QKL123 market analysis | Crude oil collapses, stock indexes fall, panic spread … Bitcoin has not been spared (0309)

Abstract: The international oil price has suffered an epic slump due to the double bearishness, exacerbating the panic in the global capital market, the global stock index linkage fell, and Bitcoin has not been spared. Although Bitcoin is classified as a commodity, Bitcoin is relatively independent of oil and has its own cyclical changes. In the short term, Ethereum and other signs of stabilizing rebound may drive the market to rebound.

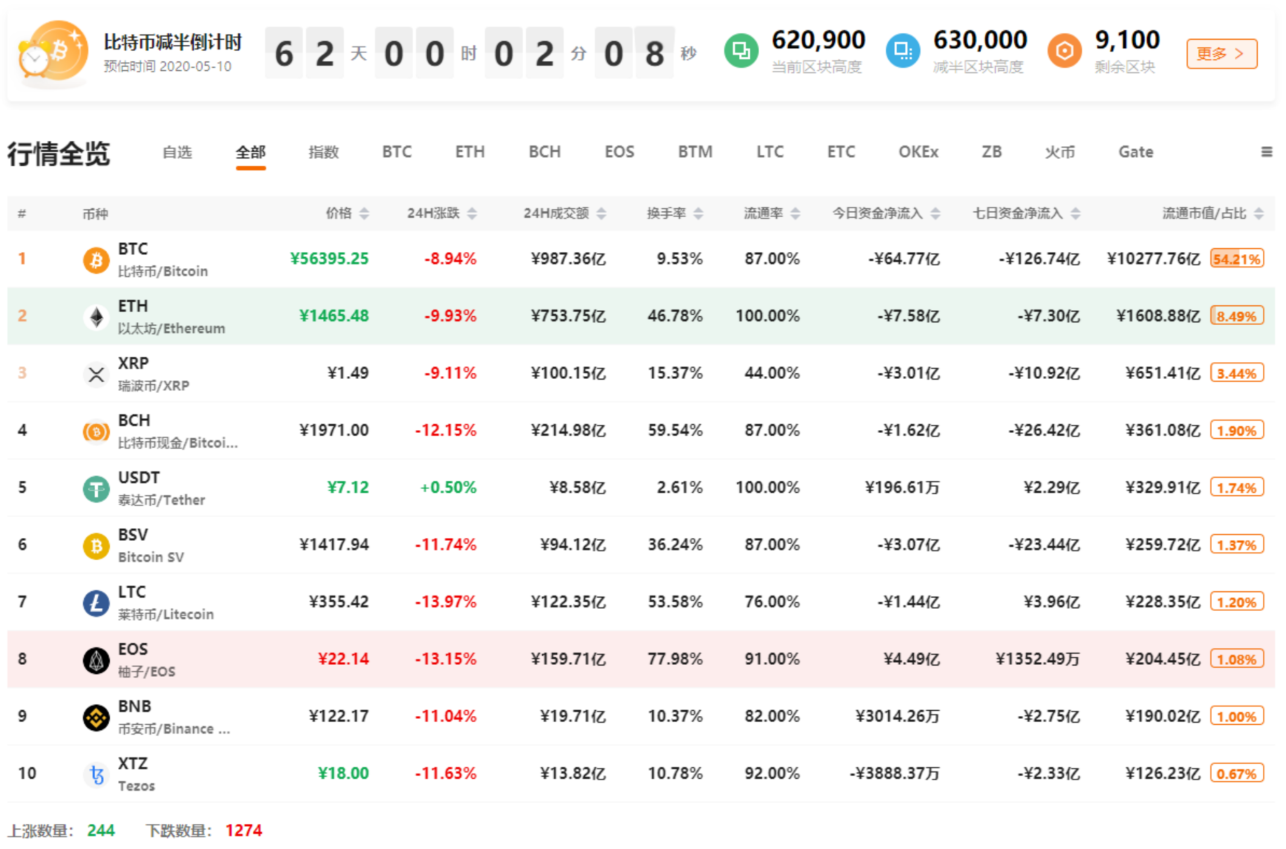

At 15:00 today, the 8BTCCI broad market index was reported at 11749.01 points, which rose to -10.26% in 24 hours, reflecting the rapid decline of the broad market. The total turnover was 980.424 billion yuan, with a 24-hour change of -0.91%. The Bitcoin strength index was reported at 88.55 points, with a 24-hour change of + 2.95%. The relative performance of altcoins in the entire market has weakened significantly; the Alternative sentiment index is 17 (previous value 33), and the market sentiment is expressed as extreme fear; ChaiNext USDT field The external discount premium index was reported at 102.60, with a 24-hour rise or fall of + 0.36%, and the strength of OTC fund inflows increased slightly.

Analyst perspective:

- The most expensive ERC-1155 NFT ever released, worth $ 102,000

- Digital wallet company Argent secures $ 12 million in Series A funding, led by well-known fund Paradigm

- Blockchain game Horizon raises $ 5 million in funding, investments including ConsenSys and DCG

At the OPEC + Vienna meeting last Friday, in order to cope with the downside risks of the current global epidemic, the oil producing countries should have “united together” to deal with the oil crisis caused by the downturn. However, in the face of the sudden increase in output reduction quotas and the extent of production cuts, Russia did not buy it and went away, leading to the failure of the production cut agreement. To make matters worse, Saudi Arabia spearheaded a market war on Saturday: First, the price of crude oil sold to foreign markets was significantly reduced, and the discount rate reached a new high of nearly two decades; second, it was prepared to increase crude oil production. Production will increase significantly. Affected by the double negative, oil prices plummeted after the market opened today. Brent crude oil and WTI crude oil fell by about 30%, the largest drop since the United States launched the Iraq war in 1991.

Today, more than 2,200 new cases of new coronavirus have been diagnosed abroad, of which more than 60% have been added in Italy, and more than 100 have been added in France, Germany, Norway and the United States. At present, there are still many uncontrollable factors in the spread of the global epidemic, coupled with the stock market crash in the past few weeks, the panic surrounding the capital market has not dispersed. The epic decline in the price of oil this time has further aggravated market panic, stock index futures have fallen sharply, and gold has experienced high levels of short-term fluctuations. Although A shares are generally optimistic about the capital market, they have also experienced significant declines. Even the relatively independent Bitcoin has not been spared.

Many people have classified bitcoin as a commodity, but using statistics found that there is no obvious correlation between crude oil price and bitcoin, and a weak negative correlation has been shown in the past decade. Moreover, bitcoin and crude oil have their own cyclical fluctuations: Brent crude oil futures prices recorded their lowest point in less than a decade (less than $ 30) in January 2016, and Bitcoin as early as January 2015 Bottom point; although both had a sharp rise in 2016, Bitcoin and crude oil recorded their highest points in nearly five years in December 2017 and November 2018, respectively. From the perspective of volatility, the volatility of bitcoin has gradually decreased in recent years, while the volatility of crude oil has increased significantly, the former has been significantly lower than the latter, which indicates that bitcoin has gradually matured as a new class of assets.

In short, this big drop in Bitcoin is likely to be affected by the panic in the capital market and is not directly related to the plunge in crude oil.

First, the spot BTC market

Yesterday to date, BTC has continued to decline in volume. Under the influence of market panic, a large amount of net outflow of funds, panic disk components are relatively large. Waiting a short time for the Air Force to run out will rebound.

Bitcoin fell below the 200-day moving average again, and has deviated from the long-term trend. Various indicators support long-term fixed investment. Although the daily RSI has entered the oversold range, you need to wait for stabilization, and then you can intervene in small positions to gain a short-term rebound.

Second, the spot ETH market

Judging from the four-hour K-line, the volume of ETH at $ 200 is relatively obvious. At present, there are signs of stabilization and rebound, which will drive the broad market to rebound in a short time.

Third, the spot BCH market

The trend of BCH is similar to that of BTC, but it has fallen back to the level when the market opened in April last year. If it is broken, there may be another bottom. Looking at the strength of Bitcoin's rebound in a short period of time, if the rebound is not strong, the downside risk will increase.

Fourth, the spot LTC market

The decline of LTC is large. At present, a four-hour hammer-shaped K line appears at the bottom, and there are signs of stabilization for a short time. The number of kills this time can be slightly reduced compared to the end of February, indicating that the air force is depleted, and the short-term linkage rebound is mainly based on the upper pressure of 58 dollars.

V. Spot EOS Quotes

Since the beginning of the decline on February 15th, EOS has experienced four significant volume increases, and is currently returning to the level before the January volume increase. For the main force, the current price is a relatively ideal range for pulling up, so after the stabilization and rebound this time, the main force may re-engage. But follow-up depends on whether Bitcoin can stabilize.

Six, spot ETC market

At the end of last year, ETC started to rise in a wave earlier than ETH, mainly due to the positive impact of recent production cuts, and its increase was significantly higher than ETH. However, near the high point of last month, the main force has a relatively obvious heavy volume shipment action. The recent continuous decline is large, the trend tends to stick to the ETHK line, and the short-term weak linkage is mainly ETH.

Analyst strategy

1. Long line (1-3 years)

The long-term trend of BTC is still in the next one to two years, and it is expected to usher in the crazy bull market. It is now a good time to vote. The smart contract platform leader ETH, altcoin leader LTC, DPoS leader EOS, BTC fork currency leader BCH, and ETH fork currency leader ETC can be configured on dips.

2. Midline (January to March)

BTC fell to the 200-day moving average, and the halving is good, and there is room for further release. The relative prices of other assets are relatively low, and they are involved in batches.

3. Short-term (1-3 days)

There are short-term rebound signs, small positions attract low and sell high.

Appendix: Interpretation of Indicators

1. 8BTCCI broad market index

The 8BTCCI broad market index is composed of the most representative tokens with large scale and good liquidity in the existing global market of the blockchain to comprehensively reflect the price performance of the entire blockchain token market.

2.Bitcoin Strength Index

The Bitcoin Strength Index (BTCX) reflects the exchange rate of Bitcoin in the entire Token market, and then reflects the strength of Bitcoin in the market. The larger the BTCX index, the stronger the performance of Bitcoin in the Token market.

3.Alternative mood index

The Fear & Greed Index reflects changes in market sentiment. 0 means "extremely fearful" and 100 means "extremely greedy." The components of this indicator include: volatility (25%), transaction volume (25%), social media (15%), online questionnaire (15%), market share (10%), and trend (10%).

4.USDT OTC Premium Index

The ChaiNext USDT OTC INDEX index is obtained by dividing the USDT / CNY OTC price by the offshore RMB exchange rate and multiplying by 100. When the index is 100, it means the USDT parity, when the index is greater than 100, it means the USDT premium, and when it is less than 100, it means the USDT discount.

5.Net Funds Inflow (Out)

This indicator reflects the inflow and outflow of funds in the secondary market. By calculating the difference between the inflow and outflow of funds from global trading platforms (excluding false transactions), a positive value indicates a net inflow of funds, and a negative value indicates a net outflow of funds. Among them, the turnover is counted as inflow capital when rising, and the turnover is counted as outflow capital when falling.

6.BTC-coin hoarding indicator

The coin hoarding indicator was created by Weibo user ahr999 to assist bitcoin scheduled investment users to make investment decisions in conjunction with the opportunity selection strategy. This indicator consists of the product of two parts. The former is the ratio of Bitcoin price to the 200-day fixed investment cost of Bitcoin; the latter is the ratio of Bitcoin price to Bitcoin fitting price. In general, when the indicator is less than 0.45, it is more suitable to increase the investment amount (bottom-sweeping), and the time interval accounts for about 21%; when the indicator is between 0.45 and 1.2, the fixed investment strategy is suitable, and the time interval accounts for about 39 %.

Note: Crypto assets are high-risk assets. This article is for decision-making reference only and does not constitute investment advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The history of the death of the most bullish fund in the history of CXC: the rebate is as high as 10, and it is now down 85%

- Or will retail demand force the SEC to approve the Bitcoin ETF?

- Former Bank of England (BoE) official: Bank of England digital currency will eventually take on many different "hybrid" forms

- Under the global economic downturn, the digital currency bull market is dead?

- BTC Weekly Report | Coin price plummets, data on the chain drops, Binance net inflows for two consecutive weeks

- Crypto market soars, how to deal with the "black swan"?

- Babbitt Column | Why Coins Rise and Fall Together?