Speed reading | Bitcoin S17+ new mining machine revenue evaluation; exchange wallet holds 6.7% of all bitcoin

Author: True Satoshi

Editor's Note: The original title is "Zhenben Congjiji|Bit Continental S17+ New Mining Machine Benefit Evaluation"

Today's content includes:

1-bit mainland Antminer S17+ and T17+ new mining machine evaluation

- What are the major impacts of the accelerated development of the central bank's digital currency?

- Failed to pay 500,000 bitcoins, CSW violated the settlement agreement, litigation restarted

- The first anniversary of the Uniswap agreement, how is this alternative Ethereum DEX developed?

2 Exchange wallet holds 6.7% of all bitcoins (and is growing)

3 The rise of Staking: from theory to the construction of large infrastructure

4 Elephants in the room on the San Francisco blockchain week

5 Industry's top DAO overview

Bit Continental Antminer S17+ and T17+ New Mining Machine Reviews

This is Coinmonk's mining machine evaluation, mainly for the recently released Bitcoin mainland ant mining machine S17 series. According to the official statement, Bitmain has just announced that it will release the latest generation of Antminer ASIC mining equipment.

The new devices, named S17+ and T17+, have higher hash rates than previous generations and have relatively comparable energy consumption rates.

In the past few years, Bittland has been regularly releasing newer mining machines in its Antminer series. Often, these devices are among the best in their class in terms of hash rate, but their advantages are often quickly challenged by other competing ASIC companies. It is often the case that the retail price of equipment sold in Bitland is quickly out of stock, and there are yolk resellers asking for higher prices.

The biggest question is, is it profitable to run its equipment now? For our calculations, we used the Coinwarz Mining Profitability Calculator and assumed the electricity price was $0.10 per kilowatt. All other variables, such as bitcoin difficulty, are left at their default values, which are based on regularly updated data.

According to our findings, S17+'s operating profit is considerable, but it is not absolutely true. The calculator recommends running 7 days a week, 17 hours a day and 24 hours a day (assuming the difficulty has not changed, considering that a more powerful device is unlikely to launch quickly), you can expect to earn about 0.52212548 BTC.

When you consider the electricity bill, you can reduce your potential revenue by about half, and the estimated electricity bill is $2,557.92.

Is this worth it? This is a difficult question to answer because it is based on many unpredictable variables.

You may ask yourself, is it better to mine Bitcoin than to buy and hold Bitcoin?

The vast majority of Bitcoin mining is done by industry-scale participants who can use extremely cheap electricity and benefit from economies of scale. These large companies are likely to buy hundreds or even thousands of such machines at a discounted price and run them at very low prices. For these players, earning bitcoin profits can be easy.

Full text link: https://medium.com/coinmonks/bitmain-antminer-s17-and-t17-review-625368ca2476

The exchange wallet holds 6.7% of all bitcoins (and is growing)

The exchange has increasingly swallowed up Bitcoin's liquidity and now accounts for 6.7% of all liquidity. This trend has been accelerating since 2017.

The exchange is by far the largest holder of the entire cryptocurrency market. About 6.7% of all circulating BTCs are held by exchanges, about $9.8 billion worth of bitcoin.

Huobi, Binance and Bitfinex hold the top three, and their share is accelerating.

There is a troubling question as to whether an exchange holding so many BTCs is even a good thing. Do we need a centralized entity to control such a large amount of liquidity? Although the current exchange is more secure than ever. However, this still depends on the exchange itself to ensure that the cryptocurrencies they hold are not stored in a single point of failure. Trading with more BTCs is not a bad thing – it is important that they have the appropriate security to prevent possible disasters.

Full text link https://beincrypto.com/6-7-of-all-bitcoin-is-held-by-exchange-wallets-and-growing/

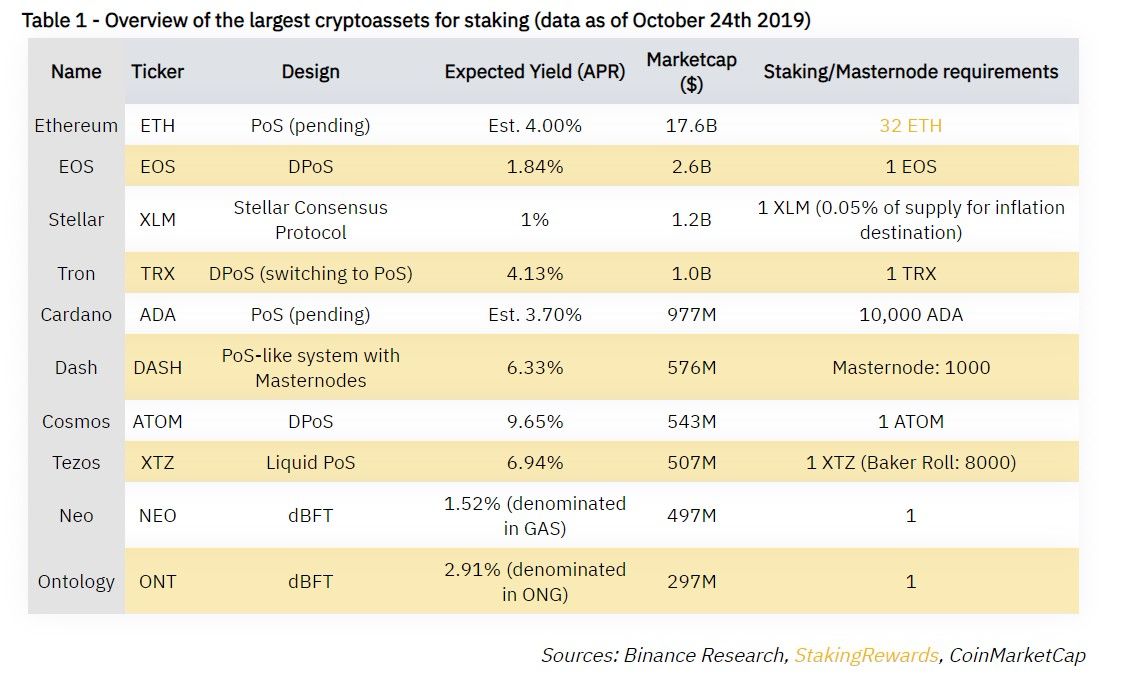

The rise of Staking: from theory to the construction of large infrastructure

This is the Staking research report of the currency security info. The content is actually good. The research is quite detailed. It also summarizes the Staking situation of some mainstream projects. The content is a bit long, and the main points are summarized as follows:

- Staking is a reward-driven process that holds funds to support the process of blockchain network operations. Staking has become one of the unique differentiation features offered by the encryption industry.

- Similar to passive income strategies in traditional finance, Staking allows users to earn rewards directly on the chain by holding a specific currency.

- Staking can be used in many forms on many chains, but the specific mechanism depends on the token design and consensus mechanism of the mortgage project.

- Staking benefits cannot be pursued blindly – instead, they must be compared to other chains based on potential risks and obligations, for example: different chains pay rewards based on various restrictions and time of payment.

- When deciding which blockchain to invest in for a long time, participants must address the risk of technical failure and the exposure to the underlying token.

- Participating in different networks requires different resources and sometimes requires extra labor to collect rewards.

- With Staking, existing players in the cryptocurrency ecosystem and blockchain projects have formed incentives for sustained symbiotic growth. As more infrastructure participants support it, the entire ecosystem will mature.

- As Ethereum is about to turn to PoS, PoS is expected to take most of the market's attention.

Full text link:

Full text link:

Https://info.binance.com/en/research/marketresearch/rise-of-staking.html

Elephant in the room on the weekly blockchain in San Francisco

The old financial system is dead and the old financial system is forever.

Well-known foreign podcast bloggers Meltem Demirors and Jill Carlson said in the San Francisco blockchain week that cryptocurrency and traditional finance have more in common than some cryptocurrency advocates think.

When you and someone else hold a cryptocurrency, it actually completes part of the bank's main function. As Demirors said, “All the most profitable businesses in our industry are banks.”

“I entered this field because I was excited to be able to build an entire alternative to the existing financial ecosystem. In fact, we created something similar to the old system, with fewer risk indicators and models around it. Less control."

And, like Wall Street's institutions, some of the cryptocurrency platforms included in the exchange are considered too big to fail. This happened when Ethereum voted to abolish the failure of the DAO smart contract to avoid theft of a large number of ETHs. She asked: "What if the exchanges such as Coinbase were hacked and 6% of the bitcoin supply was stolen?" When the equivalent is so huge, will we withdraw the Bitcoin blockchain?

Full text link: https://decrypt.co/11009/the-elephant-in-the-room-at-san-francisco-blockchain-week

Industry's top DAO overview

On this year's DevCon 5, many users quickly emphasized the term "#yearoftheDAO", which means that in 2020 you can see the expansion and growth of many of the largest decentralized organizations that have been established to date. For the time being, most DAOs are based on Ethereum and its successor products and services, but this structure is by no means limited to a blockchain-based ecosystem.

In the next few months, it's important to pay attention to a new round of DAOs, all of which have unique niche markets. If some DAOs get a lot of attention, we are likely to see a surge in interest in creating the next big DAO, perhaps bringing 2017 similar to what we saw in ICO.

– MakerDAO MakerDAO is undoubtedly the largest and most mature DAO in the field, including the core team behind Maker (the project that created the Dai Stabilizer), as well as the personal community that participates in the governance polls through the Governance Dashboard. MakerDAO uses the governance token MKR, which is used to vote on all polls. Similarly, MKR is designed as the system's primary value acquisition mechanism, which means that if the project continues to succeed in the future, people who use MKR tokens to hold and vote to help shape the ecosystem will get the most benefit.

– Aragon Aragon is unique in that it not only strives to act as a DAO itself, but is also fully focused on providing users with the tools they need to create their own DAO. In this sense, Aragon can be seen as an ecosystem of multiple DAOs with unique structures and rules governing a given task.

– Moloch DAO As one of the newer projects in this field, the core focus of MolochDAO is to fund the development of Ethereum 2.0. In this world, most of the fundraising based on Ethereum is invested in projects that will mobilize competitive solutions for those who are actively seeking to improve Ethereum and its infrastructure without trying to take advantage of profitable financing. For the developer of the vulnerability, there is very little money. .

– MetaCartel MetaCartel is the fork of MolochDAO, focusing on dApp funding to leverage shared product data and user insight. In this sense, members of MetaCartel theoretically benefit from the form of valuable information obtained by any product or company funded by DAO.

– Although Gitcoin Gitcoin is not an inherent way of DAO, it is worth mentioning because of the spirit behind it. Gitcoin is a platform for purchasing blockchain developers, similar to UpWork, but specifically for blockchains. Related to the DAO concept, Gitcoin recently hosted a program called Gitcoin Grants that uses the EIP1337 token standard, in which all donations are matched using a second vote.

DAO's impact on DeFi

For those who want to know how DAO relates to the larger DeFi ecosystem, recognizing that so far, it's important that people have been criticizing DeFi products for being more central than the products they sell. It is undeniable that most DeFi projects use traditional corporate structures to try to provide the most compelling products.

Seeing that DeFi has unlocked the potential of automated financial services, it is likely that a new round of DAO will emerge, and people are particularly interested in DeFi and its follow-up products and services. In addition to introducing governance mechanisms, DeFi DAO can also benefit members from the benefits of any product they create or through dividends and/or profit sharing. In this sense, it is interesting to consider how DeFi products created by the community compete with products that are heavily affected by venture capital.

Full text link: https://defirate.com/top-daos/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Research report | Libra is still on the line, the project development is hot

- Weekly data on the BTC chain: data on the chain began to fall, and the exchange traded frequently

- Can BTC be independent?

- BTC retreats slightly, but the average support is still strong

- Babbitt Entrepreneurship + | "All changes are possible", how does the investment institution X-Order explore the new open financial order?

- CasperLabs launches "Highway" to improve the security of the PoS blockchain

- People's Daily Commentary Blockchain: Breakthroughs in Overtaking