RMB overseas mobile payment growth, talk about the way DCEP solves the "double spend problem" of transactions

Last week, the People ’s Bank of China released detailed information about payment processing. The data shows a substantial increase in mobile payments, in which the number of transactions increased by 68% and the amount of RMB increased by 25.13%.

The data also shows that in cross-border transactions, the amount of RMB payments is 34 trillion US dollars (4.76 trillion US dollars), the number of transactions has increased by an average annual rate of 30.64%, and the average annual amount of money has increased by 28.28%.

As the preparation of the central bank's digital currency becomes more and more perfect, these statistics are more and more worthy of attention.

Currently, the RMB cross-border payment system still uses the RMB cross-border Interbank Payment System (CIPS). It is an independent payment system developed by the People's Bank of China and officially launched on the morning of October 8, 2015.

- The hardware wallet is upgraded again, Cobo joins hands with Chain Node and Chain Store to officially release a new generation of products

- Blockchain startup Dltledgers handles more than $ 3 billion in trade financing

- My understanding of the investment process: the way to fight anxiety is "long-term thinking"

The essence of the CIPS system is based on bank accounts. The People's Bank of China approved CIPS to open a clearing account in the large payment system. This account is the common equity account of all direct participants of CIPS. The funds in the account belong to all direct participants of CIPS, and enjoy the corresponding rights and interests according to the account balance in CIPS. .

Direct participants are required to meet the following conditions for joining: legal person qualifications or institutions designated by legal persons, qualifications for handling domestic and foreign RMB settlement business, direct participant qualifications for large payment system, business centralized processing and straight-through processing capabilities, etc. condition.

When a direct participant joins CIPS, the operating institution simultaneously opens an account for it in CIPS. The account does not accrue interest or overdraft. The end-of-day account balance is automatically transferred back to the institution's large payment system account. If the conditions for direct participants are not met, cross-border settlement of RMB needs to go to the designated bank for operation.

The CIPS system is much simpler than the original RMB agency bank model, RMB offshore clearing bank model, and non-resident RMB account model.

However, as a digitalized RMB, DCEP is a kind of cash, and as long as both users have a DCEP wallet, they can complete the transaction. This will mean that the threshold for using DCEP cross-border payments will be significantly lower than in the past, and the efficiency will also be improved.

However, regardless of the payment under the bank account system today or the DCEP payment in the future, we must face the "double-spending problem" in the transaction.

The so-called "double-spending problem" refers to double or multiple payments. In the digital currency system, due to the reproducibility of the data, the same asset may be reused by two or more parties in the transaction due to improper operation.

Using data as currency may be one of the dreams of people living in the modern information age. With the development of human society, people's demand for currency portability and means of increasing currency circulation is increasing, and people are constantly exploring more methods to make currency more portable and more liquid.

The advent of the information age has made people realize that data has the characteristics of easy circulation, quick transfer and low transfer cost. Therefore, people began to think about how to use data to construct currency very early.

This is the source of the basic concept of digital currency that we all call now.

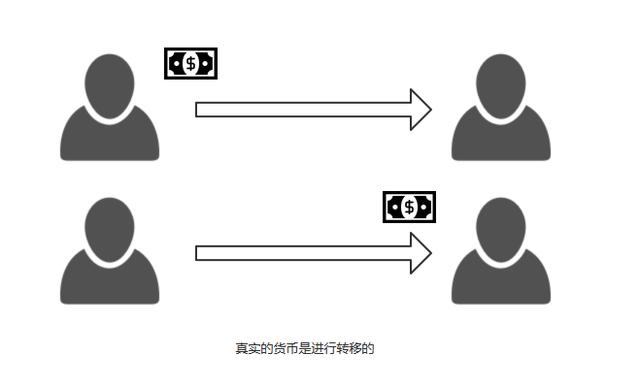

But if we want to use data as currency, we will first encounter a very serious challenge. This serious challenge stems from an endogenous contradiction between data and currency. The data can be easily circulated around the world, but it also has a very obvious disadvantage, that is, the data can be easily copied.

This contradicts the nature of the currency. A piece of currency with legal value should be unique in real life and cannot be copied.

For example, Zhang San has a currency worth 100 yuan. After he gave this currency to Li Si, Zhang San should have no currency. If we directly use data as currency, then we will have Zhang San giving a 100 yuan currency to Li Si, and there is an extra 100 yuan currency out of thin air in this world, because Zhang San holds 100 If the currency of one dollar is in the hands of Li Si, 100 yuan of currency will be added.

We are here to convert this problem into such a problem: a piece of 100 yuan currency, after Zhang San spent, Zhang San has lost the 100 yuan currency, the 100 yuan currency Zhang San cannot It will be used again, but if Zhang San still owns the ownership of the 100-dollar currency, it will cause this 100 yuan to be spent twice. This kind of problem is the so-called double-spending problem, referred to simply as double spending.

In fact, the fundamental source of the double spend problem comes from the reproducibility of data. Therefore, if we want to use data as a currency to build a so-called digital currency, we must solve this problem.

And solving this problem is not complicated.

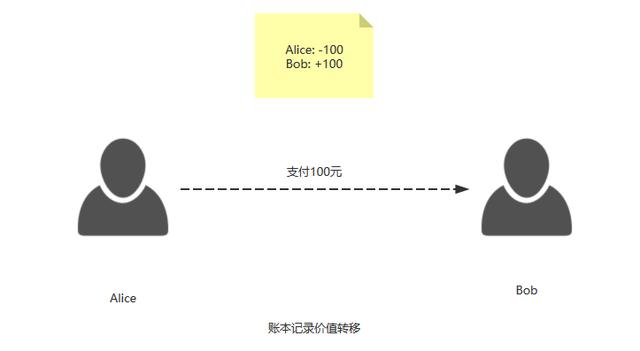

If we do not digitize the currency itself, but imagine using a ledger to achieve the following operations. We record how many currencies each person has. When a currency transfer occurs, operate on two people's accounts at the same time, one to increase and one to decrease.

This ledger is what we now call a bank account. Everyone can open an account in a bank, and this account records the total amount of money each of us has now.

When Zhang San wants to transfer 100 yuan to Li Si, the bank, as the maintainer of this ledger, will deduct 100 yuan from the account under Zhang San's name and increase the account under Li Si's name by 100 yuan. In fact, Zhang San and Li Si do not have this real currency in their hands. All they see is that the numbers in their accounts have changed.

The bank only needs to guarantee that the act of deducting 100 yuan from Zhang San's account and adding 100 people to Li Si's account can happen at the same time.

However, this account-based design cannot be a currency because it is just a ledger. This way of trading is determined, and it is very different from real currency trading.

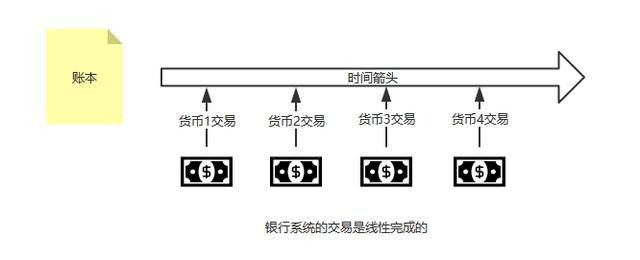

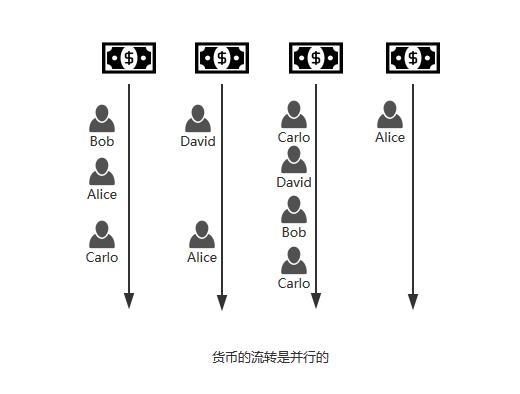

The biggest difference is that transactions based on the account mechanism are linear, while transactions based on real currency are distributed and parallelized.

Suppose now that we have 100 people, 50 of these 100 people want to give their own money to another 50 people. Then, in these 50 transactions, the person who pays the money needs to be paired with the person who receives the money.

But when trading in real currency, we directly traded this currency to the other party. No matter how many pairs of traders exist in this world, transactions can be completed without affecting each other. At the same time, such a transaction process only involves both parties.

If the account book mechanism is used for transactions, both parties of the transaction need to send their own transaction requests to the maintainer of the account book, which is called a bank. The maintainer of the ledger needs to sort these transaction requests received in order after receiving these requests, and then execute them in sequence.

There are two main reasons why banks use this sorting method to execute requests:

The first reason is that the maintainer of the ledger must ensure that while the money on Zhang San's account decreases, the money on Li Si's account can increase. In this process, the accounts of Zhang San and Li Si need to be locked and cannot be written by others, otherwise the maintainer of the ledger will not know whether he actually performed such an act. This is to ensure that the data will not create "competition".

The second reason is that the maintainer of the ledger must determine that before the transfer, Zhang San's account is rich, and the transfer can only be made if this condition is met. Because in the real transaction process, Zhang San probably transferred the money after he received the money transferred to him by other people, which means that the specific transaction process may be dependent. .

In the above way, we can use the ledger to construct a concept similar to "currency". But in fact, its essence is still ledger rather than currency.

Because real money is in circulation, money is parallel to money, and the owner of each currency is constantly changing.

This shows that the account book mechanism is used to construct currency. What is constructed is only an account book that records the value transfer relationship, not the real currency circulation system.

Therefore, if we really want to construct a real digital currency, then we need to redesign to ensure that the circulation process of digital currency can be similar to the circulation process of real currency.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A brief history of stablecoins: the master key that unlocks the crypto world

- Popular Science | How is the Ethereum block size determined

- The crisis under the iceberg: DeFi financial crisis and challenges

- Data: Demand for Bitcoin from institutional and retail customers explodes

- Blockchain empowerment, charging pile accelerates new infrastructure

- Bybit Airdrop Gifts are available for a limited time! Teach you how to receive 1632 USDT in 10 minutes!

- After halving, the cost of Shuanghua BCH and BSV is less than US $ 10,000? There are two major misunderstandings