Research Report | Interpretation of Psychological Misunderstandings of Investors' Trading

Overview

When engaging in highly speculative risk trading, the psychological factors of traders are increasingly important for investment performance. Regarding the judgment of the long-term future, most of the traders in the market are converging, but in fact, the proportion of the number of traders in profit and loss is always hovering around 3: 7. In addition to factors such as the amount of funds and information acquisition, transaction psychology also plays an important role. Therefore, the psychological misunderstanding of trading is an important obstacle to the profitability of traders. This article will briefly introduce some psychological misunderstandings in the transaction process. And it can be seen that trading needs to control emotions, but it is difficult for people to control themselves at all times. Trading is inherently boring and extremely professional. So professional things still need to be handed to professional people.

Report

Superstition Trading Tips

The transaction looks very simple. You can win or lose. You can find book data related to "transactions" online. The number of related products exceeds 180,000. And these books always make people have a fantasy, mistakenly believe that as long as they have mastered the trading secrets, they will be able to make a long-term stable profit and achieve wealth in the transaction.

- Blockchain investment: which "platform coin" has more investment value?

- The central bank's digital currency occupies the "C position" of the Davos Forum. Why is it popular among countries?

- Cosmos founder Jae Kwon announces exit and moves to new project Virgo

Others believe that success can be achieved only by listening to the opinions of analysts, and that they can make money as long as they hear inside information from investment consulting agencies and relevant internal staff, but the end result is often the opposite. In fact, experts or investment consulting agencies have not deceived you, but the timing of the purchase and the judgment of the increase are different from person to person. Investors with different funds have their profit tolerance and transaction risk tolerance. different. In the process of trading, there is no such thing as 100%. Every transaction has to face the subsequent changes in the market. So if you only know some trading tips or the so-called inside information, you choose the transaction. There is no corresponding response. The trading plan cannot cope with the continuous changes of the market, and will only allow you to bear more risks in the trading process.

Obsessed with trading pleasure

Every trader has a clear and strong belief in profitability. However, in the actual trading process, traders will easily pursue the pleasure brought by that intense and stimulating risk, and repeatedly trade for this purpose. This is like many people like to ride a roller coaster and experience the excitement brought by the roller coaster. If the mentality of pursuing stimulation is brought in during the transaction process, then it is not far from failure. The transaction itself is a rather boring thing. Those who can really make a profit must strictly abide by the established plan and continuously research technology and market conditions, and wait calmly and patiently for feedback from the market.

At the same time, it is easy for traders to enter a self-suggestion, especially when the decline starts after the rise in earnings. They will have the idea that anyway, this part is also profitable, and it doesn't matter if you lose it. This kind of thinking will cause investors to take risks that are not proportional to the returns.

Focus on the current price change

Regardless of the trading logic of short, medium, and long periods, the market is always determined by supply and demand, and the intuitive response of supply and demand is market sentiment.

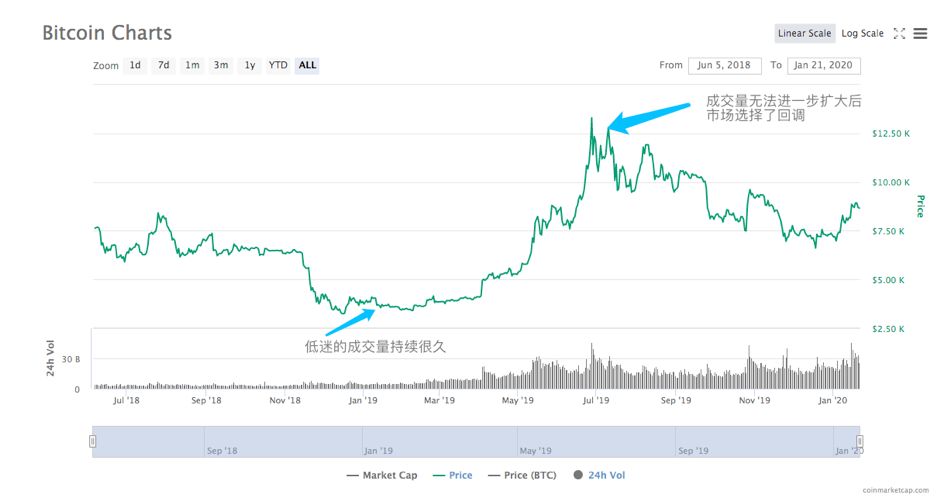

Most individual investors start trading not when the market is at its lowest point, but when the market is booming. Because of the ever-rising good situation, individual investors will subconsciously ignore any negative news, thinking that all trading targets are investable and will bring objective returns.

This also explains to some extent that the reversal often occurs at the time of the lowest volume, and the highest volume is often almost the highest. When it is no longer possible to attract new investors to enter the relay, the market only Can turn from prosperity to decline.

Lost in Loss Avoidance

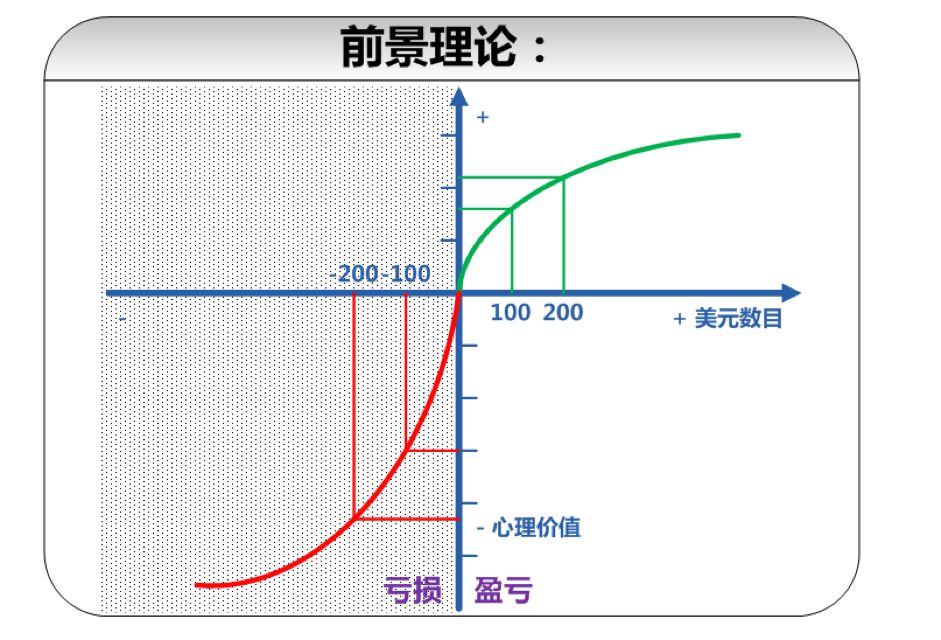

In 1979, Daniel Kahneman, a professor at Princeton University, and Amos Twowski, a professor at Stanford University, found through multiple empirical studies that "People tend to value losses more when they face the same amount of gains and losses ( "People are more sensitive to losses than gains." This principle is called loss avoidance. Therefore, when people face the same benefits and losses, the pain caused by losses is greater than the satisfaction brought by gains. "

Prospect theory states that most people are reluctant to take risks when facing profit, and that everyone is risk appetite when facing loss. The loss and profit are relative to the reference point. Changing the reference point when evaluating things will change the attitude to risk.

For example, let a person choose between a profit of 100 yuan and a 51% probability of 200 yuan and a 49% probability of 0 yuan. Most people will choose a profit of 100 yuan because the stability is not willing to bear the greater profit. The risk that comes with; let a person choose between a loss of 100 yuan and a loss of 200 yuan with a 51% probability and a loss of 0 yuan with a 49% probability. Most people choose a loss of 200 yuan with a 51% probability.

As shown in the figure, when the income rises from 100 yuan to 200 yuan, and then increases from 200 yuan to 300 yuan, people's joy will become weaker and weaker, and there will no longer appear as the income from 0 to 100 yuan. That sharp rise in satisfaction. However, when the income falls from 200 yuan to 100 yuan, and then from 100 yuan to 0 yuan, especially when it falls from 200 yuan to 100 yuan, the mood will become very strong, and the satisfaction will suddenly fall. When the income drops from 0 yuan to -100 yuan, the anger, regret, and sadness due to the loss will suddenly appear. Because regret is too strong, people are unwilling to accept losses, so it is difficult to sell. When the income fell from -100 to -200, regret faded, and it was enough to disappear the painful feeling. People were controlled by this idea and missed a good time to stop loss.

Therefore, trading should not rely on instinct and emotion, but should be judged rationally to avoid wrong operations caused by emotional fluctuations.

No planned transaction

Many investors do not have any plan when they decide to buy or sell. Instead, they rely on their sudden intuition and have no stop-loss points and profit targets at all. Even the funds invested have exceeded their own risk tolerance.

As shown in the figure, some investors' trading mentality:

1. Bitcoin has started to rise, and many investors are recommending it. It is worth paying attention to. 2. It is still rising. If it has risen so much, it should fall at any time. I will buy it when it has fallen by half. Why is it still rising and I missed a good time to buy it? If I do n’t buy it, it ’s too late, then buy it. Come in. (Hesitation and regrets) 3. Sure enough, my judgment is correct. This rise will last a long time (full of confidence). 4. The price has pulled back. It doesn't matter. This callback is the best opportunity to buy. 5. Call back again, it's awesome, it even gave me the opportunity to add a position, this time I want to buy everything. (Risk control is gradually lost) 6. As I think, the price of bitcoin continues to rise; how did it start to fall, why hasn't it risen back to my buying price, why has it hovered at low prices for so long, etc. When the price rebounded, I closed the position. (Began to enter the self-doubt stage) 7. It is still falling, and it has fallen below the previous reserve price. In this case, the price will still fall, or all of it will be thrown away; it is still falling, but fortunately I have already cleared the position, will not Lost again. (Transformed into a sense of certainty about the decline) 8. How did it rise again, and still rise so fast, indicating that the bottom has been completed before, and now you can make money by buying it back.

Investors must be planned in the trading process, not controlled by the current price fluctuations. This will become the price to control you, rather than the profit in the difference in your demand trading.

Conclusion

The real market is that most traders are dominated by emotions, hovering in fanatical and pessimistic moods, which is why the market sentiment will always successfully predict the market reversal. In the actual transaction process, people's psychology and emotions are full of uncontrollability. Therefore, subjective transactions will always be disturbed by psychological factors, while machine quantitative transactions avoid the risks caused by psychological fluctuations to a certain extent. And in the professional team has better psychological and behavioral control, in general, the transaction still needs more professional people to take charge.

risk warning:

- Beware of illegal financial activities under the banner of blockchain and new technologies. The standard consensus firmly resists the use of blockchain for illegal fundraising, online pyramid schemes, ICOs, various variants, and dissemination of bad information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Featured on Twitter | BCH12.5% miner tax blocked, Bitcoin.com under Roger Ver withdraws support

- Take a look at the different perspectives of countries on digital currencies

- Blockchain technology fusion, traceability of the entire process is not a false proposition

- How much does Bitcoin rise in half? How will computing power and prices change? Take a look at the best reference indicators!

- Why does the world need anonymous cryptocurrencies?

- Learning | Blockchain Governance Design Framework: Prysm Wheel

- India releases draft national blockchain strategy, recommends RBI to issue digital rupee