What are the major impacts of the accelerated development of the central bank's digital currency?

Source: Tongxuntong Research Institute

Editor's Note: The original title is "Five Impacts of the Central Bank's Digital Currency"

Guide

In the second half of 2019, the central bank's digital currency research and development will accelerate, and what major impact will it bring after its launch?

Summary

Topic: Possible Impact of DC/EP

- Failed to pay 500,000 bitcoins, CSW violated the settlement agreement, litigation restarted

- The first anniversary of the Uniswap agreement, how is this alternative Ethereum DEX developed?

- Research report | Libra is still on the line, the project development is hot

(1) Defend national digital sovereignty. The future digital sovereignty will form part of the overall national strength of the country. Digital sovereignty will be at least as important as financial sovereignty. The early introduction of the central bank's digital currency is expected to give China a first-mover advantage in the digital currency trend and be in an invincible position.

(2) Promote the internationalization of the RMB. The central bank's digital currency is guaranteed by national credit, and its value is relatively stable, which helps the circulation of the renminbi in a wider range and promotes the internationalization of the renminbi.

(3) Improve the effectiveness of monetary policy. The central bank's digital currency provides the central bank with new monetary policy tools, or helps the central bank to more accurately measure the money supply and structure, circulation speed, etc., and help to improve the central bank's monetary status and monetary policy effectiveness.

(4) Improve the efficiency of financial supervision. The cash transaction itself has difficulties in supervision. BTC and Libra have further expanded the supervision blind zone. The introduction of the central bank's digital currency will help strengthen financial supervision.

(5) Adapt to the development of cashless society, or break the barriers to paying the industry, but the short-term impact may be relatively limited.

Quotes: It is expected to continue to attack after consolidation. The total market value of digital certificates this week was 251.37 billion US dollars, up 5.4%; the average daily turnover was 101.95 billion US dollars, up 54.8%; the average daily turnover was 40.5%, up 10.9%. The current price of BTC is US$9,261, with a weekly increase of 6.9%; the average daily turnover is US$30.7 billion, and the average daily turnover is 18.3%. The current price of ETH is 219.6 US dollars, the weekly increase is 1.3%, the average daily turnover is 10.7 billion US dollars, and the average daily turnover rate is 53.7%. This week, the exchange's BTC balance was 843,500, a decrease of 42,400 from last week. The exchange's ETH balance was 8.58 million, a decrease of 620,000 from last week. In the BICS secondary industry, the market value of the supply chain declined significantly.

Output and heat: The computing power is declining and the attention is rising. The difficulty of mining this week is 13.69T, which is unchanged from last week. The average daily power of this week is 89.26EH/s, which is 1.03EH/s lower than last week. The difficulty of mining this week is 2465, which is 42 days higher than last week. The average power is 187.0TH/S, which is 2.6TH/S lower than last week.

Industry: BTC options contracts will be available. The central bank's trade finance blockchain platform has achieved remarkable results; Bakkt and CME intend to launch BTC options, Bakkt platform announced that BTC options contracts will be launched on December 9, 2019, CME officially announced that it will launch BTC options in the first quarter of 2020; BTC was Formally included in the French high school syllabus.

Risk warning: regulatory policy risk, market trend risk

1

Topic: Five major influences of the central bank's digital currency

1.1 DC/EP R&D Acceleration

Since 2014, the People's Bank of China has started research and development on digital currency and central bank digital currency under the auspices of then Governor Zhou Xiaochuan.

On March 9, 2018, at the press conference of the 13th National People's Congress, Zhou Xiaochuan mentioned that the central bank is studying DC/EP, DC, digital currency, which is digital currency; EP, electronic payment, is electronic payment.

In August 2019, the central bank’s video conference in the second half of 2019 proposed to accelerate the pace of research and development of China’s legal digital currency (DC/EP); in September 2019, according to China Daily, the “closed-loop test” of the central bank’s digital currency has begun. .

1.2 DC/EP development path

1.2.1 Operational System: Two-tier architecture

The central bank's digital goods adopt the "central bank-commercial bank/other institutions" two-tier operating system, that is, the central bank first converts the central bank digital currency to commercial banks or other operating agencies, and commercial banks or other institutions convert the central bank digital currency to the public, commercial institutions. The reserve is paid in full to the central bank. The reasons for adopting the two-tier operating system mainly include the following aspects:

(1) The large country is facing the diversity and complexity of issuing central bank digital currency;

(2) Give full play to the resources, talents and technological advantages of commercial institutions;

(3) Avoid excessive concentration of risks;

(4) Avoid financial disintermediation. Under the single-tiered delivery framework, the central bank directly faces the public to place digital currency. Compared with the deposit money of commercial banks, the central bank's digital currency is better than the commercial bank deposit currency in the case of central bank credit endorsement, which will have a crowding out effect on commercial bank deposits, affecting the ability of commercial banks to lend, and increase commercial banks' interbank market. Dependence. In this case, the capital price will be raised, the social financing cost will be increased, and the real economy will be damaged.

1.2.2 Positioning: Focus on M0 replacement

The reasons for the substitution of M0 mainly include two aspects. M1 and M2 have realized point electronicization and can still meet the needs of economic development, while M0 is not digital enough.

(1) Substituting M1 and M2 does not help to improve efficiency, but also wastes resources of existing systems.

- M1 and M2 have been electronically implemented, that is, based on the existing commercial bank account system;

- The inter-bank payment clearing system that supports M1 and M2 circulation, the online banking system of commercial banks, and various types of online payment methods of non-bank payment institutions are increasingly efficient and can meet the needs of China's economic development.

(2) M0 digitization is insufficient

- The existing M0 (banknotes and coins) are easy to be forged anonymously, and there are risks for money laundering, terrorist financing, etc.;

- Electronic payment instruments cannot completely replace M0, such as bank cards and Internet payments. Based on the tight coupling model of existing bank accounts, the public's demand for anonymous payment cannot be fully satisfied;

- In areas where account services and communication networks are poorly covered, people are more dependent on cash.

1.2.3 Technical route: technical neutral

In order to meet high concurrency requirements (at least 300,000 pens per second), the technical route is not preset. The "Regulations on the Administration of Renminbi of the People's Republic of China" stipulates that it is forbidden to intentionally damage the renminbi. Adding additional social or administrative functions to the cash is actually damaging the renminbi. Therefore, the central bank's digital currency will load smart contracts that are beneficial to the monetary function. Smart contracts for functions remain cautious.

1.2.4 Anonymity: Implementing Controlled Anonymity

The central bank's digital currency is based on the loosely coupled form of the account, that is, the transaction link does not depend on the account. In this model, transaction data is transmitted asynchronously to the central bank by the operating agency daily, and the system burden of the operating organization is reduced while ensuring that the central bank has the necessary data to ensure prudent management and anti-money laundering supervision. In terms of anonymity, the central bank's digital currency will achieve controllable anonymity, and only the third party will disclose transaction data.

1.3 Five major impacts of DC/EP

Defend national digital sovereignty. The future digital sovereignty will form part of the overall national strength of the country. Digital sovereignty will be at least as important as financial sovereignty. The early introduction of the central bank's digital currency is expected to give China a first-mover advantage in the digital currency trend and be in an invincible position.

Promote the internationalization of the RMB. The central bank's digital currency is guaranteed by national credit, and its value is relatively stable, which helps the circulation of the renminbi in a wider range and promotes the internationalization of the renminbi.

Improve the effectiveness of monetary policy. The central bank's digital currency provides the central bank with new monetary policy tools, or helps the central bank to more accurately measure the money supply and structure, circulation speed, etc., and help to improve the central bank's monetary status and monetary policy effectiveness.

Improve the efficiency of financial supervision. The cash transaction itself has difficulties in supervision. BTC and Libra have further expanded the supervision blind zone. The introduction of the central bank's digital currency will help strengthen financial supervision.

Adapt to cashless social development, or break the barriers to paying the industry, but the short-term impact may be relatively limited. The proportion of China's M0/M1 has dropped from 18% in 2013 to 13% in 2018. The proportion of countries such as Sweden has dropped below 5%; the proportion of M0/M2 in China has been declining in recent years, rarely exceeding 5 after 2013. %, it can be said that the introduction of the central bank's digital currency has adapted to the development trend of the cashless society. Due to the extremely high credit rating of the central bank's digital currency, it is possible to break the monopoly of the payment industry. However, in the short term, as users have built trust in commercial banks and head payment institutions, payment habits have gradually solidified, and anonymous payment needs have been limited. The overall impact may be relatively limited.

2

Quote: It is expected to continue to attack after consolidation

2.1 Overall market: rebound rebound

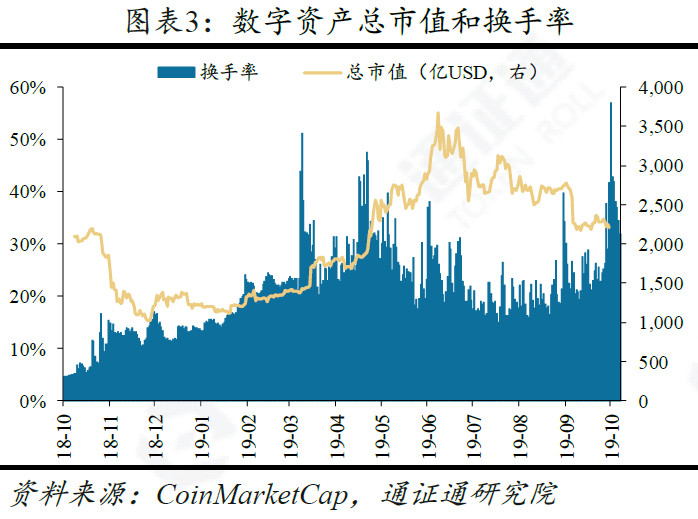

The total market value of digital passes this week was $251.37 billion, up by $5.49 billion from last week, or about 5.4%. At the beginning of the week, the market rebounded sharply, and the second half of the week oscillated downward.

The average daily trading volume of the digital pass market was 101.95 billion US dollars, up 54.8% from last week, and the average daily turnover rate was 40.5%, up 10.9% from last week.

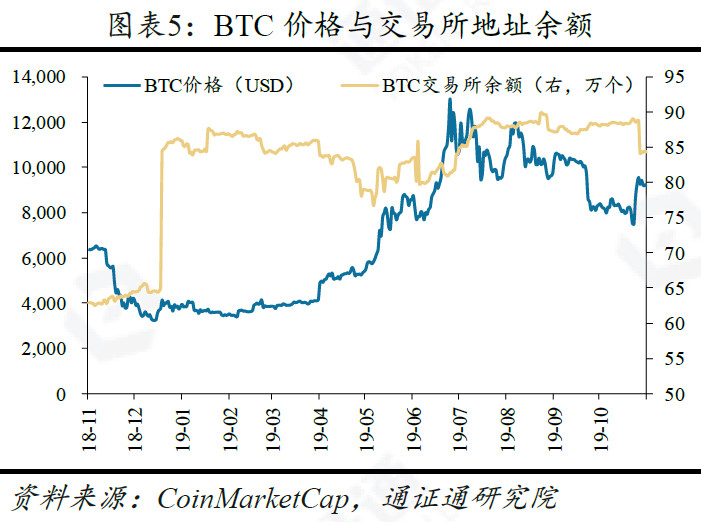

This week, the exchange's BTC balance was 843,500, a decrease of 42,400 from last week. The exchange's ETH balance was 8.58 million, a decrease of 620,000 from last week. Both the BTC and ETH balances of the exchanges declined, and the selling pressure on the market eased.

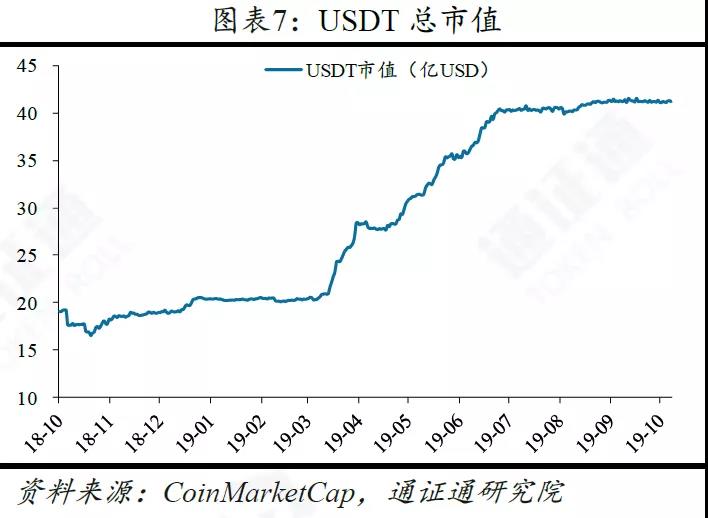

The market value of USDT was $4.12 billion, an increase of $7.92 million from last week. The enthusiasm for funds entering the market has rebounded, and the USDT premium has increased slightly.

2.2 Core Pass: BTC dominates the market

The current price of BTC is US$9,261, with a weekly increase of 6.9% and a monthly increase of 10.3%. The average daily turnover of BTC this week was 30.7 billion US dollars, and the average daily turnover rate was 18.3%. The BTC rebounded at the beginning of this week and fell slightly.

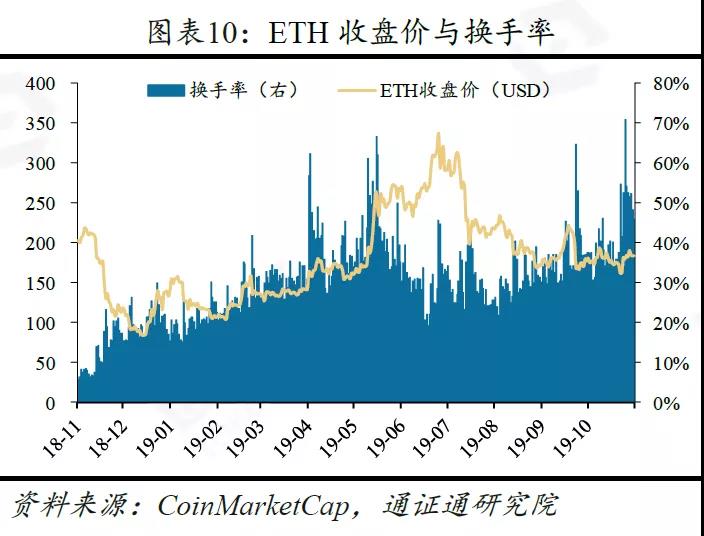

The current price of ETH is 219.6 US dollars, with a weekly increase of 1.3% and a monthly increase of 1.8%. The average daily turnover of ETH this week was $10.7 billion, with a daily average turnover rate of 53.7%. ETH was weaker this week.

EOS is currently trading at $3.35, a weekly increase of 5.5%, and a monthly increase of 11.3%. The average daily trading volume of EOS this week was 2.94 billion US dollars, and the average daily turnover rate was 95.4%. EOS rebounded.

The current price of XRP is 0.29 US dollars, with a weekly decline of -1.9% and a monthly increase of 15.4%. The average daily volume of XRP this week was $2.1 billion, with a daily average turnover rate of 16.3%. XRP's performance this week is relatively weak, not as good as the main circulation certificate.

The monthly volatility of BTC and EOS increased slightly this week. The monthly volatility of BTC was 20.4%, up 1.0% from last week. The monthly volatility of ETH was 18.5%, down 0.9% from last week. The EOS monthly volatility was 22.0%. Last week, it rose 0.4%; XRP monthly volatility was 16.6%, down 0.8% from last week.

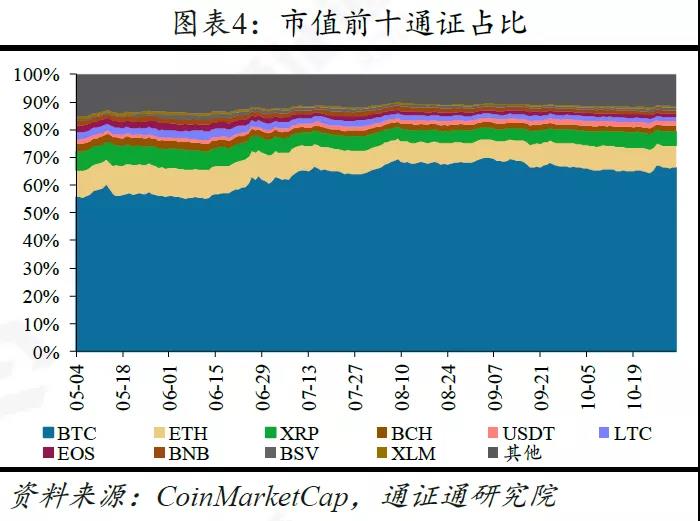

2.3 BICS industry: supply chain market value declines significantly

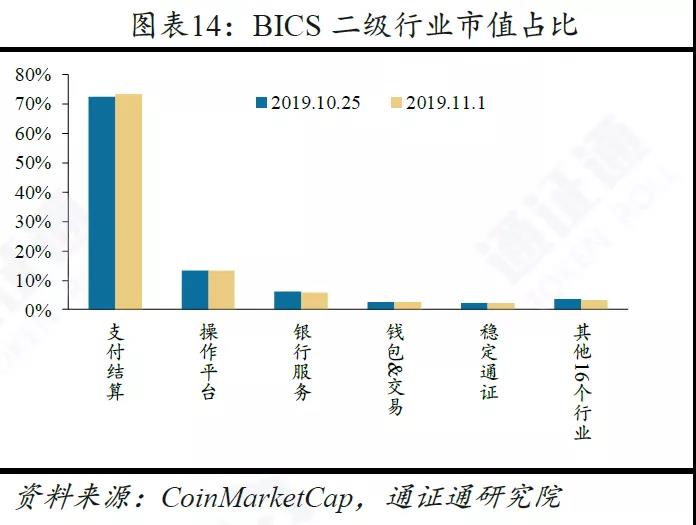

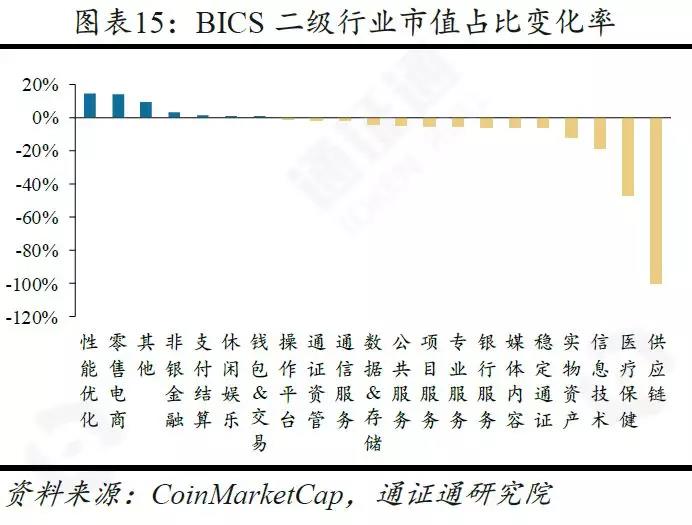

In the top five industries of BICS (Blockchain Industry Classification Standard), the market value of payment and settlement industry rose from 72.4% to 73.2%. From the perspective of market value ratio change, performance optimization, retail The market share of e-commerce industry has a higher growth rate, and the proportion of supply chain and health care market value has decreased significantly.

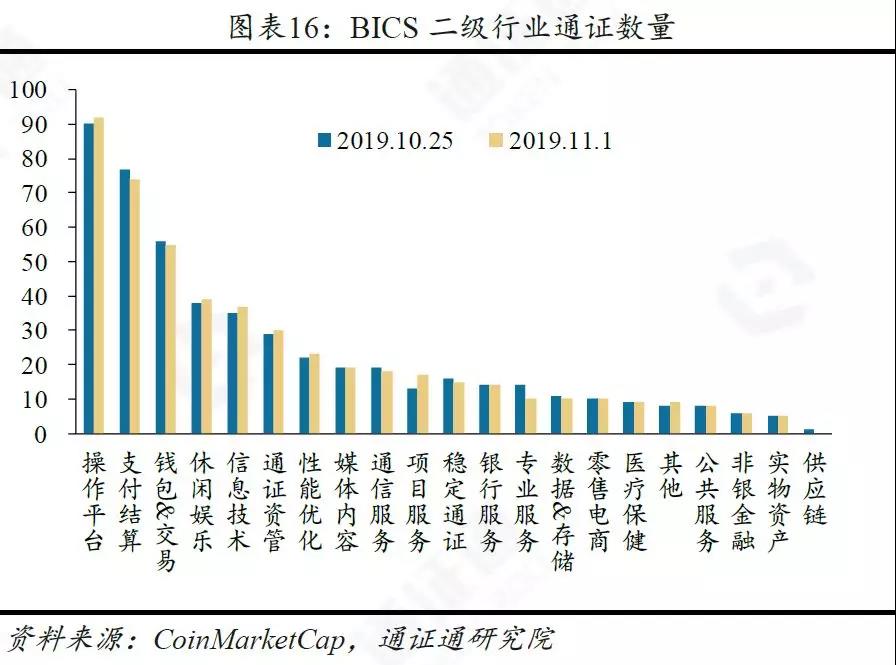

The BICS secondary industry, which has seen a significant increase in the number of certificates in this week, is the operating platform, project services and information technology. The more obvious declines are payment settlement and professional services.

2.4 Market View: It is expected to continue to attack after consolidation

This week, the market rebounded slightly after a large rebound. The top is still suppressed by the MA120. The support near the $9000 is strong. After the consolidation, the market is expected to continue to attack. Investors can hold BTC spot-based, $7,300 or become the BTC "policy base."

The callback can be gradually added. In the long run, the quality pass has a large imagination, and it is still in the early stage of the bull market. The callback is a rare opportunity to increase the position. Investors can do a good job of asset allocation based on their own situation.

3

Output and heat: the computing power declines, the attention rises

The difficulty of mining has been reduced, and the BTC computing power has rebounded significantly. The difficulty of mining this week is 13.69T, which is unchanged from last week. The average daily power of this week is 89.26EH/s, which is 1.03EH/s lower than last week. The difficulty of mining this week is 2465, which is 42 days higher than last week. The average power is 187.0TH/S, which is 2.6TH/S lower than last week.

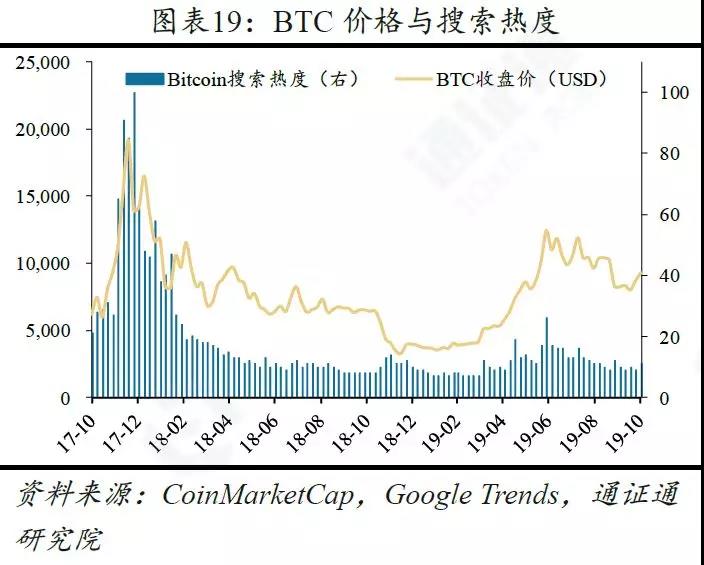

This week, Google Trends's Bitcoin entry search heat was 11, which was higher than last week. The Ethereum entry search heat was 6, which was slightly higher than last week.

4

Industry News: BTC Options Contracts will be available

4.1 The central bank's trade finance blockchain platform has achieved remarkable results

The central bank's trade finance blockchain platform has achieved remarkable results in Shenzhen for more than a year. Up to now, 485 outlets of 29 banks in Shenzhen have participated in the promotion and application, achieving more than 30,000 business transactions and 5,000 business transactions. In addition, the business volume is about 75 billion yuan.

4.2 Bakkt and CME intend to launch BTC options

The akkt platform announced that the BTC options contract will be launched on December 9, 2019, and the options contract will be based on the Bakkt monthly BTC futures contract. CME officially announced that it will launch BTC options in the first quarter of 2020.

4.3 BTC is officially included in the French High School syllabus

BTC-related explanations have been added to the economics and social sciences courses in French high schools. BTC has recently become an integral part of many university courses in France.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Weekly data on the BTC chain: data on the chain began to fall, and the exchange traded frequently

- Can BTC be independent?

- BTC retreats slightly, but the average support is still strong

- Babbitt Entrepreneurship + | "All changes are possible", how does the investment institution X-Order explore the new open financial order?

- CasperLabs launches "Highway" to improve the security of the PoS blockchain

- People's Daily Commentary Blockchain: Breakthroughs in Overtaking

- Market Analysis: BTC continues to maintain shock consolidation, lowering expectations