The bull market has a top! The indicator tells us where the top of the BTC is.

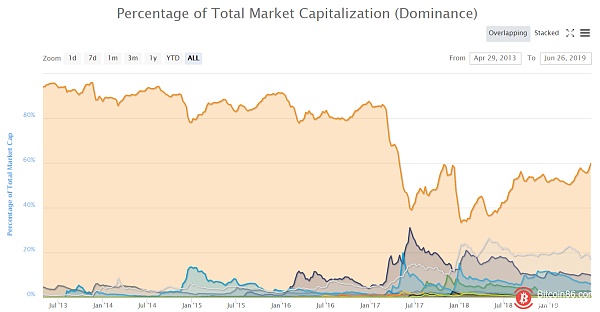

Judging from the market value of BTC, historically, BTC's long-term market share has never fallen below 80%. In recent years, since March 2017, most of the currencies after the start of the bull market have soared, occupying the market value of BTC. If we take the BTC's 80 market capitalization as the standard, it is of course easy to verify the important reversal points on the BTC bull market.

In the history of December 28, 2015, when the proportion was 91.26%, it showed the adjustment performance of BTC.

- BTC broke through 11700 and hit a new high, and the trend achieved a strong rise

- Amaranths are tied! After the big rise, the price of bitcoin fell below 10,000 dollars.

- Deloitte Report: 73% of Chinese companies regard blockchain as a strategic priority

Before December 26, 2015, the market value of BTC rebounded sharply. When it touched more than 90%, the top position of BTC was easily verified. It can be seen that the increase in the market value ratio can indeed verify important adjustment points. Even a partial adjustment is an opportunity for entry to investors who have not yet managed to succeed.

On January 4, 2017, the highest proportion was 87%, which also prompted the BTC to adjust the signal by 30%.

The figure shows that BTC prices have ushered in a deep correction in the case of BTC's market capitalization ratio of 87%. From $1,158 to less than $800, this was an adjustment in January 2017. In fact, when the price accelerates, we can judge the top of the price by increasing the ratio. Indeed, the market value is as high as 87%, which is already a long-term high.

What we have to look at next is that the BTC has soared recently, and the market value will indicate the adjustment signal.

From the perspective of BTC's market capitalization in 2017, which fell sharply and fell below 80%, the important pressure on the market value of BTC in the near future is around 60%.

In the early period, on October 30, 2017, the highest proportion was 59.37%, and on December 4, 2017, the highest proportion was 58.98%. BTC had a history on December 17, 2017. It can be seen that in the case of an increase in the proportion of large-capital currencies such as ETH and XRP, the pressure on the BTC market value to exceed 60% is very large.

In the past 24 hours, the market value of BTC has risen from 59.4% to 60.82% during the rise, which is close to an important turning point.

Therefore, the risk of holding money in the near future is also increasing.

In addition to the market share, we see that the impact of futures on BTC prices is also very large. If the current futures trading does not have this step, the price impact is not real enough. When Bakkt and Bitcoin derivatives provider LedgerX are about to launch deliverable BTC futures, the price of BTC may be less crazy.

In the news, the US Commodity Futures Trading Commission has approved the bitcoin derivatives provider LedgerX to provide physical settlement of bitcoin futures contracts.

According to the CFTC official website, the US Commodity Futures Trading Commission (CFTC) has approved bitcoin derivatives provider LedgerX to provide physical settlement of bitcoin futures contracts. This means that the company can now offer new futures contracts, which can be either retail or institutional customers.

Futures delivery makes BTC futures more closely linked to spot prices. If institutions and small and medium investors are involved in delivery, BTC price performance will be more reasonable.

Summary: The BTC market value ratio is a less frequent indicator. If there is no major change in the medium and long-term market, the differentiation of BTC and most currencies will not be very obvious. The current situation is that the BTC independent market is getting stronger and stronger. The difficulty of compensating for large market capitalization is increasing.

Whether the BTC market value ratio can stand at 60%, or whether it can challenge 80%, is still unknown. Before that, we may wish to confirm the top position of the BTC through this indicator.

Of course, if the market value of BTC accounts for 60% of the highest value, and the trend of BTC recovery continues, then the large market capitalization will inevitably increase, to push up the total market value of the overall digital currency. (CoinNess)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reaffirming that it does not threaten global financial stability, what promises G20 has made to the encryption industry

- Market analysis: BTC double bottom formation, rebound immediately

- Bitcoin once fell below $10,000 and fell nearly 30% in a few days.

- "It" allowed Bitcoin to evaporate $4,000 in 5 days.

- Bitcoin rose, it turned out that someone silently assisted

- A single day plunged more than 10%! Bitcoin is being sold as a safe haven asset?

- In June, a total of 15 security incidents occurred in the cryptocurrency wallet.