Speed Reading | USV Li Li, Ethereum Developers Conference 6 years speech full collection summary

Author: True Satoshi Editor's Note: The original title "Notes | Libra been misunderstood and reviled, but USV say it will be quite in the end."

Today's content includes:

1. The future history of the open Internet 2. The third quarter of the digital asset investment report released by Grayscale 3. Libra is unpopular and/or misunderstood, but the USV will stick to the end. 4. The Ethereum network is highly congested and causes DeFi problems. 5. Ethereum development Conference Devon0 – Devon5 six-year speech full collection summary

1. The future history of the open Internet

The author is @owocki, from Gitcoin, who gave a speech on @efdevcon titled "The Future of Open Internet". The highlight of this article is actually on his slideshow image, although the text is good, but His slide pictures are very beautiful. Here's a simplified version of the content:

The collapse of institutions in the industrial age + we will migrate to the information age… what kind of network species we want to evolve into. Let's start by talking about the current history of the open Internet:

- US lawmakers: If Facebook can use Bitcoin directly, there will not be so much trouble.

- Competing for "5G+ blockchain"! The relevant person in charge of China's three major telecom operators confirmed to attend the World Blockchain Conference·Wuzhen

- Lava open source opens a new era of PoC ecological development

In 1985, Richard Stallman founded the FSF in 1985 as the foundation. The goal of the free software movement was to obtain and guarantee a certain degree of freedom. Is the creator of the device in your pocket serving the interests of your users? Or is it for Apple's interest-driven interests? Software is increasingly entering our lives. This is related to control/impact.

In 1991, Linus Trovalds created the Linux kernel. Linux is important and important today because it is the most widely used computer operating system in the world. It sets a precedent that an open source project may be more successful than commercial software!

In 2008, Bitcoin was founded by Satoshi Nakamoto. For the first time in history, a group of p2p individuals can send value over the Internet without the need for an intermediary.

In 2015, Vitalik launched Ethereum, which has many of the same features as Bitcoin, but now allows developers to build programmable applications on top of the decentralized funding layer of the blockchain.

This is our history today, and the following is our future.

The Internet has changed our politics, entertainment, etc. It allows computers to send information over the Internet. Value Internet can change anything that depends on money, because now we can send value over the network. The size of this new economic system can be large.

My biggest hope is that we can use Ethereum's invariance/transparency scale attributes to prevent/reverse the Matthew effect. One of the great advantages of DeFi is that it allows access to financial instruments that were previously only available to those with rich/Western affluence.

We are designing the power structure of this new world today. The next generation of economic relations will default privacy as a human right, they will be affected by the free market rather than the supervision of political machines, we become a complete p2p network species rather than an oligopoly, we are building new things together. The decisions we make today through invariance may be cases that have been passed down from generation to generation.

I hope that our descendants live on free/open internet, and we become the shoulders of their standing.

Full text link: https://threadreaderapp.com/thread/1182519416124108803.html

2. Grayscale's third quarter digital asset investment report released

Highlights for the third quarter – total investment in Grayscale products: $254.9 million – average weekly investment – all products: $19.6 million – average weekly investment – bitcoin trust: $13.2 million – average weekly investment – product (excluding bits Currency Trust: $6.4 million – The majority of investment (84%) comes from hedge fund-dominated institutional investors.

The famous investment institution Grayscale released their 19th quarter digital asset investment report, and they have their own inventory summary, as follows:

The $254.9 million buy-up marks the strongest demand since the company's inception. Despite the recent decline in digital asset market prices, purchases have tripled from the previous quarter, from $8.4 million to $254.9 million.

Grayscale Bitcoin Trust's capital inflows were $171.7 million: In the third quarter of 19, we saw the largest quarterly capital inflow of the product in six years. The inflow of funds in July also reached the highest monthly level.

In 2019, Grayscale's Ethereum Trust and Ethereum Classic Trust's purchases reached $100 million: this year we have seen $104.4 million in inflows beyond the Bitcoin Trust.

Full text link: https://grayscale.co/insights/grayscale-q3-2019-digital-asset-investment-report/

3. Libra is unpopular and/or misunderstood, but USV will stick to the end

This is a personal blog post by Fred Wilson, the famous investment institution USV (Joint Square Venture Capital). He mainly talks about his thoughts and responses to the negative comments Libra has received now. The USV is going to be a node of Libra and is also very active. Push Libra. The article is very streamlined, but it feels very real. There is something in it that I think is ironic. It is my own opinion that is not Fred’s original words. Defi’s mission was to make basic financial services free. People in the three worlds have enjoyed basic financial services through decentralized finance, but now Defi is in full swing in the United States, where financial services are the best, and has become a tool for everyone to arbitrage. When we first had the word Defi last year, everyone would think that we are going to make the world better, I don't even think that most of the Defi projects have this initial heart, they will think about We are going to make profit or arbitrage. Cefi's representative Libra actually showed his willingness and even more likely to achieve the original goal of the original Defi project, bringing basic financial services to the people of these backward third world countries, but it was insulted and nicknamed.

The excerpt is as follows:

Now everyone is very popular with Libra, calling it "Facebook's cryptocurrency project." In this case, it is understandable. But if this is a Facebook project, it’s not quite right after starting the Libra Association. Facebook is one of the many sponsors and has one-fifth of the board seats.

Libra's mission is to create a stable, cryptocurrency that can run on a sufficient scale so that Facebook and others can use it as an exchange/payment system in their applications.

I was with Kiva yesterday (Kiva is a non-profit organization that allows people to lend to low-income entrepreneurs and students in more than 80 countries via the Internet) and the Women's World Bank, and they have become a member of the Libra Association. Because the people they serve lack funds, and the traditional financial system has no conditions to provide them with basic financial services. I believe Libra can bring new services to people who don't have access to the financial system around the world, just as everyone can read my blog.

One of the benefits of engaging in a venture capital business, we can support unpopular and/or misunderstood projects. Not everyone can do this, and we think it's very important to do this.

Full text link: https://avc.com/2019/10/the-libra-association/

4. DeFi problem caused by high congestion of Ethereum network

When trading on Ethereum, many DeFi applications have recently experienced delays due to high network congestion. In particular, because the gasoline standard is not clear, such as opening CDP on Maker, lending money on Compound or moving assets to and from assets such as Metamask or Coinbase wallet has been problematic. As a result, the transaction has been "stuck", causing the wallet to be unable to process further transactions until the original transaction is cleared or removed from the memory pool.

Defirate's Cooper Turley wrote a more popular popular science article explaining why this happens, what happens after this happens, and a future view of the Defi problem caused by the Ethereum network congestion. With the continuous development of Ethereum towards Ethereum 2.0 and Serenity, and the optimization of ETH 1.x, I believe the situation is getting better and better.

Full text link: https://defirate.com/high-network-congestion-on-ethereum-causing-defi-issues/#more-1153

5. Ethereum Developers Conference Devon0 – Devon5 six-year speech collection

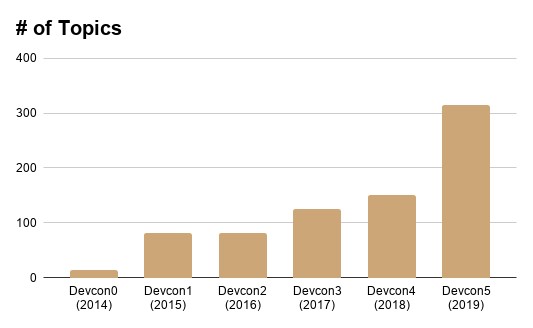

Henri Hyvärinen, a former partner at WaveVentures., decided to put together all the presentations related to Devcon (developer conference) into one post. This post is very interesting. If you seriously look at the topic of each year's speech and the speaker, the progress of the Ethereum ecosystem can well represent the development of the entire blockchain. This is the living history of a blockchain! Since there are too many speech topics in the future, only Devon0's full speech topics have been selected. It can be seen that in 2014 Gavin Wood took a very heavy role.

Devcon0 (2014) – C++ Ethereum and Emacs / Lefteris Karapetsas – Ethereum 1.x: On blockchain interoperability and scaling / Vlad Zamfir, Vitalik Buterin – Ethereum 2.0 and Beyond / Vitalik Buterin – Gavin: Welcome! Our mission: ÐApps / Gavin Wood – Golem / Piotr Janiuk – How to Sell Ideas / Vinay Gupta – How will Scrum work for us? / Sven Ehlert – Keeping the Public Record Safe and Accessible / Daniel Nagy – Looking at the Ethereum IDE: Mix / Gavin Wood – Multi-Protocol Peer Network Framework: Vision and Roadmap / Alex Leverington – Solidity, Vision, and Roadmap / Gavin Wood, Christian Reitwiessner – The Path to the Ethereum Light Client / Vitalik Buterin, Gavin Wood – Whisper: the Multi DHT Messaging System with Routing Privacy — Vision & Roadmap / Gavin Wood

Full text link: https://medium.com/@henri_43038/what-rebuidling-the-internet-looks-like-devcon0-to-1-and-beyond-27089043ea20

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Twitter Featured | Institutions secretly open positions, buy 250 million US dollars in cryptocurrency in the third quarter

- Multinational giants retired Libra, but also organized the six international blockchain alliances

- Decoding technology community: Github blockchain code library exceeds 50,000, this is the most concerned

- The 18 millionth bitcoin will be dug out this week, and the remaining 3 million bitcoins will still need 120 years.

- Harvesting 30% of the market share, IBM's enterprise-level blockchain strategy is still questioned?

- Helping to save energy and reduce emissions, Ford uses blockchain technology to track car green mileage

- Peter Tell's layout of bitcoin mining, Layer1 company finalized $50 million in Series A financing