Sweep the haze of physical delivery futures debut, Bakkt cash delivery bitcoin contract hotly opened

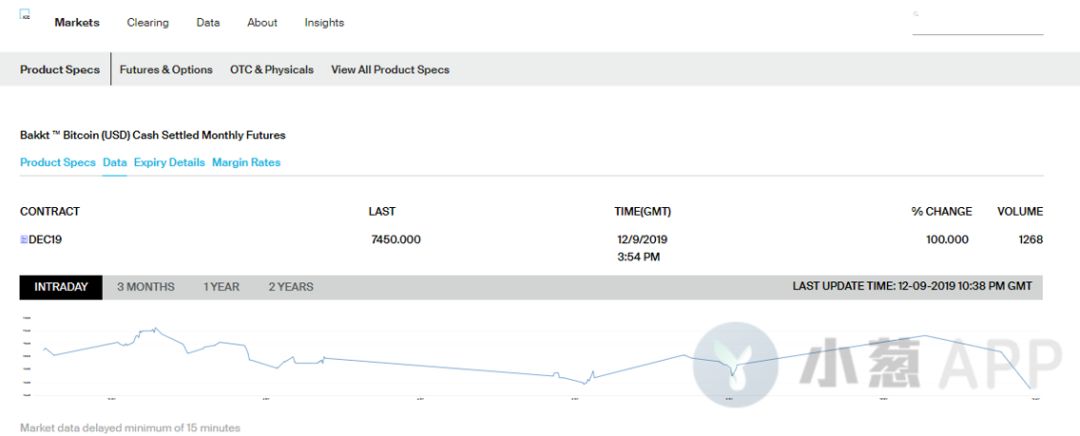

On Monday (December 9), the Bakkt cash delivery bitcoin futures monthly contract, which has been warming up for a month and a half, was officially launched. According to official website data, the first day of the new contract's trading volume reached 1268 (each corresponds to one This is a stark contrast to the bleak performance of the Bitcoin delivery contract launched by the exchange in early September, when only 72 bitcoins were traded on the first day of the contract. It seems that Bakkt has finally found a breakthrough to seize the bitcoin futures market.

On September 23 this year, Bakkt officially launched a futures product delivered with bitcoin. As the first futures product delivered with bitcoin, its decoupling from fiat currency once made the market regard it as a catalyst for the start of a new round of rising prices. However, the market's disappointment was disappointed by the dismal performance of the contract in the early stages of its launch. At the time, Bakkt's futures variety for bitcoin delivery was only 72 bitcoins on the first day, which was far less than the performance of CME and CBOE bitcoin futures on the first day.

At that time, the bleak start of the Bakkt Bitcoin delivery futures triggered a heated market debate. At one time, worries about the actual participation of the cryptocurrency market fell to freezing point, and the voice of the declining market also appeared in the market. However, at the time, some people remained relatively optimistic. Own Lau, a senior analyst at market research company Oppenheimer Co., said that although the start of Bakkt Bitcoin futures was disappointing, it is too early to comment Don't worry about Bakkt's sluggish trading volume. At least the performance of Bakkt's Bitcoin delivery futures should not be used to determine the success of Bakkt's Bitcoin delivery futures.

- Intensive Reading | "2019 China Blockchain Industry Development Report": a comprehensive review of the current status and trends of the development of industry, university and research

- Perspective | DeFi's Pillar: Decentralized Liquidity

- Re-understanding Bitcoin: 8 answers to Satoshi Nakamoto's wisdom

It turns out that after a dismal start, the volume of Bitcoin delivery futures at Bakkt has indeed shown a steady growth trend in the past two months.

On October 5, Bakkt's parent intercontinental exchange (ICE) announced that the cryptocurrency investment fund Galaxy Digital and the over-the-counter trading company XBTO had conducted the first block trade of the Bakkt Bitcoin futures contract.

On October 10, the daily trading volume of Bakkt bitcoin monthly futures reached 224 BTC, a new high since the launch.

On October 24, the daily trading volume of Bakkt Bitcoin monthly futures reached 640 BTC, continuing to refresh the new high since the launch. On the same day, Bakkt officially announced that it will launch a regulated Bitcoin option contract on December 9.

In just two days on October 26, the daily trading volume of Bakkt bitcoin monthly futures reached 1,179 BTC, and the peak value of single-day trading volume nearly doubled from the historical high created two days ago.

On November 9, the daily trading volume of Bakkt Bitcoin monthly futures reached 1,756 BTC.

On November 23, the daily trading volume of Bakkt bitcoin monthly futures reached 2,367 BTC.

On November 28, the daily trading volume of Bakkt bitcoin monthly futures reached 4,525 BTC, once again rewriting history.

Cryptocurrency rating agency Wechsler Ratings tweeted that Bakkt's bitcoin futures trading volume has steadily increased, which is a positive sign that it is increasingly accepted by the broader investment community. As we said at its launch, these things take time, and things will only get better as more institutional participants join. There are also opinions in the market that the continuous decline in the price of bitcoin over the past period of time has stimulated the rapid growth of the volume of Bakkt bitcoin futures contracts.

It is during this window of continuous contract market demand that Bakkt welcomes two new Bitcoin-related derivatives. Yesterday, Bakkt Bitcoin options and cash-settled Bitcoin futures contracts were officially launched. Interestingly, when Bakkt launched the Bitcoin “physical delivery” futures product more than two months ago, the main strategy was to expect to be able to compete differently with the existing cash delivery Bitcoin futures varieties on the market, but with the new contract ’s With the launch, Bakkt's “curve overtaking” plan has obviously changed. Currently, it has forcibly entered the market and started to confront other existing cash-settled bitcoin futures products.

Bakkt's official announcement shows that new cash-settled monthly futures will be available through the company's Singapore-based clearing house, ICE Clear Singapore. Regulated exchanges will allow customers around the world to conduct Bitcoin transactions safely and efficiently. The company said that the contract will use the settlement price of physical-settled Bakkt monthly futures. In addition, Bakkt's Bitcoin options were the first Bitcoin futures contract options under CFTC supervision. The contract will be based on Bakkt's monthly monthly Bitcoin futures and will settle as a basic futures contract two days before its expiration.

Bakkt Chief Operating Officer Adam White said in an interview that the introduction of cash-settled bitcoin futures and bitcoin options will be an important milestone in Bakkt's overall layout of bitcoin derivatives.

The recent active performance of Bakkt is undoubtedly a "demonstration" to the CME. The company seems determined to rely on the newly launched cash settlement products to complete the transcendence of the CME and become the "biggest" exchange in the Bitcoin futures market in the near future .

In mid-November, Adam White announced that Bakkt had opened its custody solution to all institutions wishing to store bitcoin, with a view to expanding "the path to the global economy by building trust in digital assets and releasing their value". It now appears that Bakkt's ambition to occupy the institutional cryptocurrency market as soon as possible has been revealed.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Small mining companies help themselves: use financial derivatives to hedge hash rate fluctuations

- People's Daily Observation: How Manufacturing Plants Blockchain

- Can the founders easily take half of the "decentralized scam" that raised 30 million?

- Amun AG receives regulatory approval again to provide cryptocurrency ETP products in EU countries

- Popular science | Amazing, how can digital currency pay offline

- CCTV News: To build a new engine for high-quality development, General Secretary Xi Jinping has "numbers" in mind

- The technical route of the central bank's digital currency may have been confirmed, and ICBC shoulders the heavy technical burden