Research Report | Preliminary Study on the Digital Currency of the People's Bank of China: Goals, Positioning, Mechanism and Impact

Summary

The existing physical cash system has several pain points, and there is a real need to issue central bank digital currency. Fan Yifei, deputy governor of the central bank, proposed in the "Several Considerations on the Digital Currency of the Central Bank" that the "necessity of digitization of legal tenders is increasing day by day." Specifically, existing banknotes and coins have the following problems: (1) issuance and printing The costs of system, return and storage are relatively high, and there are many levels of circulation system; (2) inconvenient to carry; (3) easy to be forged, anonymous and uncontrollable, and there is a risk of being used for money laundering and other criminal activities.

DCEP is a central bank debt focus on M0 (cash) replacement, adopting a two-tier operating system of “central bank-commercial bank/other institutions”, considering blockchain technology, controllable anonymity (disclosure of transaction data only to the central bank), which makes it Distinguished from other digital assets. DCEP is still the concept of Cash, but it is more portable than physical cash; it is a central bank debt, which is safer than ordinary bank deposits; it will be higher than the third-party payment institution's account balance, which is conducive to comply with the digital economy. For example, compared to bank deposits, for holders, DECP is a claim to the central bank and is less risky; bank deposits are claims against commercial banks and are risky (although very small). – Participants may be more inclined to hold DECP than bank deposits under the demand for diversity.

The market has not yet realized that DCEP is similar to the balance of third-party payment institutions. The same thing: (1) are central bank liabilities; (2) the reserve ratios that circulation institutions need to pay to the central bank are 100%; (3) are all figures M0. Differences: (1) DCEP is distributed by commercial banks or other institutions, and the balances of third-party payment institutions such as Alipay and WeChat payment can be regarded as distributed by third-party payment institutions. (2) Although the third-party payment institution's reserve funds are the same as the physical cash, the current merchants still do not accept electronic payment methods such as Alipay and WeChat payment, and almost accept cash, but it can be expected that the merchant cannot refuse to accept DCEP. (3) The DCEP transaction information is only visible to both parties and the central bank, while the information of the third-party payment institution's account is in addition to the transaction parties and the central bank, and the third-party payment institution itself is also in control, and there are hidden dangers in privacy protection.

DCEP may have an over-the-counter market and needs to be protected against related risks. As mentioned earlier, in order to prevent holders from converting large amounts of bank deposits into DCEP, the central bank may impose restrictions on DCEP's exchange quotas and fees, which may lead to the emergence of DCEP “black market”, and the risk of its OTC market is worthy of attention.

- QKL123 market analysis | Bitcoin continues to drop, will fall below $ 9,000? (0924)

- Winners such as Tencent, Fidelity and Lotte, Everledger finally won $20 million in Series A financing

- Jia Nan, Zhi Zhi Kong Jianping: It is only a matter of time before bitcoin breaks through 100,000 US dollars. The limit of computing power in 2020 is doubled.

The secondary market is hot, we recommend to pay attention to: (1) The issuance link, DCEP is issued by the central bank, we recommend service providers that can help the central bank identify and control the risk of DCEP over-the-counter transactions. (2) Distribution, which is expected to become a DCEP distribution company, for example, a company with a large number of B-side (enterprise) merchant resources or a payment institution with C-end (personal) payment service experience; commercial banks, payment system developers are also worth attention. (3) Clients, payment institutions or technology developers, POS equipment manufacturers, payment security service providers, multi-function ATM service providers with experience in network payment service infrastructure development such as digital wallet, including Hailian Jinhui, Feitian Integrity, Digital certification, Weishitong, Kelan software, easy to see shares, Quartet Jingchuang and so on.

Risk warning: The central bank's digital currency has fallen short of expectations, the central bank's digital currency regulation has become stricter, and the central bank's digital currency has the risk of over-the-counter trading.

1. The central bank frequently blows up the digital currency DCEP "calls out"

Central bank leaders frequently whistle, saying that the central bank’s digital currency is “out of the box”. On August 10, Mu Changchun, deputy director of the Payment and Settlement Department of the People's Bank of China (hereinafter referred to as the “Central Bank”), proposed at the China Financial Forty Forum. The relevant personnel of the central bank have started to develop related systems since last year. “It can be said now He is ready to go out." Shortly thereafter, Mu Changchun took the position of director of the New Central Bank Digital Currency Institute and on September 4th he got the course "Technology Finance Frontier: Libra and Digital Currency Outlook" on the knowledge payment platform. The market originally thought that the central bank's digital currency was still at the concept stage, but the recent frequent air blows have greatly increased market expectations.

The central bank's work conference clearly proposed to accelerate the development of China's legal digital currency. At the beginning of August, the central bank held a working video conference in the second half of 2019. The meeting called for accelerating the pace of research and development of China's legal digital currency (DC/EP), tracking the development trend of domestic and foreign virtual currencies, and continuing to strengthen Internet financial risk remediation. This is the second time after the central bank’s 2018 national currency gold and silver work video conference on the development of the central bank’s digital currency on March 28, 2018, when the central bank proposed that its currency gold and silver sector steadily advanced the central bank’s digital currency research and development, 2018 It is necessary to promote the central bank's digital currency research and development in a solid manner.

The media's follow-up reports also show that the central bank's digital currency is getting closer. The Shenzhen Commercial Daily reported that the central bank’s digital currency has begun a closed-loop test and is on the verge of appearance.

1.2 The central bank began research on digital currency five years ago

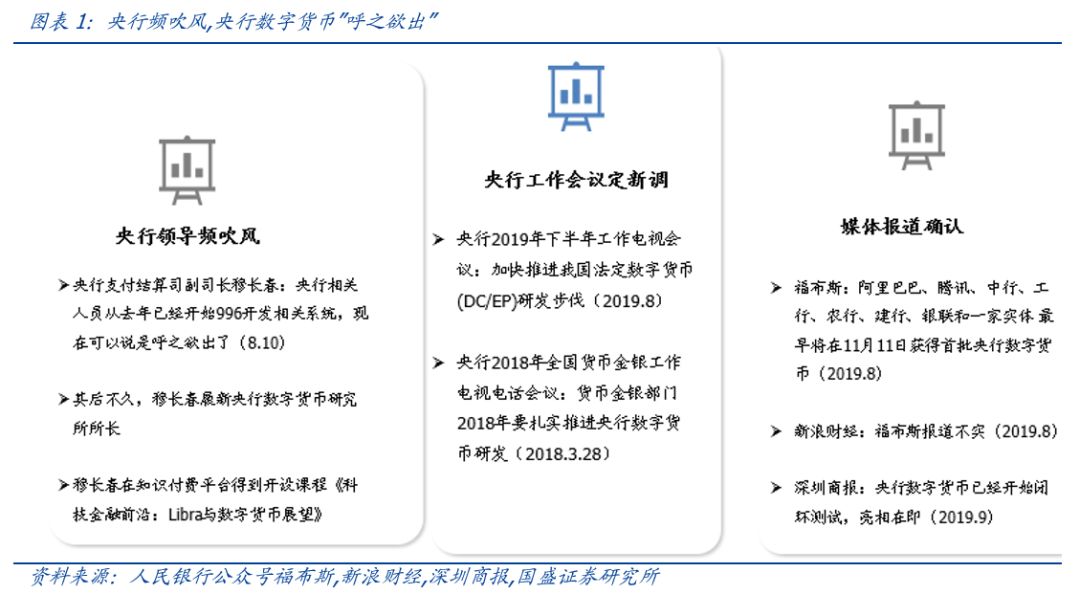

We have sorted out the development process of the central bank's digital currency. Since 2014, the central bank has been active in digital currency research and development. They include at least the following aspects:

(1) Specially propose “central bank digital currency” in the above two working meetings to deploy related work;

(2) Set up a special digital currency research institute, which also initiated the establishment of a wholly-owned Shenzhen Financial Technology Company;

(3) Actively apply for relevant patents. The Patent Enquiry System of the State Intellectual Property Office showed that as of August 4, 2019, the Central Bank Digital Money Research Institute applied for a total of 74 patents involving digital currency;

(4) Determine the pilot application scenario of using the digital ticket trading platform as a legal digital currency, and complete relevant tests and trial runs.

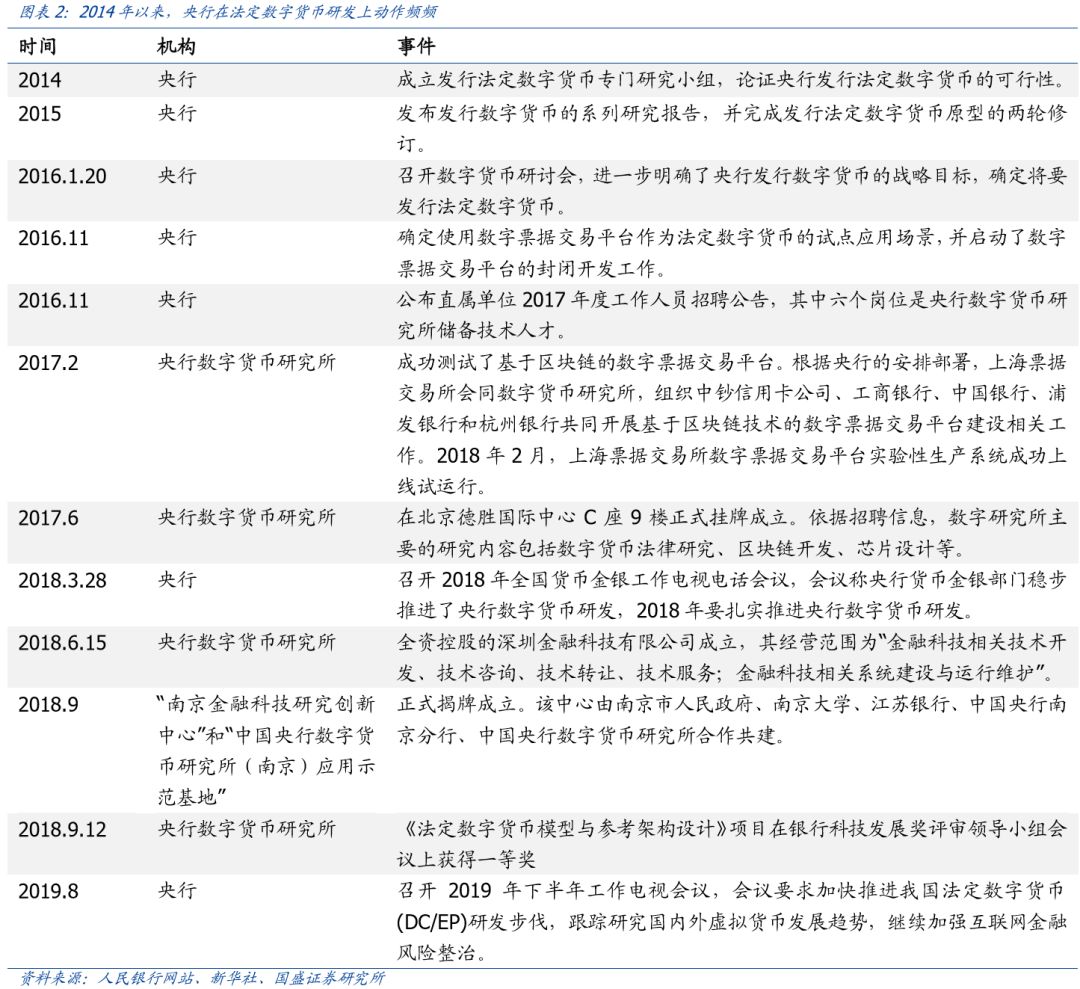

Zhou Xiaochuan, former president of the central bank, Yao Qian, former director of the central bank's digital currency research institute, and Wang Xin, director of the Research Bureau of the People's Bank of China and the director of the Monetary and Financial Bureau, and other central bank officials have repeatedly voiced the central bank's digital currency. These statements highlight the statutory status. The importance of digital currency. For example, Yao Qian, former director of the Central Bank’s Institute of Digital Money, said at the time of his post, “If finance is the core of the modern economy and the blood of the real economy, money is the core of the economic core, and the blood circulating in the blood of the economy. The legal digital currency is the jewel in the crown of financial technology and has a huge impact on the future development of the financial system."

In the past ten years, the active promotion of Internet giants such as Alibaba and Tencent and the tolerance of regulatory agencies have pushed China's mobile payment into the forefront of the world and achieved world-renowned achievements. The central bank's digital currency is the wave of digital finance in China's regulatory agencies. Actively trying and embracing will undoubtedly fundamentally change the digital economy and China's financial system, and help promote the further development of China's financial technology manufacturers.

Previously, the market has been confusing the blockchain concept with the central bank's digital currency, but in the recent propaganda we saw no inevitable connection between the two. Blockchain is more of a technology. Although Bitcoin and other products have certain financial asset attributes, it is still not a currency at all. In the future, the application of blockchain is more in the fields of traceability, trading, etc. The characteristics of bitcoin transactions, ie settlement, are also greatly inspired by the future bookkeeping system. The central bank's digital currency is more complementary to the existing currency issuance system and the layout of the monetary infrastructure in the future digital economy. The technology adopted will be more mature, and the blockchain is only an alternative.

2 Overview of central bank digital currency: central bank liabilities, two-tier operating system, controllable anonymity, use restrictions

2.1 Objective: Comply with the wave of the digital economy and defend the national monetary sovereignty

2.1.1 Compliance with the digital economy

The work paper issued by the Bank for International Settlements in February 2019, Proceeding with caution-a survey on central bank digital currency, shows that 63 central banks responded to their questionnaires. Of these, 70% are (or will soon) carry out central bank digital currency work, many central banks have entered the experimental or proof-of-concept phase; physical cash is unlikely to meet the needs of future payments, although many people can only wait for the emergence of central bank digital currency The central banks are working hard to ensure that it is worth waiting; the reasons for the central bank of the developed economies to issue general-purpose central bank digital currencies are: payment security, financial stability, others, payment efficiency (domestic), monetary policy enforcement, payment Efficiency (cross-border), inclusive finance; and the order of developing economies is payment efficiency (domestic), inclusive finance, payment security, others, financial stability, monetary policy enforcement, and payment efficiency (cross-border).

Yao Qian, former director of the Central Bank’s Institute of Digital Money, said many times when he was in office. “If finance is the core of the modern economy and the blood of the real economy, money is the core of the core of the economy. It is the blood circulating in the blood of the economy. And the legal digital currency is the jewel in the crown of financial technology, which has a huge impact on the future development of the financial system."

Yao Qian believes that the legal digital currency is the cornerstone of the digital economy. Digital technology has not only caused tremendous changes in social production and lifestyle, but also created conditions for the reshaping and innovation of monetary patterns. The currency form is evolving in the direction of digital currency after going through commodity coins, metal currencies, paper money, and electronic money. The development of the digital economy requires digital finance, and more requires a legal digital currency. Accelerating the development of legal digital currency is of great significance to boosting the development of the digital economy.

2.1.2 Improve efficiency, reduce costs, and prevent risks

The existing physical cash system has several pain points, and there is a real need to issue central bank digital currency. Fan Yifei, deputy governor of the central bank, proposed in the "Several Considerations on the Digital Currency of the Central Bank" that the "necessity of digitization of legal tenders is increasing day by day." Specifically, existing banknotes and coins have the following problems: (1) issuance and printing The costs of system, return and storage are relatively high, and there are many levels of circulation system; (2) inconvenient to carry; (3) easy to be forged, anonymous and uncontrollable, and there is a risk of being used for money laundering and other criminal activities.

2.1.3 Defending national monetary sovereignty

Fan Yifei, deputy governor of the central bank, also said that due to the credit advantage of the central bank endorsement, the issuance of the central bank's digital currency is conducive to curbing the public's demand for private encrypted digital currency and consolidating China's monetary sovereignty.

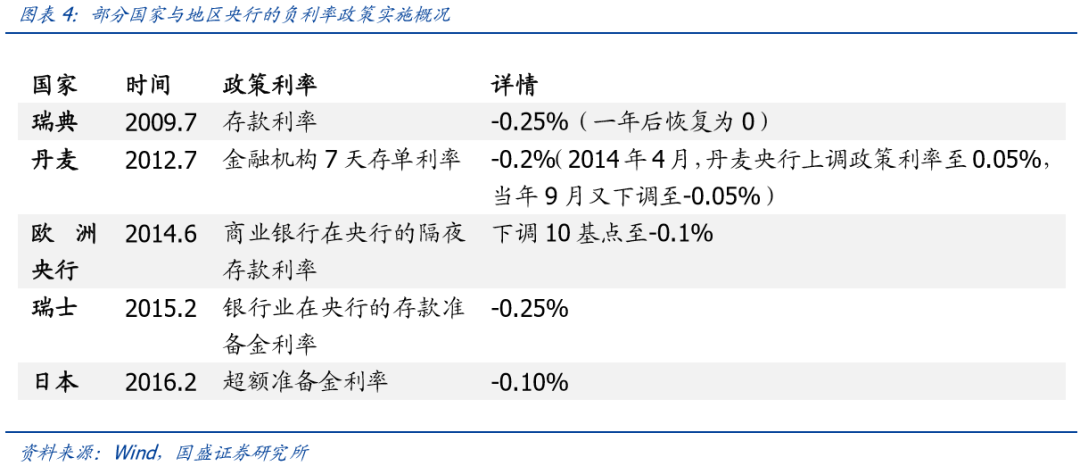

2.1.4 Creating space for negative interest rates

Interest rate is the price of funds, and adjusting interest rates is an important monetary policy tool of the central bank. For example, when the economy is down, the economic growth momentum is weakened, the tax reduction stimulus effect is declining, or the local currency is under pressure to appreciate, the interest rate is lowered to stimulate consumption or stabilize the exchange rate. In practice, the negative interest rate policy is mainly manifested in the form that the central bank charges the deposits of commercial banks in the central bank to stimulate commercial banks to lend, and avoids the funds released by the central bank through quantitative easing to return to the central bank, so that funds flow into the real economy. The Swedish central bank implemented the negative interest rate policy for the first time since July 2009. Since then, central banks in Denmark, the European Central Bank, Switzerland and Japan have implemented negative interest rate policies. These policies are mainly aimed at the deposit interest rates of commercial banks in the central bank. Most of them are not transmitted to the personal deposit rate.

Sun Guofeng and He Xiaobei, then directors of the People’s Bank of China’s Financial Research Institute, proposed in the central bank’s working paper “Deposited Negative Limits of Deposit Rates and Negative Interest Rate Transmission Mechanism” issued in 2018 that in a banking system where interest rates can effectively break through the zero interest rate space. The central bank can implement a negative interest rate policy that is significantly lower than zero to cope with the deflationary recession; with the development of technology, the central bank issues digital currency is the general trend, the central bank can set the digital currency interest rate to a negative value when needed, and the future digital currency will replace the cash The mechanism solves the problem of restricting residents' cash withdrawal to negative interest rate policy; the central bank's digital currency is conducive to the implementation of negative interest rate policy, so it should accelerate the development of the central bank's digital currency. Fan Yifei and Mu Changchun also proposed to create conditions for the central bank to implement a negative interest rate policy.

2.2 Positioning: Number M0

According to Fan Yifei and Mu Changchun's statement (the following italics are the two words), DCEP pays attention to the substitution of M0, which means that it does not pay interest like physical cash (banknotes and coins), is the central bank's debt (with unlimited There is a certain degree of anonymity, and the main reasons for this positioning are as follows.

First, replacing M1 and M2 does not help to improve payment efficiency, and it will cause huge waste to existing systems and resources. (1) M1 and M2 have been realized electronically and digitally; (2) Interbank payment clearing system supporting M1 and M2 circulation, various online payment methods of commercial banks and non-bank payment institutions are increasingly efficient and can meet China's requirements. The need for economic development.

Second, the digitization of M0 needs to be further improved. (1) The current M0 is easy to be forged anonymously, and there is a risk of money laundering and terrorist financing. (2) Existing bank cards and Internet payments are based on the tight coupling model of existing bank accounts and cannot fully meet the public demand for anonymous payments. Such an electronic payment tool cannot completely replace M0. (3) In areas where account services and communication networks are poorly covered, people are highly dependent on cash. The design of DCEP maintains the properties and main features of cash, and also meets the needs of portable and anonymous, and is a good tool to replace cash.

2.3 Operating System: “Central Bank-Commercial Bank/Other Operating Organization” Double Layer

DCEP adopts a two-tier structure of “central bank-commercial bank/other operating agencies”: the central bank will adopt “first convert digital currency to commercial banks/other operating agencies” compared to the single-tier transportation system that directly issues digital currency to the public ( A two-tier operating system in which commercial institutions/other operating agencies pay the central bank 100% in full, and then the commercial banks/other operating agencies are redeemed to the public.

The expressions of Fan Yifei and Mu Changchun can be attributed to two aspects: “profit-making” and “avoidance”:

Profit. (1) The two-tier structure is conducive to giving full play to the resources, talents and technological advantages of commercial institutions, fully mobilizing market forces and promoting innovation; (2) helping to resolve risks; and (3) helping to curb public demand for cryptographic assets. Consolidate China's monetary sovereignty.

Avoid harm. (1) The single-tier operating system will bring great challenges to the central bank, which is not conducive to improving the availability of DCEP and enhancing the willingness of the public; (2) the two-tier operating system will not change the existing money delivery system and the dual account structure. It will not compete against the deposit currency of commercial banks, does not affect the existing monetary policy transmission mechanism, and will not strengthen the procyclical effect under the pressure environment. Therefore, it will not have a negative impact on the real economy. The single-tier structure may have an extrusion effect on commercial bank deposits, affecting the ability of commercial banks to lend, and enhance the dependence of commercial banks on the interbank market, leading to financial disintermediation, raising capital prices, increasing social financing costs, and damaging the real economy. The central bank has to subsidize commercial banks. In extreme cases, the existing financial system may be subverted, returning to the situation of the central bank's “great unity” before 1984; (3) avoiding wasting resources; and (4) avoiding excessive concentration of risks.

In particular, (1) in the two-tier operating system of DCEP “distribution-distribution” , not only commercial banks but also other institutions can be distributed and participated in the operation ; (2) Mu Changchun said, “ currently belongs to In a horse racing state, several designated operating agencies adopt different technical routes to do DC/EP research and development. Whose route is good, who will eventually be accepted by the people and accepted by the market, who will eventually win the game. So this is the market competition. The process of selection. " This means that the evolution of DCEP may be a long-term process, and there may be room for market-oriented institutions to participate.

2.4 Technical route: no preset; consider blockchain technology; load smart contract

Mu Changchun said that DCEP does not preset the technical route, but because the target application scenario of DCEP is the high concurrent retail business field (at least 300,000 transactions per second), the current blockchain technology is in performance. This goal cannot be met. DCEP does not use blockchain technology at the central bank. Yi Gang, president of the People's Bank of China, said that the People's Bank of China does not presuppose technical routes in the research and development of DCEP, and can compete for fair competition in the market. It can consider blockchain technology or on the basis of existing electronic payments. The new technology evolved to fully mobilize the enthusiasm and creativity of the market, we have also established a mechanism compatible with the incentives of market institutions.

2.5 Account and Anonymity: Loosely coupled; disclose transaction data only to the central bank

Fan Yifei said that the central bank's digital currency should be based on the loose coupling of accounts , so that the dependence of the transaction link on the account is greatly reduced . The centralized operating model adopted by the central bank's digital currency is different from traditional electronic payment instruments. The transfer of funds from electronic payment instruments must be done through an account, using a tightly coupled account. Under the loosely coupled account system adopted by the central bank's digital currency, operators can be required to transmit transaction data to the central bank on a daily basis, which is convenient for the central bank to obtain the necessary data to ensure that regulatory objectives such as prudent management and anti-money laundering can be achieved, and business can be alleviated. The system's system burden.

In terms of anonymity, the central bank's digital currency must achieve controllable anonymity, and only disclose the transaction data to the central bank. The reason is that if there is no transaction third party anonymity, personal information and privacy will be revealed; but if full third party anonymity is allowed, it will promote crimes such as tax evasion, terrorist financing and money laundering.

2.6 Restrictions on use: time, amount, transaction fee limit

Because DCEP is more secure than bank deposits, it may lead to “deposits moving” of commercial banks, which will affect the stability of the financial system. To this end, the central bank will impose restrictions on DCEP and increase bank deposits to DCEP. Cost and institutional friction. In addition, in order to guide holders to use DCEP for retail business scenarios, the central bank may also take corresponding measures. These measures may include:

Time and amount limit. The central bank may set transaction limits and balance limits based on different levels of the DCEP account, and may also set daily and annual cumulative transaction limits, and stipulate large redemption.

Transaction fee limit. When necessary, the central bank may implement a tiered charge for DCEP exchanges, no charge for small, low-frequency exchanges, and higher fees for large, high-frequency exchanges and transactions.

These usage restrictions may result in unequal value of DCEP and physical cash or other currency forms. We suspect that DCEP's over-the-counter market may occur and the central bank needs to closely monitor the risks, which will generate demand for technology companies in the field of financial risk control. .

Mu Changchun mentioned another reason for DCEP restrictions in the App course: anti-money laundering. He mentioned that the measures that the central bank may take include registering the wallet with the mobile phone number, and the DCEP that can be obtained can only meet the daily micropayment requirements; if the ID card or bank card is uploaded, a higher level digital wallet can be obtained, if There is no limit to the check-in at the counter.

2.7 Target Usage Scenario: Small Retail Business

Fan Yifei and Mu Changchun said that the central bank will guide the holders to apply the central bank's digital currency to the small-scale retail business, and impose restrictions on the application of quotas and large amounts of reservations (see above). This shows that the target usage scenario of DCEP is the small retail business.

3 Compare it from DCE's M0 attribute with other "currencies"

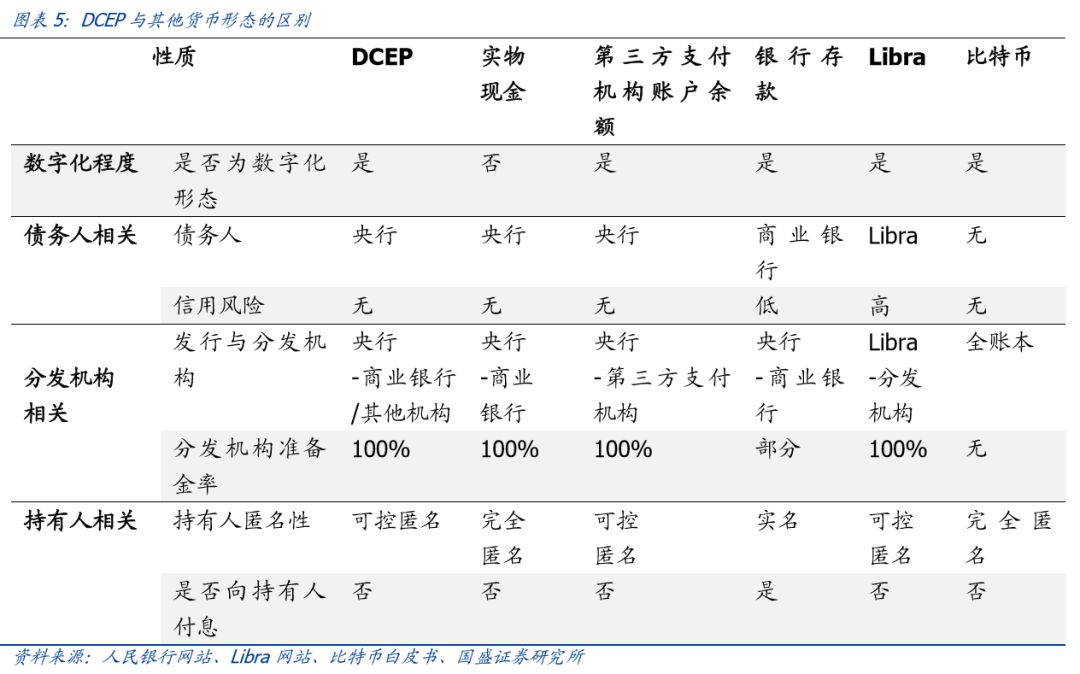

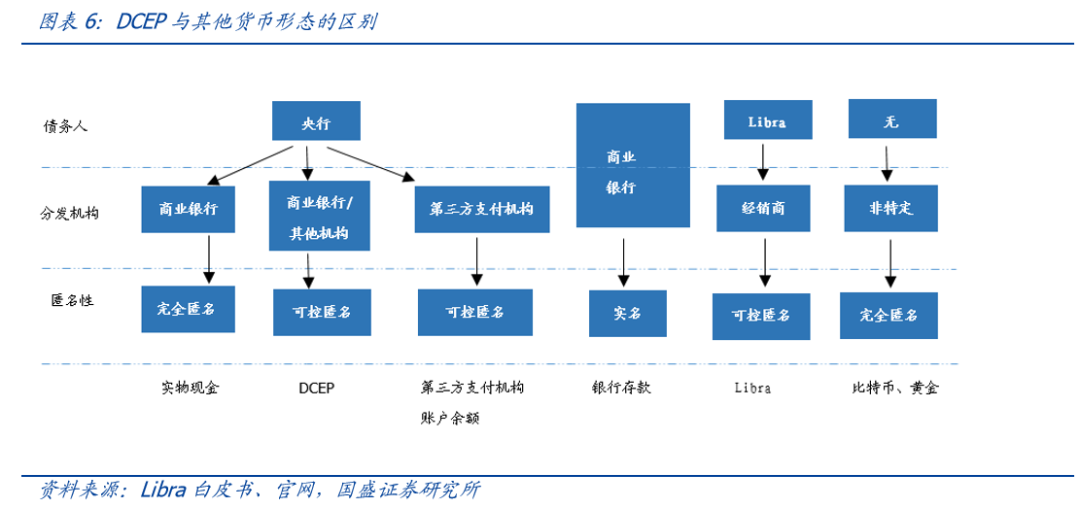

Subsequently, several central bank officials said that the People's Bank of China Digital Currency (DCEP) was positioned as digital cash (M0). This positioning is the key to understanding DCEP, which distinguishes it from other currencies. We compare the similarities and differences between DCEP, physical cash, third-party payment institution account balances, bank deposits, bitcoin and gold from the degree of digitization, debtor-related factors, distribution-related factors and holder-related factors.

3.1 Other forms of DCEP and French currency

According to the Interim Measures for the Statistics and Publication of the Money Supply of the Bank of China (1994), China defines the currency as “financial instruments that undertake the means of circulation and payment” and divides the published money supply into three levels (M0, M1). M2), in which physical cash (banknotes and coins) belong to M0, the liquidity level is the highest, the central bank is in debt, no interest is paid; bank deposits belong to M1 and M2, liquidity is second, and commercial banks are indebted and pay interest; The balance of the three-party payment institution belongs to M2, which is the central bank's debt and does not pay interest. This report only compares the similarities and differences between DCEP and China's legal currency form with the most holders of physical cash, third-party payment institution account balances and bank deposits.

Note: The level of money released by China (the total stock of money in the society is the sum of financial instruments that bear the means of circulation and payment at a certain point in time):

(1) M0 (currency currency): cash in circulation (cash issuance outside the organization of money supply statistics);

(2) M1 (narrow money) = M0 + corporate deposits (corporate deposits deducted from unit time deposits and self-financed infrastructure deposits) + agency group army deposits + rural deposits + credit card deposits (individual holdings);

(3) M2 (broad money) = M1++ urban and rural residents' savings deposits + corporate deposits with regular deposits (unit time deposits and self-financing infrastructure deposits) + foreign currency deposits + trust deposits + securities company customer deposits + housing provident fund Central deposit + non-deposit financial institutions deposits in deposit-type financial institutions + money market funds held by non-deposit institutions.

Source: Interim Measures for the Statistics and Announcement of the Money Supply of the People's Bank of China (1994), Announcement of the People's Bank of China

3.1.1 DCEP is more portable than physical cash

Physical cash includes banknotes and coins. DCEP has the following similarities and differences.

The same thing: (1) are central bank liabilities; (2) do not pay interest to the holder; (3) are anonymous.

The differences are: (1) DCEP can control anonymity, banknotes are completely anonymous; (2) DCEP has no printing, transportation, storage and ATM machine manufacturing and operation and maintenance costs, and banknotes are – bearish ATM machine manufacturers; 3) DCEP may have related app and banking system development costs, banknotes do not have this cost; (4) DCEP is easy to carry, banknotes are relatively difficult to carry; (5) DCEP allows holders to go to banks or ATMs anytime, anywhere. Application.

3.1.2 DCEP is safer than bank deposits

The demand deposits in bank deposits belong to M1, and the time deposits belong to M2. They have the following similarities and differences with DCEP.

The similarities: (1) are all currencies; (2) both issuance and circulation are two-tier structures of “central bank-commercial banks”, that is, they are all paid by the commercial banks to the central bank after they have paid the reserves. — may be good for banking system developers.

Differences: (1) Different risk levels. For the holder, DECP is a claim to the central bank, no risk; bank deposits are claims against commercial banks, and there are risks (although very small). — Holders may prefer to hold DECP instead of bank deposits. Therefore, the central bank does not pay interest on DCEP, but when the bank deposit rate is low, the DCEP advantage is highlighted. In response, the central bank may impose other frictional costs on the conversion of bank deposits to DCEP, for example, setting a limit, at which point a DCEP off-market ("black market") may be formed.

(2) The reserve ratio is different. For banks, DCEP is required to pay the full amount of reserves to the central bank; to provide bank deposits to users only need to pay part of the reserve to the central bank. — This means that banks may not be motivated to actively promote DCEP.

(3) The holder's interest return is different. DECP does not pay interest (possible negative interest rate if necessary), bank deposits pay interest;

(4) The degree of anonymity is different. DCEP can control anonymous, real name of bank deposits.

3.1.3 DCEP is similar to the account balance of a third-party payment institution

DCEP is similar to third-party payment institutions such as Alipay and WeChat payment account balances. Yao Qian, former director of the Digital Bank Institute of China, cited the views of IMF economists Tobias Adrian and Tommaso Mancini-Griffoli and said that 100% of the preparation for payment is 100%. The payment of Alipay and WeChat after the deposit of the central bank is equivalent to trading with central bank liabilities, which is essentially the central bank's digital currency.

But we think that there are differences between the two. The DCE and third-party payment institution account balances have the following similarities and differences.

The same thing: (1) are central bank liabilities; (2) the reserve ratios that circulation institutions need to pay to the central bank are 100%; (3) are all figures M0. ——Unlike the public perception, the balance of the account of the third-party payment institution is the deposit reserve of the customer deposited by the payment institution, which is the central bank liability, not the liability of the third-party payment institution, and the “debt” in the central bank’s balance sheet. The following is shown as “non-financial institution deposits”.

Differences: (1) DCEP is distributed by commercial banks or other institutions, and the balances of third-party payment institutions such as Alipay and WeChat payment can be regarded as distributed by third-party payment institutions. (2) Although the third-party payment institution's reserve funds are the same as the physical cash, the current merchants still do not accept electronic payment methods such as Alipay and WeChat payment, and almost accept cash, but it can be expected that the merchant cannot refuse to accept DCEP. This will be an important difference between DCEP and third party payment agency account balances. (3) The DCEP transaction information is only visible to both parties to the transaction and the central bank, while the information of the third-party payment institution account is in addition to the transaction parties and the central bank, and the third-party payment institution itself is also in control. (4) Mu Changchun proposed that DCEP can be paid without network, and both parties can go offline and pay, which can realize “double offline payment”. He suggested that as long as the mobile phone has electricity, even if the entire network is broken, payment can be realized. This is different from the balance of the third-party payment institution such as WeChat payment and Alipay in the ordinary payment scenario. (Note: Some payment also has dual offline payment technology, for example Alipay realized the mobile phone and gate double offline QR code payment technology in the bus scene.

3.2 DCEP and cryptocurrencies such as Bitcoin and Ethereum

The biggest difference between DCEP and Bitcoin, Ethereum and other cryptocurrencies is that DCEP is centrally operated by the central bank. Only the two parties and the central bank can see the specific information of the transaction, while the management of the latter is more decentralized. The web is publicly available, and the production of bitcoin is completely controlled by open source programs, and the generation mechanism is fixed, more similar to native assets.

Specifically, DCEP has the following similarities and differences with cryptocurrencies such as Bitcoin and Ethereum.

The same thing: (1) are all digital assets; (2) do not pay interest to the holder.

The difference is: (1) DCEP's debtor is the central bank, and bitcoin and other cryptocurrencies have no debtor; (2) DCEP's operating system is the central bank-led "central bank – commercial bank / other institutions" double-layer, while bitcoin, ether There are no double-layer operating systems in the cryptocurrency, such as decentralized management; (3) DCEP can control anonymity, while cryptocurrency books such as Bitcoin and Ethereum do not grasp the true identity of the holder.

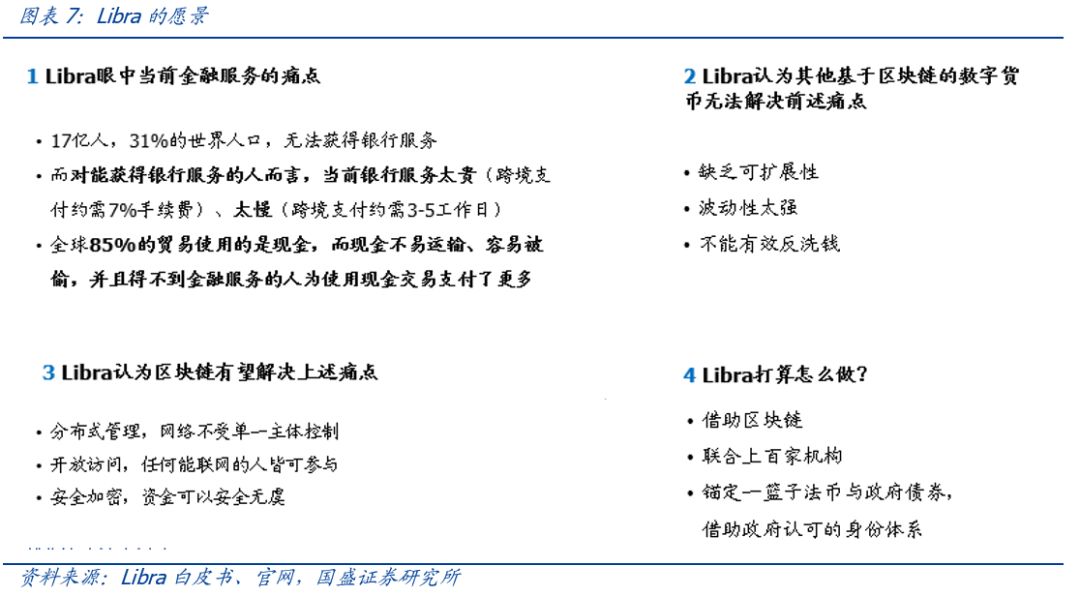

3.3 DCEP and Libra

On June 18th, Facebook and 27 institutions including PayPal and Visa released the Libra white paper on cryptocurrency. Libra is sponsored by Facebook with 2.7 billion users, and its partners also cover a large potential user group. This makes Libra's subversion and impact far more than other digital currencies, and has a huge impact on the global financial system. That is to cause the concerns and “encirclement and suppression” of central banks and financial regulators.

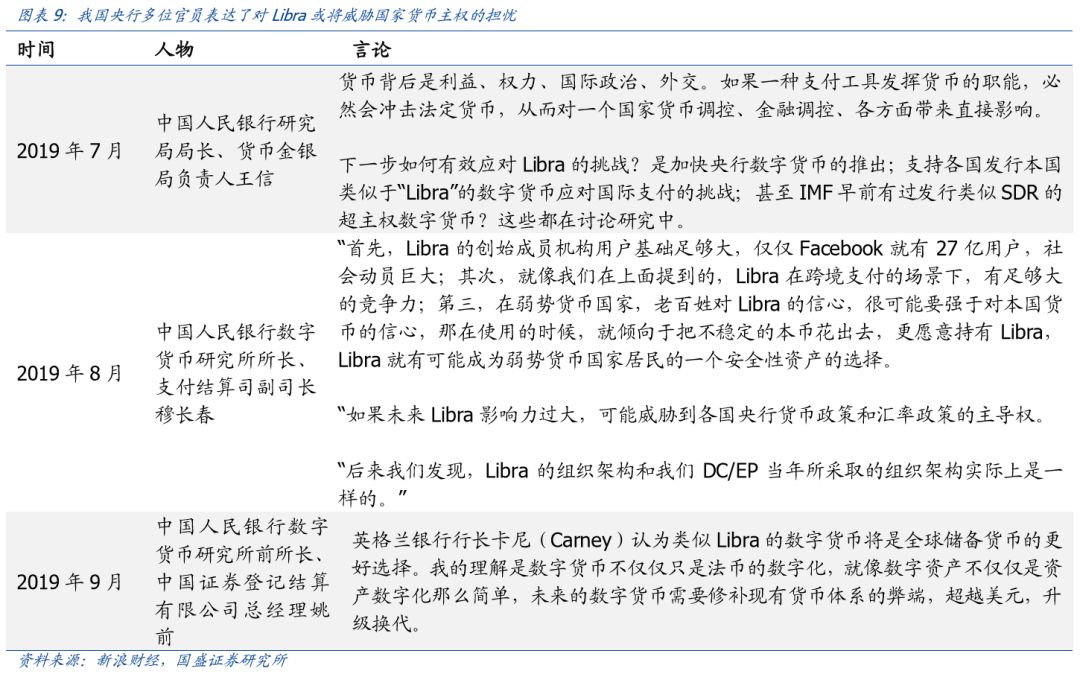

Many officials of China's central bank expressed concern about Libra and its concerns about the sovereignty of the country's currency , and some officials pointed out that DCEP has similarities with Libra's two-tier operating system.

According to the Libra white paper, Libra is a digital currency based on the open source Libra blockchain. Unlike most cryptocurrencies, Libra is fully supported by real asset reserves. Libra is 1:1 exchanged by the user to the dealer through the French currency (the capital of Libra's underlying assets is 5 kinds of legal currency, of which, the US dollar accounts for 50%, the euro accounts for 18%, the yen accounts for 14%, and the British pound accounts for 11%. Singapore dollar accounts for 7%). For each newly created Libra cryptocurrency, there is a basket of legal and government bonds of relative value in the Libra Reserve, and the Libra Association builds trust in its intrinsic value to ensure that it does not fluctuate over time. In contrast, DCEP is the digital renminbi, which is the central bank's debt, while 59% of the PBOC's assets are foreign exchange (mainly in US dollar assets), and 29% are claims against Chinese deposit companies (mainly commercial banks) (2019). August data).

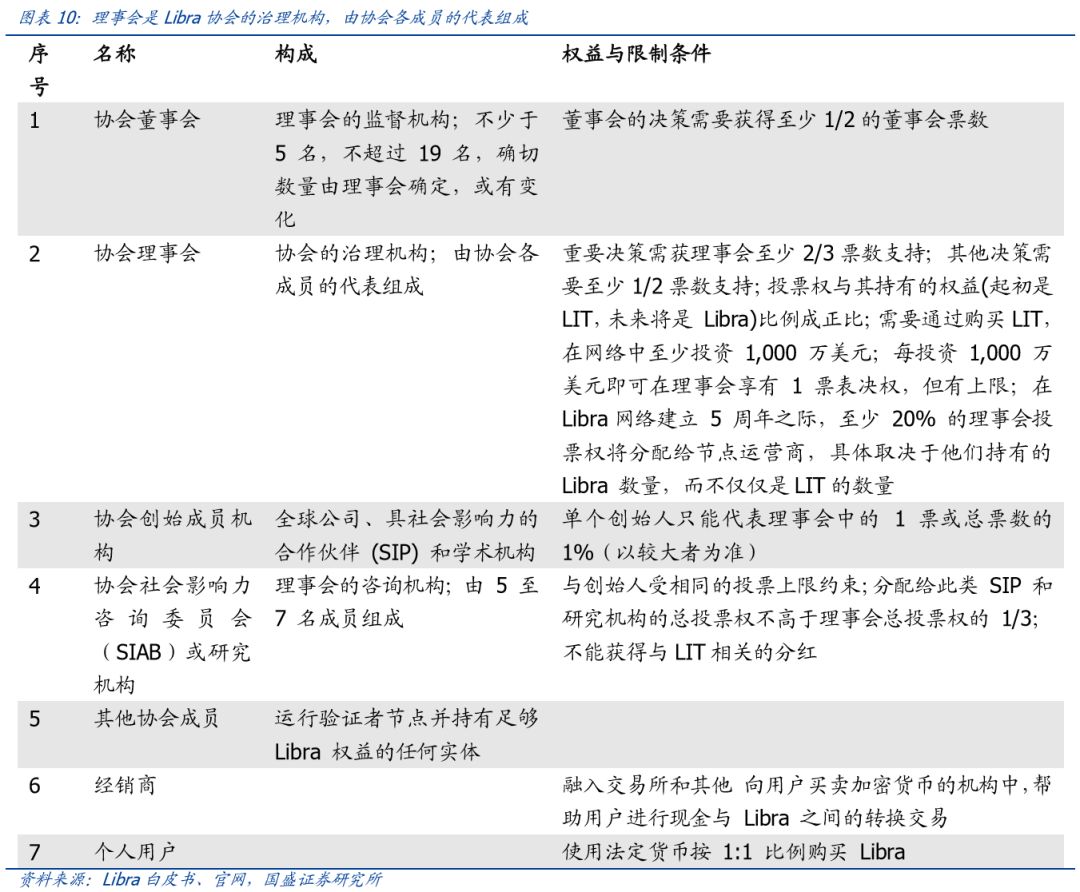

According to the Libra white paper, Libra is operated by the Libra Association. The Libra Association is an independent, not-for-profit membership organization based in Geneva, Switzerland. The Libra Association is governed by the Libra Association Council, which is composed of a single representative from each of the verifier nodes. Board members work together to make decisions about the governance of networks and reserves. All decisions will be made through the Board of Directors, and two-thirds of the members will vote for approval in a major policy or technical decision. In 2019, Facebook played a leading role in the association. The Libra blockchain and ecosystem will begin to transition from a licensed blockchain to an unlicensed blockchain within five years of public release. This means Libra is committed to achieving true decentralization. In contrast, DCEP is centrally operated by the central bank.

DCEP and Libra have the following similarities and differences.

The same thing: (1) are all digital assets; (2) the reserve ratio of the distribution institution to the issuer is 100%; (3) no interest is paid to the holder; (4) all controllable anonymity (can Meet regulatory requirements).

The difference: (1) DCEP's debtor is the central bank, no risk; and Libra's debtor is the Libra Association, which faces the dual credit risk of the Libra Association and its distribution agencies. Specifically, for the holder, there is a dealer who fails to pay the full amount of reserves to Libra and the Libra Association's own credit risk. (2) DCEP's operating system is “Central Bank-Commercial Bank/Other Institutions”, while Libra's operating structure is “Libra Association-Libra Distribution Agency”, and the Libra Association acts as the de facto central bank.

3.4 DCEP and other central bank digital currencies

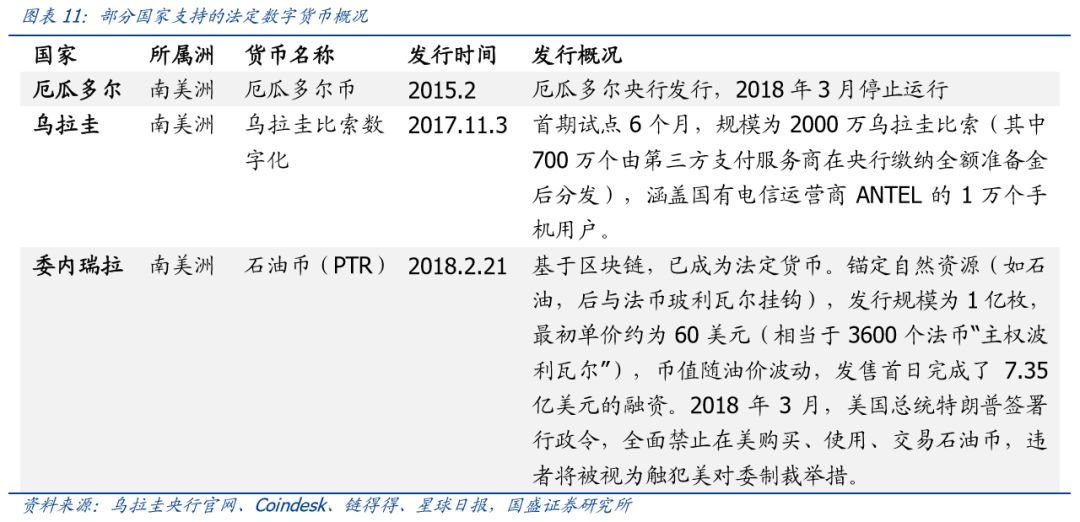

The more well-known legal digital currency that is currently online in the world is Ecuadorian currency. Another well-known legal digital currency is the petroleum coin (Voco) launched by Venezuela. It was paid as an international trade currency and convertible foreign exchange on October 1, 2018. The means was officially put into use.

DCEP has the following similarities and differences with other central bank digital currencies.

相同之处:都是政府发行的数字货币

不同之处:(1)发行主体不同。DCEP的发行主体为中国央行,其他国家数字货币除厄瓜多尔外并非由本国央行发行。(2)运行阶段不同。DCEP尚未上线。乌拉圭数字比索未大范围启用,厄瓜多尔币已经停止运行,而石油币已经用于委内瑞拉的国际贸易。(3)地域不同。DCEP由中国发行,已发行国家支持的数字货币的国家均在南美洲。(4)技术基础不同。DCEP仅在考虑使用区块链技术,石油币声称使用了区块链技术。

4 DCEP可能有哪些影响?

负利率成为可能,丰富央行货币政策工具。如同实物现金,DCEP在目前的设计中不计息,但正如央行官员多次提到的,央行数字货币为实施负利率创造了条件,有利于刺激消费。仅有实物现金时,负利率对持有人个人而言难以实施,并有可能引发挤兑风险,但央行数字货币时代到来后,央行对持有人货币掌握情况更了解,能更有效地追踪其流向。对央行数字货币计息无疑将影响无风险资产与风险资产的定价体系。

可能存在场外交易市场,需防范相关风险。如前所述,为了防止持有人将银行存款大量兑换为DCEP,央行可能对DCEP的兑换额度和费用等施加限制,这可能导致DCEP“黑市”出现,其场外市场的风险值得关注。

4.2 微观:无现金社会或将到来,消费者生活更便利

In the past, some merchants refused to accept electronic payment methods. According to the law, they have no right to refuse to accept the central bank's digital currency. Consumers do not need to search for ATMs or banks, or they will bid farewell to physical cash and make life easier. Different from the “cashless society” activities led by third-party payment institutions in the past, the central bank's digital currency will further replace physical cash and promote the real arrival of a cashless society. But short-term physical cash will not disappear, for example, there are still many elderly people who are not used to using mobile phones.

In addition, because the central bank issued DCEP to reduce anti-money laundering, anti-terrorism financing and other needs, DCEP must be bound to the individual's true identity. Therefore, DCEP may carry certain identity authentication attributes , which may contain certain opportunities. For example, users may no longer need to go to a bank, a securities company, etc. to open an account, but simply provide evidence of their own DCEP to prove their identity.

5 What opportunities are worth paying attention to in the DCEP industry chain?

In the distribution process, we recommend companies that are expected to become DCEP distribution agencies. The operating system of DCEP is a two-tier “central bank-commercial bank/other institution”, in which the distribution institution is not necessarily a commercial bank. Both types of companies have a competitive advantage in this regard.

(1) Companies with a large number of B-end (enterprise) merchant resources, such as payment institutions, e-commerce, and operators. Although merchants can't refuse to accept the central bank's digital currency, even though it is a central bank's debt, it is more secure. It does not mean that users will choose to hold DCEP and give up other online payment channels. If the central bank's digital currency is going to bloom, it still needs to be Traffic support, that is, B-side merchant support. For example, DCEP's peers, Libra's white paper, show that Libra has selected a number of B-terminal merchant resources such as Mastercard, Visa, PayPal and other payment network service providers and Vodafone and other telecommunications service providers, as well as e-commerce platform eBay and online hotel booking website Booking Such institutions, this has a reference to the DCEP extension. Uruguay, which launched the central bank's digital currency pilot, had chosen payment service providers as part of the distribution agency.

(2) Payment institutions with C-end (personal) payment service experience, for example, third-party payment service providers such as WeChat payment and Alipay have extensive experience in C-end user services. At the same time, C-side payment behavior will still use mobile phones as carriers, and telecom operators will also be indispensable participants.

Commercial banks and payment system developers are also worthy of attention. After the emergence of DCEP, commercial banks or other DCEP distribution agencies will need to adjust the payment service system, which brings opportunities for financial technology service providers in the field. For example, DCEP requires both parties to complete payment when they are offline. This may require NFC (Near Field Communication), Bluetooth, or two-dimensional code payment, POS machine and other technical support, and related technology services and equipment manufacturers are worthy of attention.

Clients, we recommend to pay attention to: (1) payment agencies or technology developers with experience in network payment service infrastructure development such as digital wallets. (2) Multi-functional ATM machine service provider. (3) POS equipment manufacturers. (4) Payment security service vendors. After the emergence of DCEP, although in theory users no longer need to go to the bank or look for ATM machines to take out physical cash, we believe that ATM manufacturers will not disappear, because users will need to deposit their own physical cash in the ATM machine. From this perspective, ATM machines may assume the role of “recycling physical cash” or light outlets.

Since the central bank's digital currency has an alternative to physical cash, in the short term, users may still go to the bank to convert physical cash into DCEP. When DCEP's replacement of physical cash is further developed, the demand for users to go to the bank outlets in the field may decline. In addition, because the central bank issued DCEP to reduce anti-money laundering, anti-terrorism financing and other needs, DCEP must be bound to the individual's true identity, therefore, DCEP may carry certain identity authentication attributes, which may contain certain opportunities. For example, users may no longer need to go to a bank, a securities company, etc. to open an account, but simply provide evidence of their own DCEP to prove their identity. Therefore, in the long run, the flow of financial institutions may be further reduced. We recommend focusing on service providers that can help the transformation of physical institutions and their own businesses that seek business transformation.

In summary, the A-share market can focus on Hailian Jinhui, Feitian Integrity, Digital Certification, Weishitong, Kelan Software, Yijian Shares, and Sifang Jingchuang.

Source: Guosheng District Block Chain Research Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis | Is the Black-Scholes model for pricing traditional financial derivatives also applicable to Bitcoin?

- Binding social media to send Bitcoin with one click, Bottle Pay received $2 million investment

- Babbitt Column | From Highlights to Fall: P2P Brings Revelation to Defi

- Twitter Featured | Blizzard, Bakkt only 71 BTC on the first day of trading? COO: retail investors will arrive soon

- Viewpoint | Is Bitcoin a macro hedging tool?

- The "public opinion war" of the dealer? BTC's Google search volume is 7 times that of Bitcoin

- Indicted by the SEC, Kik CEO suspected of collapse and drunk: "I don't want to go to jail"