Bitcoin rose, it turned out that someone silently assisted

It is understood that on June 22, the price of bitcoin broke through 10,000 US dollars, even the 12,000 US dollar mark, and then fell back. This is also the bitcoin price returned to the high of 12,000 US dollars since March 6 last year. In December 2017, the price of Bitcoin approached the peak of US$20,000. Since then, it has fallen all the way to a minimum of around US$3,000. Since the beginning of 19th, Bitcoin prices have bottomed out, rising more than 240%.

Since the beginning of this year, bitcoin prices have risen all the time, and every breakthrough in resistance has been accompanied by fierce long and short battles. However, in the near future, a series of favorable incentives have caused the bitcoin price to break through the two strong resistance levels of 10,000 US dollars and 12,000 US dollars, and the market sentiment is high. According to the analysis of the chain world, the reasons for the rise of Bitcoin this time are as follows:

Main reasons: FaceBook God assists and Bitcoin hedging

- A single day plunged more than 10%! Bitcoin is being sold as a safe haven asset?

- Bitcoin, the moment of shearing

- In June, a total of 15 security incidents occurred in the cryptocurrency wallet.

As we all know, on June 17 this year, social networking giant FacBbook released the LIbra white paper. The industry is also a positive and hug voice for this move. It once pushed the matter on the hot search and became a hot topic of competing reports. Prior to this, there were few real-world scenarios for virtual currency. After the WhiteBook released the white paper, the industry seemed to see the real application scenarios of virtual currency. In addition to Facebook’s announcement of plans to launch Libra, bitcoin’s successive rises, International trade and the intensification of the geopolitical situation and the global risk aversion have a certain relationship.

At the beginning of the Asian market today, spot gold jumped, and the highest intraday price reached 1411.10 US dollars / ounce, setting a new high in the past 6 years.

(Spot gold chart since 2019, source: FX168 financial network)

Experts said that the price of gold has been rising all the time, mainly due to the escalation of tension between the United States and Iran and the rise of geopolitical risks. The investment and hedging characteristics of gold have been further stimulated.

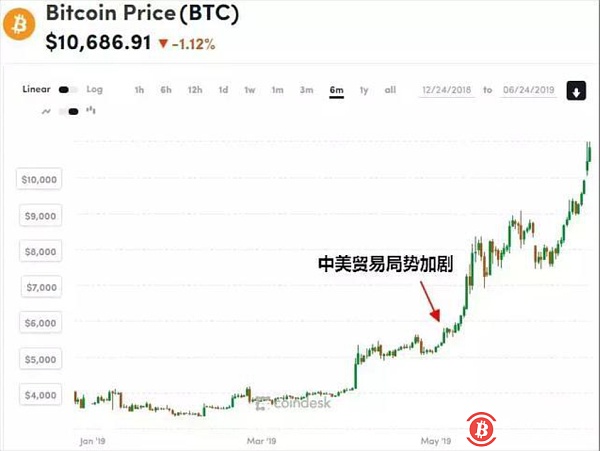

According to Coindesk data, since the beginning of May, Bitcoin has been more eye-catching in the context of market volatility, with prices surpassing the $6,000, $7,000, $8,000 and $9000 thresholds, and its potential as a safe-haven asset has once again been hit by the market. attention.

(Bitcoin trend chart since 2019, image source: Coindesk)

It can be seen that cryptocurrencies such as Bitcoin or new safe-haven assets have become one of the portfolio options for investors' asset allocation because they are more convenient than assets such as real estate and gold.

Anthony Pongliano, founding partner of Morgan Crick Digital Corporation of the United States, believes that Bitcoin plays a role in countering the instability of the global market, which is the core reason for institutional investors to hold cryptocurrency.

Among the many cryptocurrencies, the head is undoubtedly bitcoin. According to AICoin data, the total market value of global cryptocurrency is 315.138 billion US dollars, of which the market value of bitcoin is about 178.9 billion US dollars, the current market value is 56.73%; the second is Ethereum, the market value is 31.4 billion US dollars, and the market value is 9.97. %; Ripco ranked third, with a total market capitalization of $18.9 billion and a market capitalization ratio of 5.98%.

The strong position of Bitcoin makes it the first choice for investment cryptocurrency. When investors choose cryptocurrency as a safe harbor or hedging instrument, a lot of money flows to Bitcoin. In addition, according to network data, 75% of Bitcoin transactions are all so-called institutions, and large-scale institutional entry is also one of the important reasons for the rise of Bitcoin.

Indirect reasons: investors chasing up, holding money carnival

After 2018 years of painful, investors have returned to the cryptocurrency market, and the currency circle has been driven by emotional investment. Some analysts said that after breaking through $10,000, Bitcoin's resistance was $1,1500, $14,200 and $17,000. In particular, the last highest resistance level was 20,000 US dollars. In December 2017, once it breaks through, it will bring a new wave of investors' fear of missing. Bitcoin is expected to break through the historical high.

The emotion of “fear of missing” is common in the cryptocurrency market, and the specific performance is “chasing up”. In November 2017, after breaking through the resistance level of 10,000 US dollars, Bitcoin quickly broke through 15,000 US dollars after 15 days. This year, Bitcoin also experienced several large-scale corrections when prices climbed. Many analysts believe that this sentiment will begin after Bitcoin broke through $10,000. According to the chain world observation, after bitcoin has not broken through a pressure level, some people will post pictures on social platforms such as friends circle and Weibo to express their joy of holding the currency. This phenomenon will also drive up the price of Bitcoin. (chain world)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Read the blockchain in a single article, letting you meet the future trend

- Getting started with blockchain | Bitcoin price flash is a feature, not a bug?

- Market Analysis: Bitcoin is accelerating, can it break through the historical highs?

- Bitcoin broke through $11,000 again, and the three major media outlets such as Bloomberg

- The Financial Times: Libra running in a closed-loop system can't change the world

- Facebook will take a step forward, will Ali Tencent follow up?

- The twelve points you must know about Libra