The rise of EOS, the public link is great, and the second wave of the market opens?

Now I don't know how many people still remember that the market at this time last year, the rise of the public chain, the group dances. Now that EOS has risen again, it touches the pressure of $6. As long as it can break through, the new wave of market will start again.

Investment is imaginative, and the blockchain is still in the early stages of development. The most imaginative non-public chain is the one that will carry most of the future applications. Of course, most of the applications are not yet playable, and the only thing worth playing is the game betting, but it is hard to be elegant.

If the first wave is the market sentiment activated by the exchange, then the second wave of public chains may set off the climax of this round of the bull market. The exchange will do things, in fact, the public chain will do things, think about it last year.

The main line of the public chain is a craze. Many public chains look for a few nodes to put together, and put the server on the cloud to declare the public chain. This is not a nonsense. But when you are targeted by funds, you will be able to make money, no matter if you are Li Wei and Li Gui, you will start a public chain.

- A picture of bitcoin bifurcation history

- What is the actual impact of the “Development of Bitcoin Mining” by the National Development and Reform Commission? Different opinions in the industry

- The rise of the PoS mechanism can bring "new mining market" to the fire?

This wave of EOS BM took the lead to say that it was necessary to do things. Sun Yuchen of the wave field also said that the wave field was going to do something. After a few days, V God said that ETH had to do something, and the funds would slowly be attracted to these projects and start a new round. Pull up.

From the perspective of futures, the strength of the bulls is significantly greater than the shorts, and the USDT outside the market has also begun to premium, and funds are accelerating into the market. According to statistics, the institutional position of Bitcoin has also increased by 9% compared with the beginning of the year. Many funds are coming into play silently, and the funds waiting to see are also in the tendering place.

As for saying, the market can go to what extent, I think it is currently at the beginning of the rebound, the second wave of the acceptance period. However, the market has not had a deep correction, and many profit-taking pressures are on it. It is not so easy to pull up.

Now, if the main fund is not to sell itself, it is no longer necessary to pull up a step. I prefer the former a few days ago, and now I tend to the latter. It may be that there is too much money in the appearance of the field, and the main fund is afraid to wash it off. In fact, this is very similar to the A-shares. Many funds are used to do T. Finally, the retail investors wash the dealers off.

Let's analyze the market below

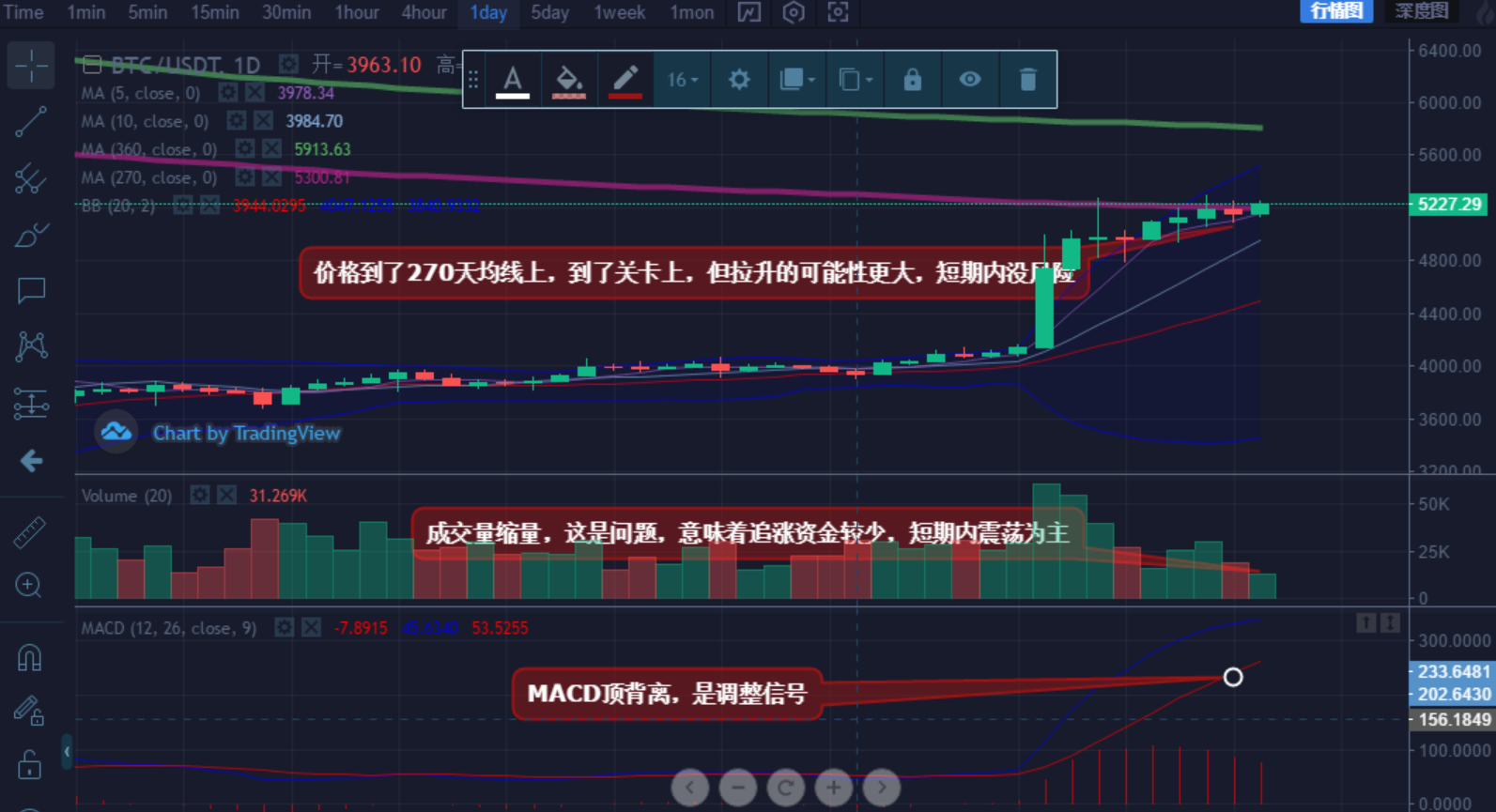

Bitcoin will continue to fluctuate in the short term. It will reach the level of the 270-day moving average. Even if it breaks, it will face a callback, which is not a good place to enter. The shrinking volume indicates that the chasing funds are insufficient, and the probability of maintaining shocks in the short term is large. The MACD appears to be diverging from the top, and it needs to be oscillated or deepened to restore the trend and temporarily wait and see.

EOS accelerated the rise, as the second wave of the leader brought a good head, but also reached the pressure of the top 6 dollars, it is not so easy to break through. On the indicator point, the Zhongyang line has reached the previous high, and the probability of continuing to rise is large. The callback is the buying opportunity. Don't hesitate to add the position in batches.

ETH is in a period of gaining momentum, the indicators are very soft, the late fatigue may be large, 200 dollars is no problem, as long as it can be held. It can be seen that the trend of ETH is one side up and one side of the callback. The advantage of this trend is stability. The disadvantage is that the explosive power is insufficient and it requires great patience.

For more information on pushing cryptocurrencies, you can follow the public number: biquandamowang.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- US Attorney Davidson's Attitude: Demarcation of Digital Tokens and Securities Law

- Staking Economy (Series 7) is wary of Staking Profit, talking about Slash risk! ! !

- Old text rereading | Ethereum and black box

- GeekHub Global Online The fifth phase of cross-chain – dialogue COSMOS content record

- Lightning network is exposed to amazing defects! BU chief scientist says users may lose all funds innocently

- A hundred times of space or worthless? Learn about the three valuation methods for digital assets.

- The road to rights protection is not seen? Mt. Gox creditor organization leader opt out