Securities Pass 2.0 Agreement: Hybrid Securities Pass

As an encryption asset, a securities pass may bridge the gap between existing institutional investors and the world of encryption. The beauty of securities passes is that they can be viewed as programmable, globally tradeable expressions of existing financial products. With the evolution of securities-based certificates, we may see more encrypted securities modeled on mature financial instruments such as equity, debt, and derivatives. However, to achieve this, the existing securities-type pass-through agreement needs to include some of the basic elements of financial assets.

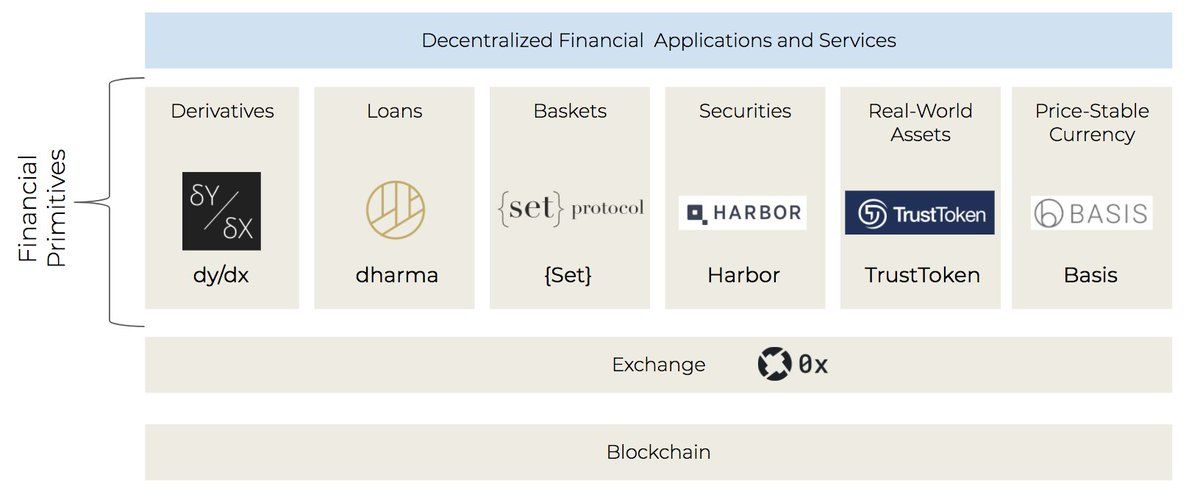

Encryption financial fundamentals

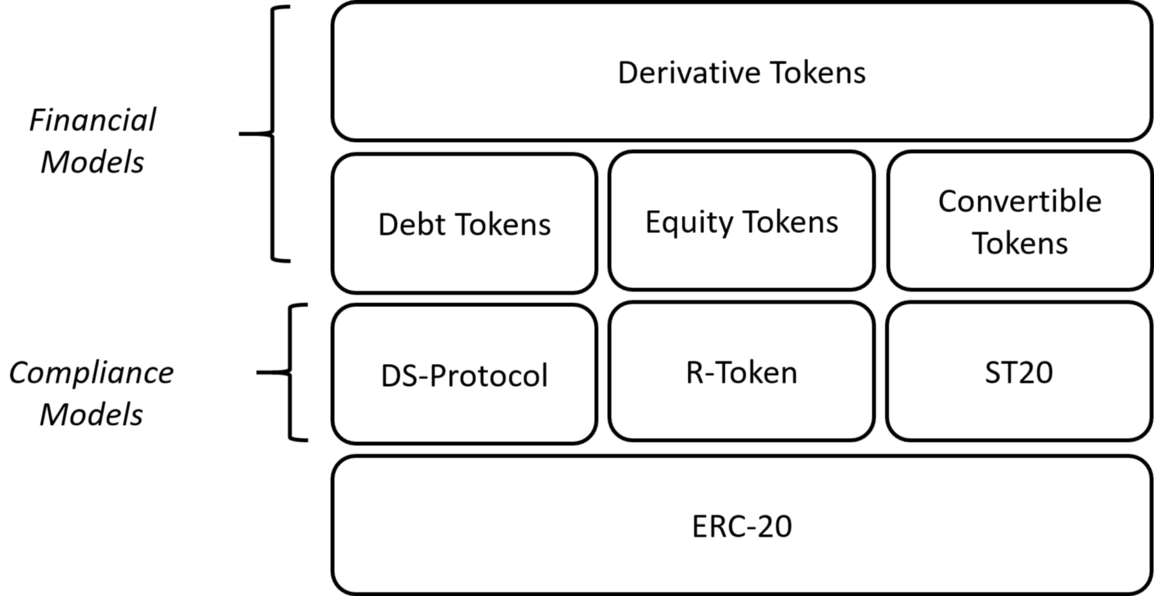

At present, the securities-based certification agreement is mainly aimed at solving a series of compliance challenges such as understanding your customers (KYC) and anti-money laundering (AML). Based on these agreements, the second wave of securities-based certification platforms should focus on the realization of financial models that simulate real-world securitization products, and the transition from a financial model based on the same securities-based certification agreement to a complex The cryptographic financial architecture of financial products.

In the field of crypto finance, there are four main types of elements that can be an important part of the next wave of securities-type certificates:

- Enterprise encryption service provider enters the game, Keystore officially joins the Wanchain galaxy consensus node plan

- Quote analysis: Bitcoin sky map convergence concussion at the end, is about to face a change!

- Bitcoin "New Bull Market", Li Xiaolai came back, and the off-site organization also came.

Debt-type pass: A pass for representing debt or generating cash flow.

Equity-based pass: A pass for representing the underlying asset equity position.

Mixed/convertible pass: A pass that can be converted between debt and equity.

Derivative Pass: A certificate that derives value from the underlying pass.

Today, let's discuss a more interesting type: mixed/convertible pass.

Hybrid securities

In financial market terminology, a hybrid security is a financial security consisting of two or more financial instruments that combine the characteristics of similar stocks and similar debts in a single tradable financial product.

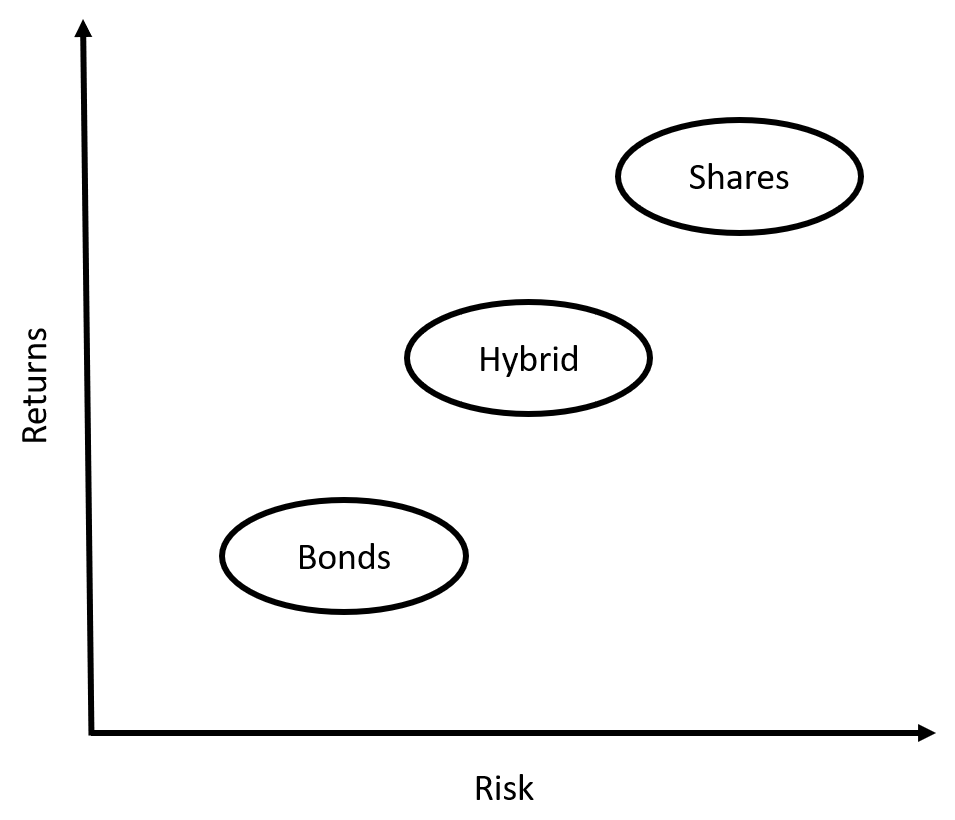

Hybrid securities usually promise to pay a certain rate of return (fixed or floating) before a certain date, which is the same as debt securities. However, it also has similar stock characteristics, which means that their return rate may be higher than ordinary debt securities.

By combining debt and equity in the same product, hybrid securities can balance financial risks and returns and can hedge against different market conditions. If you compare the risks and returns of hybrid securities with other financial securities, you can get the following picture:

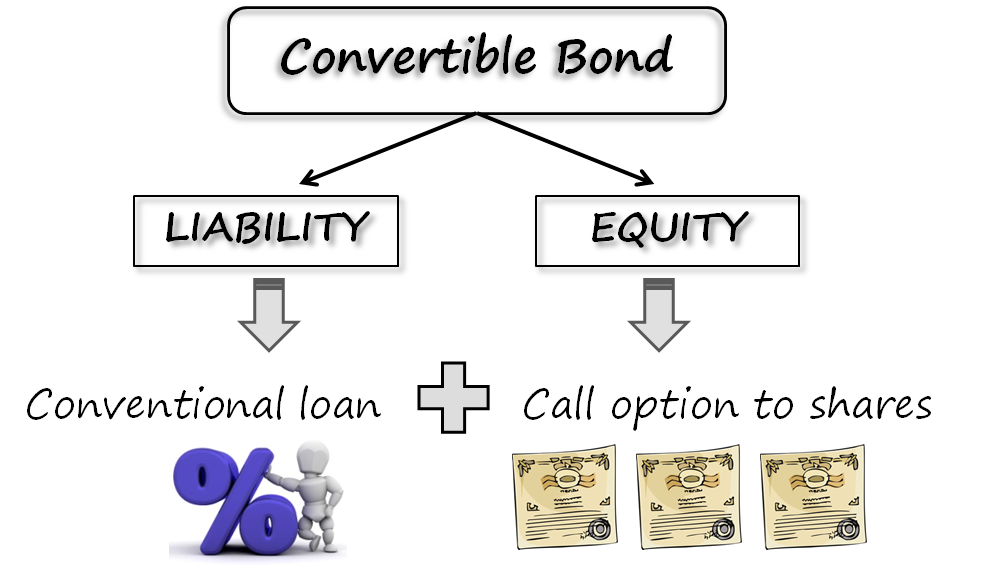

Another hybrid type of securities is the combination of debt securities and options.

Type of hybrid securities

There are many types of hybrid securities, including some financial models that combine stock and debt characteristics. Some well-known hybrid securities products on the market include: convertible bonds and convertible preferred stocks.

1. Convertible bonds

A convertible bond is a type of debt securities that can be converted into a predetermined company's share capital at a specific time during the bond's life. For example, suppose a company issues a convertible bond with a face value of $100, with a maturity date of two years from the date of issue. The bond will pay a quarterly dividend of 5%, and the company's stock value will be $2 at the time of issue. Each note gives the holder the right to convert to 40 shares of common stock at maturity at a conversion price of $2.50 (ie $100/$40). Two years after the release, the company’s stock was worth $4. At that time, the convertible bondholders can decide to receive a note with a face value of $100, or convert the bond into a value of $4*40 shares, or $160.

2 , convertible preferred stock

Convertible preferred stock refers to the stock in which the company pays dividends to shareholders before the issuance of common stock dividends. Convertible preferred stock typically pays dividends to shareholders and includes an option that allows shareholders to convert preferred shares into a certain number of common shares, usually at any time after a predetermined date.

Suppose an investor buys 100 shares of company convertible preferred stock. According to the registration statement, each 1 preferred stock can be converted into 3 common shares of the company after two years (conversion date) (the ratio of common stock to preferred stock is called the conversion ratio. In this example, the conversion ratio is 3.0). If the company's common stock price is $20 two years later, then shareholders can convert the $50 preferred stock into three shares of $20, which is $60 of common stock.

Hybrid securities pass

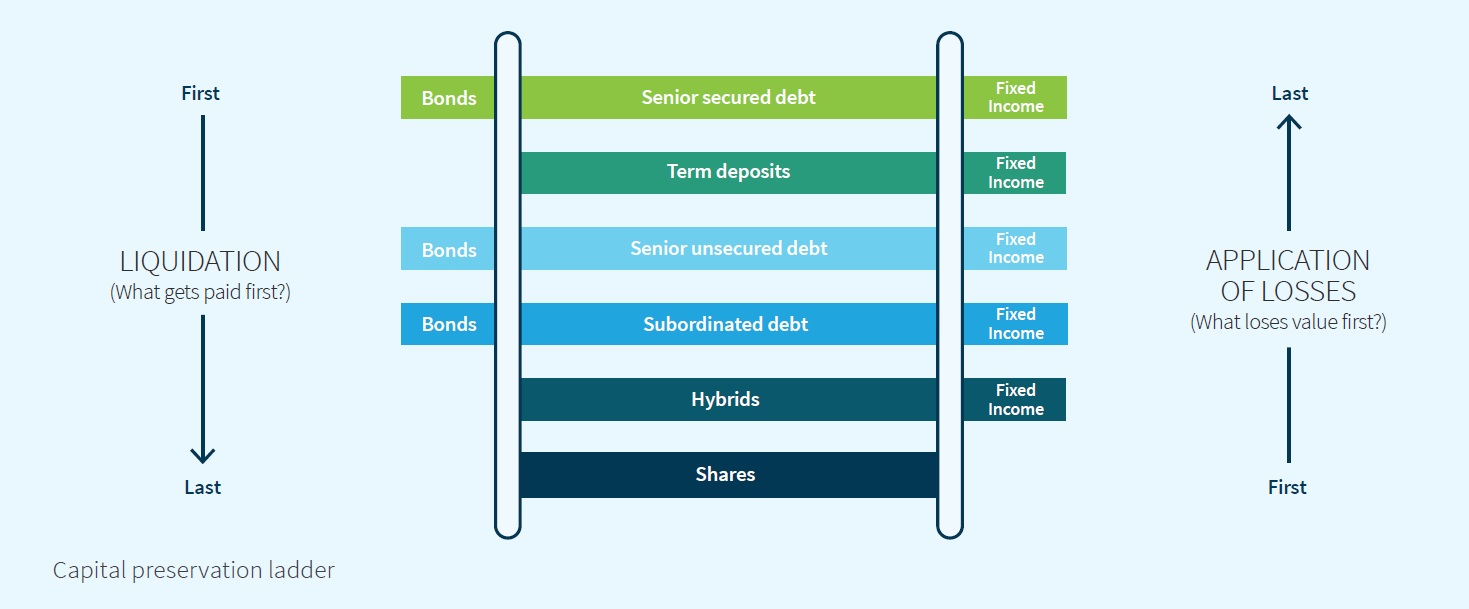

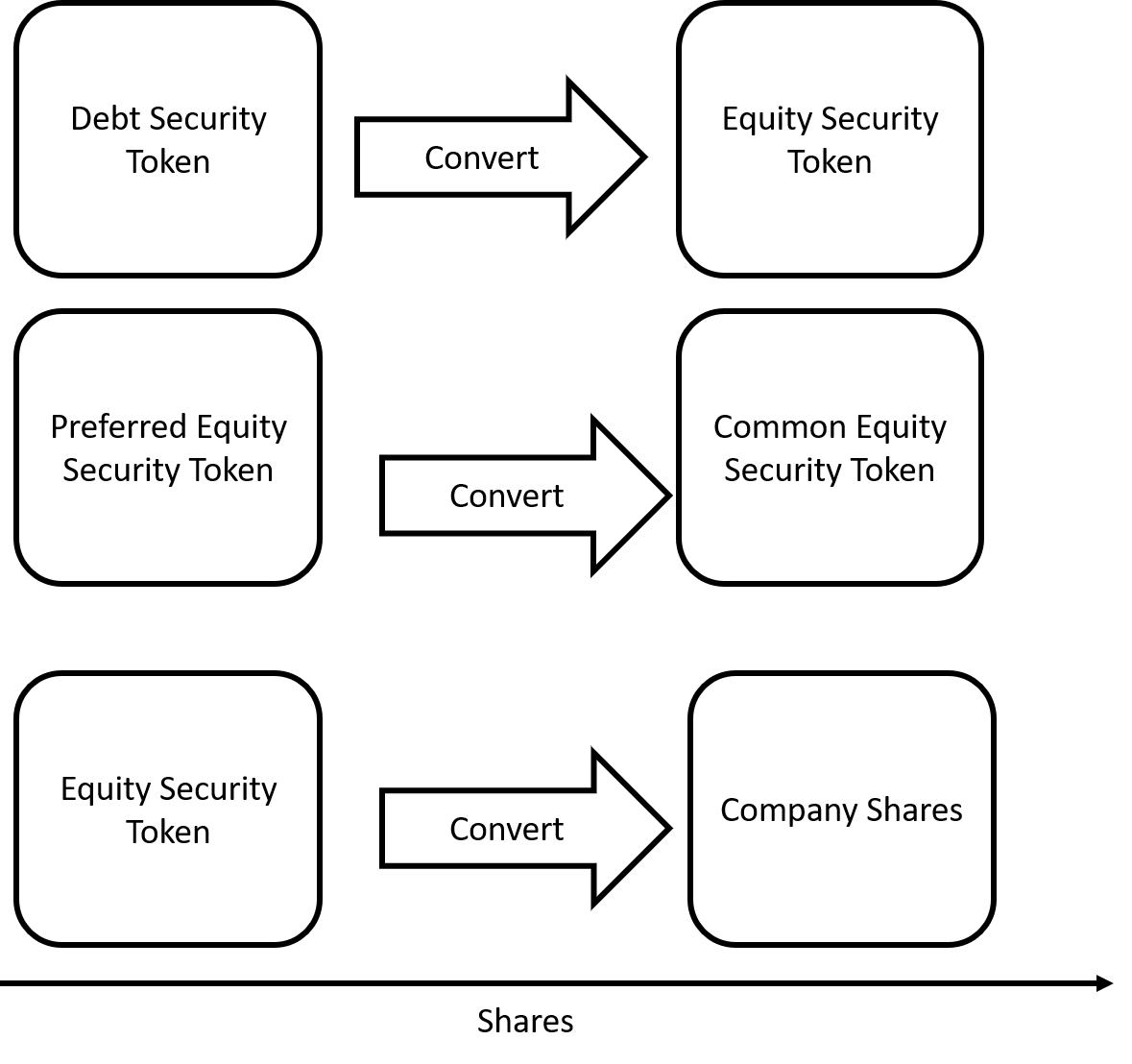

The hybrid model can include a conversion between a programmable debt-based pass and an equity pass. For example, a company may issue a hybrid securities pass that behaves like a debt-based pass for a period of time and then reissued as an equity pass. Similarly, organizations can issue different types of equity-based certificates based on liquidation preferences.

Interestingly, a hybrid securities pass can represent a transition between on-chain and off-chain securities. For example, a company can issue a securities certificate that is converted into a company share after a period of time. This is the model followed by the issuance of the first convertible certificate, and is being tested in jurisdictions such as Malta.

In this innovative case, a blockchain company called Palladium plans to issue a “pass-certified convertible warrant”, which is approved and regulated by the Malta Financial Services Authority and is subject to the European Union. Under strict regulations, this issue will give investors the right to convert them into company shares three years after the issuance of the certificate.

Hybrid Securities Pass Agreement

The implementation of the hybrid securities pass agreement is very simple, just add a basic operation in the process of issuing bonds or equity passes. Suppose a company wants to issue a one-year convertible debt securities pass. Platforms like Securitize and Polymath can use protocols like Dharma, which will provide some basic extensions. At the time of issue, the platform used Dharma underwriting to issue a credit-based smart contract with additional terms such as face value and maturity date, and issued the corresponding equity certificate based on the company's shares. In the first year, the debt securities holder will receive dividends in accordance with the terms set out in the smart contract. After the expiration, the holder of the debt securities pass may choose to convert its pass into an equity pass. The securities-based issuance platform may use such conversion clauses as part of the agreement to enrich the distribution model of such certificates.

At the operational level, hybrid securities passes may seem a bit complicated, but they will certainly open the door to a variety of interesting scenarios. With the development of securities-based certification platforms and agreements, we may consider hybrid models as one of the key financial elements to match the complexity of securities-based securities with securitized financial products to achieve new and traditional finance. Full integration.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Twitter Featured: BSV soars 200%, EOS parent company brings 65 times earnings to investors

- What is the reason for the continued surge in bitcoin since May?

- BM declares war on Ethereum again: DeFi has failed in Ethereum, and EOS is the future

- Is the blockchain mobile phone running Bitcoin full node reliable?

- Every meeting will be "outbreak"! BTC's 20% surge in a week is just a warm-up?

- Dry goods | What are the criminal risks involved in currency cases?

- Blockchain Weekly | Bitcoin accelerates sprint, hitting a new high of $7,500 during the year