Research | IEO is accelerating to the stage of exhaustion?

2017 was the first year of a prosperous “ICO” market boom, and in the year the world discovered new ways to raise funds. However, with the gradual decline in the total market value of digital currency in 2018, the market has gradually fallen into a downturn. By 2019, the world's first exchange issued "IEO" broke into the investor's field of vision, bringing new hope to the depressed market.

If ICO, it is because the following three points have gradually declined.

1. A large number of “aircoin” projects that can only be funded by white papers have led to market disorder, the trust base of transactions has collapsed, and market sentiment is extremely low;

- Two minutes to see the change in the market value of cryptocurrency in 6 years: the currency diversity is enhanced, Bitcoin is always king

- Babbitt column | What is the cross-chain across?

- Xiao Feng: The Internet of Things business needs to form a closed loop, which must complement the blockchain.

2. The Token economic model of the blockchain project is unreasonable, or the project does not have real and effective technical product support, resulting in almost no liquidity even if the token is on the exchange;

3. The formulation and maturity of relevant regulations and regulations are relatively lagging behind, which makes it difficult to blame the previous fraudulent projects, and the emerging blockchain projects cannot be relied upon;

Then IEO is also trying to embark on the old path of ICO, bringing the fire of hope that investors just ignited into the abyss.

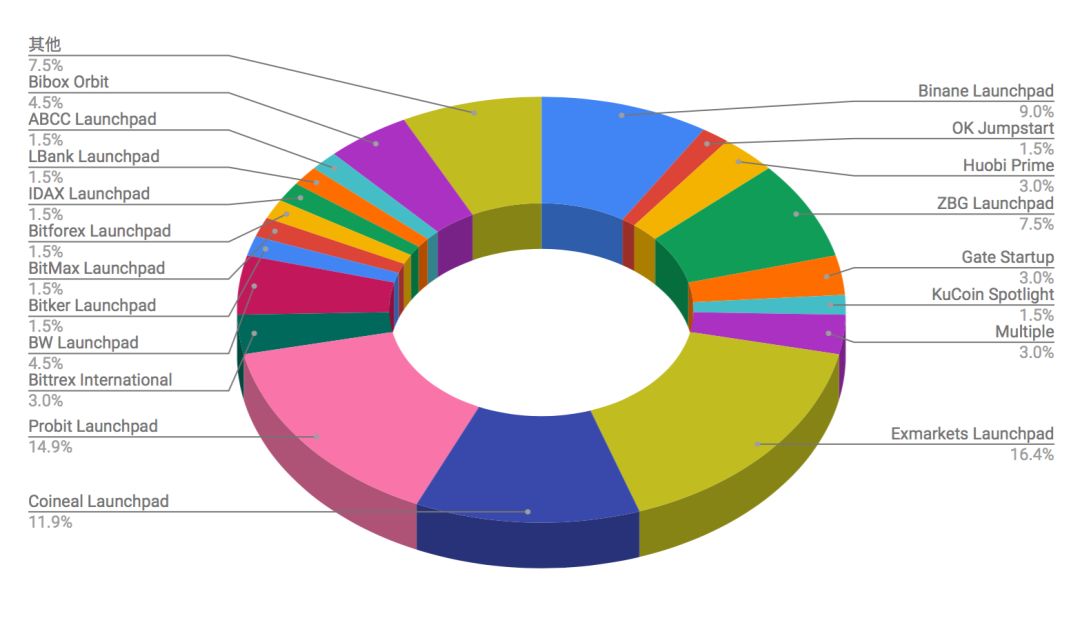

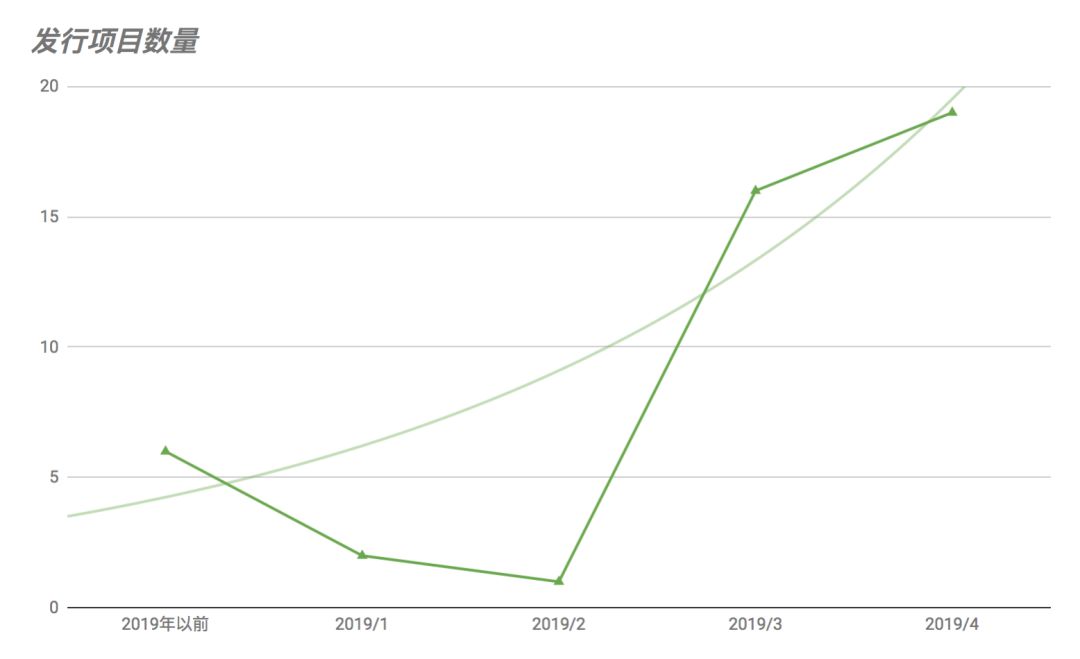

The battle for the "IEO" of the exchange is in full swing. It is not completely statistical. There are more than 20 trading platforms in the world that are online or about to go online. The number of IEO projects exceeds 50, mainly due to the formation of a blowout from March to April. According to ICObench, the most popular distribution platform for IEO projects is Exmarkets Launchpad, then ProBit Launchpad, which released 11 and 10 IEO projects respectively. Binance Launchpad, Huobi Prime, and OK jumpstart issued 4, 2, and 1 IEO projects in 2019.

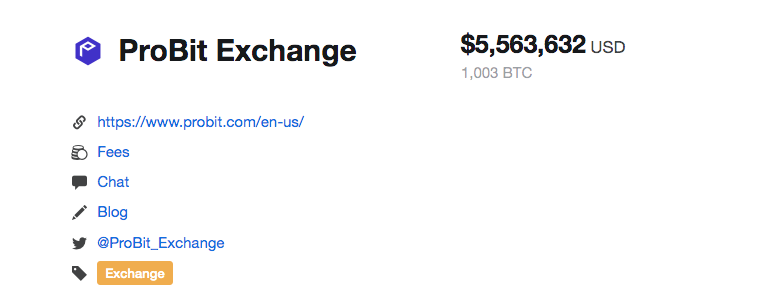

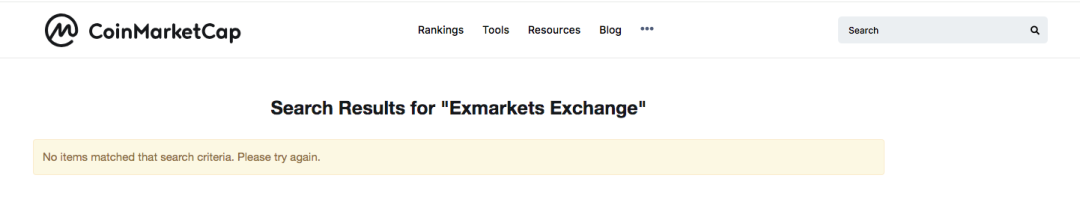

At present, mainstream exchanges can still maintain the rhythm of issuing an IEO project every month. However, due to the overall market sent by IEO, some small and medium-sized exchanges have started to launch IEO projects in batches, with Exmarkets Launchpad and ProBit Launchpad as the mainstays. representative. According to CoinMarketCap data, the average daily transaction volume of ProBit Exchange is $5,563,632, and ExMarkets Exchange has no relevant data. There have even been reports of IEO projects running. Such high-volume IEO projects may lead to a decline in the review of the project by the exchange, frequent inferior projects, excessive diversion of funds, and ultimately will lead to increased investor distrust and an overall decline in the IEO model.

According to the statistical analysis of the standard consensus data, the IEO projects on the three major exchanges Binance, Huobi and OKEx were presented as representatives.

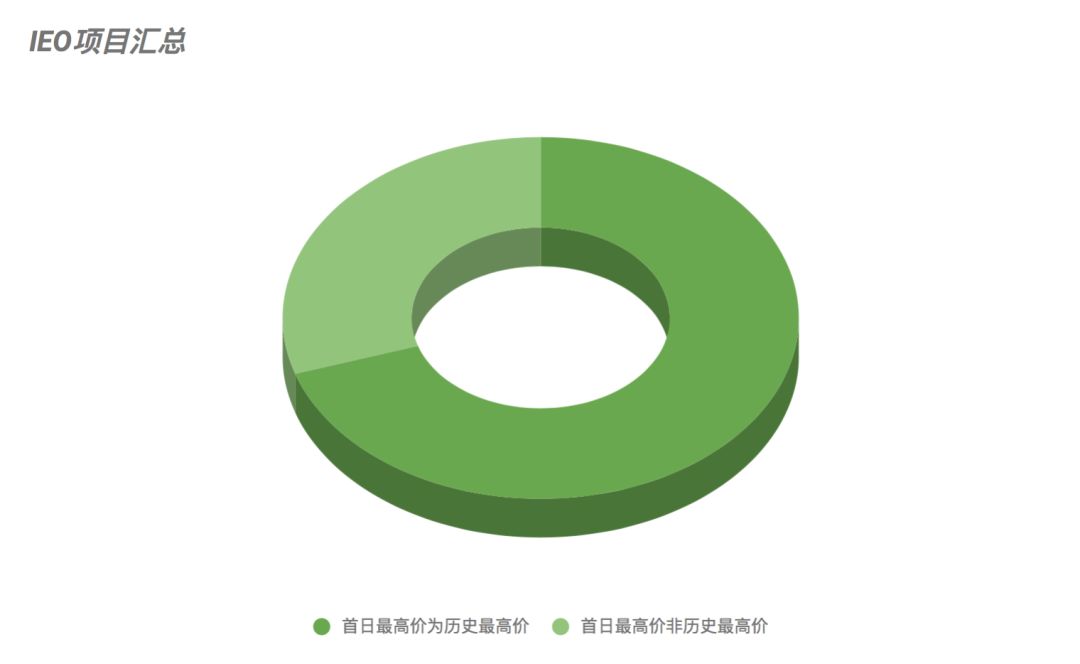

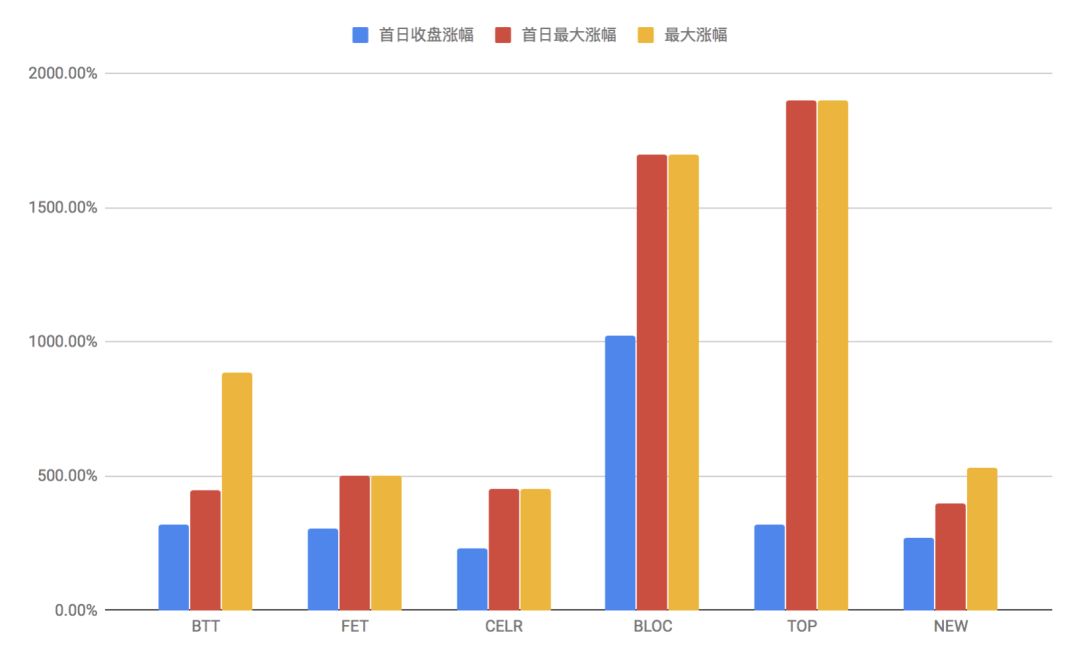

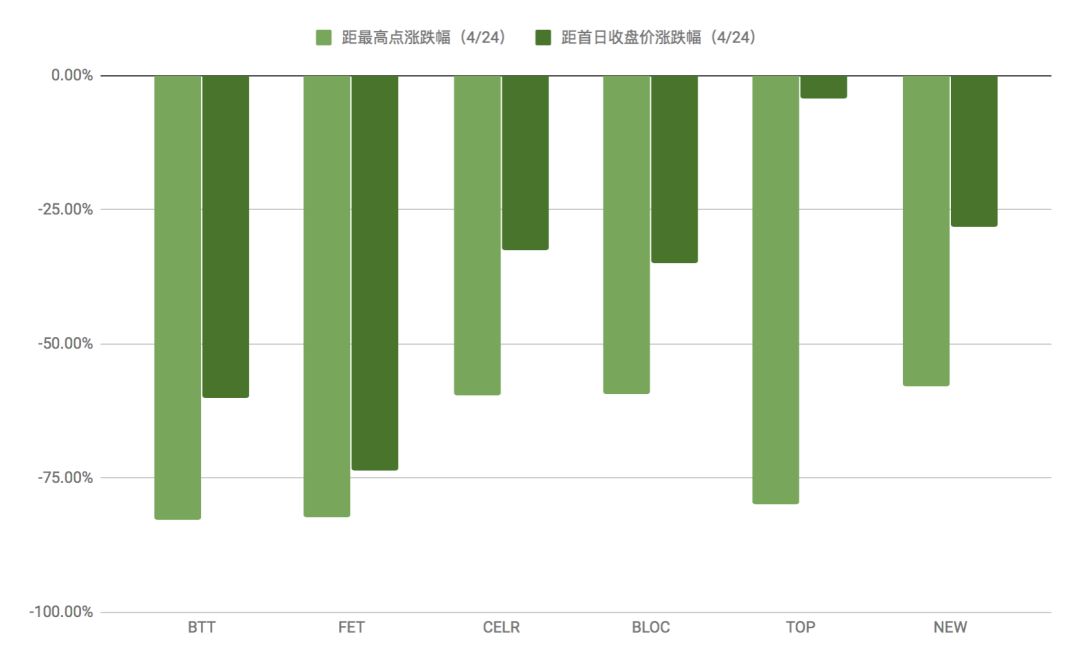

1. The first day of the IEO project reached the historical high price of over 70%, and the first day closing price has a larger retracement than the highest price.

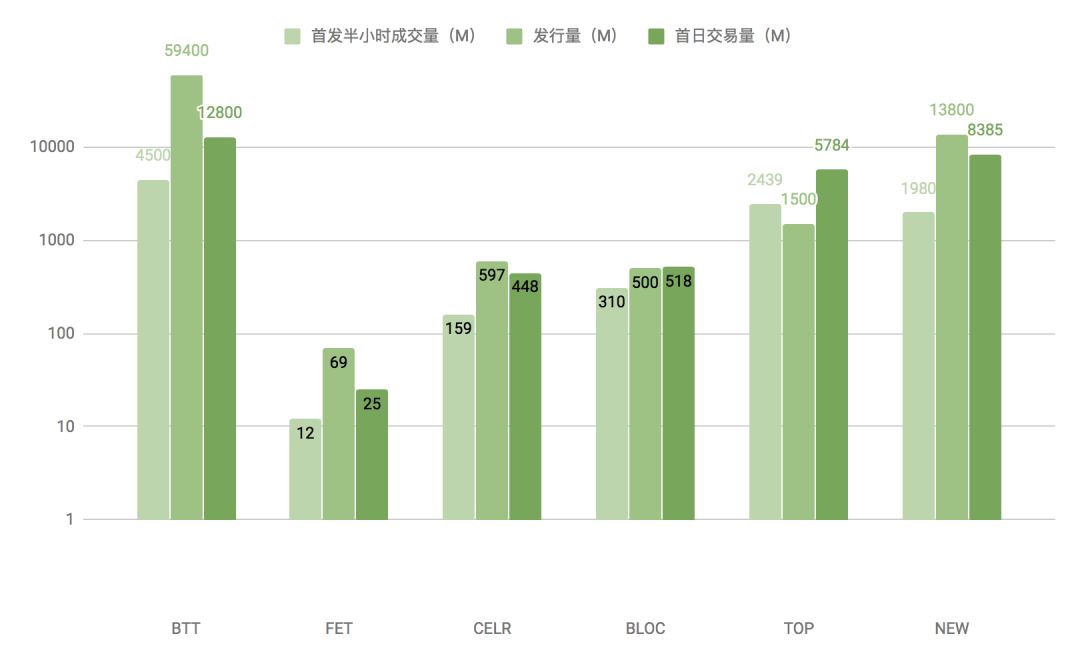

2. The first day trading volume of the online line is basically the same as the IEO sales volume of the project. Even some projects such as BLOC and TOP are the first day trading volume far above the project sales volume. According to the statistics, the closer the transaction volume on the day of the online transaction is, the higher the probability that the highest price on the day is the highest historical price. The data shows that the IEO project snap-offs have sold a lot of chips on the day of the project's launch, and the project side lacks the need to maintain the price of the currency continuously. More is to use the trading platform as a channel for converting the chips into working capital.

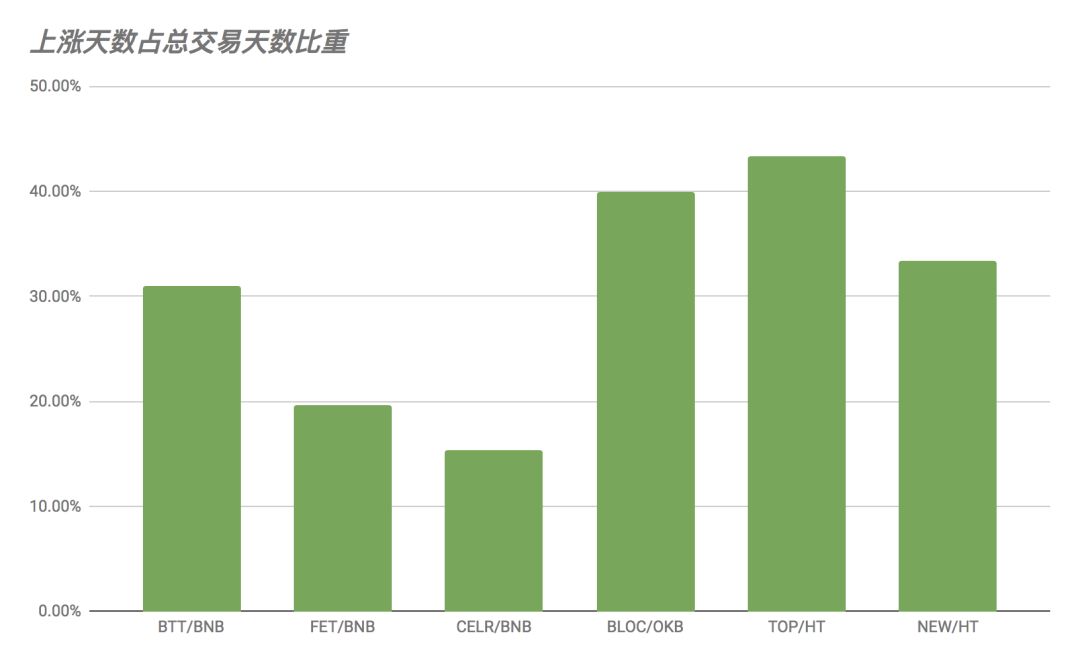

3. Incomplete statistics The IEO project's rising days accounted for more than 50% of the total trading days. The overall decline of all projects was more than 50% lower than the closing price of the first day. The shorter the total trading hours of IEO projects, the higher the proportion of rising days in total trading days, due to the fact that there are still wide fluctuations in the initial stage of the new project to attract investors' attention and attract new capital to enter the market. However, in general, the IEO project lacks the money-making effect in the transaction process in addition to the snap-off winners, which will lead to the increasingly attractive market for the IEO project, and the rushing revenue will gradually narrow.

In summary, the IEO project is currently in the outbreak of the number of projects, but there is a higher return in the process of snapping up, and there is no profit-making effect in the overall transaction process. And most of the newly launched IEO projects staged a one-day parade, which quickly fell after the rapid rise. Investors who bought the chips could not get the profit of the IEO project, and gradually became the channel for the project to sell the chips to exchange funds. . In the long run, investors' attention to the IEO project will continue to decline, and the IEO model market will accelerate into a state of exhaustion. If the IEO project is still in a blind overshoot, lack of supervision and strict project review, IEO will eventually embark on the ICO's old path.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Tentative, conservative, fried leftovers, Tencent this game actually dominated the list for 15 days

- Tether frantically issued 640 million USDT, and the market outbreak in April was caused by its manipulation.

- MakerDAO continuous rate hike: purpose, policy effect, decentralized currency market impact

- Leading encryption companies, DeFi organizations, and financial technology how to build different communities

- M*V = P*Q does not apply to the valuation of cryptocurrency

- Read the classic design model of the centralized exchange

- Tobacco pledge economics 丨 Investigate the deficiencies and changes brought about by working tokens