Block space is a scarce commodity, how to objectively evaluate it?

Block space is scarce, how to evaluate it objectively?Author: Nate

Translation: Deep Tide TechFlow

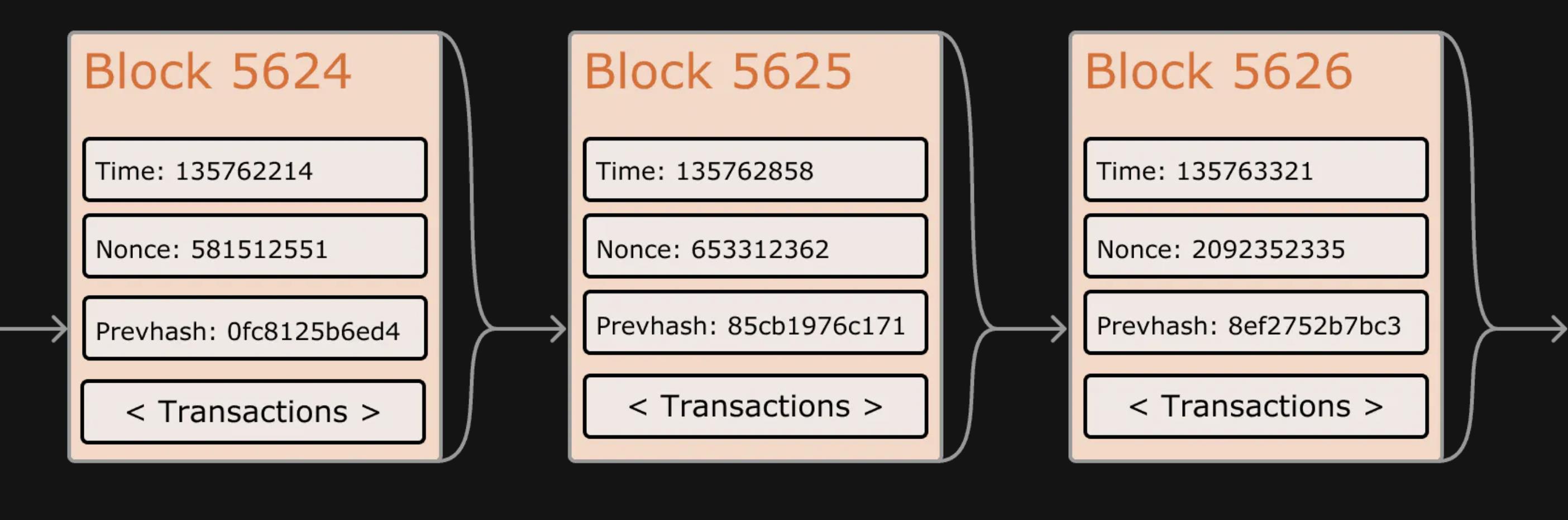

Trading, storing data, and computing on the blockchain is the concept of block space. In simple terms, the transactions contained within a block are the block space.

- How do the interest rates and future prospects of the Federal Reserve affect the cryptocurrency market?

- Data What is the crypto market like outside of the United States?

- Dialogue with Circle CEO How can USDC recover the market lost due to SVB’s bankruptcy?

In various articles, posts, and podcasts, block space is increasingly referred to as the “best product” or “most important commodity.” Understanding what block space is and how to create and evaluate its value can be confusing, especially since it is constantly evolving.

Not all block spaces are equal; in fact, they vary significantly. Block space is a type of commodity that can be easily graded based on common features such as security, flexibility, and decentralization. This article will provide a detailed explanation of each feature, provide examples, and then explore the market participants of the most valuable digital commodities currently in existence.

First, let’s briefly introduce the consensus mechanisms that protect block space:

Proof of Work (PoW) requires miners to solve complex mathematical problems to validate transactions and create new blocks. The first miner to solve the problem is rewarded with newly minted tokens. The process of solving these problems requires a significant amount of computational power, making it difficult for any miner to control more than 50% of the network’s computing power. If a miner can control more than 50%, they can launch a 51% attack. In a 51% attack, the miner with the majority of computational power can manipulate transactions and potentially reverse transactions, allowing them to potentially double-spend coins. Today, almost all PoW production is done through mining pools.

Proof of Stake (PoS) is a relatively new consensus mechanism that requires users (known as validators) to stake a certain amount of cryptocurrency as collateral to validate transactions and create new blocks. Validators are selected based on the amount of tokens they have staked and have an incentive to act in the best interest of the network.

Quality

Block space can be constructed and generated in many different ways and can be used for various purposes. Each block space market has different levels of security, decentralization, and guarantees, as well as different choices in terms of the size, quantity, and validation methods of block space. When deciding to participate in the block space economy, you may want to evaluate different qualities.

Security

Perhaps the most important quality is the security of the blockchain. How much resources and effort is required to attack the chain, often referred to as a “51% attack,” although there are other types of consensus mechanisms that only require 33% agreement from producers.

A common measure of blockchain security is to look at the “attack cost.” How much resources would it take to rent and/or purchase computational power/staking to control 51% of the network?

It is very rare for a blockchain to be completely taken over, with only a few occurrences in history, one of which was Justin Sun’s takeover of the steem blockchain. I often wonder why well-known blockchains like Dash, Bitcoin SV, and even Zcash have not seen more complete takeovers. But if their security is so poor, it is easy to infer that their other qualities are equally, if not more, poor.

A more common attack is a simple blockchain reorganization. This is often seen on blockchains like Polygon, where reorganizations occur frequently. It should be noted that, given the probabilistic consensus of Polygon, not all reorganizations are necessarily malicious. However, a reorganization can also be an attack where producers reorganize transactions in previous blocks for their own benefit.

To better understand the issues brought by reorganizations, consider the following example: a small company bids on a billboard on a popular highway. After intense competition with rivals, the company’s owner pays 20% more than originally expected. They are satisfied with the billboard and send their design to the billboard company. Weeks later, the small company owner drives to the highway to see their ad, only to find that their competitor is displayed on the billboard. This is similar to what happens in a reorganization, where your previously paid transaction is “rolled back” and reorganized.

For users of the blockchain space, security may be the most important feature. They want to ensure that the transactions they make are secure and relatively immutable. This directly affects the value of the blockchain space, the willingness of producers to spend resources to produce blockchain space, and the interest of traders in conducting transactions on it.

Decentralization

The degree of decentralization in a blockchain is equally important as its security and is a very important quality. Decentralization has several equally important components:

- Nakamoto coefficient;

- Different operators;

- Geographical distribution;

- Client diversity;

- Unique hardware.

The Nakamoto coefficient is undoubtedly the most commonly used metric to measure the degree of decentralization in a blockchain. It is a very simple formula: the number or percentage of validators or computational power required for an attack, helping to understand the number of validators needed to collude successfully to prevent a blockchain from functioning properly.

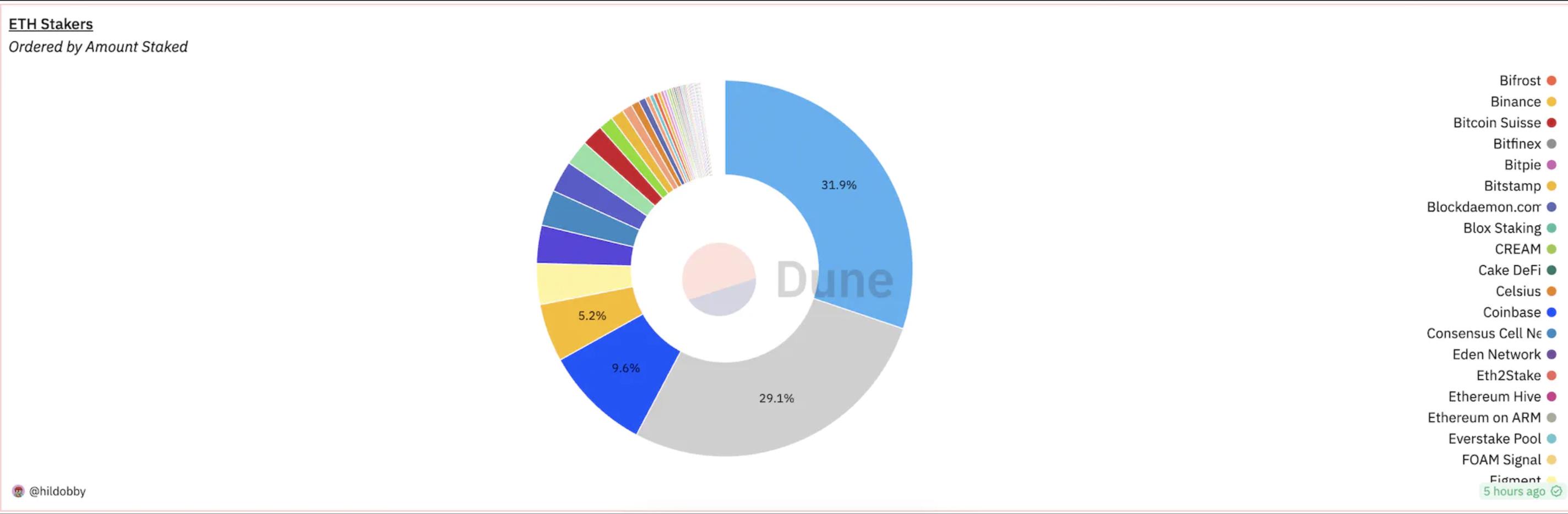

Equally important as the number of participants is the number of different participants required to collude. For example, Coinbase operates about 7% of Ethereum validators. Lido, a liquid staking provider, currently accounts for about 33% of Ethereum network validators. Lido itself is not a validator but collaborates with trusted operators in the blockchain space like Coinbase. By calculating the proportion represented by Lido’s operation plus the number of validators, Coinbase actually controls about 12% of the entire network.

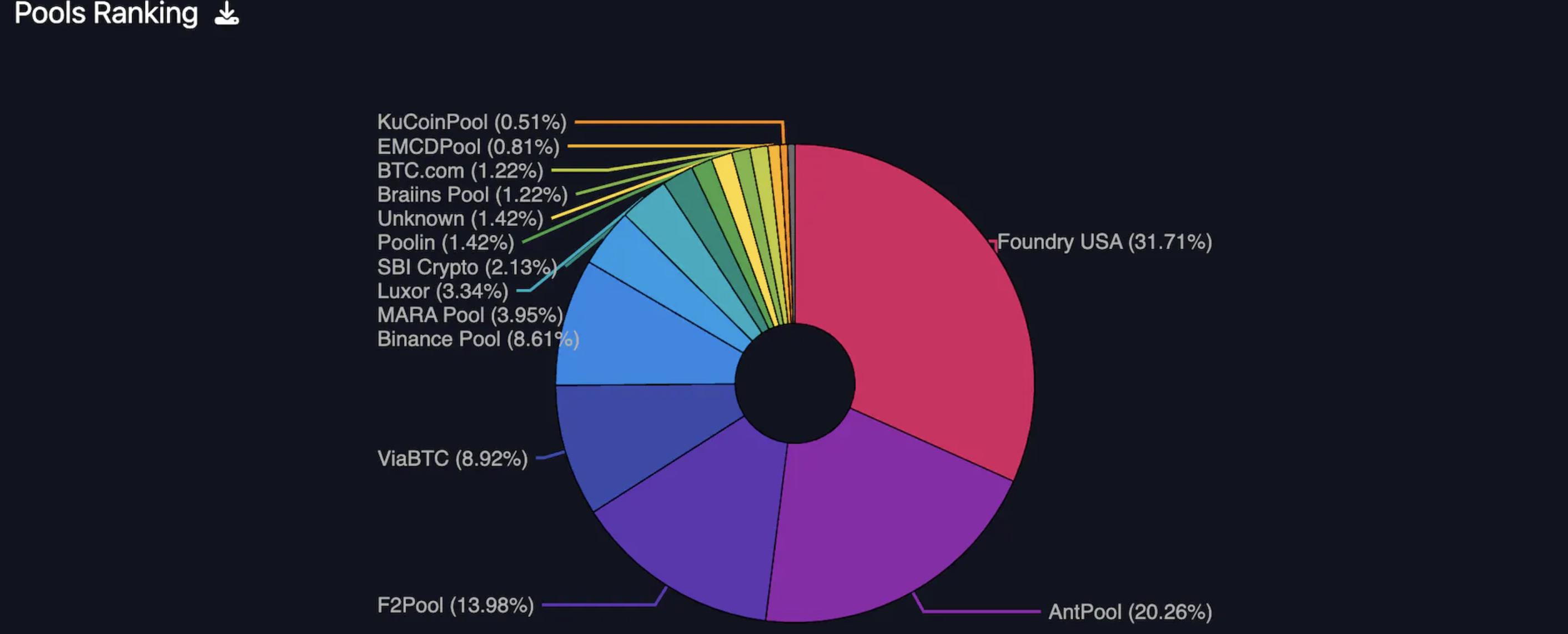

Bitcoin is often seen as a decentralized leader, but the Nakamoto coefficient is only around 5. Although there are indeed many unique block producers, Bitcoin mining pools have complete control over the sorting of transactions in blocks (until Stratum V2 is fully implemented and used).

Throughout most of Bitcoin’s history, 1 to 2 mining pools have controlled over 33% of the hashrate, thus controlling the order of transactions in a given block.

Some market participants are very concerned about the order of their transactions in specific blocks, and having a single party in complete control of the order greatly reduces the quality of block space for them. It should be noted that this is also the case for Rollups with a single sorter.

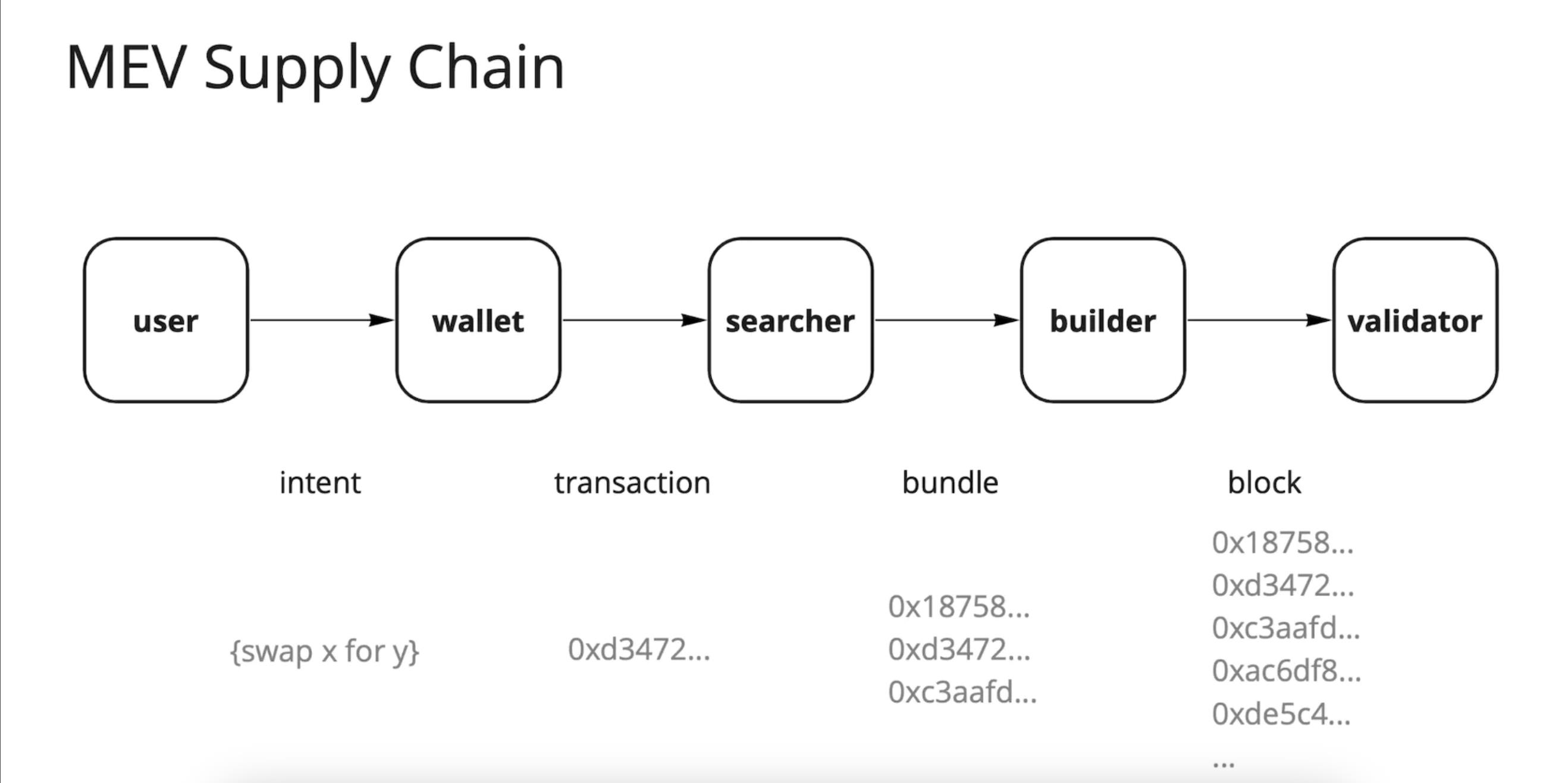

A single party sorting/building most of the block space is intuitively very detrimental to decentralization, but it can also have a significant impact on producers extracting additional value for themselves. This is often referred to as maximum extractable value (MEV), where producers can extract a large amount of value. It is also important to note that MEV is helpful for the normal operation of certain applications, such as liquidation, arbitrage to maintain market competition, and even searchers required for Squeeth rebalancing, are good examples.

When discussing block space, MEV is a very large and important concept (the MEV supply chain itself is now a multi-billion dollar industry), which may require a separate article. But here are a few points to know:

Building a separate MEV supply chain is crucial to avoid harming block space consumers. Many protocols are addressing this issue:

- Flashbots;

- Jito for Solana;

- Skip for Cosmos;

- Stratum V2 for Bitcoin;

(MEV solutions from Polkadot and Near are still pending)

MEV also exists in Bitcoin, and large mining pools have already started to extract it, with the amount of MEV that can be extracted directly related to the value of the given block space.

Size, Quantity, Verification

The actual specifications of block space are also important factors in determining quality. These are very simple and clearly defined:

- How big is a block? How many transactions can a block accommodate? How much data can a block accommodate?

- How often are blocks generated? How many blocks are generated in a day?

- How does the network reach consensus on blocks?

The question of the size and quantity of block space is often a quality consideration for consumers or traders. If a consumer wants to complete a transaction within 1 hour, how many blocks can bid for transaction space? As a trader, how scarce is block space?

Evaluating how the network reaches consensus on blocks may be a concern for institutional consumers, such as a fund or trading company, but it is more likely to be an application built on top of a given block space, such as an exchange, custodial service, or Layer 2. Exchanges may evaluate how the network forms consensus because it may affect user execution. Examples of different network participants reaching consensus:

Cycle rotation / leader election:

- In cycle rotation, validators are regularly selected to build, propose, and independently contain the entire block.

- Examples include Solana, Cosmos, and Polygon.

General consensus:

- In a general consensus network, producers broadcast blocks to the network REST, and if there is consensus, the block is added.

- Examples include Bitcoin.

Single sequencer:

- Most layer 2 networks implement a single sequencer, which sorts all transactions, forms them into blocks, and publishes them to the layer 1 or data availability layer.

- Examples include Arbitrum and Optimism.

The way consensus is achieved has slightly different impacts on the execution of related exchanges.

Cycle rotation leader elections are usually very fast, but for networks that have not yet abstracted the block-building layer, participants in validator transactions also have an advantage.

General consensus is most fair to exchange users, but currently there are difficulties in terms of throughput. As of 2023, we have not yet seen a fully functional and fast order book on a blockchain that uses general consensus.

Exchanges built on networks that use centralized sequencers need to determine the possibility of sequencer operators engaging in front-running transactions or extracting certain types of value from transaction orders.

The fourth option for exchanges is to run certain parts of their infrastructure offline, such as their order book. This is also emphasized in the hybrid part of AMM and order book.

Availability

Ensuring that block space is widely available and can be used at any time is crucial.

Can you easily access block space? Is it always available or are there times when the chain is stopped or offline? How easy is it to run your own RPC node or access publicly available nodes? Do RPCs often overload and do they have consistent uptime?

Uptime

As a consumer, it is important that you have access to the block space market at all times. If a blockchain frequently stops or goes offline, you cannot reliably use that blockchain.

For example, let’s say you are a new liquidity provider who wants to provide liquidity to centralized liquidity AMMs and have to choose between Solana and Ethereum blockchains. Just based on availability features, the choice is simple – in the past year, Solana and almost all layer 2s have experienced days of downtime, rendering the entire chain completely unavailable.

Chain state and storage

As a producer (and possibly as a consumer), considering the accessibility of downloading, verifying, and storing the complete chain state can be an important consideration.

As a block space producer, you want to ensure that you have extremely high uptime and minimal dependency on others in case they go offline. Some blockchains, such as Solana or Near, actually require you to download chain data snapshots from AWS S3, Google BigTable, or other validators, while you have little or no way to synchronize and store chain data yourself.

For applications or protocols that require historical data, chain state and storage are also very important considerations. In Bitcoin or Ethereum, fully synchronizing a node takes only a few days and includes complete historical data. On the other hand, Solana’s complete chain state is primarily stored in the Google BigTable database, requiring petabytes of data, making it almost impossible for any ordinary consumer to synchronize and store.

Cost and Fees

Block space is valuable and has various costs and fees associated with its production and consumption.

As a producer, there are more traditional costs, such as upfront purchases and/or ongoing costs for the various hardware and software that enable you to operate on the network. In most cases, initial capital expenditure is also necessary as collateral to issue tokens (this is the case in PoS networks). In return, you typically receive block rewards from the network, which may include fees paid by consumers for the block space you produce.

As a consumer, to use block space on a given network, you need to pay fees to block producers (excluding any additional fees you may need to pay for interacting with the protocol).

The costs and fees vary depending on the implementation of the blockchain and the design of the fee market. Typically, the chain implementation follows one of the following designs:

- Priority Gas Auction (PGA): Consumers who want to utilize block space submit their transactions and given fees, which enter the mempool. Since producers receive fees from blocks, they (usually) order transactions by highest fee. This is a very simple fee market design and the most common one.

- EIP 1559: Consumers who want to use block space pay a base fee (burned) and a priority fee (or tip) to block producers. The introduction is aimed at better estimation of fees consumers need to pay.

The design of the fee market has a significant impact on the amount and willingness consumers pay and the expected rewards producers anticipate from block production.

Flexibility

Block space can be highly adaptable or very static. Most of the time, consumers may prefer stable and predictable consumption space, but in certain use cases, consumers (typically protocols) may want their space to be highly adaptable and flexible.

Flexible block space means constructing blocks in different ways based on various use cases. It could involve adding pre-processing and post-processing instructions at the validator level, allowing block size fluctuations, or the ability to abstract block construction.

For example, if you are a lending protocol exploring launching your own blockchain, you have several options to consider:

- A Cosmos-based application chain;

- A Rollup based on Optimism or Arbitrum technology stack;

- Building a parachain on Polkadot.

Each of these has different considerations in terms of security, decentralization, and usage.

- Cosmos application chains require you to build security through an incentivized validator set, but allow you great flexibility in consensus, block construction, and transaction execution.

- Building a Rollup using Optimism technology stack is currently more centralized because it uses a single sequencer, but it allows for extremely fast EVM-compatible block space.

- Polkadot parachains allow you to use the shared security model of Polkadot, but require a significant amount of DOT to be bid in the auction to be included.

In summary:

- Cosmos application chains have ultimate flexibility in block space creation, control, and security.

- Rollup provides flexible block space creation, but control and security are currently limited to a single centralized sequencer.

- Parachains bootstrap security from the Polkadot mainnet… but at a cost.

Bitcoin, Ethereum, Polkadot, and others generate general-purpose block space. Osmosis, Aevo, Lyra, Sentential use customized and dedicated block space to improve their products.

In recent months, products like Caldera and Conduit have made launching OpStack, Arbitrum, or other Rollup/application chains easier.

Market Participants

The block space market is very complex, but can be roughly divided into producers and consumers.

Producers

Block space producers are network participants who receive a set of transactions to be included and actually build them into blocks by ordering them. This is typically one of the roles of on-chain validators, miners, or mining pools. With the rise of MEV protocols, this block construction has largely been outsourced to a separate actor called a builder. The “MEV supply chain” is now very complex and involves many different actors, as shown in the figure below.

In Proof of Work, mining pools have full autonomy over the transaction ordering in the blocks mined by the miners in the pool. This will change with the release and adoption of stratum v2, which will allow individual miners to express transaction ordering preferences to the mining pool.

Producers aim to produce high-value block space, or expect to do so in the future. Here is a list of some major producers in various blockchains:

- Coinbase Cloud;

- Chorus One;

- Jump Crypto;

- Figment;

- Marathon;

- Galaxy Digital;

- Riot;

- Foundry.

Consumers

Consumers are any entities that use the block space being produced. The actual use cases can be varied, such as transfers, exchanges/trades, other financial transactions, etc.

However, the largest consumers are often overlooked. Asset issuers, exchanges, and protocols built on top of blockchains are usually some of the largest consumers. Here is a list of some major consumer protocols/companies:

- Asset issuers such as Circle, Tether, LianGuaixos, etc.;

- Centralized exchanges such as Coinbase, Binance, etc.;

- Layer 2 solutions such as Arbitrum, Optimism, etc. (with more and more application teams deploying their own Rollups in this environment);

- And of course, large users/traders.

Valuation

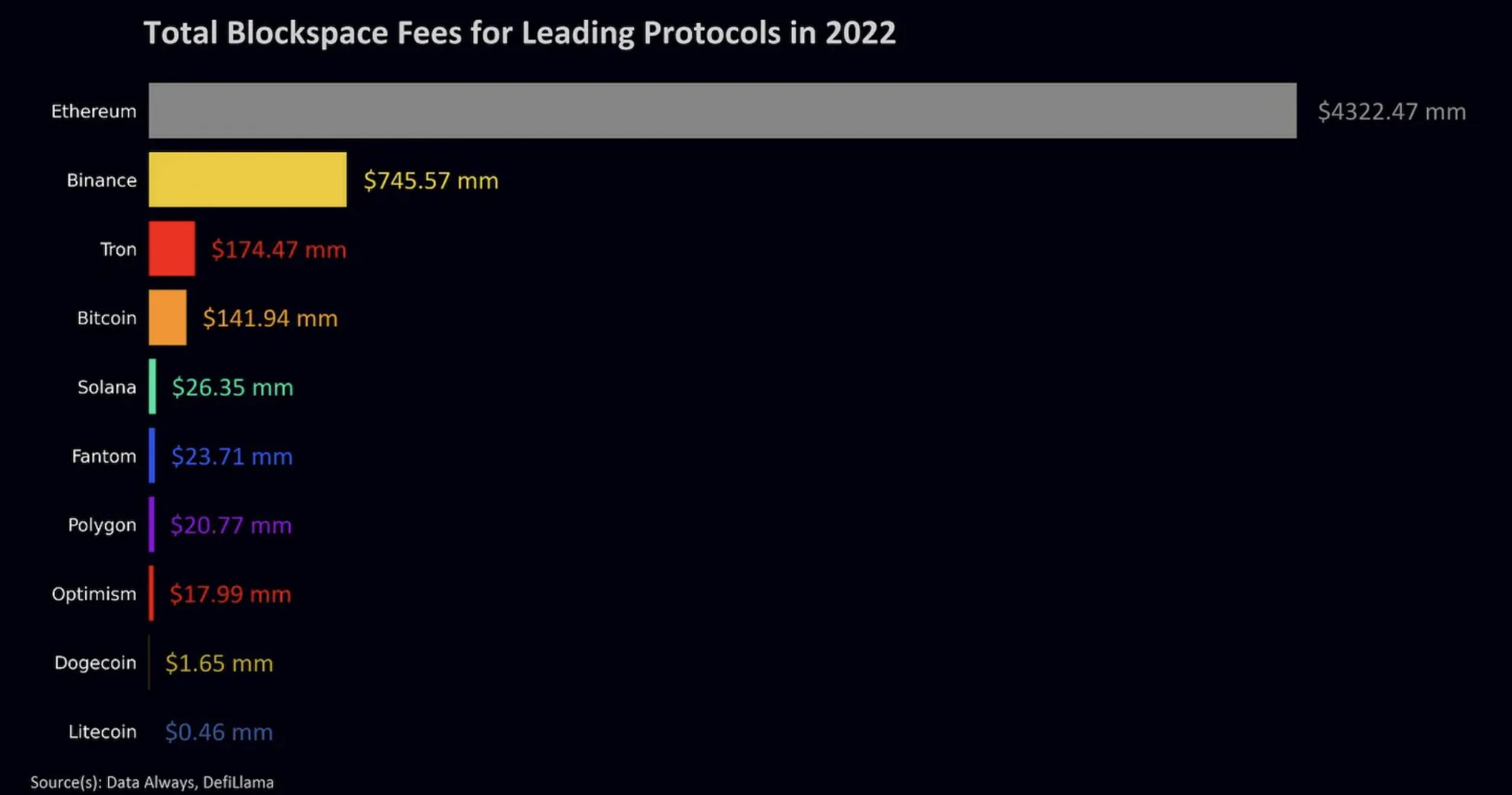

The demand for block space can vary greatly. Data Always has provided a good overview of the block space demand for 2022. The following table shows the block space fees for major protocols:

It is worth noting that most fees paid in native protocols are block subsidies. A valuable metric to monitor real demand and growth is the percentage of user transaction fees in total block rewards. For example, in Bitcoin, this is typically around 2-4%, but in Ethereum, it can be similar during low activity periods but can soar above 60%. When tracking protocols with mature MEV supply chains, tips should also be included.

Some chains have taken time to develop unique fee markets, one of which is Ethereum’s EIP1559. This upgrade has multiple goals, such as reducing fee volatility, but it also has an important long-term goal of preventing blockchain instability in a world without ongoing native token issuance. EIP1559 results in base fees being burned and priority fees going to validators, reducing the importance/weight of block subsidies in overall block rewards.

To maintain its promise of low-cost fees, Solana has created a native fee market where transaction fees are natively tied to each different contract interaction. If there is high demand for NFT minting on Magic Eden, the transaction fees on Jupiter will not increase. This change is very consumer-centric as it effectively reduces the fees that validators can expect to receive. However, considering Solana’s robust MEV supply chain, native fees may attract more users, who can earn more fees through MEV tips.

The valuation of block space is still in the very early stages, given that the majority of on-chain block rewards come from predictable block subsidies, and the rewards and corresponding valuations have not changed much. However, as halvings occur, demand increases, and MEV supply chains are created, the proportion of transaction fees/tips in total block rewards will become higher, making valuations more unpredictable and introducing unique trading opportunities.

Transactions

The pricing of block space is dismal. In many cases, blockchains have mispriced their payment to producers as they continue to mint more inflationary block space of terrible quality. Most block space is cheap and abundant, with only a few instances of high-value block space.

This is where I expect the new implementation of block rewards and fee markets to come in. Currently, most blockchains propose static block subsidies in their whitepapers, perhaps in line with some kind of deflationary schedule. How do they determine the fair value of their block space before their blockchain goes live? I look forward to the new implementation of determining block subsidies.

Considering how nascent these markets are, you may simply be a producer or consumer without even considering that you can trade block space. Currently, these transactions are often expressed in the form of swaps, forwards, and futures, but there are also more unique tools such as licensing fees, block inclusion reservations, and gas tokens.

The main places to trade block space currently are:

- Luxor, where you can trade non-deliverable futures contracts for Bitcoin called “Hashprice”.

- Alkimiya, a more flexible exchange market where you can trade block space for Bitcoin and Ethereum, and possibly gas exchanges as well.

Some projects with great potential:

- Overlay, a perpetual futures platform that allows you to trade native data feeds and explicitly mentions various block space components in its documentation.

- Oiler, with a variety of products, one of which is Pitchlake where you can trade Ethereum base fees.

- Volmex, a volatility trading platform where I can see it eventually launching something similar to a fee or validator reward volatility index.

An interesting product idea is to form a block space quality index based on the above features and create a block space exchange market between blockchains, for example, exchanging block space demands between Bitcoin and Ethereum.

In addition to speculative markets being built such as Luxor and Alkimiya, these markets are crucial for transferring risk between block space producers and risk-takers. As public companies and energy companies enter the Bitcoin mining space, they will want to reduce their cash flow volatility. As layer 2 becomes more complex, they will want to hedge their transaction fees on layer 1. As exchanges and asset issuers seek more efficient operations, hedging their variable transaction costs becomes important.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Common situations and criminal defense strategies for embezzlement of executive positions in the cryptocurrency industry

- 3 NFT markets restrict ‘Stoner Cats’ transactions after SEC takes action

- The Flow of Traffic behind Tip Coin User Profit Expectations and Internal Market Game

- Approval of Bitcoin ETF may trigger the withdrawal of $1 billion in funds from Grayscale’s GBTC.

- LD Capital Will the market remain bearish until the end of the year? What is the core of market speculation?

- The Rebirth of TON Renewing Ties with Telegram, Enabling Web3 Applications for 800 Million Users

- Opinion Still optimistic about structured opportunities in the cryptocurrency market