BSV production cuts, computing power struggles to change

Text: Kyle

Source: Honeycomb Finance

At 8:48 am on April 10, the BSV (Bitcoin Satoshi Vision) network ushered in the first block reward halving, and the miner burst block reward was adjusted from 12.5 BSV to 6.25 BSV.

Two days ago, BSV's "old rival" BCH took the lead in completing the halving of production. After that, the BCH currency price fell slightly for a short time, and the entire network's computing power was also lost. TokenView data shows that the computing power of BTC and BSV increased correspondingly during the same period.

- The Secret History of Bitcoin: The Mysterious Street Bitcoin Trader

- Viewpoints | Can blockchain technology help the cultural tourism industry to "cross the robbery"?

- Contract exchange seeks compliance: as low as 1,500 knives for high NFA licenses

There is still more than one month before the halving of BTC. After the halving of BCH and BSV, the computing power using the SHA-256 algorithm flows to the block to reward the higher BTC network. This more than one month will also become the "window period" for the performance of BCH and BSV currency prices,

As a fork of the "Prince" BCH, the BSV camp has always considered itself to be the "true bitcoin" in line with Satoshi Nakamoto's vision.

BSV Official believes that as the block rewards of BTC, BCH and BSV continue to decrease, in the long run, BSVs that take the larger block route and can package more transactions can bring higher profits to miners. The reason is that when the block reward is minimal, the main income of the miner will be converted into the sum of the transaction fees of all transactions in the block, and the role of the miner will also be converted to a "transaction processor".

When BTC is halved, the block rewards of the three major networks will be on the same level. Qiu Shaoxian, the V of the BSV community, believed that it was the highlight at that time. Not surprisingly, the SHA-256 computing power of the entire network will make a new round of choices, and the "true bitcoin" battle will enter a new stage.

BSV network completes first reward halving

With the BSV network block height reaching 630,000, BSV implemented the first block reward halving in history as planned. As with BCH two days ago, the amount of block reward coins will be reduced from 12.5 to 6.25. For miners, with constant currency prices and costs, revenue suffers.

However, due to the perception that the currency circle is halved, which is good, before the production reduction, BCH and BSV both experienced a round of upsurge. BCH rose nearly 20% in the 7 days before the halving, and BSV rose even more, rising more than 30% in the same cycle. In contrast, BTC, which is more than a month away from halving, has only a 10% increase.

The short-term rise in currency prices has reduced the loss of miners to a certain extent. When BTC has not been halved, some flexible miners choose to switch their computing power to BTC in order to seize the time difference of one month and seek more block rewards.

The average daily computing power of TokenView shows that after the BCH production reduction, the computing power is lost, from 3.51EH / S to 2.97EH / S on the next day of production reduction, and the computing power of the entire network of BTC and BSV has increased on that day. Not surprisingly, after BSV completes the halving of production, part of the computing power will also flow to the BTC network until BTC has halved in mid-May.

Qiu Shaoxian, the owner of the BSV Skeleton Association, told Honeycomb Finance that the reduction in computing power will only lead to a slower block generation, but the accumulated transactions can be fully packed in the next block to empty the memory pool, which will not have too much impact on the transaction users on the chain.

Another external concern is the price of BSV after production cuts. After BCH halved, its price dropped slightly from $ 280 to around $ 265. There is no lack of market opinion that BSV will also follow a similar trend.

From the market point of view, BSV did drop slightly after halving, from the opening price of 215 US dollars to 211 US dollars on the same day, the decline is not too large.

As the youngest currency in the bitcoin genealogy, BSV has been showing ups and downs many times since its birth one and a half years. On January 14 this year, BSV surged 119% in one day, reaching a record high of $ 459, briefly surpassing BCH. But then, BSV fell rapidly, until now the price has been cut. This was ridiculed by investors as "first to halve the price before the output is halved."

Of course, after the block reward is halved, some people think that BSV is expected to achieve a price increase due to the break of the supply and demand balance. The currency price is also a key factor that determines whether BSV can continue to compete with BCH and BTC in the future.

The "window period" between BCH and BSV

In this year of "halving" concentration, the halving of the two major currencies of BCH and BSV has been settled. The two competing blockchain networks will continue to compete.

At present, because there is more than one month before the BTC is halved, the computing power of BCH and BSV is in a relatively weak "window period". Compared with the BTC which has not yet been halved, the contest between BCH and BSV is relatively equal. With limited computing power, whoever brings the higher income will attract more miners.

OKEx Investment Research believes that the fluctuation of the currency price can change the direction of the flow of computing power. If the price of BCH or BSV rises when it is halved, it will reduce the outflow of computing power; if the price of BTC rises due to halving expectations or other reasons, It will attract more computing power to BTC. In addition, the reduction in BCH and BSV computing power will lead to a 51% reduction in attack costs, increasing network security risks.

Whether it is BCH or BSV, we must not want to lose a large amount of computing power, so it is necessary to maintain price stability during the "window period". Judging from the currency price trend before the halving, the BSV camp has a strong momentum, and the increase is more than BCH. However, the price still needs to be supported by the actual application of the blockchain, and the on-chain application and transaction volume of the two are the keys to determine the outcome.

Judging from recent trends, BCH took the lead. Earlier this month, AnyHedge, BCH ’s first decentralized financial agreement, was announced. This agreement can provide BCH users with a peer-to-peer, decentralized, and fully mortgaged way to mitigate price fluctuations. Under extreme conditions, BCH investors can hedge risks .

Although BSV has not recently launched a new heavyweight application, but over the past year or so, the BSV network has also built WeiBlock, the weather data software WeatherSV, and various game applications on the chain.

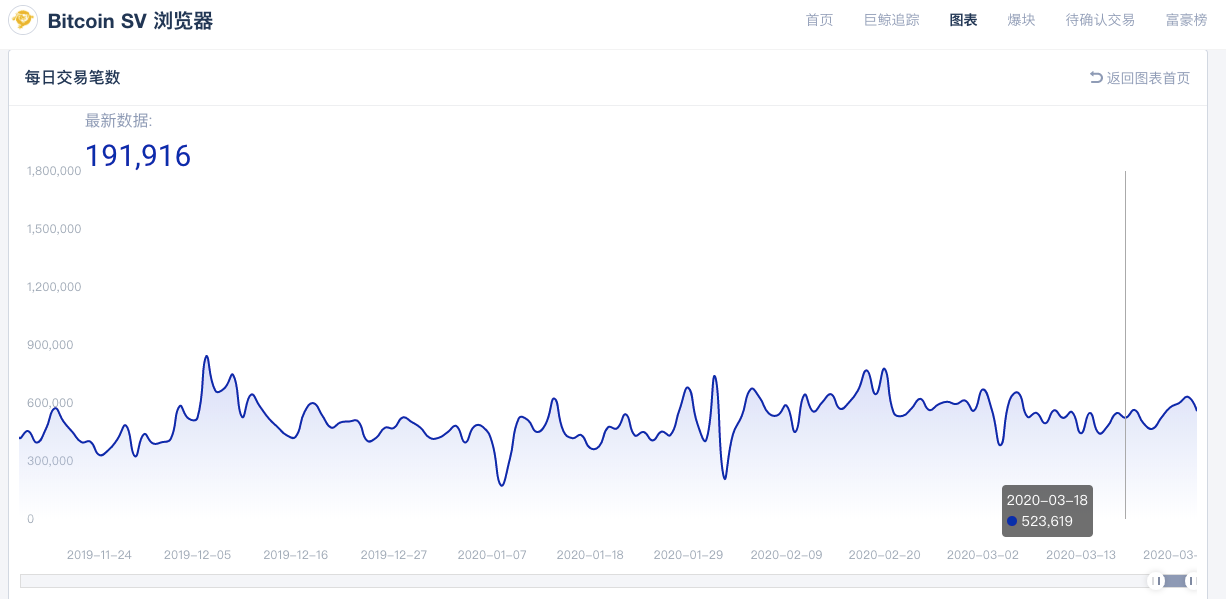

From the perspective of on-chain transaction volume, BSV has obvious advantages over BCH. According to TokenView data, in the past month, the average number of daily transactions on the BCH chain has been around 50,000, while the daily number of BSV transactions is about 500,000, which is 10 times the former.

The average daily BSV transaction number is around 500,000

In the long run, maintaining the growth of the number of applications and the activeness of on-chain transactions are the foundation of the two major blockchain networks, and will also determine the market price level and the retention of miners. Industry insiders reminded that rational investors should focus on whether digital currency and its technology have real utility, and whether they have reasonable survival logic and long-term vitality when evaluating the true value of digital currency.

The transaction volume and price on the chain determine the miners to stay

According to Qiu Shaoxian, the share of computing power occupied by BSV and BCH is relatively small at present, and the highlight will not be seen until BTC is halved.

The data shows that on April 9th, the total hashrate of BTC is 107.55 EH / S, BSV and BCH are 3.05 EH / S and 2.97EH / S respectively. The sum of the two is nothing more than BTC's fraction.

BTC's entire network has far more computing power than BCH and BSV

However, the halving of the three major networks this time may bring some uncertainty to the "computing market".

In addition to BTC, BCH and BSV are both halved for the first time, so whether the two will have better market performance after halving will determine whether there will be a targeted influx of computing power.

From the current situation, the three major networks have their own balance of computing power, mining difficulty and market price. Generally speaking, computing power, mining difficulty and market price affect each other, and the higher consensus BTC price is the highest, but the mining difficulty is also greater.

After the new halving node, whether the balance of the three major networks will be broken will be the focus of the market. Earlier, many industry insiders including Bitmain founder Wu Jihan said that with the gradual increase in currency circulation, the benefits of halving production will become smaller and smaller, if the price of the mined currency is not obvious In order to improve, the profit-mining miners must face a new choice.

OKLink believes that in the long run, after the BTC, BCH, and BSV block rewards are reduced, transaction fees will become the main compensation for block-producing nodes. By then, BTC, BCH, and BSV will fight on-chain transaction volume and price.

Taking this opportunity, BSV, which takes large blocks as the main development route, began to promote the advantages of BSV after the gradual decrease in block rewards. On April 9th, BSV Official issued a document saying that block rewards are an incentive to attract miners to expand the network at the beginning of the Bitcoin network. When block rewards are halved again and again, miners will gradually reduce their dependence on block rewards and gradually Turn to profit from transaction fees. BSVOfficial believes that in the future "miners" will be transformed into "transaction processors".

As a supporter of BSV, BSV Official stated that the BSV designed in large blocks will be able to carry as many transactions as possible in a block, thus allowing miners to obtain more fee income, "This will enable miners to continue Operate and make money. "

However, in the short term, the real world does not have enough support for cryptocurrency payment and other usage scenarios, and the so-called large block advantage of BSV has yet to be verified.

Some industry insiders predict that although this round of halving will force miners to make new choices, it is not surprising that BTC with stronger consensus and higher prices will continue to be the “gold mine” of miners. In contrast, BCH and BSV miners will continue to wrestle, the result is more suspenseful. With market attention, the choice of miners will be announced after BTC halves.

Do you think the pattern of the three major networks will change after the halving?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Popular Science | PoS mining and bank deposits to earn interest, are the same?

- Analysis | Retail investors are pouring into BTC options contracts, and BTC has a 10% chance of breaking $ 9,000

- BitMEX CEO: Bitcoin's computing power may drop by 30% to 35% after halving, with a target price of US $ 20,000 at the end of the year

- Electronic licenses are on the chain, block chain licenses in two regions of Beijing landed at the same time

- French AMF responds to EU crypto asset advisory: establishment of classification is premature and proposes special terms for stablecoins

- Why are derivatives of the Lightning Network important?

- In the era of negative interest rates, the USDT status is not guaranteed?