Will the large-scale adoption of Bitcoin fundamentally change the financial system?

Credit expansion

The main feature of the traditional banking system and the modern economy is that large depository institutions (banks) can expand the total amount of credit (debt) of the overall economy without the need to provide additional capital reserves.

The general public’s misunderstanding of finance is that banks must have corresponding reserves, liquidity or “cash” in order to issue new loans. Otherwise, where does the bank's money come from? Although smaller banks or financial institutions do need to obtain capital for lending through financing, they are not needed for large depository institutions in the market.

If the depository provides a new loan to their client, a new “money” will be automatically generated in the form of a deposit. In the process, these depository institutions do not need additional financing. This is because the borrower or asset seller will deposit the loan received into the bank. Therefore, banks do not need to have "money" to borrow. In fact, we are powerless in this situation. These deposits are “trapped” in the banking system. Unless we take out the deposits in the form of cash or other bills, it is rare to trade in large amounts of cash in today's society. of.

- Is it blowing leather, or is it really stock? John McAfee postpones the announcement of Nakamoto’s identity

- Babbitt column | The general economics will subvert the company system?

- Research | Stabilizing and Stabilizing Coins

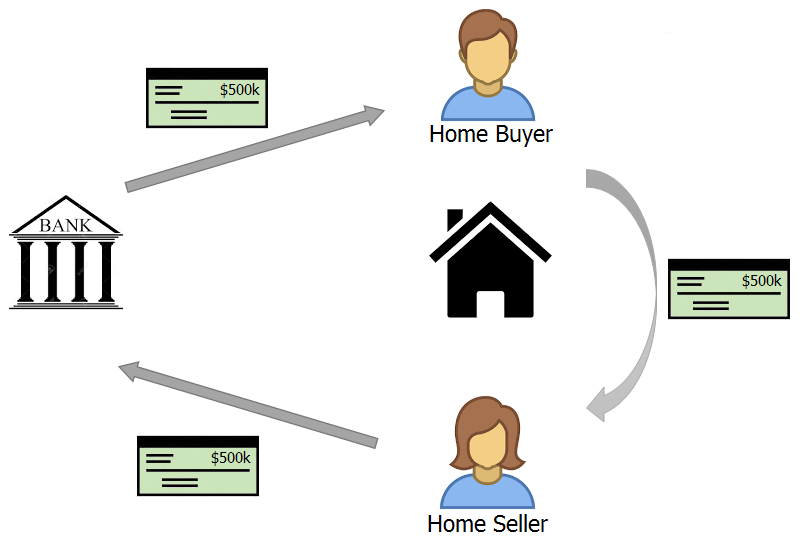

Please refer to the following simplified case:

1. Large bank JP Morgan provides $500,000 in home mortgage loans to a first-time home buyer

2. JPMorgan Chase will give a $500,000 check to customers applying for mortgages

3. The client applying for the mortgage deposits a $500,000 cheque into his account at JPMorgan Chase

4. The customer applying for the mortgage will write a new $500,000 check and hand it over to the house seller.

5. The seller is also a client of JP Morgan Chase, so the cheque is deposited in his bank account at JP Morgan Chase.

An illustration of the bank’s mortgage purchase in the economic market

We can see that the above process has no impact on the liquidity or reserves of the bank. At any point in the above example, the bank never needs to take any extra "money". Of course, the asset seller does not necessarily open an account with the loan bank. However, large depository institutions such as JPMorgan Chase, HSBC or Bank of America have a large market share in the local market. Therefore, on average, these large banks are expected to receive more deposits into their banks than their loan market share. In fact, when the overall economic loan is added, it will increase rather than reduce the liquidity of these large banks.

The bank’s accounting for the mortgage is as follows:

Debit: Loan (asset): $500,000

Credit: Deposit (liability): $500,000

The bank thus increased its assets and liabilities, causing the balance sheet to expand. Although from the perspective of the home seller, he has more than $500,000 in cash. The above transactions increase the total amount of loans and deposits in the overall economy. From the customer's perspective, these deposits are considered “cash”. In a sense, the new "money" was created out of thin air while the house was being bought and sold. In the above case, M0 or the base currency, the total amount of physical notes and currency in the economy plus the total amount of central bank deposits remain unchanged. The amount of M1, including M0 and bank deposit accounts, increased by $500,000. Although the clear definition of M1 varies from region to region.

From a bank perspective, the concept of “cash reserve” is paper money and the currency deposited in the central bank. The ratio of total deposits and reserves that banks can absorb is called the “statutory deposit reserve ratio”. This reserve management requirement has led to the emergence of a “partial reserve system” in which the total amount of bank deposits owed to savings customers is much greater than the reserves they hold. However, contrary to traditional wisdom, in most of the western economies, there is no regulation that restricts the size of banks' loans to correspond to each other based on the total amount of cash reserves. The statutory deposit reserve ratio usually does not exist, or is low enough to have no effect on the bank.

However, another regulatory system does limit the credit expansion process, which is called the “capital ratio”. The capital ratio is the ratio between bank capital and total assets (or more accurately, risk-weighted assets). Therefore, banks must have sufficient capital to create new loans (new assets) and deposits (liabilities). Capital is the bank's equity investment plus accumulated retained earnings. For example, if a bank has $10 in capital, then only $100 of assets can be allowed, with a capital ratio of 10%.

Credit cycle

To a certain extent, the above process has enabled banks to create new loans and expand the scale of economic credit almost at will, causing inflation. This credit cycle is generally considered to be the core driver of the modern economy and an important reason for financial regulation. Although the impact of the credit cycle on the business cycle has been heatedly debated by economists. This cycle is often thought of as the main cause of the expansion of the credit bubble and economic collapse, or as described by Nakamoto:

We must trust banks to keep and electronically remit our deposits, but they lend large amounts of loans with little reserve and generate a credit bubble.

Ray Dalio, founder of Bridgewater Associates, a leading investment company, believes that the credit cycle is the main cause of economic growth volatility, at least in the short term, and his video is as follows:

https://youtu.be/PHe0bXAIuk0

The credit cycle caused by the partial reserve system, including the boom and bust cycle, is a major driver of the modern economy and is very popular in the Bitcoin community. This theory is sometimes referred to as the “Austrian business cycle theory”, although many economists outside the Austrian school are aware of the importance of the credit cycle.

The root cause of credit expansion

Not many people understand the above-mentioned credit expansion and partial reserve system. However, with the advent of the Internet, the politically leftist, rightist or conspiracy theorists are gradually aware of this situation, although perhaps not fully understood. As the narrative of “Banks change money out of thin air” or “partial reserve system” has received some attention, the next question we should explore is why the financial system should operate like this? We believe that the fundamental reason is that society lacks an understanding of the financial system.

For some who have a unique perspective on politics and the economy, one might think that this is a powerful elite banker to ensure that they have some kind of conspiracy to control the economy. For example, perhaps the Rothschild family, JPMorgan Chase, Goldman Sachs, Beidberg Group, the Federal Reserve and other powerful secret entities deliberately built the financial system in this way so that they can have absolute competitive advantage or influence? But this is not the case.

The ability of depository institutions to expand credit without the need for reserves is the result of the inherent characteristics of “money” and the fundamental nature of the currency. This is because people and businesses can very reasonably treat bank deposits as “cash”, and for banks, these are considered “loans”. This allows the bank to increase the amount of deposits because the bank knows that the deposits are safe because the customer has treated it as cash and will never take it out.

Bank deposits are handled in a logical manner. In fact, bank deposits have some significant advantages over physical cash. Bank deposits are much better than physical cash. As some believe, these inherent advantages have led to the adoption of part of the reserve system rather than a malicious conspiracy.

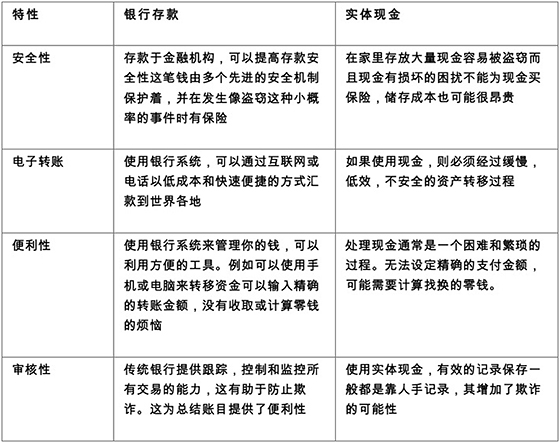

Advantages of bank deposits compared to physical cash

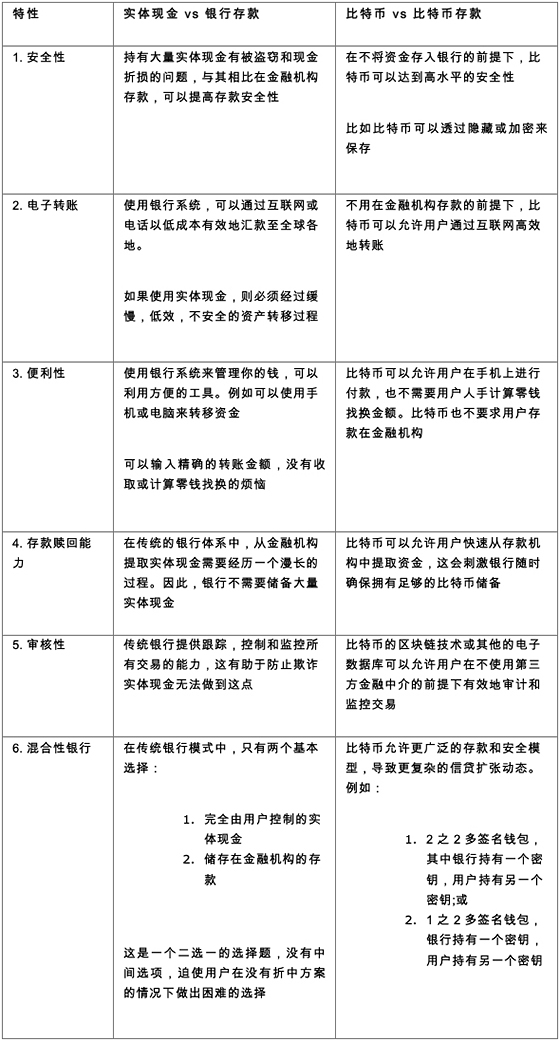

Main features of different types of currencies

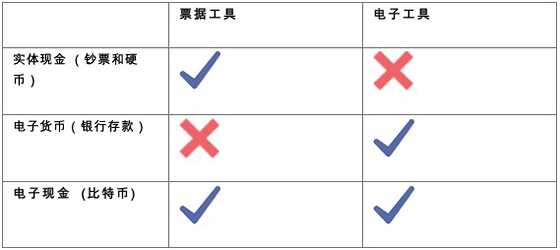

Despite the strong advantages of bank deposits mentioned in the first part of this article, namely the ability to electronically transfer money, there are some significant benefits to physical cash compared to electronic money. The table below summarizes the main features of different types of currencies, including bank deposits, physical cash and electronic money (bitcoin).

Bank deposits, physical cash and electronic cash characteristics

Note: * Since physical cash is issued by the central bank, there are still potential problems in terms of liquidity due to its policy

According to the above table, physical cash will always retain its part of the advantage. However, in general, bank deposits are better than physical cash for most users. The ability to electronically remit or receive bank deposits still attracts users, especially in the digital age. As we explained in the first part, it is precisely because the money can be manipulated electronically, the demand for bank deposits is always high, allowing banks to expand the credit scale without fear.

The unique nature of Bitcoin

Bitcoin and physical cash have many advantages in common compared to bank deposits. Although Bitcoin does not have the full advantage of all physical cash, as shown in the table above. But the main feature of Bitcoin is that it has both the advantages of physical cash and the functions of electronic operations.

Bitcoin aims to replicate some of the characteristics of physical cash in electronic form, the “ electronic cash system ”. Prior to Bitcoin, one could only make a choice between physical cash and bank deposits.

Although physical cash is also a form of bank deposits in terms of technical characteristics, it belongs to the central bank's deposits, while physical cash still has a unique note attribute that cannot be copied by electronically. For the first time in 2009, Bitcoin provided the ability to electronically transfer notes type assets. The following simple table shows the important features of Bitcoin and other blockchain-based technology tokens.

Traditional finance and bitcoin options

Therefore, Bitcoin can be considered as a new mixed form of currency, with some advantages of physical cash, and also has some advantages of bank deposits.

Bitcoin limitations

Although Bitcoin inherits some of the advantages of traditional electronic money and physical cash, Bitcoin does not have all the advantages of electronic money or physical cash, but it has a unique positioning that can be a subset of the above two dominant features. This undoubtedly provides a new intermediate option.

For example, Bitcoin may never reach the volume of traditional electronic payment systems or can transfer transactions without physical power like physical cash. As technology advances, Bitcoin may slowly develop more advantages, gradually improve functionality and close the gap.

The impact of these characteristics on credit expansion

With these characteristics in mind, we can assess the potential economic impact of the Bitcoin ecosystem's continued growth. Bitcoin has at least six characteristics that traditional currencies do not have, and its characteristics have a certain degree of resilience to withstand the problems caused by credit expansion. Because compared to other currencies, Bitcoin does not have to deposit funds into banks like bank deposits. However, Bitcoin cannot fully resist the credit expansion that exists in the traditional system. In fact, people can deposit bitcoin into financial institutions just like cash in kind. Bitcoin may have more defensive power than the same credit expansion.

At the heart of our inference is the search for advantages in bank deposits compared to physical cash, which allows large banks to freely expand the scale of credit and assess the extent to which their advantages are applicable in the Bitcoin ecosystem. As shown in the table below, in the world of Bitcoin, the advantage of depositing funds into banks is not significant, so we believe that Bitcoin does have a unique resilience to credit expansion.

Entity Cash vs Bank Deposits compared to Bitcoin vs Bitcoin Deposits

Reduce the economic situation of credit expansion

This analysis does not indicate whether this new economic model of low credit expansion will be more favorable to society, and it is uncertain whether Bitcoin will succeed in the future. The former is a subject that has been debated by economists for decades, and the latter is considered to be another subject. Despite decades of debate, Bitcoin is very different from its predecessor, and it is necessary to be placed in the center of the debate again because of the addition of new information. For example, a currency system that is based on bank deposits and debts and that causes inflation or deflation through a credit expansion cycle may have very different economic consequences than a bitcoin-based monetary system. A key issue in deflation in debt-based monetary systems is that it will increase the real value of debt, leading to a downward trend in the economy. For non-debt monetary systems like Bitcoin, the effects of deflation remain unknown.

Although Bitcoin may not necessarily produce a superior economic model, we believe that this analysis shows that Bitcoin has some characteristics that make its economic model more unique and interesting than its previous model. Therefore, it seems to be an area worthy of further study.

For many people, the ultimate goal of Bitcoin is to take full advantage of the credit expansion, so that the credit cycle can be neutralized and the economic cycle eliminated. Although this is considered an ambitious goal, we also believe that this possibility is very low. And even if Bitcoin develops to the above scale, other unforeseen economic problems may arise.

Author: BitMEX team

Welcome to reprint, please indicate that the article is provided by the BitMEX research team

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Paving for the currency? Samsung accelerates the layout encryption industry and injects 2.6 million euros into the hardware wallet company Ledger

- Why did Charlie Munger and Buffett always reject digital assets?

- Why should the development of the next generation blockchain platform be led by the community?

- Babbitt Column | Is digital currency investment legal?

- Market analysis: incremental funds are not in place, the market is under pressure

- The fund holdings have not yet ended, and the market is hard to say.

- NASDAQ: Joined Bitcoin's "Wish List" this year