A brief history of stablecoins: the master key that unlocks the crypto world

Next weekend is your son's birthday. He knows that you have invested in bitcoin, so he wants you 1 bitcoin as a birthday gift.

You asked him in surprise:

People hope that in a crazy world of inflation, Bitcoin can become our refuge. Bitcoin is not linked to the monetary policy of any country, and people have high hopes. However, despite so many expectations, we have to face one thing: the world of Bitcoin and even cryptocurrency is still too small, and assets such as Bitcoin are still far from being widely adopted. One of the main reasons is price fluctuations.

- Popular Science | How is the Ethereum block size determined

- The crisis under the iceberg: DeFi financial crisis and challenges

- Data: Demand for Bitcoin from institutional and retail customers explodes

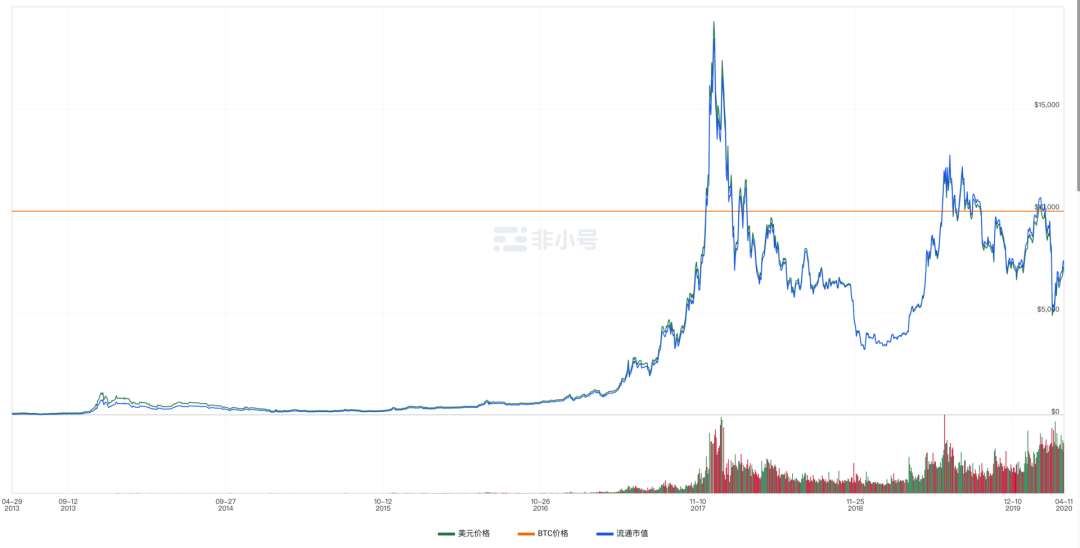

Traditional cryptocurrencies fluctuate violently, and it is not uncommon for prices to fluctuate by 10-20% within a day, making many people unable to use them in daily transactions. 2017 was the craziest year for cryptocurrencies. We saw a crazy increase of 10,000 times, but 2018 erased everything. This led to a few carnival moments, but for many it was a nightmare.

Of course, the advantages offered by cryptocurrencies cannot be ignored, but the dramatic price fluctuations have kept many serious participants away. Although it is exciting to see an upward trend, not everyone has an investor mentality. Since regulation in most countries is not friendly to cryptocurrencies, volatility has made institutional investors farther away from cryptocurrencies.

The emergence of stablecoins

In this context, stable coins appeared.

Stable coins are linked to fixed values such as fiat currencies or commodities to solve the problem of sharp fluctuations in prices of traditional cryptocurrencies. This is an answer for users who do not want to be exposed to price fluctuations. It does implement the basic functions of currency:

- Medium of exchange

- Accounting unit

- Value store

Cryptocurrency transactions are complicated by fluctuations, and it is almost impossible to trade with accurate amounts. The primary task of stablecoins is to protect the value of transactions. This also provides a strong reason for cryptocurrency and gradually transforms it into a mature value storage tool.

Can stablecoin become a catalyst for large-scale popularization of decentralized financial services? Financial institutions hope to grow with the help of new technologies, while the cryptocurrency community is committed to promoting the popularization of digital currencies. Stable currency may be a compromise solution.

1. What is a stablecoin?

There are many different definitions of stablecoin: Simply put, stablecoin is a cryptocurrency linked to another asset. In other words, it is a global digital currency that has nothing to do with the central entity. Stablecoins do not have the high volatility as traditional cryptocurrencies, and they can realize safe and convenient transactions. Therefore, they provide practical usage scenarios for cryptocurrencies.

2. The goal of stablecoin

The goals that stablecoin is trying to achieve are:

-

Stable trading between different cryptocurrency trading pairs, similar to the way foreign exchange transactions; -

Diversify the investment portfolio when the market is unstable; -

Hope it can be used as a daily transaction, just as easy as using fiat currency; -

Facilitate the popularization of digital currency; -

Form a new financial ecosystem; -

Provide assistance for investment planning and minimize current cryptocurrency market fluctuations; - As a stable currency used worldwide, it helps citizens of countries suffering from hyperinflation.

3. History of stablecoins

Although Satoshi Nakamoto's vision for bitcoin is to use it as electronic cash, bitcoin, as a brother of cryptocurrency, is rarely used in daily transactions. On the contrary, large price changes and high handling fees make many cryptocurrencies unsuitable for daily transactions, and are more used as long-term investments.

Stablecoins provide all the advantages of cryptocurrencies, including:

-

With cryptographic security -

The ability to transfer assets digitally - Fast and convenient transactions

The concept of stablecoin officially appeared in the document attached to the first version of Mastercoin in 2012. The founder claims that the Mastercoin protocol "will allow cryptocurrencies to be tied to stable traditional assets." (A brief history of Mastercoin can be viewed at blog.omni.foundation)

In July 2014, Realcoin was established and changed its name to Tether on November 20 of the same year. In 2015, Tether released the first fully realized stablecoin: USDT. USDT is supported by the US dollar and is pegged to the US dollar 1: 1. In the second year, a similar company in Europe created EURT.

In January 2016, one of Ethereum's code contributors created the stablecoin project DigixDAO.

The most frequently mentioned project, MakerDAO, is one of the earliest decentralized autonomous organizations in Ethereum, created in 2014, and Dai is the name of the stablecoin created by the MakerDao project. Three years later, Dai was officially launched in December 2017, and now it has also developed into a popular project in the blockchain stablecoin ecosystem.

Of course, there are more projects such as Libra and JPMorgan Coin in the pipeline. In the field of stablecoins, we expect to see more exciting stories in 2020.

4. Stable currency and supervision

Despite the controversy about cryptocurrencies as a trading medium, the birth of some stable currencies is hoped to obtain the approval of mainstream society through the approval of regulatory agencies. For example, the Gemini dollar and Paxos agreement is authorized by the New York State Department of Financial Services (NYDFS).

The issuer of the stablecoin is likely to be obliged to buy back or redeem the tokens from the holders. If a stable bond represents the issuer ’s debt to the holder, this may constitute a bond type. Therefore, unless otherwise proven, stable assets are likely to be considered bonds and securities.

Under the framework of the Monetary Authority of Singapore (MAS), stable value assets are considered bonds, and issuers need to hold a capital market services (CMS) license in order to trade capital market products under the National Securities and Futures Act (SFA) .

Looking back at the many battles between Libra and the US Congress, we can also foresee that there are still many legal and regulatory issues to be faced and resolved on the way of stablecoin to the wider public. This also provides a sample for the broader cryptocurrency community, let us think: what kind of regulation is appropriate for cryptocurrencies? What will happen in the future?

Fifth, how does stablecoin achieve stability?

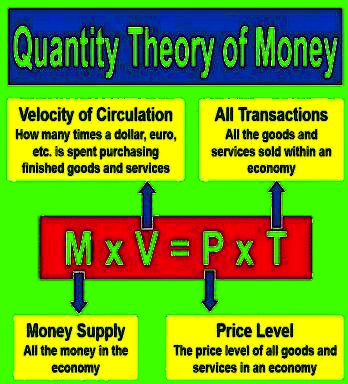

Many stablecoin white papers claim that their cryptocurrencies are designed based on the "money quantity theory" with the purpose of controlling the money supply to maintain price stability.

The mathematical equation in the figure below is called the "Fisher equation". In the 20th century, Irving Fisher and Milton Friedman developed this equation based on the traditional theory of the "quantity of money" theory of classical economists in the 17th century.

In short, the amount of money multiplied by the speed of circulation is equal to: the price level multiplied by the volume of transactions. (M x V = P x T)

If the value of M is doubled, and V and T remain unchanged, then P will theoretically double; therefore, the value of each unit of currency will be halved.

Most well-known economists accept the "Fisher equation" and believe that the "Fisher equation" is effective in long-term use. Therefore, according to the classical monetary theory that appeared before the 17th century, economists believe that stablecoins will maintain price stability by increasing or decreasing the money supply.

According to this concept, the reason why stablecoins can remain stable is because if the value of a cryptocurrency falls below a certain price point, its users will tend to abandon the cryptocurrency, and the total supply of stablecoins drops, thereby stabilizing its value. If the value of the token rises above a certain price point, users will increase the supply to maintain the fair market value of the cryptocurrency.

As an ancient theory, the quantity theory of money has some problems. An example is that V and T are assumed to be constant for a long time. Therefore, M and P are completely proportional. Due to intelligent design, this theory is developed based on an advanced economic structure, assuming that currency speed and transactions will be consistent. However, blockchain projects are constantly changing and the technology is in its infancy, so it is difficult to calculate the token speed and transaction volume, and it is difficult to assume that they are constant. Considering that V and T are variables, it may be necessary to add more variables to the "Fisher equation".

6. Types of stablecoins

As the name suggests, stablecoin is a token with a design philosophy of stability. How to achieve this stability? Different types of stablecoins have different practices.

Although there are now dozens of different types of stablecoins in circulation, they can be divided into three categories: mortgaged stablecoins, non-collateralized stablecoins, and mixed currencies.

- Asset-backed stable currency. The currency used by most countries is the fiat type. Fiat literally means 'something that can be created without effort'. Before 1971, world currencies were supported by gold. Before the currency was printed, diamonds, silver, gold, land, real estate, and other commodities were used as a means of transaction.

From the asset-backed currency to the current bill system, there is naturally the concept of asset-backed stable currency. The purpose of these specific stablecoins is to use stable assets as a digital currency on the blockchain as a fast, safe and stable daily transaction method. This kind of stable currency should guarantee to exchange 1: 1 stable currency for its underlying anchored assets.

Collateralized stablecoin

-

Stable currency supported by fiat currency

As the stable currency supported by fiat currency, fiat currency is the most common simple design method of stable currency. The value of such stablecoins is linked to the reserve of fiat currencies.

Tether (USDT) is the first stable currency supported by fiat currency. However, since its launch in 2014, Tether has been criticized for failing to produce any audit documents to prove that it has equivalent US dollar reserves. In April 2019, the New York Attorney General initiated charges against Tether's parent company iFinex. It is said that Bitfinex uses Tether's reserves to maintain its solvency.

Nevertheless, the incident did not cause Tether to lose its dominance as a stablecoin. At the time of writing this report, Tether ranked fourth on CoinMarketCap. There are many other stablecoins that provide greater transparency. For example, TrueUSD Company has published audit documents confirming its reserves. Paxos Standard and Gemini Dollar are regulated by New York State. USD Coin is also supported by reserves held by financial institutions.

In addition, the concept of supporting the issuance of central bank digital currency through bills has also frequently appeared in all kinds of news reports we have seen. Both the European Central Bank and China are exploring their own central bank digital currency versions.

-

Cryptocurrency-backed stablecoins

Stable coins backed by cryptocurrencies, but using protocols to ensure that the value does not fluctuate with the price of tokens that support stable coins. DAI is the most famous example. The DAI token is linked to the value of the US dollar and is supported by Ether. DAI maintains the price through the Maker smart contract, which will create and destroy MKR tokens based on the fluctuation of the ETH price. Maker has launched Dai tokens in multiple currencies, allowing users to use other types of tokens to support DAI.

Relative to stablecoins backed by fiat currency assets, stablecoins backed by cryptocurrencies are not as popular. Nonetheless, there are still some other things worth noting. At present, there are more ETH locked in Maker than any other DeFi project. In the eyes of decentralized believers, this project is still very popular and can become a way to earn passive income. However, there is a concern that if the market suddenly plunges, the stablecoin may end up with insufficient collateral. In March, when the price of the crypto market plummeted, MakerDao also suffered severe challenges.

- Asset-backed stablecoin

Asset-backed stablecoins are supported by asset reserves other than notes or cryptocurrencies. Although this category is relatively new, it may become very broad. These tokens are not necessarily linked to the price of fiat currency, but to the value of their underlying assets.

For example, Venezuela ’s famous but failed Petro Petroleum project is linked to oil prices. Digix is backed by the price of gold and linked to the price of gold. Similarly, Paxos, the publisher of Paxos Standard, also provides a gold-backed token called Paxos Gold.

Unsecured stablecoin

Also known as algorithmic stablecoins, or seigniorage supply coins, these tokens do not have any underlying assets. They are somewhat similar to the fiat currency issued by the central bank, and their value increases or decreases according to the relationship between supply and demand, as a means of suppressing fluctuations. Compared with other stable coins mentioned above, this type of stable coin is not so well-known.

It turns out that one reason why these stablecoins are not as popular as other types of stablecoins may be that they are not particularly effective in achieving stability. For example, NuBits, a non-collateralized stablecoin governed by DAO, failed after the exchange rate pegged to the US dollar broke several times. Lack of reserves means that nothing can hedge against a sudden drop in demand.

Hybrid stablecoin

Hybrid stablecoins claim to combine the best features of all stablecoins by providing a mixed reserve support for tokens, while using algorithms or voting to offset volatility. However, they are often structured in rather complicated ways.

The stablecoin Boreal issued by Aurororadao (now renamed IDEX) is an example of a mixed stablecoin. It is supported by a combination of ETH reserves and loans, and the price is managed by Decentralized Capital, a decentralized bank in the IDEX ecosystem.

Another example is Saga, which is more centralized and only recently launched. This is an ambitious project, admired as an opponent of Facebook ’s Libra, and its advisory team includes Nobel Prize winner Myron Scholes. The ERC-20 Saga token is linked to the IMF's special drawing rights and will initially be supported by reserves. However, the project expects that over time, the value of the token will be completely determined by the underlying smart contract.

7. The future of stablecoins and cryptocurrencies

Stable coins are now very common and can be traded on cryptocurrency exchanges. Naturally, during the fluctuation of the cryptocurrency market, stablecoins will better maintain their value. An example is during the recent collapse of the cryptocurrency market, when many currencies fell by 30-70%. The USDT (Tether), a stable currency backed by the US dollar, has a volatility of only 8%.

-

Centralized design. Some users are unsure whether they can provide decentralization and anonymity for owners if they are tied to traditional banking systems. -

No substantial asset support behind. Some people think that cryptocurrencies are "counterfeit currencies", however, after the 1970s, there was actually no asset behind fiat currencies. -

Cryptocurrencies represent the only code in an unbreakable computer network, or digital ledger. However, in the stablecoin system, adding traditional assets often requires special storage conditions, providing funds for these conditions, and requiring third parties to participate in the review. Once again defeats the entire purpose of cryptocurrency.

Stablecoins and stablecoins of real-world value assets can be used in daily life; this opens the door to the overall application of cryptocurrencies.

After most people use digital cash, for example in the form of stable coins, the cryptocurrency community can better educate people about the benefits of decentralization and the need for trustless cash exchange. With the experience of digital cash, there is less to learn in a new, highly complex and evolving financial technology ecosystem.

All in all, stablecoins may be a key factor in the future of a vibrant cryptocurrency. Promoting the adoption of mainstream cryptocurrencies may require stablecoins as a viable hedging mechanism in highly volatile markets.

-END-

Translator: Jing Kai.

Original: https://hackernoon.com/2019-complete-stablecoin-guide-0n9es3zab

Disclaimer: This article is the author's independent point of view and does not represent the position of the Blockchain Research Society (public account), nor does it constitute any investment opinion or recommendation.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain empowerment, charging pile accelerates new infrastructure

- Bybit Airdrop Gifts are available for a limited time! Teach you how to receive 1632 USDT in 10 minutes!

- After halving, the cost of Shuanghua BCH and BSV is less than US $ 10,000? There are two major misunderstandings

- The MOV Federation Node is officially unveiled, and the original team revealed the destruction plan

- From the halving prediction of BCH and BSV, will BTC enter a decline phase?

- Crisis before the midday diving has emerged, analysts say the test has just begun

- Introduction | What support does ETH 1.0 need to provide for ETH 2.0?