulators have not completely banned tokens and the industries around them, but have taken various punitive measures. The SEC sued the worst ICO and pardoned others. Some scholars even praised the SEC's strategy of selective law enforcement.

Please remind ourselves that there is a reason why the United States has a 40% share of the public stock market, and many practitioners ’declared strategies of seeking a place to live seem to be short-sighted. The fact that inferior instruments (public ICOs) have not received the blessings of regulation does not mean that the United States is destined to lose its throne as the main venue for capital formation. In fact, in other capital-friendly jurisdictions, many well-known securities regulators are in line with the United States in accordance with established practice. If cryptocurrency issuance is to develop into something more buyer-friendly, functional, appropriate disclosure, real algorithmic implementation of unlocking and locking, and other strong investor protection regulations, there is no reason for regulators not to recognize this reality . They did not give full support to these releases, which reflects the poor implementation we have seen so far, not the lack of ideas.

In view of the above, recall why the United States has disproportionate public equity capital. For most of the last century, the United States has not only been a hegemonic country, but also has political stability, has not seen violent conflicts on its coast, has a tolerant common law system, and has shown strong shareholder protection. In addition, it has a large middle class, for them to invest in stocks is both a pastime and a necessity. There is no doubt that this tendency of active consumers to participate in the capital market has also spread to cryptocurrencies. The world's largest cryptocurrency exchange / custodian (so far!) Coinbase is an American company. The largest financialized Bitcoin product is the Bitcoin Investment Trust issued by Grayscale in New York. Fidelity, based in Boston, is the first global financial institution to take Bitcoin and digital assets seriously. As far as this industry is an asset class (obviously, the jury is inconclusive!) , A jurisdiction with a good financial position and a client with a need for risk exposure will naturally be the first to serve it.

This view may make you Anglocentric. However, please consider the context. In the encryption industry, the United States is regarded as a despicable person simply because of the enforcement of local laws (even at that time, it was extremely lenient-see Block.one settlement). The token mania is currently being pursued overseas, but if it relies on the goodwill of marginal jurisdictions to operate in an anarchy, it is unlikely to develop into a functional securities market. The industry's biggest hope is to recognize that market supervision is what makes the market work, and to accept a system that has a common-sense view of the protection of shareholders / token holders.

If these markets are indeed mature, and securities tokens, or tools for wrapping cash flows on the chain, or highly automated smart contract-mediated stocks do become an important part of the securities industry, then I fully hope that US regulators will actively participate . By then, issuers and market participants will benefit from participating in the most active capital markets on the planet.

Original link: https://medium.com/@nic__carter/lessons-from-the-uneven-distribution-of-capital-ce665def00e6

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How to choose cryptography technology? Final exploration of the security model of quantum computing communication

- The money circle of the currency circle is eyeing a short video: dozens of "fire bull" platforms have been born, claiming to be "500 per month lying"

- Ali & JD.com ’s blockchain war, Jack Ma: 100 billion is not enough, I will invest 200 billion

- U.S. Congressional Oversight Agency Says Very Interested in Blockchain Technology

- Babbitt column | stocks inward, tokens outward

- Viewpoint | Blockchain can improve data governance transparency and efficiency, privacy protection still faces challenges

- What is the impact of halving BCH, BSV, and BTC?