Viewpoint | The Way to Success in Digital Money: Valuation Models and Network Effects in Chaos

Author: village two old

The network effect, also known as the demand-side economies of scale, is commonly used in the Internet industry, and the digital currency industry is occasionally mentioned, with insufficient attention. The reason is that there are many confusions and misunderstandings in the network. As a result, many times when the digital currency network effect is said, it is like an itching and cannot grasp the key points. Try it today.

Musk once said, "Facebook's network effect is deeply ingrained. Once formed, it is difficult to break through." Charlie Munger once commented on Google. "I may have never seen such a wide moat. I don't know how you can replace Google. ". These are all descriptions of achievements of big coffee-to-name companies, reflecting the power of the network.

- The US Congress blocks the truth and opportunity for Facebook to issue digital currency

- Eth2 progress: Eth2 test network is coming!

- Babbitt column | Last night, the central bank back pot 21 times, Xiao Zha rescue Libra hit the Chinese card

What is the network effect?

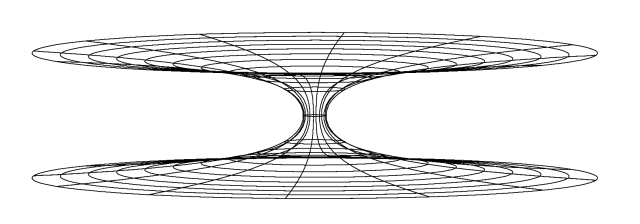

In short, the value of the network grows with the growth of users, and the more people use, the greater the value of the network (refer to Metcalfe's law, an empirical observation law, no physical evidence). You want to use others, use more people, more people have to use, and constantly strengthen this process, such as google, windows system, IOS system, WeChat are very obvious network effects.

The network effect will have a locking effect, that is, all customers who use the network product seem to be surrounded by huge suction. For example, WeChat, the author of this article has a friend, does not like Tencent, but has to install a product of Tencent on the mobile phone: WeChat . The reason is self-evident. If a project has a network effect, even if the economy is turbulent and the bear market is under pressure, it will not affect the expansion of this project.

What is the network effect of digital currency?

This is a question worth pondering. Let me talk about currency first. As a consensus of the world, gold and silver have been in existence for a long time, especially gold. In ancient legends, there will be gold. You can’t imagine that the pirate ship has gone through hardships and finally found a copper mine. Island, but if it is "Treasure Island", this treasure is truly worthy. It is said that the chaotic gold, the grand world antiques, but the prosperity still needs gold, the world does not necessarily need antiques. The story of gold attracts more people to find gold, tap gold, and store gold. There is a place in the world called "San Francisco", which explains the impact of this network on people's psychology.

The world's monetary system is also a manifestation of the network effect. It is not an exaggeration to call it a monopoly or a big one. When the pound is strong, it uses the pound; after World War II, it is basically the dollar. The dollar is still strong, and the settlement of commodities is the dollar. Trading USD for Bitcoin itself is also a benchmark USD USD. The US dollar acts as a trading medium pricing unit and a stored value tool, and because the network effect is more powerful.

In contrast to Bitcoin, what network effect does it have? All digital currencies are almost all against Bitcoin. The most reliable currency to raise money is also Bitcoin, which is a network effect in the blockchain network. Of course, the scope is expanded. The original intention of Bitcoin is as a payment currency. It is not very successful at present, but it is very successful as a pricing unit and a stored value tool.

Why are you willing to buy Bitcoin? Because you think that the value of this thing can be improved, there are many people who are willing to buy and hold this result. The result is that it has gone a long way. The first two years of Bitcoin came out, it didn’t feel anything, and then it rose to 1 US dollar, 100 US dollars, 1000 US dollars, 10,000 US dollars, because of the price attraction, everyone is pouring in, but the price attraction is only the result, then, where is the value judgment?

The network effect of digital currency, I collect information, it is indeed sorted out that it can be summarized into sixteen sub-areas (cited from the "Blockchain Digital Money Investment Guide" Renmin University of China Press), of course, some are the nature of money:

1. Security effect;

2. The network effect of the payment system;

3. The network effect of the developer;

4. The network effect of the miners;

5. The network effect of the news media;

6. Network effects integrated by third party payments;

7. The scale effect is stable;

8. Network effect of the accounting unit;

9. Network effects of market depth;

10. Spread effect

11. Individual single currency preference effect;

12. Interpersonal single currency preference effect;

13. Network effects of marketing and cognition;

14. The network effect of price;

15. Network effects of ecological diversity;

16. Network effects of government regulation

These network effects are quite numerous, and it is estimated that they have been forgotten. It is the key to this article to understand the academic language that abandons the network effect and speak it in the simplest words.

First look at the use of digital currency?

- Payment and donation. Is there a scene that BTC has used to pay for it? Yes, Microsoft previously supported the use of Bitcoin to pay for their software systems. Darknet transactions use btc and anonymous coins. For example, the famous "Silk Road" website used btc as a trading method in the early years; Decryption once allowed everyone to donate to the platform with bitcoin.

- Private equity, crowdfunding and ICO are not much different in nature, financing. Whether it is money or stocks, these methods are financially risky activities for investors. The basically accepted currencies are btc and eth, which also prove the advantages of these two currencies in financing;

- Over-the-counter OTC, this one is mainly bitcoin, it can also be counted as payment. Because exchanges in the market cause unnecessary price fluctuations and other reasons, many large households are willing to conduct OTC transactions, ranging from tens of thousands to tens of thousands of btc;

- Fried coins. Low buy and sell high to make a difference, this need not be explained.

- Collection. "Grandpa, have you seen 100 yuan of eos?" "I have not seen it and bought it yet." Buy a tulip and make a specimen for future generations, tell them about the risks and opportunities that have occurred in the world, tell him This thing is a scientific souvenir in the blockchain era, and it is normal. The famous words left in the founding block of Nakamoto, quoted from the front page of the Times, the price of the newspaper in that year has gone up; the first batch of ASIC mining machines in the world, the first batch of Apple computers have certain The value of the collection, of course, bitcoin is also there. In the world, a small number of people are collecting some bitcoins and never going to sell them. I count one.

- The pass on the network, you must use this network to have this currency. For example, the Ethereum network, you must use this so-called "world computer" and "operating system" to use Taifang. The games and products developed above should also be used too. Square. Why do I put this to the end, because this is farthest from the investor's money, but it is very important.

Ok, now basically what is the use of digital currency, and perhaps there are still many imaginary usages. You can rest assured that the current digital currency is mainly 2C products, the public do not know, what is the network effect? So for the time being so much.

Then, based on these uses, think about network effects. What kind of digital currency can do these things or some of these things, the omnipotent type can be six high scores, some digital currencies can take up a few, remember, these are not necessarily high or low, if a number Money has been pulling, people are swarming, pushing up comparisons, and then attracting more people. There are also network effects in the short term, such as some new online coins.

Network effect of anonymous currency and mixed currency service

To put it simply, Bitcoin is the highest score. Anonymous coins are much worse. Moreover, the coin-operated function of Bitcoin and the largest application of anonymous currency "anonymous transaction" itself are incompatible. It is logically difficult to explain. If Bitcoin can be anonymous, I want to do anonymous money. Of course, some areas are forbidden. Bitcoin mixed currency services will also ban anonymous coins, open one and open, which is a bug. If it is only a currency function, the network effect itself can't beat the US dollar, but it can't beat Bitcoin. Therefore, the anonymous currency has no network effect. It depends on the traffic and transactions of the dark network. It is a bit difficult to push up the currency price.

Technology and market network effect

Because of the large number of developers, Ethereum attracts more developers, and makes the system more optimized and attracts developers. This is a network effect; because ICO used btc and eth early, especially the emergence of erc20, eth In terms of financing, it is unique, and it also has a network effect.

Bitcoin and Ethereum have relatively high long-term network effects. You said, if eos and wave field are the same, is it a network effect? It is also counted that although these two currencies, I am subjective and not optimistic, objectively speaking, the market ability is extremely strong, and the result of strong drainage ability is that there are many participants and many participants.

Then, for the technical application developer to develop an application with the same energy, the traffic and revenue obtained are large, the market is first, and the technology is slowly catching up. It is also the means used by the digital currency that has appeared in the last two years. Therefore, the main network does not. On the line, pull the disk, the main network will go down the price. This is also normal. I have said that the market is first and the technology is slowly catching up. It is a routine step to form a network effect. This is not yet to catch up. When will you catch up? If the team has not yet run, the technology has a certain probability to catch up. As for when to catch up, God knows. After eager for the main online line, there is an epoch-making progress. It is a very unrealistic idea. The actual operation is to sell the coins in front of the main online line, and so on. The cows are still in the air and are still running slowly on the ground. When you start to thrive, it is not too late to invest.

It is difficult to do the market to brag, and it is very difficult to land the blown cattle. This is a cycle. This phenomenon not only appears in the currency circle, but is widely distributed in all aspects of human society .

Network effect generated by market value management

In this respect, the aforementioned network effect is very short, because prices need support. When the price of the altcoin flies, people enter the market, and then, how long can it last? One month, one quarter, one year? It is very difficult, but this network effect does exist, so that most word currency project parties will have a “market value management team”. The failure of market value management will cause this digital currency to collapse quickly. The market value management is good, which leads to the retail investors. Shake, increase 30% do not buy, double do not buy, even for a week, you can not buy, well, buy and then start to fall, you say this is a technical callback, the group shouted, "hold the value of the currency, Value investment depends on time. So, when it starts to rise, this becomes a dry well.

A good market value management team is not reflected in the price that has been rising all the time. Nothing can go up all the time, but it is combined with the market operation team to let the retail investors “win the victorious” and continue to receive the goods, and willingly, and then recommend To the people around you: "This coin is really a value coin." "Brother, take it." The game of retail investors in front of the team is often difficult to win. If you win, this network effect is for whom.

The competitive advantage gained by market capitalization management is not long-lasting, but it is indispensable in this market. The traditional financial market, which is called “manipulating stock prices”, is a violation of regulations. However, the digital currency market has not been supervised for the time being, so the space is Out. Space is reserved for everyone, but most people can't beat the team most of the time.

In fact, the current digital currency valuation, or popularly predicting the currency price, is more than just looking at the network effect, because the network effect is academically called the demand side economies of scale. This is only on the demand side and the supply side needs to be considered.

Nowadays, the project is more to use the market to hit the demand side, eager to produce network effects; on the supply side, try to think of various methods to reduce the flow, the circulation is small, the market value management is also managed, and the rising logic is also given to the "believers". "They better explained, just working hard on the supply side, and moving a lot of thoughts, because without any logical support, this currency must lock the liquidity, except for market value management.

The digital currency industry is rather special or deformed, and the development of the network effect on the demand side is much slower than the “model innovation” on the supply side . This article is just an essay that generally tells the truth, I hope to give investors a little inspiration when considering a digital currency value or price trend.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The price of the currency has fallen sharply, the difficulty of mining has increased, and why is the bitcoin power not falling?

- Sharp interpretation of Zuckerberg’s testimony: avoiding heavy weight, not fundamentally answering why the approval of Facebook

- Why do I say that the encryption market is far from cool?

- A paper on how cryptocurrency reforms the traditional derivatives exchange clearing mechanism

- Digital currency of Chinese listed companies (middle)

- Ten experts took turns to accept Meng Yan's sharp question: How many points do you give to the development of the current blockchain?

- What is the SEC thinking about Crypto compliance?