Sweden starts testing digital currencies! Can the central bank digital currency become a "killer" application of the blockchain?

Author: Biser Dimitrov

Translation: Ma Kewei

Source: Blockchain Outpost

According to Reuters, Riksbank said on Wednesday that it has begun testing e-krona, which will be used to simulate daily banking operations when it finally enters the market, for example through digital wallets (such as mobile applications) Payments, deposits and withdrawals. The Swedish central bank first simulated the use of electronic kronor in an "isolated test environment", but has not yet made a final decision on whether to issue electronic kronor. The test will continue until February next year.

- CCB was shortlisted for the Forbes Global Blockchain Top 50 for the first time and has already operated 9 blockchain projects

- NFT: another path for blockchain to land

- Getting Started with Blockchain | How does the technology-less "coinless blockchain" add icing to the Internet?

In 2017, the Bank of Sweden issued a report exploring the Swedish government's prospects of launching a digital currency, the digital currency, as an alternative to the national currency, the Krone. As far as the current situation is concerned, the Swedish central bank is moving steadily according to its own plan. If no country issues central bank digital currency before next year, Sweden is very likely to become the first country to launch a central bank digital currency.

The era of central bank digital currencies is finally coming

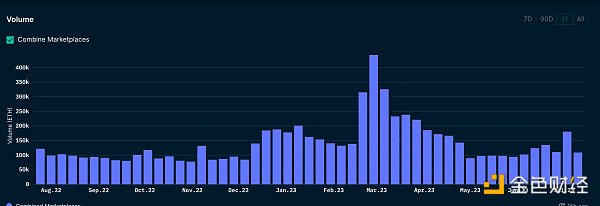

According to Bank of International Settlements estimates, more than 80% of central banks regard blockchain as a trading place for digital currencies, and the central bank's digital currency promises to achieve standardized and compliant payments by accelerating settlement and enhancing liquidity management .

In January, Cambodia, Japan, and the Bank of England began exploring the benefits of CBDC. At the same time, a large number of emerging markets and developed countries, such as China, Thailand, India, Sweden, Singapore, and South Africa, have begun research on the prototype of digital currencies. These emerging markets and countries are more aggressive in developing and adopting purely digital currencies than developed countries facing fewer problems, and even the European Central Bank (ECB) is studying how to digitize the euro.

Central Bank work on CBDC

Central Bank work on CBDC

At the annual meeting of the World Economic Forum in Davos in January, the issuance, regulation, management and use of digital currencies by the CBDC and other countries became one of the hot topics of discussion. Former US Commodity Futures Trading Commission chairman J. Christopher Giancarlo also revealed a new digital dollar version on the scene.

Looking at the current development of central bank digital currencies (CBDCs) in various countries, people may soon spend and consume on the blockchain ledger, followed by a huge change in people's transaction payment methods. At present, the global mobile payment market The transaction value has reached approximately USD 816.5 billion, and is expected to exceed USD 5.5 trillion by 2025.

Does central bank digital currency need blockchain?

Not all digital currencies or payment systems require a blockchain. The research group of the Central Bank's Digital Research Institute issued a statement today stating that the payment services provided by the central bank cannot leave centralized account arrangements and need to be built on a centralized system, which conflicts with the decentralized nature of the blockchain. Therefore, it is currently not recommended to transform traditional payment systems based on blockchain.

The FedNow real-time payment system being developed by the Federal Reserve may not have a blockchain component. However, a layered enterprise architecture centered on the blockchain is well suited to handle the load and throughput issues of payment systems. By adding blockchain or distributed ledger technology as a basic component, issuing banks can enjoy all the benefits of a token-based account, such as enhanced privacy, faster and more accurate back-end reconciliation, and predictability of funds. End-to-end KYC (know your customers) and AML (anti-money laundering) transactions, etc., bring lower fees, all of which are achieved through a completely legal framework. At present, the central bank has not chosen the public chain, and their test research goals are now focused on the private chain or the alliance chain.

One of the main advantages of current cash transactions is that they are interchangeable, and the core protocol encoding in the blockchain can achieve a clever balance of transparency and privacy protection. Most importantly, as the CBDC is widely accepted and introduced, digital wallet fraud and theft will decrease, and insurance coverage will become wider.

Why is the central bank the best place to issue digital currencies?

As we all know, most payment methods in developed countries have been digitized. For example, when we send money abroad, we pass through a bank account and do not need to hold cash, so they have all been "digitized".

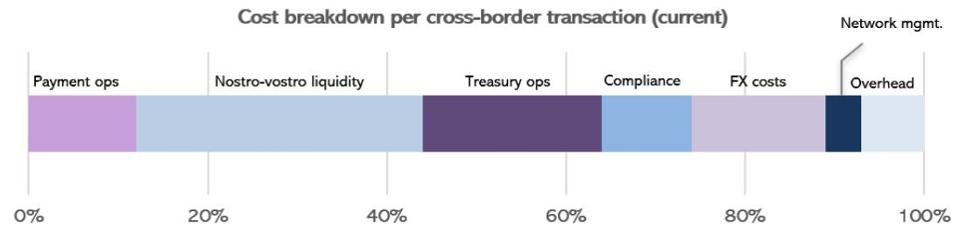

Generally, when we refer to payment, transactions are usually divided into two types, one is "wholesale" between banks, and the other is between individuals, also known as "retail". In both cases, we can clearly draw the current growth difficulties, such as capital availability, foreign exchange transaction costs, operating risks, settlement risks, visibility and traceability.

For example, the following are the main components of cross-border transaction fees, which can be reduced by introducing the blockchain layer and the Real-time Total Settlement System (RTGS):

Composition of cross-border costs

Composition of cross-border costs

Facebook's planned release of Libra can be seen as an effort to address some of these issues, but in reality this proposal faces various scrutiny due to regulators' mistrust of Facebook. Another technology giant, Apple, is currently partnering with Goldman Sachs to launch credit cards integrated into the iPhone. However, this credit card faces skepticism about interest rates and different credit lines for men and women.

Central banks are generally more trusted than private companies in issuing digital currencies and payments. For example, China was one of the first countries to adopt and implement a purely digital currency strategy. This will be a relatively easy task for countries that already have advanced payment infrastructure.

In fact, China's mobile payment market has been dominated by Alipay and WeChat Pay, and the People's Bank of China led the proposal of the Central Bank Digital Currency (DC / EP) plan. As of February 20, in terms of digital currencies, the Digital Currency Research Institute of the People ’s Bank of China has applied for 65 patents, the Central Bank ’s Printing Science and Technology Research Institute has applied for 22 patents. Generate, circulate and recycle.

To be sure, we will see a lot of news about central bank digital currencies in 2020. CBDC may become the first production deployment of large-scale blockchain technology. The use of digital currency by the central bank may become the real killer application of blockchain technology.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Digital asset custody company BitGo enters the digital securities field through acquisition of Harbor

- Viewpoint | Incremental decentralization, decentralized and gradual approach

- Blockchain weekly developments of listed companies (2.10-2.14): 5 companies have made progress

- How should "blockchain" serve SMEs? Start with cost reduction!

- Moloch v2 is coming soon and its revolutionary impact on DAO

- Featured | What is the nature of the cryptocurrency phenomenon?

- Opinion: After the epidemic, blockchain will lead 15 new employment models