From the halving prediction of BCH and BSV, will BTC enter a decline phase?

Fortunately, BCH and BSV are halved first, which provides a good market reference for BTC's halving market. Next month, the BTC will be halved, maybe it will officially enter the decline phase …

BCH hashrate drops sharply

On the first day after the halving of BCH, the computing power of the entire network dropped from 3920.24PH / s to 2597.99PH / s, and nearly 30% of the computing power migrated. As for everyone's attitude towards BCH after production reduction, it is basically bearish. A lesson from Litecoin, after the reduction in production in August last year, the newly added currency holding address once fell to the lowest point, reflecting the market's sharp decline in the enthusiasm for LTC after production reduction.

- Crisis before the midday diving has emerged, analysts say the test has just begun

- Introduction | What support does ETH 1.0 need to provide for ETH 2.0?

- QKL123 market analysis | The market has fallen, is it unfavorable to halve? (0410)

If Litecoin's fate repeats itself on BCH, then it is now on its way towards the bottom of the valley in shock. It is very likely that BCH will also fall by half in the future, just as LTC has fallen from ¥ 639 on the day of halving to ¥ 326 now.

In terms of computing power, since the halving of BCH and BSV and BTC halving have a time difference of almost a month, the halved BSV and BCH miners will be transferred to BTC mining due to the halving of revenue. If BCH and BSV miners Half of the BSV 's computing power will be converted to BTC, and the overall BTC will increase the computing power by 3%. The miners who originally mine BTC will be impacted. Don't underestimate this 3%.

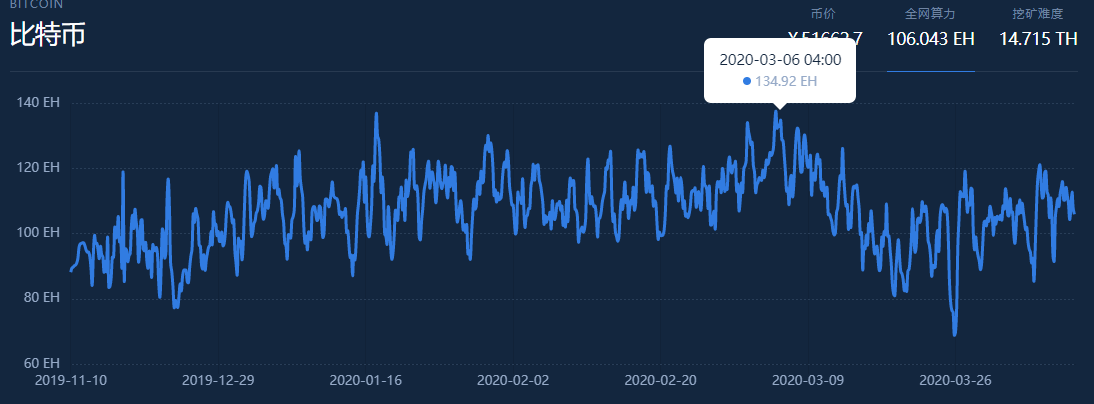

After increasing the computing power by 3%, it will reach a historical peak of about 137.8EH

Today, BTC and BCH generate a large number of blocks in a short period of time. The BCH network generates 84 blocks in a row for 3 hours. BTC also generates blocks twice in 3 minutes. In theory, the block generation time should be 10 minutes, but a large number of blocks are also normal. It is because there is some computing power to switch back and forth between BTC and BCH.

Trumpet King recorded the hashrate and price of BTC, BCH, and BSV during the halving period:

As can be seen from the data in the figure, after both BCH and BSV are halved, the computing power is quickly drawn away. BCH reduces the computing power by at least 2430Ph / s, and BSV decreases by 247.95Ph / s. Assuming that the two parts The computing power has migrated to the BTC network, which means that the computing power of the BTC network has increased by 2.68Eh / s, and the computing power we have monitored from 107.81 to 111.81 has also increased by about 1.3Eh / s. There are two reasons: 1 .Hashing power is invisible and intangible, it represents the overall hash algorithm operation times of the miner per second, just a backward push number; 2. The increase in migration computing power has led to increased competition of the original miner ’s computing power. , So it is normal for the overall computing power to rise more and float.

Competitive computing power will cause the mining cost of the original BTC miners to rise, but it will not cause the price of BTC to rise. Someone must be against it. Li Xiaolai once said: "In the long run, the cost of miners can be regarded as the fundamentals." In addition, Jiushen also pointed out that "for any other commodity, it is the price that determines the cost, but there are a few exceptions for Bitcoin. .In addition to price being determined by bitcoin, cost in turn also supports price. "

But the factors that determine the price of BTC are complex and huge, and it is not just the price of a price or the theory of supply and demand that can explain its value. Cost theory is more speculated from the perspective of the interests of the miner community-they will certainly not allow BTC prices to fall beyond their costs.

At present, only BTC is left among the three halved brothers. From the trend of the halving of BCH and BSV, BTC may not be able to escape the fate of entering a period of time.

After the halving, BSV seems to be about to enter the bottom. Even if it has been steadily rising before the halving, it will not change its destiny. BSV reached its peak two months before the halving, and BCH also reached a small peak during the same period. According to this time interval, BTC has already reached the peak before the halving on February 12 or will be declining. A new wave started again two weeks ago, before really entering the trough period after halving.

Why did it enter a trough period after halving? The logic behind it is also very simple. The market speculation on halving expectations is too high and advances overdraft. Before the halving, the currency price has a lot of bubbles in it. After the halving expectations are fulfilled, the currency price will start to step back and digest the bubbles.

However, it is relatively optimistic that the one who can live for a long time in the cold atmosphere of the game of stock funds is still the most promising. The most upstream of the currency market is mining machine manufacturers, miners and exchanges. Mining coins are in the interest of the former, and currencies that can bring huge traffic to it are in the interest of the exchange. This is the value that everyone wants. currency".

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dapp market report for the first quarter of 2020: The transaction volume is 7.9 billion US dollars, the number of new Dapps is 254,

- Opinion | New crown epidemic accelerates the arrival of central bank digital currency, CBDC may solve one of the biggest challenges facing the epidemic

- More appetite for the dark web than BTC? It's the golden key in Pandora's Box: ZEC Big Coin

- BSV production cuts, computing power struggles to change

- The Secret History of Bitcoin: The Mysterious Street Bitcoin Trader

- Viewpoints | Can blockchain technology help the cultural tourism industry to "cross the robbery"?

- Contract exchange seeks compliance: as low as 1,500 knives for high NFA licenses