Directly at Libra Hearing: Zuckerberg clarifies the strategic significance of Libra

Source: Produced by the Fire Coin Blockchain Institute

Author: Yuan Yuming, Li Hui

At 22:00 Beijing time on October 23, 2019, Libra ushered in the third congressional hearing. The hearing was initiated by the US House Financial Services Committee with the theme "Reviewing Facebook's Impact on the Financial Services and Housing Industries."

Regarding the US hearing system and its influence, the Fire Coin Research Institute has previously published an article "Directly attacking the Libra hearing, analyzing the position and supervision of the US Senate and the House of Representatives". The main purpose is to establish a reasonable enterprise and legislative body. Compliance communication channels. In other words, holding multiple hearings is an inevitable part of Libra's road ahead.

- Characters | From the founder of Hyperledger to the creation of a safe $7.5 billion financial technology empire, "pragmatic" thinker Lu Yifan

- Viewpoint | The Way to Success in Digital Money: Valuation Models and Network Effects in Chaos

- The US Congress blocks the truth and opportunity for Facebook to issue digital currency

Compared with the previous two hearings, this time is very different because the person attending the hearing was changed from Calimar CEO David Marcus to Facebook top leader Mark Zuckerberg, which is also Zuckerberg. For the first time, he participated in Libra's hearing. As Libra's haircut and Facebook helm, his statement at the hearing was very important.

I. Interpretation of the core points of the hearing

At the hearing, Zuckerberg caught two core issues that were most concerned and most worried: one was the strategic significance of Libra and the other was the relationship between Facebook and Libra. Of course, don't forget to give the Congress more reassurance: for example, emphasizing the dominant position of the US dollar, expressing its firm satisfaction with US regulatory requirements, and resolutely ensuring data security, privacy security, and user security, ensuring political correctness and meeting the government's demands. However, it still has some reservations about certain key issues regarding the use of Calibra data, which is also a piece of data assets that Facebook may value most in the future.

(1) Highlight the strategic significance of Libra

From the perspective of the United States, or from the mentality of members of Congress, Zuckerberg talked about the strategic significance of Libra to the United States, saying: First, the risk of non-innovation in the United States may be greater than the risk of innovation; Second, if the United States gives up the opportunity to give priority to the global payment system Libra, it will probably miss the best time to enter a new era. Third, other countries have been eager to try; Fourth, Libra can help the United States further consolidate the dollar's global leadership. Status; Fifth, Libra does not create money, but embraces the existing monetary system to help the dollar establish a global payment system.

Zuckerberg pushed Libra's strategic ambitions to the forefront with unbridled support. The above five points are afraid that the sentence is about the conscience of the congressmen. Libra is not Libra of Facebook, but Libra of the United States. It is an important tool for the United States to establish a global payment system for digital currency. From a strategic point of view, the United States does not really have much reason to stop the launch of Libra. If it is for financial risk considerations, you can consider and scrutinize the various mechanisms of Libra in order to minimize the financial risk.

(2) Cutting the inevitable connection between Facebook and Libra

Facebook is the initiator of Libra, and the leading organization in the preparatory stage. The relationship and actual control of Facebook and Libra are the topics of particular concern. Facebook has been questioned by the community because of data privacy issues. A company that lacks trust). At the hearing, Zuckerberg once again expressed the idea that Facebook and Libra cut at all levels. Said: First, Facebook is only a member of the Libra Association, does not have a single decision-making power; Second, if Libra goes online without regulatory approval, Facebook will withdraw from the association; Third, Libra Association is recruiting a new independent The person in charge, Calibra CEO David Marcus will not participate in the recruitment.

Facebook is well aware of the risks and implications of Libra, so it uses the decentralized model of the association to dominate operations. If Libra is successfully launched as envisioned, Facebook will not be able to get all the benefits from a single big one; if Libra fails or fails, Facebook will only be one of the participants, and it will retreat and not bear all the losses. Zuckerberg has made it clear that it is important and necessary for Facebook and Libra to be relatively independent. On the one hand, it eliminates the negative impact of Facebook's previous data privacy issues on Libra, and on the other hand, it is also designed from the organizational structure. Facebook's best choice, income and risk can be properly balanced.

(3) Emphasize the dominant position of the US dollar

According to the current proportion of Libra reserve currency (50% of the US dollar, 18% of the euro, 14% of the yen, 11% of the pound, and 7% of the Singapore dollar), the US dollar is the largest and most important currency. However, members of Congress still have concerns and hope to further clarify the dominance of the dollar. In answering the Senate’s question, Zuckerberg once again made it clear that Libra’s reserve currency composition will mainly follow the opinions of US regulators and will not rule out the possibility of further increasing the dollar’s share. And if a new currency is added to Libra's reserve basket in the future, it will also give priority to the regulatory agency's opinion to protect the dominant position of the US dollar, so as not to dilute the US dollar share. Of course, the possibility of refusing to join other currencies in order to protect the status of the dollar is not ruled out.

Therefore, we can clearly see that Libra is not the Libra of the world, but the Libra of the United States, in which the US dollar will have absolute superiority and control.

(4) Giving full supervision and regulation, but retaining the use of Calibra data

Regarding Libra's many controversies, the most critical issues are nothing more than financial concerns, financial risks, data privacy, and user security. At the hearing, Zuckerberg also reiterated his position on these issues and gave the Congress a reassurance, and said that Facebook will stand on the US position to think about and promote the development of Libra, demonstrating that the full position is correct. Zuckerberg said: First, Facebook will not launch Libra anywhere in the world until it is approved by US regulators; second, Libra needs approval from all regulators, including the US Securities and Exchange Commission, the Financial Enforcement Network, etc. Third, Libra will work with regulators to ensure compliance with anti-money laundering and counter-terrorism financing requirements; fourth, Calibra will not sell user data and will not provide it to third parties as a credit decision.

Regarding the first three articles, it should be the rigid compliance requirements that Libra can introduce. Zuckerberg reiterates that these positions are more indicative of the positive cooperation with the government. The fourth statement about Calibra's user data actually leaves a lot of room for Facebook.

What Facebook really cares about and directly controls is Calibra. Calibra is the official wallet on the Libra blockchain network. It is the core information of the core user data, transaction data, etc. on the Libra blockchain. It is on the Libra network. Throat fortress. Zuckerberg's statement about Calibra's data is still reserved. Some key issues are not mentioned. For example, the data ownership problem on Calibra belongs to users or belongs to Facebook? For example, the right to use data, because the data ownership is not defined, so the right to use is owned by Facebook by default? For example, Zuckerberg proposed that “people’s payment account information will not be used for advertising purposes”. Is it understandable that information other than payment accounts may be used for advertising purposes or for other purposes? Even if Facebook does not publicly sell data and does not provide relevant data services for third-party companies, Facebook itself has the core financial data of these users to provide them with very substantial business benefits, which will become the most important data asset of the future of Facebook. This is also one of the most worrying issues for everyone, but in the short term it is also difficult to solve the problem systematically, mainly relying on the company's self-discipline.

Second, Libra status analysis

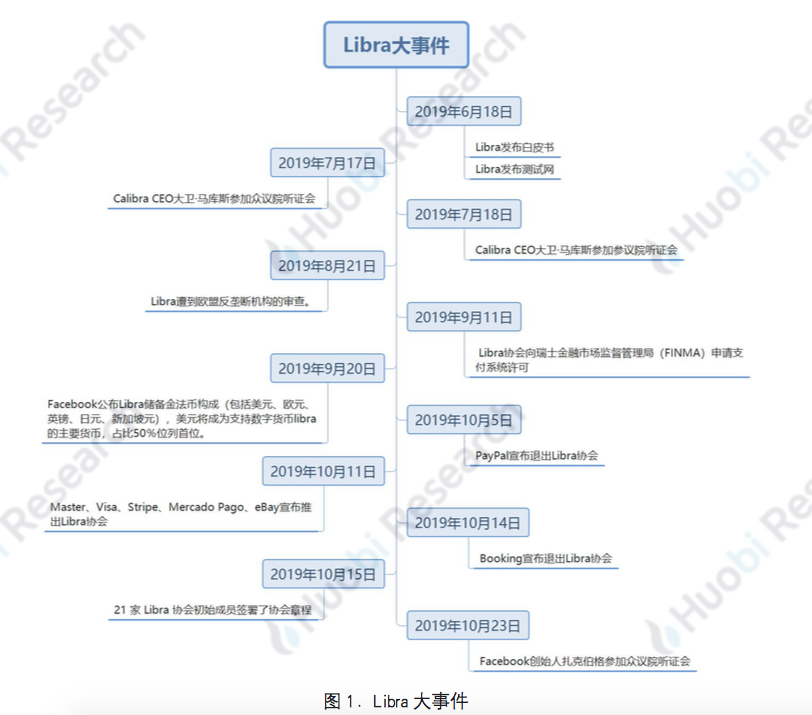

Since the publication of the white paper on June 18, 2019, Libra has been actively promoting in all aspects, as shown in the above figure. Including active and regulatory agency communication, participated in three congressional hearings, applied for a payment system license to the Swiss Monetary Authority, announced the Libra reserve legal currency composition plan, and actively promoted the Libra Association members to sign the association charter. But at the same time, it has indeed encountered a lot of resistance, such as the review by the EU anti-monopoly agencies, the major payment giants and the Internet giants have announced the withdrawal of the Libra Association, and the pressure exerted by various government agencies such as the National Assembly, which makes Libra Pushing the pace is difficult.

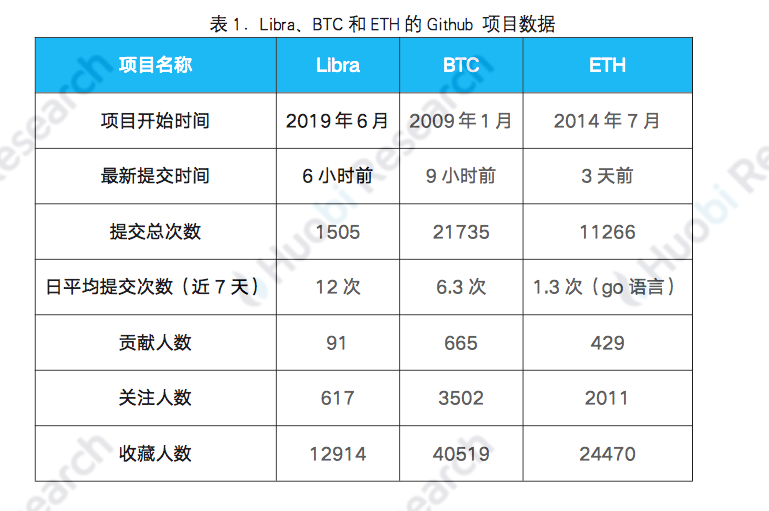

But aside from policy and regulatory issues, Libra's project development is in full swing, as shown in the following table: According to Github data (data collection time: October 24, 2019), Libra has been open source since June 2019. The progress of project development has progressed steadily. The Libra data for only 4 months on the line is very bright. In terms of the number of submissions, Libra averaged 12 submissions in the past 7 days, exceeding 6.3 of Bitcoin and 1.3 of Ethereum-GO. From the latest submission time, Libra's latest submission time is 6 hours ago, which exceeds the BTC and Ethereum-GO versions. It can be seen that Libra has continuously invested a lot of resources in the research and development of the project. It is one of the most active public chain development teams. I believe that Libra launch is a high probability event as long as the compliance issue can be broken.

Third, the conclusion

Zuckerberg pushed Libra to a strategic level at the national level, which in turn puts political pressure on policymakers. Libra is not Libra on Facebook, but Libra, which has a higher financial voice in the United States. In the article “Libra's First Board Meeting: Review and Prospects of Success and Failure in 4 Months”, the Fire Coin Research Institute has proposed that Libra will launch a high probability from the perspective of compliance, regulation and financial strategy. The interpretation of the meeting and the analysis of the current situation of Libra have once again confirmed this point. The Fire Coin Institute will continue to focus on the development of Libra.

Disclaimer:

1. The Firecoin Blockchain Research Institute does not have any relationship with the digital assets or other third parties involved in this report that affects the objectivity, independence and impartiality of the report.

2. The information and data cited in this report are from the compliance channel. The source of the data and data is considered reliable by the Firecoin Blockchain Institute and has been verified for its authenticity, accuracy and completeness. However, the Firecoin Blockchain Institute does not guarantee any authenticity, accuracy or completeness.

3. The content of the report is for reference only and the facts and opinions in the report do not constitute any investment advice for the relevant digital assets. The Firecoin Blockchain Institute shall not be liable for any damages resulting from the use of this report, except as required by laws and regulations. Readers should not make investment decisions based solely on this report, nor should they rely on the ability of this report to lose independent judgment.

4. The information, opinions and speculations contained in this report only reflect the judgment of the researcher on the date of the final report. In the future, based on industry changes and the updating of data information, there is the possibility of updating opinions and judgments.

5. The copyright of this report is only owned by the Firecoin Blockchain Institute. If you want to quote the contents of this report, please indicate the source. If you need a large reference, please inform in advance and use it within the allowable range. Under no circumstances may any reference, abridgement or modification of this report be made in any way.

( This report was published on October 24, 2019)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Eth2 progress: Eth2 test network is coming!

- Babbitt column | Last night, the central bank back pot 21 times, Xiao Zha rescue Libra hit the Chinese card

- The price of the currency has fallen sharply, the difficulty of mining has increased, and why is the bitcoin power not falling?

- Sharp interpretation of Zuckerberg’s testimony: avoiding heavy weight, not fundamentally answering why the approval of Facebook

- Why do I say that the encryption market is far from cool?

- A paper on how cryptocurrency reforms the traditional derivatives exchange clearing mechanism

- Digital currency of Chinese listed companies (middle)