Share | Blockchain Governance Proposal

The purpose of blockchain governance is to make decisions in the best interests of as many people as possible, while minimizing the opportunity for a small number of people to act in a way that benefits their own community at the expense of the community.

From the point of view of objective proof, we can conservatively assume that all accounts voted for a producer are owned by that producer. We can also think of voting and "voting to buy" as "leasing shares" to get the top N. Since there is almost no difference between leasing and selling through an untrusted repurchase agreement, there is nothing immoral about this activity and trying to stop it is actually a potential violation of ownership.

To ensure long-term prospects and "skins in the game", only tokens locked in long-term equity contracts are eligible to vote. Someone's gain can compensate for their liquidity loss and should be proportional to the length of time the token is locked. It is best to lock the token network as long as possible based on market-defined interest rates.

- Research Report | Interpretation of Psychological Misunderstandings of Investors' Trading

- Blockchain investment: which "platform coin" has more investment value?

- The central bank's digital currency occupies the "C position" of the Davos Forum. Why is it popular among countries?

Therefore, I recommend creating 6 mortgage pools: 3 months, 6 months, 12 months, 2 years, 5 years, and 10 years. In a 1B token supply network, each pool will receive 5 million tokens per minute per minute every year (assuming the network is running with 100% reliability). Users can purchase the pool to distribute the pool's revenue proportionally. The user's voting weight is based on the sum of the percentage ownership of each pool. This represents an annual inflation rate of 3% paid to different equity pools.

Only one fund can be withdrawn from the pool per week. The equity in the 3-month pool can be withdrawn at a rate of about 7% per week. 10-year equity can be withdrawn at a rate of 0.2% per week.

The tokens in the equity pool will be taken from the "resources" pool and therefore cannot be lent to REX, which increases the bandwidth per token for all tokens in REX. The mortgage pool can be viewed as a bond, and the tokens are now withdrawn from circulation and recirculated at some point in the future due to increased interest due to inflation.

As long as your tokens remain in an equity pool, their interest compound interest rate will be proportional to the total number of shares in each pool.

Tokens can be transferred from short to long term without any delay. Therefore, you can transfer 100% of your 3-month shares to 10-year shares at any time; however, you cannot transition from 10-years to short-term unless you grow at a rate of 0.2% per week.

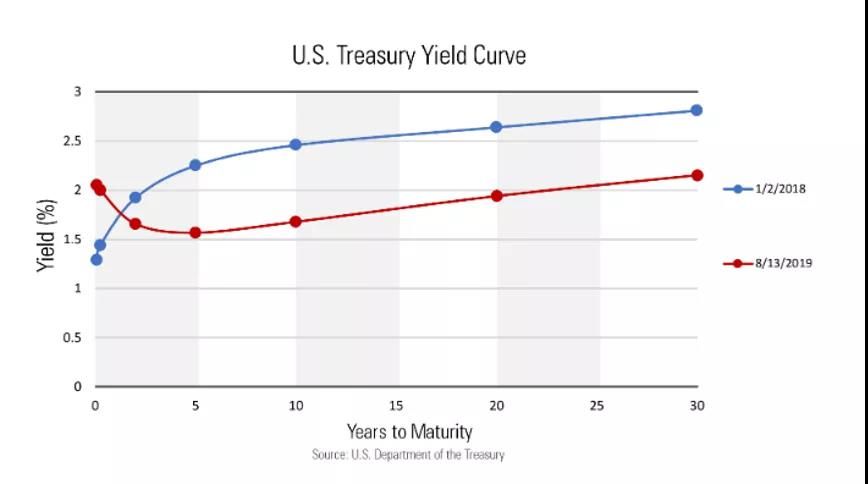

As a result of this mortgage system, market forces will set a yield curve based on balancing demand for power and liquidity. Few are willing to give up 10 years of liquidity, so they will get higher relative returns and more power on the web. More people will be willing to give up 3 months of liquidity, so they will get lower returns and less power.

Once everyone has bet and voted, 21 block producers will be selected with "one-on-one-vote" voting rights (weighted by the percentage of pooled tokens pledged). These producers will be paid pro-rata based on the number of votes they receive, rather than in blocks. Paying big producers anything other than a linear relationship with their ticketing will spur a Sebir attack and lead to centralization of power instead of 21 different parties, one person trying to control two or more slot machines, possibly only 20 Or less.

Producer compensation should be reduced to 0.5% of the coin supply per decade (at a discount of global reliability). Ultimately, the largest stakeholder will likely control the producer. Therefore, the proceeds paid to the stakeout pool are likely to flow to the majority of the producers.

If the network cannot ensure the reliable production of blocks, then all decentralization in the world will not help. As a result, all inflation is measured by a 7-day average availability that improves to the 10th power. With 99% reliability, the total expansion rate will be 90% of the maximum expansion rate of 3.5%. If the producer starts to lose blocks and the reliability drops to 97%, then everyone's income will drop to 73% of the maximum income. This means that if voters are not voting for reliable producers, they will be punished.

expected outcome

••••

Exchanges will not be able to vote with user tokens, as most control is tied to long-term mortgage contracts. With a token, a voting model and a proportional distribution of votes, the situation where two producers are run by one person can be ended. By voting on coin-only tokens, we can ensure that everyone who wants to be a producer is involved, and even the lowest producer seats may be reliable. Perhaps one of the more fascinating results was the discovery of a true market-based interest rate and yield curve. Smaller stakeholders can gain additional influence and higher returns by participating in the long-term equity pool.

REX will define the equity pool income of the shortest period (3 days), and the tokens in REX will no longer have voting rights. Those seeking income should go for mortgage instead.

Everything in this proposal is for community consideration and may be one of many possible solutions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Cosmos founder Jae Kwon announces exit and moves to new project Virgo

- Featured on Twitter | BCH12.5% miner tax blocked, Bitcoin.com under Roger Ver withdraws support

- Take a look at the different perspectives of countries on digital currencies

- Blockchain technology fusion, traceability of the entire process is not a false proposition

- How much does Bitcoin rise in half? How will computing power and prices change? Take a look at the best reference indicators!

- Why does the world need anonymous cryptocurrencies?

- Learning | Blockchain Governance Design Framework: Prysm Wheel