Reflection on the fundamental reasons for the current stagnation of the NFT market

Reflection on NFT market stagnation reasonsAuthor: Eocene Research

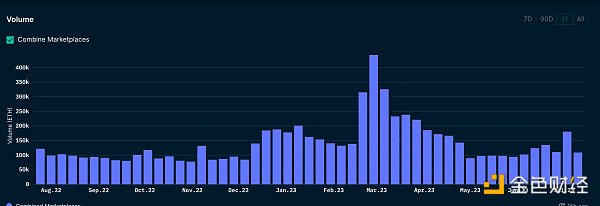

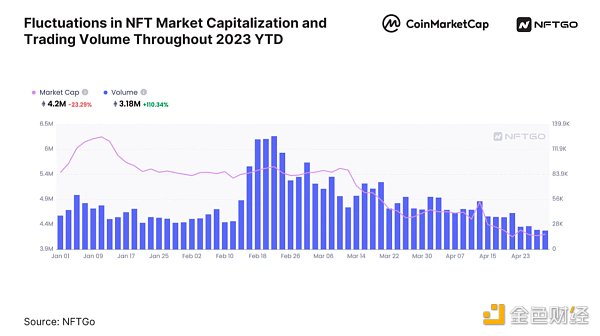

In the previous article “Data Reveals Whether the Growth of the NFT Market in 2023 is Due to New Funds Entering or Old Funds Churning”, we mentioned that thanks to the successful airdrop incentive activity of Blur, the NFT market experienced a short-lived boom in early 2023, especially between February and May, with a 60% increase in funds invested in the NFT market compared to the previous period. However, the latest data shows that after reaching its peak in February and March 2023, the NFT trading volume has started to decline, and the NFT market has once again entered a bear market.

Some people point out that the growth of the NFT market usually lags behind the growth of cryptocurrencies by one to two quarters, so with the recent growth of cryptocurrencies, NFTs may soon thrive again. But we believe that the recent bear market is not only due to the cyclical downturn of the industry, but more importantly, it is caused by some fundamental issues that have directly led to the sluggishness of the NFT market.

In this article, we will first present the specific performance of the recent bear market in the NFT market through data, and then analyze the main reasons hindering the growth of the NFT market.

- Opinion Supporting the US dollar with Bitcoin would restrict the Federal Reserve’s ability to respond to economic crises.

- Token Economics 101 How to Create and Accumulate Real Value?

- JPMorgan Chase and the Clash of Bitcoin Adaptability is the Core of Financial Evolution

Data from various dimensions reveals that the NFT market is shrinking

1. Trading volume, number of transactions, and number of active wallets are all declining

It is worth emphasizing that, apart from the weekly trading volume which is basically the same as during the bear market in 2022, the number of transactions and the number of active wallets have significantly decreased compared to 2022. In other words, the trading activity and the number of participants in the NFT market are at their lowest levels in the past year.

2. The value of blue-chip NFT collections continues to plummet

The Blue-Chip-10 and NFT-500 indices provided by Nansen measure the total market value of blue-chip/top NFT collections, reflecting the overall performance of the entire NFT market. Both indices have been continuously declining since April this year, with the comprehensive market value of blue-chip/top NFT evaporating by 70-80% compared to the peak in February.

Blue-Chip-10 Index

NFT-500 Index

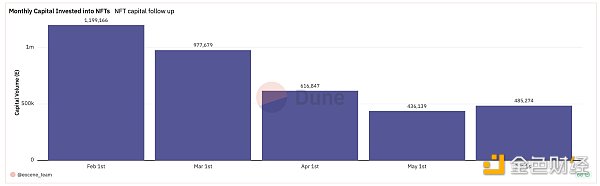

3. The investment in the NFT market is decreasing by 20%-40% month by month

Based on the method of calculating the investment in the NFT market mentioned in the previous article “Data Reveals Whether the Growth of the NFT Market in 2023 is Due to New Funds Entering or Old Funds Churning”, we calculated the monthly investment in the NFT market from February to June 2023. The data shows that the investment in the NFT market has been significantly decreasing month by month (except for a small increase from May to June). The funding level in June is only 40% of that in February.

Monthly investment in the NFT market

The above indicators reflect the decrease in traders, the decrease in trading activity, the contraction of investment, and the decline in prices in the NFT market. These dimensions collectively indicate that the NFT market is facing stagnation or even contraction.

Three main reasons for the sluggishness of the NFT market

1. Stimulating demand-side liquidity through the “Bid for Airdrop” mechanism is fundamentally flawed

Blur launched an airdrop incentive mechanism at the end of 2022, mainly rewarding loyal users who list and bid on Blur. At the beginning of the mechanism’s launch, many experienced NFT players believed that this would be a strategy that could effectively drive NFT liquidity, and the market in the early stages also confirmed this view. During the start of Blur Season 1 to Season 2, market liquidity and trading volume significantly increased.

However, shortly after the start of Airdrop Season 2, the situation took a sharp turn. After the trading volume of the entire NFT market peaked in February 2023, it continued to decline.

In addition, the prices of several blue-chip NFTs also experienced a sharp decline in the following months. BAYC’s market capitalization evaporated by 60%, Doodles dropped by 70%, and Moonbirds even dropped by 80%! Many participants in airdrop activities lost a huge amount of money due to the decline in NFT value (“buy high, sell low”), and the credit rewards obtained in the airdrop cannot compensate for this loss. Therefore, despite the ongoing bearish activities, many players have chosen to withdraw.

In a market with good liquidity, market prices usually tend to be more stable and not subject to drastic fluctuations due to trading. The original intention of Blur was to increase the liquidity of the NFT market by encouraging bidding. This starting point was good, but most series prices not only did not stabilize, but also experienced a downward spiral as mentioned above.

Because in Blur’s airdrop activities, placing a bid can potentially receive Blur token airdrop rewards, most bidders do not actually intend to buy NFTs, but only hope to receive airdrop rewards. After they “unfortunately” take over the NFTs, most people will quickly sell them, and most of the time, they will sell at a lower price than the purchase price, which leads to a decrease in the floor price of NFTs. The price level of bids also decreases, and bidders will sell NFTs at a lower price. This vicious cycle leads to a spiral decline in the prices of many NFT series, completely deviating from the concept of “stable price with high liquidity”.

The fundamental reason for this phenomenon is that the Bid on Blur is not a true market demand, which to some extent indicates that participants in airdrop activities do not have a positive view on most NFTs, mainly because most NFTs lack long-term intrinsic value.

Although the incentive mechanism of Blur did not create true liquidity, it is of great guiding significance for the subsequent “how to achieve true liquidity for NFTs”. Blur’s Airdrop Season 2 is still ongoing, but the NFT market has already become weary. This is because many players suffered heavy losses at the beginning of Airdrop Season 2 and chose to withdraw from the activity or learned from the lessons of others, leading to more cautious participation by later players. Regardless of the reasons, it indicates that the airdrop incentive mechanism cannot provide sustainable and healthy liquidity for the NFT market.

Total market value of NFTs has dropped significantly during Blur season 2

2. Most project teams lack experience in market value management

The incentive mechanism of Blur not only attracts people who want to earn Blur tokens but also attracts a lot of malicious arbitrage funds.

A typical example of “malicious arbitrage” in Blur’s airdrop activity: an arbitrageur will first buy a large number of tokens from an NFT series at a lower floor price, and then list these tokens at a higher price to raise the floor price. At the same time, they will list “fake” buy orders on Blur that are close to their list price, while other players (aka miners) who want to earn points will place orders in the 2nd and 3rd ranks to reduce the probability of “unfortunately” receiving the NFT. Since these miners do not know that the top bidders are also the ones listing sell orders and can choose the bidders who take over their NFTs, when the bid pool in the 2nd and 3rd ranks is deep enough, the arbitrageur will sell a large number of NFTs to these miners.

These malicious arbitrageurs usually repeat the same operation on a series multiple times, but each time the height of the price increase is lower than the previous one, in order to avoid the tokens sold in the previous round being dumped back into their hands at a high price. They profit from this “buy low, sell high” approach.

Arbitrageurs usually hold a certain amount of funds (tens to hundreds of ETH), so they can profit from this “game”. However, many project teams of NFT series (especially those issued before Blur introduced the reward mechanism) did not anticipate this malicious arbitrage phenomenon, so in most cases, they did not reserve enough NFTs and funds to deal with the large amount of opposing funds, ultimately unable to control the market and save the project’s market value.

3. Many NFT projects lack long-term intrinsic value, making their prices extremely vulnerable during market panic

This may be the fundamental reason for the stagnation of the NFT market.

When NFTs experienced a lot of hype in 2020 and 2021, project teams created ambitious roadmaps, promising to bring real value to holders of their NFT collections.

However, two years have passed, and the roadmaps of many NFT projects have turned into empty promises, failing to deliver real value to holders. While some project teams are doing things like T-shirts, plush toys, and organizing IRL meetups, the value they bring to holders does not match the high prices of NFT collections, and they lack innovation.

These reasons have led to a lack of real intrinsic value in most NFT projects, resulting in fewer and fewer users investing in and holding NFTs for the long term, ultimately turning the NFT market into a “speculator’s market.”

How to Revive the NFT Market

Based on a deeper understanding of the reasons for the shrinkage of the NFT market, we have some ideas for reviving it.

First, we should strive to create a truly valuable NFT ecosystem. This means that NFT project teams should continue to bring real value to holders, thus achieving the sustainable development of NFTs. At the same time, the significant price drops of many NFT collections during this bear market may not necessarily be a bad thing because it can weed out low-quality and inactive projects, while encouraging other project teams to do real work and improve innovation. Those series that truly work hard and continuously create value for NFT holders and the entire NFT ecosystem may be temporarily affected by the mining mechanism of Blur, but we believe they can still persist. For example, despite being severely attacked by malicious short selling, I still have great hope for the PROOF team of Moonbirds because they have always been creating value through high-quality content.

Second, project teams should realize the importance of market value management. After the events related to the Blur airdrop, the importance of market value management for NFT project teams has become prominent. To avoid repeating the same mistakes, project teams should prepare enough tokens in advance and have the funds and knowledge to take action when NFT prices are manipulated again, in order to control the market and save the project’s market value in a timely manner.

Finally, let’s talk about liquidity. First of all, we currently do not lack products that improve liquidity: Blur’s pro-trader trading platform, other liquidity improvement products such as NFT fractionalization protocols, NFT lending protocols, etc., are all good products. However, the main reason for the lack of liquidity is that most projects do not have real value, resulting in low market demand. Therefore, we believe that the key to creating real liquidity is for project teams to no longer focus on short-term interests and neglect long-term value, but to focus on creating real value, thereby stimulating genuine market demand and attracting value investments.

Although the recent stagnation in the NFT market has been disappointing, once we identify the root problems, we can dedicate ourselves to finding solutions. We still have a long way to go in fully realizing the true value and potential of NFTs.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Data Consensus Rebuilding the Trust System and Returning Digital Oil to Individuals

- Interpreting the RWA track of on-chain real estate Can it revolutionize the traditional trading and leasing market?

- Interview with Uniswap Founder Handing Over Routing Issues to the Market through UniswapX

- Can blockchain revolutionize the traditional real estate transaction and leasing market?

- Tokyo vs Kyoto Japan’s Cryptocurrency Twin Cities

- Reading the Bitcoin ETF 5 futures ETFs with total assets of nearly $1.3 billion. How much does the news of the Bitcoin application affect?

- Analysis of Bitcoin ETFs The total assets of 5 futures ETFs are nearly 1.3 billion US dollars, how much impact does the application news have on Bitcoin?