Bitcoin prices have tripled in half a year, breaking behind the million dollars: once fell by 80%

After the bitcoin broke through the 10,000-yuan mark on June 22, the bitcoin market has returned, but its unit price has remained above $10,000 for three consecutive days.

In the past few days, Bitcoin has become a hot search term for social media.

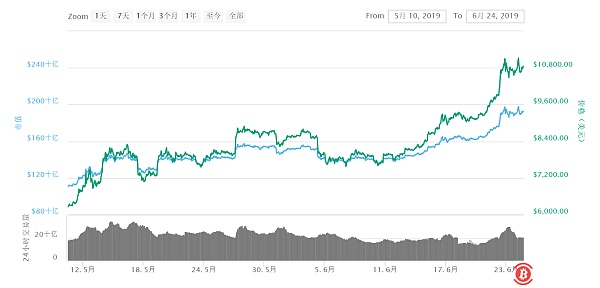

After the bitcoin broke through the 10,000-yuan mark on June 22, the bitcoin market has returned, but its unit price has remained above $10,000 for three consecutive days. As of 5:30 pm on the 24th, bitcoin prices reached $10,854, a 24-hour increase of 1.86%.

- Hype to encrypt digital currency must be cautious

- 35 days rose 113%! Can Bitcoin break through the $10,000 mark and can still get on the bus?

- Tencent's largest shareholder wants to copy the myth of investing in Tencent on Facebook Libra

In 2017, when the price of Bitcoin exceeded $10,000 for the first time, I was most impressed by the fact that many friends around me started looking for me and asked me what Bitcoin and blockchain are. This actually reflects the fact that Bitcoin is a new asset and most people are unfamiliar. But once the high price of $10,000 is reached, it will allow a lot of people to revisit bitcoin and digital assets, which in turn may lead to the entry of funds. "The president of the University of Fire Coin recalled when he was interviewed by the Beijing News."

It is worth noting that since the early morning of the 24th, a number of digital currencies that rebounded due to the rise in bitcoin have started to pull back, ranging from 1% to 3%. Financial commentator Xiao Lei told reporters that there is a possibility of significant fluctuations in the bitcoin market. In his view, due to the temporary lack of various rules, all kinds of investors have a large speculation and gambling mentality, and the market often comes and goes.

Yu Jianing suggested that investors should not easily chase high and be particularly cautious when shorting.

Behind the 10,000: The price "falls down the altar" 2 years ago, warmed up in March

On June 22, the price of bitcoin broke through 10,000 US dollars, and it was up to 11,000 US dollars on that day. It remained above 10,000 US dollars as of the 24th. At the same time, the market value of Bitcoin climbed. On June 22, its total market value was $180 billion. By the 24th, the figure was around $192.0 billion.

In fact, before this, the bitcoin market has experienced a year-long bear market and began to pick up in March this year.

Wind data shows that on December 16, 2017, bitcoin prices soared to $19,200 and reached record highs, but then "fallen into the altar." By 2018, bitcoin prices continued to fluctuate downwards, and prices once fell below $4,000 in December of that year, a drop of more than 80%. Even at the beginning of this year, bitcoin prices were quite low. According to Bitfinex data, bitcoin prices remained around $3,500 in January-February this year.

Bitcoin prices have risen sharply since late March, and bitcoin prices have exceeded $4,000 on March 27. From May to May, the bitcoin market oscillated upward: on May 3, bitcoin prices soared to $6,000, and on May 11, after seven months, the price returned to $7,000. However, on the morning of May 16, the bitcoin price once broke through $8,300, and the price dropped to $8,000 on the day. The next day, the 24-hour drop was 13%.

However, starting from June 15, Bitcoin prices continued to rise and broke the 10,000 mark on June 22. Compared with the low of more than 3,000 US dollars in December 2018, the price of Bitcoin has nearly doubled in six months.

For Bitcoin to remain above $10,000 for consecutive days, Yu Jianing told reporters that from the big logic, the reasons for the rise in Bitcoin have not changed. First of all, digital assets are a mirror of the development of the digital economy, and Bitcoin is the leader in digital assets, with a leading effect in the case of returning value. Secondly, the Libra project initiated by Facebook has made people see the great potential and value of the blockchain in the field of payment and other fields.

In this regard, Xiao Lei told reporters: "The breakthrough price of this bitcoin price is the result of various factors, including the change of market risk awareness, the demand for investors to diversify assets caused by various global risks and the Internet giant. The issuance of events such as the digital currency has had many expected levels of impact on investors."

Bitcoin prices or continued fluctuations in investor gambling mentality

Compared with the "peak time" of nearly 20,000 US dollars in December 2017, is there any room for bitcoin price to rise this time?

Xiao Lei emphasized to reporters the possibility of large fluctuations in the market. In his view, from the trend of the past few months, this market has already experienced a small bull market, more projects are also attracting funds from various investors, but because this market is special, there is a temporary lack of various The constraints of the rules, in fact, all types of investors have a greater speculation and gambling mentality, the market often comes and goes.

Yu Jianing said that Bitcoin, as a digital asset, has been highly financialized, so the probability of getting rid of the "cyclical" financial law is that "there will be a rise and a decline will rise." It is difficult to accurately predict short-term specific trends, but what is certain is that if there is a particularly rapid increase in the short term, then there will be a correction factor.

Edward Moya, chief market strategist at Oanda in New York, said: "The fluctuations in Bitcoin are likely to continue, with two key resistance levels of $12,000 and $15,000 respectively."

In addition, some insiders said that the rebound speed of Bitcoin once again proved the need to be cautious. Whitney Tilson, founder of Emire Financial Research, said that don't be fooled by this year's dead cats (meaning that the stock has rebounded in a short period of time after a long-term decline, and then continue to fall), and said that the price will be much lower after one year.

Peter Schiff, CEO of Euro Pacific Capital, also publicly warned that Bitcoin prices will eventually fall, causing book profits to be erased. “Unless you sell, it doesn’t matter how high Bitcoin prices go up. Every buyer must eventually sell in order to benefit from the rise. But the problem is here. Once those 'firm holders’ decide to cash, The price will plummet and the book income will be erased before it is realized."

Other digital currencies begin to callback experts: should not easily chase high

Stimulated by the rise of Bitcoin, other currencies also rebounded collectively. On June 22, Ethereum broke through $300, and the prices of digital currencies such as XRP, BCH and EOS also rose. However, from the early morning of the 2nd, most of the digital currency will be adjusted back and forth. According to BFX.NU, the correction rate for many types of currencies is between 1% and 3%.

According to the chain tower data platform, the top 10 currencies of the market value rose by 9 in 24 hours, and EOS fell the most, at 5.46%. The market value of the cryptocurrency market fell back to about $320 billion within 24 hours. After a two-day rally on the weekend, Bitcoin hit 10,000 points and hit 11500 points once, reaching the position where the last bull market was announced.

The platform said that at present, although Bitcoin broke through 10,000 US dollars, many investors who are concerned about cryptocurrency began to enter the market, but it has not yet led the market to snap up. There are shipping trends for addresses with more coins, and the short-selling space will gradually increase.

At the same time, the platform analyzed that Bitcoin stood firm at 10,500 points in the short term. After the start of the trapping on the 24th, it will prepare for the next round of upswing to 11,500 points. The short-term profit will be exhausted, and the next wave will be stretched, and has not yet reached the obvious resistance position. The platform currency lacks the amount of energy that continues upwards, and the basic callback is adjusted to the position before the current round of pull. OKB continues to pay attention. Other mainstream currencies can't run out of their own market, and they don't consider operations.

The market trend is still unclear, how should investors make decisions? Yu Jianing suggested that investors should not easily chase high and be particularly cautious when shorting. In his view, digital assets are still risky investment assets, and the price fluctuations and speeds of asset prices are significantly different from traditional assets.

Yu Jianing also stressed that the equity mechanism and technical support behind digital assets are significantly different from traditional investment assets. Before investing in digital assets, it is necessary to comprehensively and thoroughly implement blockchain technology, distributed business logic, and digital financial systems. Learn to understand, in order to clearly understand the intrinsic value of related digital assets, and to control the risk of investment in essence. (New Beijing News)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin is dead, Libra is standing?

- Bitcoin Data Weekly | Price breaks 10,000 US dollars, the data on the chain is a new high, "mad cow" strikes?

- Bitcoin's strong breakthrough in the million mark, FOMO mode will open?

- India's BTC premium exceeds $800, and strong regulation has led to a surge in demand

- Talking about the Prisoner's Dilemma in the Bitcoin System

- South Korean government: pay close attention to encryption market trends, suggest investors to invest in virtual currency carefully

- Former US Congressman Ron Paul: The Bitcoin ban will not prevent the dollar from "self-destruction"