Tobacco pledge economics 丨 Investigate the deficiencies and changes brought about by working tokens

Before delving into the current working tokens, let's take a look at the previous token economic model.

Current problem

Fundraising tools: Many projects simply create tokens as a fundraising tool instead of fiat currency or ETH. It is even more difficult to refinance through traditional equity financing or through existing tokens, and the project has to release new tokens. Therefore, even if the project completes the technical roadmap, the decoupling between the project product and the token will still be found.

Exchange Media MoE Model: "Practical" tokens do not increase network value as usage increases. After the product is released, even a network with a dedicated payment system seldom motivates users to hold tokens. Both the supplier and the buyer can purchase tokens, use the service, and sell after completion. Considering inflation, selling pressure will further push prices down. Eitafang Vitalik Buterin and Multicoin Capital Kyle Samani have all discussed the issue of token circulation:

“Now, we look at things in the “exchange medium MoE” token model. N people look very much at the x-denominated decentralized network product, which will be sold at a price less than x. They buy value w for each person. Tokens. Developers build networks. Some sellers participate and offer products in the network at price w. Buyers use tokens to buy this product, pay the value of the token, and get the value x of the product. The seller passes the resource and time Producing products, cost price v is less than w, and holds tokens of value w. Buyers and sellers continue to participate in order to continue to play the value of the token." – – Vitalik Buterin

- Getting started with blockchain | How much does it cost for Nakamoto to dig bitcoin for the first time?

- With an annual salary of $240,000, the SEC needs a cryptocurrency financial analyst

- Babbitt Column | Cai Weide: 2018 US Edition "Unified Weights and Measures" – Chain Network Medicine Supply Chain Management

Speculation: The 2017 bubble caused the project to ignore the token economy and is now not being valued, focusing on “practicality” rather than incentives. This will not only fail to realize their technology, but will further push the project to failure. Even if the token economy improves, speculation will undermine the market equilibrium.

Based on these issues, some projects will consider their token economy from the very beginning, and better balance the supply and demand sides.

The emergence of work tokens

Exchange media tokens are prone to free-riding problems. Some market participants enjoy benefits other than payment. Non-participating and inactive currency holders will share the benefits of some active users. Not only is there insufficient credit for holding money, but the continued selling pressure from the speculative market will further push prices down.

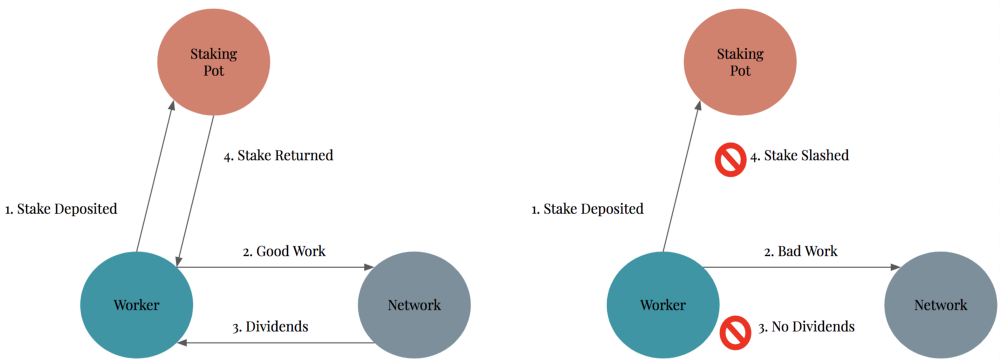

Work tokens introduce a new approach to network engagement. Through appropriate incentives, in theory, participants have the motivation to actively contribute to the network.

In the working token system, network participants need to mortgage a certain amount of tokens to serve the network and earn corresponding income. Similar to the taxi license model, where individuals pay high upfront costs to obtain a license, they have the right to drive a taxi or lease a license to get extra income.

Work token model evaluation

As the demand for services grows, we can predict how much will be charged by nodes performing work on the network.

What factors need to be considered when designing a working token model?

Projects that simply execute work tokens are not equivalent to intrinsic value accumulation mechanisms.

1. Total size market TAM and available service market SAM

TAM is a very useful number to understand the size of the market the project is trying to solve. Usually this is the total revenue size of a particular good or service. Large markets tend to have disruptive opportunities, and often marketing warm-ups, however, relying entirely on TAM can mislead value.

In the context of decentralization, the project's SAM should also be analyzed as it represents a value point for decentralized solutions that complement existing markets. This is important, and a decentralized network is difficult to capture 100% of an industry's TAM. On the other hand, the SAM can reveal which part of the TAM is the target user.

For example, the Livepeer project's TAM is equivalent to a $30 billion live streaming market. However, due to censorship, platform limitations, etc., SAM may be a small part of the market, and they are looking for a decentralized streaming platform. Not all existing streaming media needs to be converted to another platform to reduce potential costs, which means they have to abandon existing larger platform opportunities and network effects.

2. Cost and node participation

With TAM / SAM analysis, we can generate as much potential cost as switching to a specific product or service. The token weight of the node pledge determines the amount of work available to the node and also determines the corresponding fee. If the demand for services grows rapidly, the total cost will start to increase. In theory, online participants will see increased cash flow as an opportunity to buy more tokens and get more revenue.

For example, if you use Graph's DApp to find more transactions, the number of queries will increase, providing more cost for indexing and management nodes.

3. Expected growth and net present value

By predicting the growth of specific services and applications, we can predict how much the cost will increase. This projected growth indicates how much the total cost will increase and the value of the equity required to become a service provider.

With the appropriate discount rate and associated cost adjustment assumptions, we can use NPV to get the value of the work token.

This type of analysis makes a number of assumptions that vary from project to project, so it is important to understand the boundaries.

Risk point of the work token model

1. Service provider concentration and governance

As demand for specific services grows, more nodes are using the ever-increasing cash flow to enter the market, which is controversial. Moreover, entry barriers may block new players.

In addition to the amount required, a node may require some type of dedicated hardware or technical expertise, depending on the services provided. Unlike a typical PoW or PoS network, the service-based work token model may only cater to a small group of participants from the first day, such as early investors and hardware experts who can actually perform the required work. If a node is not working properly, their tokens may be cut. However, if the threshold for entry is getting higher and higher, the number of new nodes that can replace the malicious node will gradually decrease.

This may lead to an increasingly concentrated group of service providers, triggering new attack vectors and possible cartel behavior.

In addition, what happens to network governance? If network participation has been shown to be low, then highly concentrated providers may choose to change the agreement, such as higher fees or mortgage changes, without discussion.

While working tokens provide service providers with more incentives to participate in protocol changes, the question boils down to: Who is the token holder and how focused is the decision-making power?

In the New York taxi market, the cost of licenses is getting higher and higher, and only a few entities have the opportunity to enter. These concentrators then have complete control over costs and supplies, resulting in poorer service between the driver and the customer. This does not explain 100% of how work tokens work, but an interesting case study worth learning.

2. Fees and cash flow

Because of the specialized hardware or technical expertise required, service providers need to have enough power to perform their work to compensate for hardware/time. If a decentralized platform attempts to subvert the rent-seeker and provide cheaper services, the cost must be low enough to attract buyers. However, if the cost is too low, the service provider will not provide the additional hardware/time required for this particular service because the revenue is too low.

Over time, this may reach some market equilibrium, but economically, if the early supply side is not motivated, the network will not be able to operate.

3. Economies of scale and decentralization

Many working token models target existing centralized services such as video, queries, storage, and more.

The existing centralized enterprises have benefited greatly from economies of scale. As the total amount increases, the unit cost decreases. For example, over the past decade, as Amazon ASW has grown in size, the cost of new computing and storage has decreased.

As a result, the project provides a service that includes decentralized elements such as anti-censorship, improved long-term economies of scale and lower costs, and elimination of counterparty risk, which is more valuable than immediate cost and risk reduction.

In the absence of clear decentralized logical business reasoning, the project side attempts to subvert the concentration of economies of scale through the working token model, which will be a long and arduous battle.

This idea is related to product and market fit. Why do services need to go to the center? How does the token model help network growth?

in conclusion

Working tokens can help solve problems found in many of the CIS economies, but there are also some issues to be resolved. Any working token model should address two basic issues:

1. Does the application really need to have its own token?

2. How to motivate participants to stay active for a long time?

As the cryptocurrency industry matures, we expect the existing work token model to be iterated multiple times.

* This article has been cut Author: Anjan Vinod Translator: Mavis

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Twitter Featured: The largest brokerage in the US to test bitcoin spot trading; Samsung plans to develop blockchain main network

- If the currency circle is an "Avengers League," who will be the tyrant?

- Randomness on the blockchain (II) project analysis

- BAP-2: The first UTXO-based asset standard

- Will the large-scale adoption of Bitcoin fundamentally change the financial system?

- Is it blowing leather, or is it really stock? John McAfee postpones the announcement of Nakamoto’s identity

- Babbitt column | The general economics will subvert the company system?