The most complete timeline of the MakerDAO Black Swan incident.

Author: Tom Schmidt

Compilation: Share Finance Neo

On March 12, MakerDAO ushered in the worst day in history. Against the backdrop of a global currency crisis, the value of ETH has plummeted by more than 50%. This triggered a series of clearing between the exchange and the DeFi protocol, and led to large-scale network congestion. Most of MakerDAO's collateral is in ETH, and it faces an incredible task: to liquidate more than 10 times the loan in some way within 24 hours.

- Wu Jihan debuted on live broadcast: Bitcoin is hardly a safe haven in a volatile world

- President of the Beijing Internet Court: Black technology such as "Tianping Chain" provides advanced experience for the blockchain system of the court system

- What kind of blockchain project is worth investing in? Graph Network Data Tells You | Babbitt Industry Lesson

To understand how Maker survived this crisis, we must first go through this series of events and then peel off each layer.

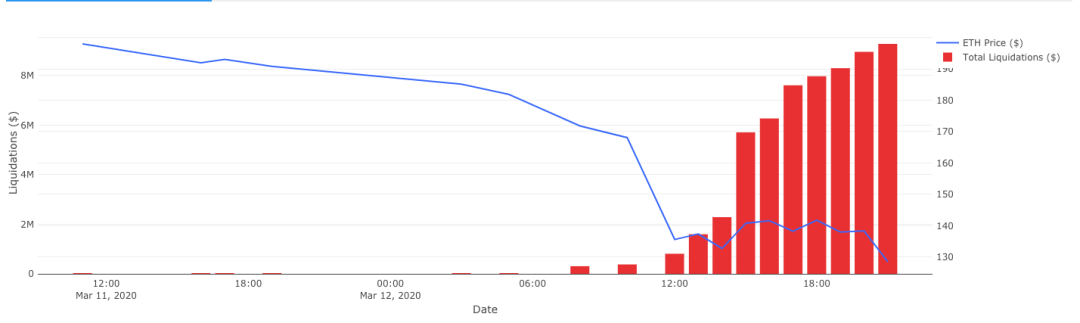

At 1am Pacific Time on March 12th, ETH is 171 USD, and liquidation begins

As ETH prices fall, Maker's collateral begins to be liquidated

When the price of ETH started to fall slowly, the clearing work on the MakerDAO platform proceeded as usual. Falling collateral prices are not a big deal. Leaving aside the panic of some ETH investors or Maker value holders, it is important to remember that the MakerDAO protocol is deliberately designed to withstand a significant shrinkage in collateral value.

In fact, it withstood a 90% decline in ETH in 2018, while DAI barely broke away from the fixed exchange rate of $ 1. Because every MakerDAO loan must have a large amount of excess guarantee (at least 150%), the liquidator has sufficient buffers to step in and seize high-risk loans to maintain the system's solvency.

Of course, loans with insufficient liquidation guarantees are no exception. Both centralized and decentralized exchanges can easily do this. The question is: what happens when the value of collateral falls so quickly or becomes so harmful that the loan becomes undercapitalized? In other words, the value of the collateral is lower than the value of the loan, which means that it is better for the borrower to leave and leave the lender at a loss.

Centralized exchanges usually make up for this loss through the socialization of insurance funds or cross-market participants. But what happens in a decentralized protocol? Although some protocols, such as the Compound protocol, mimic central exchanges and retain on-chain insurance funds, Maker takes a different approach.

If the system has insufficient capital, Maker will recapitalize by printing and auctioning new MKRs (governance tokens). This MKR was sold to DAI, and DAI was burned until the system capital was reorganized. Bidders can submit lower and lower MKRs they are willing to accept at a fixed DAI amount until the highest bidder wins and repays the system debt.

Maker's auction mechanism is designed with the knowledge that system debt is possible. But this auction made some assumptions: bidders will make reasonable bids under reasonable market conditions to fill reasonable small loopholes. In abstract terms, all this sounds good. But the "Black Thursday" panic has made those assumptions more vivid.

At 5 am Pacific Time on March 12 , ETH USD 130 , system debt begins

Price after liquidation starts to fall far below market level

As the price of ETH accelerated, things started to derail.

Unlike the liquidation price which closely tracks the market price of ETH, they begin to fall, fall, and fall again without any support. Many lucky liquidators won ETH at auction for $ 0, rather than simply repaying the borrower's collateral value minus a small fine, leaving borrowers with nothing but the Dai they recovered.

To make matters worse, the liquidation of these severe discounts left a hole in Maker's balance sheet-it began to hold less ETH collateral than Dai that it should fully support. For those unfortunately being liquidated in this way, panic began to spread through community message boards.

Author tip: don't do this

To understand why these can be bid for $ 0, we need to first review the history of Maker. For those familiar with the old "Single Collateral Dai", you probably know that Maker has previously imposed a 13% fine on liquidation. In other words, the liquidated borrower received 13% less than the deposit, of which 3% belonged to the liquidator and 10% belonged to the Maker. However, this system is relatively inflexible and may be penalized inadequately (or too severely) and is replaced by a collateral auction ("flip") in the multi-collateral Dai. This new flip auction is divided into two parts:

1.Minimum Satisfaction Stage

In the auction, the liquidator bids more and more Dais for a certain amount of ETH, until the smallest number of Dais is hit.

These quotes:

- Must be within a fixed time of the last bid

- Must be a fixed amount of Dai larger than previous bids

- Must come at the end of the auction

Once someone has proposed a minimum satisfaction value, the second phase begins.

2.Value maximization stage

In the second auction stage, the liquidators bid for less and less ETH, and they are willing to use this money in exchange for the Dai set at this stage. A similar mechanism to the above, the bidder continues to bid, and the auction ends when the winner leaves with some discounted ETH,

Theoretically, this system is more effective than a fixed penalty. It allows the market to control the value of liquidated collateral, allowing collateral to expand and contract under overwhelming market conditions. But as we have seen time and time again, the Black Swan incident may force the market to derail, as was the case on Thursday.

Maker flip auctions are no exception. Due to market fluctuations, bids to win flip auctions are always slightly lower than market levels, but have bottomed in the afternoon. Eventually, in the darkest swan, the liquidators started winning ETH collateral with a bid of $ 0, effectively taking away free ETH. Borrowers cannot redeem their tokens and cannot retrieve their vaults. The Maker system's debt began to grow, swelling to over $ 5 million.

Why is this happening?

Under normal market conditions, any rational participant should see a $ 0 bid and be willing to bid $ 1 (at least) to get some extremely cheap ETH. But two key factors exacerbated the financial system, which was already under pressure Thursday afternoon.

Blockchain network congestion

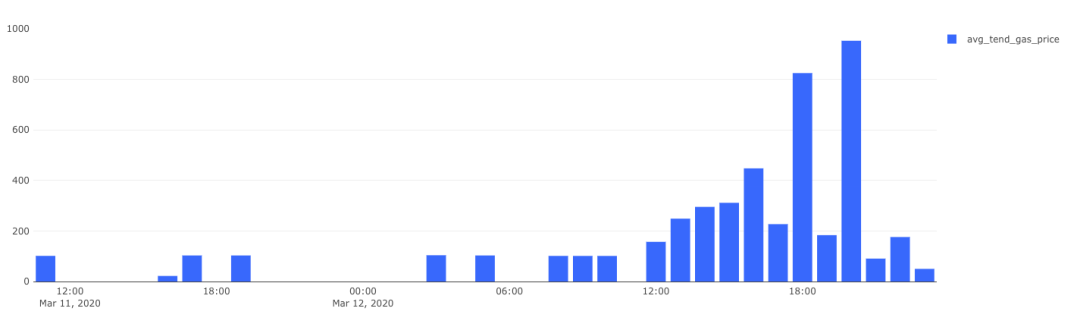

Blockchain transaction bandwidth is a shared resource whose price is determined by the relationship between supply and demand. Thursday's network congestion caused transaction prices to soar to 10 times the normal cost, causing price drift on the exchange because arbitrageurs could not quickly arbitrage price mismatches. Mining low-value transactions in a timely manner becomes unfeasible.

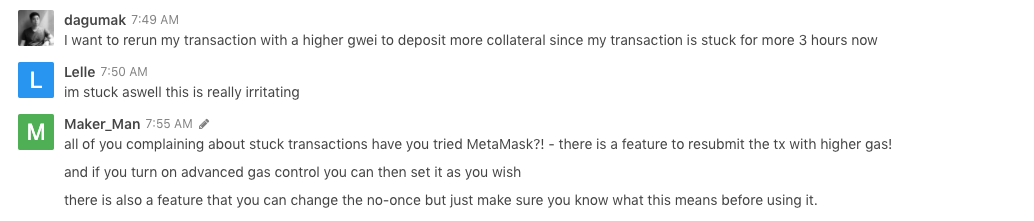

In the case of Maker, some users tried to make a counter-offer to bidders with a bid of $ 0, but due to network congestion, they could not be dug in time, which caused the auction to end early. We can see that the average bidder paid nearly 1,000 gwei, or 100 times the cost of standard Ethereum tx to mine. Even ordinary users have to resubmit their interface on the clumsy interface again and again just to save their vault.

Maker community members struggle to mine transactions

Gas prices spiked to extremely high levels during the worst of the crisis

All this congestion actually slows down the liquidation process because price updates from Maker oracles have not been tapped. Interestingly, this may avoid a worse situation as it acts as a circuit breaker in the ETH liquidation process. As a result, several liquidations occurred much later than they should have occurred.

Dai lacks liquidity

Dai can be obtained in two ways: by collateralizing ETH, or by buying on an exchange. Usually, this works-you can exchange dollars with minimal swipes on Coinbase, or buy Dai through Uniswap. However, on Thursday, as more and more Dais were redeemed and used as collateral for ETH in auctions, Dai's liquidity began to dry up.

In addition, fewer and fewer users are willing to deposit ETH in mint Dai to bear the risk of being liquidated in turmoil. As a result, the supply of floating tokens decreased, became extremely scarce, and the transaction price reached a peak of $ 1.12. This means that even if liquidators are willing and ready to liquidate, they will not be able to obtain sufficient Dai funds to purchase and use for liquidation.

We can see that bidding has begun to shrink, and fewer and fewer liquidators are able to participate, until only 3 liquidators remain in the end. These liquidators have won several $ 0 bids, bringing the Maker system below the target mortgage threshold of $ 5.3 million.

At 6pm Pacific Time on March 12, ETH 100 USD, how to make up for the loss

At this point, the loopholes on Maker's balance sheet are serious and growing. Maker enters crisis mode. The Maker team holds an emergency meeting with the community to discuss possible solutions. The meeting is divided into two workflows:

How can we stop the loopholes and prevent them from becoming larger?

How can we most effectively fill this loss?

Dai's liquidity

The biggest problem causing these "$ 0" liquidations is Dai's lack of liquidity. Dai's lack of liquidity has made it more difficult to maintain the Dai exchange rate, and has created a larger sliding space for liquidators trying to find Dai. The Maker Risk team eventually came up with two separate changes to address this issue:

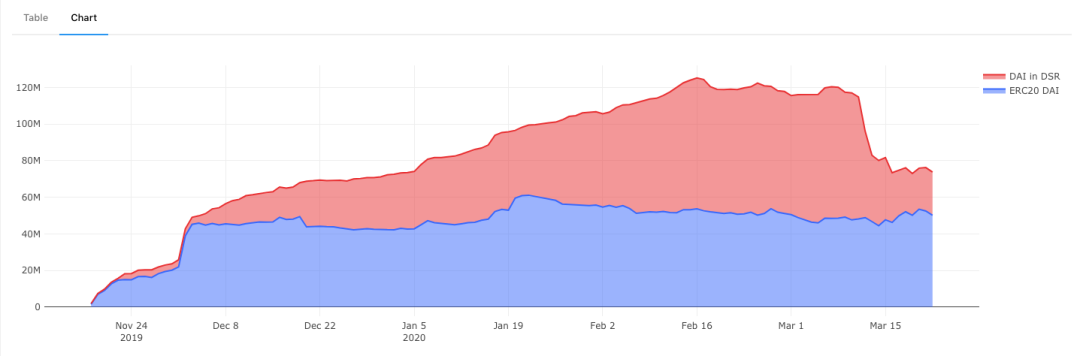

Lowering Dai's savings rate (DSR) to 0% will reduce the demand for Dai and hopefully lower its price to bring it closer to the peg to the US dollar.

Adding USDC as maker's collateral allows Dai to mint in a very low-risk way when liquidity is extremely lacking.

For DeFi purists, this last proposal sounds blasphemy-USDC, a centralized stablecoin, will now undermine the flawless glory of MakerDAO. Many believe this change will be the death knell for Maker. In fact, this move-using real-world assets as collateral, including USDC-has been prepared in advance by the Maker core team for several months, and Thursday's situation only accelerated the process.

Dai's interest rates fall, which helps improve liquidity

These arguments have caused widespread confusion in USDMaker's purpose in MakerDAO. USDC is not intended to be a core collateral for Maker. After all, why should I use my U.S. dollars to apply for a U.S. dollar-denominated loan? Instead, USDC aims to be strictly a utility to help liquidators who need liquidity to cast Dai, and to help when Dai is above $ 1 Fix it at $ 1.

A savvy trader can borrow a loan from Dai, sell it for $ 1, and buy it back when Dai returns to $ 1. In fact, the loan guaranteed by usdc in the Maker system has an interest rate as high as 20%, which is 40 times higher than the 0.5% interest rate of ETH loans, which proves this.

Robustness of auctions

Another core issue that caused Thursday's debt was the auction mechanism itself. If the auction lasts longer or other parameters are adjusted, more bidders may try to get some Dai and raise the price of the collateral auction, but the duration of the auction is too short. Due to network congestion, a single bidder can win a bid before competitors. To make these collateral auctions more resilient in the face of network congestion, the Maker Risk team has proposed two changes:

Increased the time from the last bid to the end of the auction from 10 minutes to 6 hours, allowing additional bids to enter when the network is congested.

Increase the size of the ETH auction from 50 to 500 to reduce the number of transactions and consolidate bidders. Now, bidders no longer bid 10 bids at 10 different auctions, they can bid 1 bid on a combined collateral pool at one auction.

There is still much work to do to make auctions simpler and more robust, but these two changes seem to be increasing the efficiency and competitiveness of auctions.

Filling the debt loophole

Despite all these mitigation measures, there is still a problem that there is a $ 5.3 million difference between the amount of collateral in the Mkaer system and the number of tokens issued. How does the system solve this problem? There are three options:

Emergency stop

Maker's nuclear options are always on the table. During an emergency shutdown, all Dais will be frozen so it can only be used to redeem Maker's underlying collateral. After some discussion, this option was ruled out given the fairly small debt gap.

Has the Maker Foundation repaid the debt?

The Maker Foundation can simply send ETH back to the system to repay debt and complete the system. Although this did solve the problem, it violated the implicit social contract of the system in some ways.

MKR holders charge fees from the Maker system, but in exchange they must support the solvency of the system. Therefore, in this case, it should be paid by the MKR holders-after all, under normal circumstances, they are compensated for taking this risk. If the Maker Foundation simply stepped in and repaid debt, it would raise questions about whether MKR's purpose and protocols were truly decentralized.

Mint and auction MKR to repay debt

Fortunately, the Maker protocol is designed to repair itself in the event of a loss. 48 hours after the debt was created, the new MKR was automatically generated and sold to Dai in a series of reverse auctions. These auctions will continue until full debt is repaid. If the liquidation prices of these auctions are inconsistent with market prices, more and more MKRs will be manufactured to fill this gap, and MKR holders will face large-scale dilution.

Many people realize that large-scale dilution is a very realistic possibility: in the context of widespread market panic, this auction is unlikely to be sold at a reasonable price. Most importantly, even if many people want to participate, Dai's lack of mobility can make participation difficult.

Therefore, some people have proposed that the MKR auction be postponed for another 4.5 days until the market stabilizes and Dai's liquidity problem is resolved.

At 12 am Pacific Time on March 13th , ETH is $ 120 and voting begins

Proposed administrative voting, reconvened MKR holders, and passed a series of proposed changes, minus USDC guarantees.

March 13-March 19. Preparing for the auction.

In a widespread market panic, a small group of participants began preparing to participate in the auction. First, bidders must collect enough Dais to bid. This was difficult until more than $ 10 million USDC joined the Maker contract, and Dai was minted against it, bringing the linked exchange rate system back to normal and restoring market liquidity.

In addition, bidders must bid 50,000 Dai on MKR. Although some larger funds, such as Paradigm, promised $ 5 million to participate in the auction, smaller buyers were out due to over-bids. Of course, there are technical obstacles-bidders must run their own Maker "auction manager", an off-chain robot that monitors auctions and bids.

We can see that ETH (green) flows out of the Maker and USDC (red) flows in

In response to these questions, a decentralized "Backstop Syndicate" suddenly appeared and announced that they would use their pooled funds to commit to being the last buyer of MKR, with their Backstop bid at $ 100 / MKR. Anyone can join this Syndicate, just place Dai in a shared smart contract and rely on the shared housekeeper robot to bid in the auction. More than 350,000 Dais are housed in "Backstop" MakerDAO. Although none of the final bids were successful, it underscored the grassroots support for Maker and the importance of Maker to the entire DeFi ecosystem.

The Maker Foundation has also made its own contribution, building a customized user interface that makes it easier for investors to enter auctions.

7:30 AM Pacific Time, March 19th , ETH $ 126 , auction starts

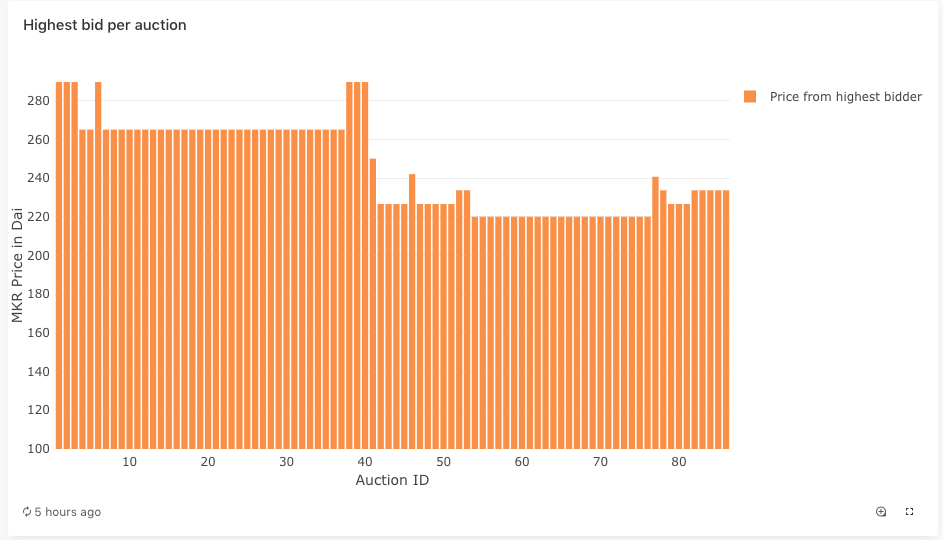

Within 6 days of preparation, MKR began to let go, and the bidders stood out and demonstrated good demand. We see that the price of the auctioned MKR is closely related to the MKR on the spot market, with more than 30 unique bidders participating. This may be less than the actual number of people involved, as the Maker Foundation volunteers to bid on behalf of those who cannot participate.

Although the auction is still ongoing, so far we have seen 17,630 MKRs minted and sold to repay $ 4.3 million in debt, with an inflation rate of about 1.7%.

The price of the auction closely tracks the market

What's next?

Every crisis is an opportunity to learn and improve. So, what can Maker learn from this crisis? Should we expect it to be more resilient in the future?

We need better risk modeling and threat analysis

Many of the problems with Thursday's Maker's system didn't immediately surface when the system was originally designed. When these systems are exposed to an anonymous group of money-inspired participants, the emerging properties manifest themselves in a way that their creators cannot immediately predict.

Although it was acceptable for Maker to start with the original design and repeat it over time, it now faces hundreds of millions of dollars of risk and unpredictable external incentives. Now, Maker needs a more rigorous approach. Visual inspection with a simple model is no longer enough.

Take the decentralized currency market-Compound Finance as an example: using Gauntlet's agent-based simulation, they found that when the market is highly volatile, the decentralized exchange may not have enough liquidity to profitably liquidate risk positions, thereby Put the entire system at risk. These insights can only be gathered through complex risk models.

We need better tools and data

Another issue that exacerbated debt and consequences on Thursday was simply the lack of transparency in the financial system. It took us too much time to understand what was happening, and even longer to diagnose the cause. Many participants from the Maker ecosystem pieced together the data transaction log and mempool data to reconstruct the timeline of events. Even if people understand the problem of a $ 0 bid, there is another obstacle: the new auction robot is difficult to strip out because the Maker code base is notoriously opaque and difficult to operate. For example, the MKR auction website did not exist even before the MKR auction began, until it was set up madly, which would prevent non-technical users from participating in the auction.

Improving the legibility and accessibility of Maker will greatly help. If Maker wants to be more resilient, it needs more diverse participants.

We need better risk management tools, hedging and insurance

In addition to the overall improvement of the Maker system, there is a broader question, how can we make the crypto market as a whole more robust and immune to tail risks.

Some have called for a reform of the broader crypto market structure, but DeFi is a different area and needs its own solution. One can imagine that a more diversified and unrelated basket of basic collateral may alleviate the bank's shrinking assets to a certain extent. Suppose a vault contains not only ETH, but also assets that are inversely related to ETH, such as ETH puts or sETH, thereby creating a portfolio that is closer to the market neutrality. Although in the recent sell-off we have seen an increase in the relevance of all asset classes, the addition of unrelated synthetic assets to the Maker vault collateral improves the security of the entire system.

Still others, their vaults were liquidated to $ 0-in fact, their collateral was stolen. Although technically, Maker has not been hacked, but for these users, the result must make them feel like they are the victims of something.

By using the right insurance tools, these risks can be hedged to increase end-user confidence. Just as many Compound users use Opyn's decentralized options to insure their Conpound deposits, one can imagine that Maker vault owners would purchase similar options to sell the value of their vault at a specific market price.

This will allow a network of financially-motivated underwriters to assess Maker and price risks and reallocate the accompanying risks. Compared to more traditional insurance products such as Nexus Mutual, options also offer greater flexibility to pay compensation in case of uncertainty. This is different from traditional insurance products like Nexus Mutual, which has rejected Maker claims since Thursday.

As Maker completes its hero journey, there is no doubt that it has changed in many ways and is expected to be more resilient. However, as Maker further strengthens its position as the global credit instrument that underpins DeFi, there is still room for improvement.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Viewpoint | Ethereum 2.0 inspired by the Ethereum 1.0 upgrade

- Perspectives | Numerous entrepreneurial opportunities can be found through blockchain in the next decade

- Opinion | Crypto analyst Tuur Demeester: Bull market trend may resume, and my bullish stance on Bitcoin remains unchanged

- Depth | Favorable policies come out frequently. Will 2020 be the first year of blockchain outbreak?

- Video: Exploration, Application and Prospect of Blockchain in Digital Marketing (Part 1)

- Technical Guide | How Do Digital Contracts Decentralize Ownership?

- Data analysis: how to maintain the emerging market structure of digital currencies under the market waterfall