The world is changing, how can top-tier blockchain venture capital seek opportunities in turmoil?

The continuous spread of the new crown epidemic worldwide makes it difficult for people to be optimistic about economic development expectations. Although the cryptocurrency industry does not seem to be affected by daily operations due to its inherent digital attributes, the investment situation and behavior have undergone considerable changes.

Last Friday, Winkrypto, as an integrated marketing service provider connecting home and abroad, joined the chain to hear that ChainNews and Yama launched the online talk show " Crypto Tonight ". The second episode of "Crypto Tonight" was successfully launched at 9:30 pm on April 10th, Beijing time. Yama and four top experts in the field of cryptocurrency investment discussed their views and countermeasures on the " impact of the new crown epidemic on crypto investment ", and Share your own industry experience, investment style and strategy, as well as views on the technical fields such as Layer 1, DeFi and CeFi.

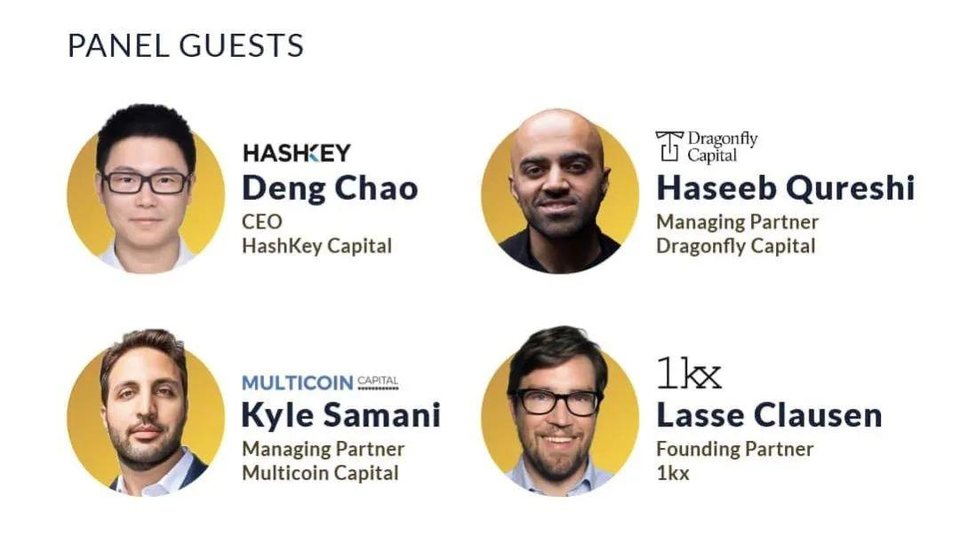

Deng Chao once participated in the first phase of Crypto Tonight as an observation guest. The HashKey Capital he led is the head investment institution in Asia, and Haseeb Qureshi is also an old friend of Lianwen. The Dragonfly Capital he serves is also an industry star investment institution, Kyle Samani Multicoin and 1kx, each led by Lasse Clausen, also have distinct investment styles in the field of crypto venture capital, and are the leading pioneers in the field of Western cryptocurrency investment. The core highlights of this show are:

- Chainalysis: Coronavirus is destroying the two largest crypto scams

- Babbitt Column | MLM in currency circle, money recovery or return for buyers?

- Zou Chuanwei: Large-scale collaboration between machines is not a fantasy, it requires blockchain to introduce market mechanisms

- Multicoin partner : Only invest in DeFi agreements that can surpass CeFi in all aspects. Layer 2 and shards are yet to be verified;

- Dragonfly Partner : Asian CeFi companies are better than their European and American counterparts, growing faster, and the status of the fully digitalized cryptocurrency industry after the new crown epidemic will be strengthened;

- HashKey Capital Deng Chao : Five projects have been invested in the first quarter. The sluggish market has created buying opportunities . Our style is not "theme-driven", but more ecologically driven;

- Founder of 1kx : Asian cultures are more likely to accept cryptocurrencies. The advantages of DeFi are transparency and low fees. The diversity of knowledge in the cryptocurrency field far exceeds that of other industries.

You can view the complete program video at the end of the article by recognizing the QR code. The following is the text record of the entire program of this issue. The content has been edited.

Quick Questions and Answers: Investment Style and Strategy

Multicoin partners: only invest in DeFi agreements that can surpass CeFi in all aspects

Hello everyone, my name is Kyle Samani and I am the co-founder and managing partner of blockchain investment firm Multicoin Capital . We specialize in blockchain and cryptocurrency investments and invest in this area with two funds. We have a hedge fund and a venture capital fund to invest in the primary and secondary cryptocurrency markets.

I spent most of my time reading various things about the cryptocurrency field and talking with other investors and entrepreneurs in this field. I am also very actively involved in the operation of the companies we invest in, helping them better handle various matters, from exchange listing to token design, corporate development strategies, recruitment matters, etc.

Yama: We know that Multicoin ’s investment objective is "theme-driven", Kyle, you wrote in the article. You have written a lot of articles, not only about the investment in the field of encryption, but also about investing in Tesla … Can you tell us where your ideas come from so many high-quality articles? Or, what inspired you?

Kyle Samani : I started writing in 2013. I set a goal for the 2013 New Year's plan: write 3 blogs a week. I actually did it! I wrote a total of 156 articles that year.

When I first started writing, the inspiration came mainly from the traditional venture capitalists I have been following, such as Fred Wilson from Union Square Ventures, Mark Suster from Upfront Ventures, and others. At that time, I didn't try to analyze cause and effect together, but imitated them, and I just started writing.

Although I didn't realize this problem at the time, continuous writing gave me the opportunity to create Multicoin Capital. Without the foundation of the original practice, I can't write as I do now-neither quantity nor quality will be like this.

Yama: You have invested in several Layer 1 projects such as Solana, Algoland, Nervos, etc. Which one is your favorite?

Kyle Samani : Although many people in the crypto space have lost interest in the new smart contract platform, we have not. In fact, our expectations for these opportunities are greater than ever.

I entered the field of encryption in 2016 because I wanted to see real Internet page-level capacity and trust-minimized applications. We are now beginning to see that such a system is truly supporting the global user base. Each new blockchain project has different strengths and advantages, which is why we invest in each of them.

For example, we invested in Nervos because they really focused on the adoption of Chinese users and the expansion of Layer 2. At the same time, we invested in Near because they are the leading team in the sharding process. If I were to choose only one, I would choose Solana . Solana is transitioning from the testnet to the mainnet. This project really focuses on the expansion of Layer 1 through pure engineering. We see that Solana has an absolute lead in three areas: 1) high throughput; 2) lowest latency; 3) lowest transaction cost.

The so-called "Layer 1 cannot be expanded" is very popular. When people see that Solana can really support 50,000 transactions per second in real-world parameters, they think there must be a trick. But counterintuitively, Solana did not actually try to deploy any new techniques. Fancy new tricks are things like Layer 2 and sharding, which are completely unverified. Solana is focused on what we know, focused on Layer 1, and only focused on pure engineering . I think the Solana protocol and implementation is a miracle of engineering.

Yama: Haha, after listening to this show, friends in Beijing must know that Solana is not just a shopping mall near Chaoyang Park in Beijing. This is also a cool Layer 1 project. The third question, what do you think of DeFi?

Kyle Samani : DeFi is part of open finance. Open finance is a part of our "mega theses". We wrote an article about this. I personally believe that DeFi will replace CeFi's huge volume globally in the next 10 years . Therefore, we are investors in the DeFi agreement.

When evaluating DeFi protocols, we usually focus on understanding how each DeFi protocol can surpass the CeFi version in every aspect. This is often difficult to do. But as the DeFi ecosystem continues to mature, it is much easier to discover this opportunity.

Dragonfly Partner: Asian CeFi companies are better than their European and American counterparts and grow faster

Hello everyone, I am Haseeb Qureshi , managing partner of Dragonfly Capital , a global crypto venture capital fund. My personal background is technical, and I used to be a software engineer. I often write things and share personal views through writing articles in our research organization Dragonfly Research.

Yama: I heard that you are still a professional player. Can you please talk about being a professional player, being a software engineer at Airbnb and in the encryption field, what are the most exciting things for you?

Haseeb Qureshi : My personal favorite part of professional players is its pure competitive nature . There are only a few things in life that are only about correctness. At the poker table, it does n’t matter who you are at all, what matters is that the cards are played correctly. If you do it right, you will get a reward. I like the feeling of players.

At Airbnb , I am very happy to work for a world-class software system, it will make people cherished. But at the same time, everyone working in a technology company has the same experience: People think that everything in a top company must be very elegant and perfect, like a well-lubricated machine. But you look around with the eyes of the engineer and find that everything is barely okay. You will think: "This place sucks. It's awkward. Other companies must have done a lot better." Privately, everyone in a technology company sees their owner in this way: you always think your little corner is dilapidated, and the rest of the world is in order. But in fact everything is tattered ! I don't know why, this world can basically work.

What excites me most in the field of encryption is that this is a technology that will change the world in the future. Frankly speaking, when I first realized this problem, I was still at Airbnb. At that time, I was developing their payment system. Airbnb had to solve the global payment problem. But if you look at how their global payments are processed, it will be fragmented.

I realize that for a global enterprise such as Airbnb, which is native to the Internet, this payment system is really not worthy of it. As an engineer, when I saw such a bad system, the first instinct was to delete this global payment system and completely rewrite one from scratch. I understood the meaning of the field of encryption. This is a group of scientists, economists, cryptographers, and game theorists gathered together and said, "If we understand all the problems of the current world, how about we rebuild a financial system from scratch?

That's where I understood that encryption will change everything. I believe that the way we deal with currencies in the next 50 years will be very different from the past 50 years. Cryptocurrency is the beginning of understanding the future currency , so I will put my full efforts into the field of crypto.

Yama: I see Dragonfly always say "Global from day one", what does this mean?

Haseeb Qureshi : Global from day one is Dragonfly's motto. The first level means that from the first day, the field of encryption is a matter of global impact. Since Wu Jihan translated the Bitcoin white paper into Chinese in 2011, the Bitcoin community has been a global community. Although most Internet companies are global companies on the surface, they are actually local companies. They serve customers in domestic or local cities, and they start to reach the international market until they reach a huge scale.

But in the field of encryption, since the birth of a token or an encryption company, transactions have begun in the United States, China, South Korea, and Germany. The encryption field has been affecting the world since its birth, this is the key! This is the digital economy of our digital age, which breaks through the physical borders.

But the second level means that as a company, we have served global customers from the day we were born. We have also managed to influence the global scope from the day of birth, because this is the case in the field of encryption. We have offices in Beijing and the United States, and our partnerships are spread all over the world. We believe that to do the right thing in the field of encryption, this is the only way.

You can think of an encryption company as a local company and look at the development of encryption companies in mainland China or Silicon Valley, but from this perspective, what you see is only part of it. This is like a story of a blind man touching an elephant. One person touches the tail of an elephant and thinks the elephant is thin and short. The other person touches the elephant's legs and thinks the elephant is like a big tree. If you only look at encrypted transactions or only technology, you cannot get an overview.

The only way to truly understand the field of encryption is from a global and multiple professional perspectives . From the first day of our birth, Dragonfly hopes to implement this principle.

Yama: What do you think of the centralized financial CeFi?

Haseeb Qureshi : CeFi is great. In this area, Asian companies are better than their European and American counterparts. Regulatory regulations are relatively cumbersome and business models are more innovative, making Asia a real step forward.

Looking at organizations like Bybit, they are growing much faster than their Western counterparts, and they have performed very well. We will continue to actively invest in CeFi products in China and hope to communicate with other entrepreneurs who are considering doing business in this area.

Cryptocurrencies as a whole are still very new, and the financial stack of cryptocurrencies is still in its infancy. From 5 to 10 years from now, the most powerful competitors in the industry will become very different, and there is still much room for innovation in this field.

HashKey Capital Deng Chao: Our style is not "theme-driven", but more concerned about ecological drive

Hello everyone! This is Deng Chao from HashKey Capital . I come from the traditional financial field and started to enter the blockchain field in 2014. HashKey Capital is the main investment institution under the HashKey Group. We all belong to the HashKey / Universal Blockchain ecosystem.

Our investment strategy is to avoid "theme-driven", consider " ecosystem-driven " more, and value long-term development. We mainly invest in three major areas: technology layer, application layer and crypto finance. We now manage two blockchain funds, one focuses more on equity investment and the other mainly focuses on token investment.

Yama: I know you have two lovely sons. Can you tell us how it feels to work from home?

Deng Chao : I have a kid two years old, and another four years old, all at the age of cats and dogs.

Working at home feels like a roller coaster. In the past year, I traveled two-thirds of the time and always wanted to go home with my family. We are stuck at the beginning of the house and it ’s not bad, we can relive the warm family life together. But the children in the house will challenge your limits.

After a week of quarantine, they have started yelling and chasing in the house. I can only take the path of "creative", take the "crazy play, crazy work" strategy, do my best to create games and various sports methods, let them play crazy, and then exhausted to go to bed early, so that I can have enough time Work at night or early morning. This method is still working.

Of course life is not easy, but this is life, face it, solve it, and then enjoy life to the maximum.

Yama: Great, both a great investor and a great dad! Next question: I remember in the last episode, we talked about the business model and adoption of investment. Can you tell us more about this issue?

Deng Chao : Yes, I remember last time we talked about the relationship between technology and business, and the principles of investment.

Technology is important, and it cannot be overemphasized. But for me, technology does not only mean laboratory or proof-of-concept, but to achieve scale, which can be commercialized and bring value to users. Excellent technology is an important part of achieving a successful business model and an important part of it.

From the perspective of investors, I think we must keep in mind: investment is to generate returns, not simply pursuing a vision, enthusiasm or like doing charity, especially early stage investment in the blockchain field.

Therefore, when we make decisions, we usually start with evaluating the technical strength of the project, and then advance to how their technical strength can be translated into commercial success. If I start a technology project, I will expect from the first day that this technology will be implemented on a large scale and achieve commercial success.

Yama: HashKey has been actively investing globally. Please state your favorite three of the companies you invest in.

Deng Chao : I am willing to point out an example in each of our three key investment areas:

Technical layer: I would say Ethereum . There is no need to introduce this. This is one of the earliest projects we invested in and one of the most proud investments. Despite repeated delays in the Ethereum timetable, there are still many technical difficulties ahead-of course all technical projects have many difficulties, but by most standards, Ethereum is still the most competitive public chain project, regardless of technical strength, The number of developers, the number of user communities or DApps, etc.

Application layer: I would say Maskbook , which is an excellent application of blockchain technology in the field of privacy protection. Maskbook uses the OTT_ (over-the-to) _ method, trying to build a bridge between Web 2.0 and Web 3.0 . Users can enjoy all the functions of decentralization and Web 3.0 through Maskbook without migrating from centralized platforms such as Facebook. Users can send encrypted posts that are only visible to friends, reward them with cryptocurrencies, build smart contracts, and even organize DAOs without using the APIs of Facebook or Twitter.

In the field of cryptocurrency finance: I will mention BlockFi , which is the only cryptocurrency loan platform supported by institutions, registered in the United States, and subject to U.S. regulation. This company is offering crypto asset management products that reach traditional financial standards. There are several reasons why I like BlockFi:

- BlockFi's team has rich experience and a professional-level founding team, which can bring excellent practices in traditional financial related product design, risk management, customer service, etc .;

- They embrace regulation . Unlike many crypto players who do their best to evade regulation, BlockFi strives to be compliant, accept regulation, and obtain all necessary permits in as many countries as possible. BlockFi founder Zac talked about more details in last week's show, and I highly recommend it to viewers who haven't heard it.

Founder of 1kx: Asian cultures are more likely to accept cryptocurrencies, and the advantages of DeFi are transparency and low fees

Hi everyone, my name is Lasse Clausen and I used to be a software engineer. I currently manage 1kx , an encrypted digital fund that invests in early projects. We invest in open source token networks such as Nervos, Arweave, and Terra. Our investors include Huobi, Dragonfly and Gnosis.

Yama: We know that 1kx invested in Terra and Nervos. Are you optimistic about the Asian market, why?

Lasse Clausen : East Asian culture is good at quickly adopting new technologies , while Europe does not accept new things like smartphones. In addition, here has a very strong video game culture, and can better understand the value of digital items. Coupled with the strong economic growth here, it is natural that I will be optimistic about the Asian market.

In fact, Layer 1 is a deep technical agreement that needs long-term development, so it requires a certain amount of faith, not something that can be perfected in a year and a half. Most of the Chinese practitioners I have contacted are more concerned about short-term returns, and the Nervos team has deep technical skills, so we invested in Nervos.

Our investment in Terra is that their co-founder is the head player in the Korean e-commerce field, accounting for only about 9% of the retail market in the US, and 40% in Korean e-commerce, which can be called the world's leading . Therefore, we believe that Terra's experience and advantages in the field of e-commerce, as well as solid technical development strength, can promote the large-scale application of cryptocurrency.

Yama: Please tell me the three benefits of DeFi quickly.

Lasse Clausen :

- DeFi's processing fee is close to zero, very low;

- DeFi protocol operators can not monopolize , and intermediaries have no way to abuse the network effect and extort money from the market. For example, you can think about the problem of the exchange asking for sky-high listing fees from crypto projects;

- Good transparency . It is difficult for the outside world to know how much leverage is hidden in CeFi and exchanges. So no one knows when a catastrophic deleveraging event like "Black Thursday" will occur. On the other hand, with MakerDAO, all data is public on the chain, and everyone can build a risk management tool on it.

Yama: You are an early encryption technologist and a crypto native. How do you keep curiosity in the field of encryption?

Lasse Clausen : Very simple, there are crazy activities in the encryption field every week. I think one reason is that the encryption community is globalized and license-free. People with different cultural backgrounds and all kinds of people can participate in it. I have not seen any The diversity of knowledge in the industry is comparable to the cryptocurrency field.

In addition, blockchain has spawned trust, and trust is an element that permeates all aspects of life and business, so it can reach people in many different industries and disciplines. These things make me full of excitement and curiosity.

Topic Q & A: How does the new crown epidemic affect blockchain investment?

Yama: We all know that the new crown epidemic has changed our lives. Now I want to hear your views on how the new crown epidemic affects blockchain and cryptocurrency investment. How is your fund affected? How have the companies you invested been affected? What will happen to the crypto market's recovery later this year? Please give us your freedom to share your thoughts.

Kyle Samani : Multicoin manages two funds. We have long / short hedge funds and one long-term venture capital fund.

In the secondary market, we are fortunate to have a hedge fund that can be long or short, and can use the short to hedge our positions in a market like March 2020.

Our investment portfolio in the primary market has achieved good investment results. Since our establishment, we have made about 25 private equity investments , and the invested companies all have very healthy balance sheets. Once we realize that the economic growth is slowing down, we will communicate with the companies we invest in in an orderly manner, understand their cash reserves, and do our best to help them. Fortunately, we don't need to do much.

Yama: Let ’s hear Haseeb ’s opinion.

Haseeb Qureshi : For Dragonfly, thanks to the global perspective, one of our gains is to prepare for the new crown ball outbreak. Since most of our team is in China, they have been at home since January, so we understand the seriousness of this situation and the epidemic is likely to spread to the United States. Therefore, we are fully prepared. We also told many companies we have invested in to prepare for this.

Overall, the crypto industry has made relatively good preparations for the new crown epidemic. I think this is because we live in a future industry and it is an exponentially growing industry. Therefore, we can easily see the impact of the virus spreading exponentially.

But the global impact of the epidemic is huge. The turmoil in the financial market has affected many companies we invest in. But overall, we are very fortunate to enter a completely digital industry. If it is influential, this industry's position will be strengthened because it is a substitute for the traditional financial system.

I think that when we look back on 2020 in the future, we will think this is the first real test of the vitality of encryption technology. Bitcoin was created during the last financial crisis and it will be tested during this financial crisis. I hope that when we look back in the future, we can say: Yes, the crypto world has proved itself and passed the test with amazing results.

Yama: Let ’s hear what Deng Chao thinks.

Deng Chao : I must say that at HashKey Capital, the new crown epidemic has changed the way we cooperate. For example, the inability to go to the office, such as reduced business trips, changed to work from home and communicated by means of communication.

We used to conduct weekly weekly telephone conferences from offices in three places, but in the worst period of the epidemic, it turned into dialing in from 10 people's homes and holding telephone conferences. Now we are gradually returning to normal working condition. In terms of work efficiency, we have not been affected much, and we are still actively reviewing projects. In the first quarter of 2020, we invested in 5 new projects, and the investment of the other 4 projects is in the final stage.

We mainly focus on the primary market and always want to discover and invest in the leaders in all segments. In addition, thanks to our fund's distribution strategy between cryptocurrencies and cash reserves, fluctuations in the secondary market have little effect on us. In fact, the sluggish secondary market has created a buying opportunity for us.

We regularly communicate with the companies we invest in. When we were in contact with them recently, it was a relief that they almost did very well. Some token projects, such as SKALE, have begun trading on large exchanges. The new round of financing for some equity projects is ending, and some technology projects have made milestone progress.

Financially speaking, many of the companies we invest in have cash reserves of more than 12 months. The downside is that we have also noticed the negative impact of the global epidemic and the downturn in the macroeconomic environment. We have seen that some projects in the market have difficulty in financing, or can only reduce their financing targets, and some overwhelmed investors have begun Reduce or suspend investment, and even consider transferring the equity of early investment to return cash.

Regarding market recovery, as I said before, we focus on the primary market and are not the best candidates to predict market conditions. However, we believe that no specific industry or asset class can survive macroeconomic cycles. When we discuss the impact of this epidemic, we may need to consider it in the context of a larger business cycle.

We believe that volatility in the secondary market will not change fundamentals. We are optimistic about the blockchain industry as always, and will continue to actively look for the best projects to invest in. Of course, we will also raise the investment threshold.

Yama: It ’s great to hear that so many venture capital funds are still actively investing. Lasse, what do you think of 1kx?

Lasse Clausen : Overall, early investment in the primary market has slowed significantly. But 1kx has a lot of cash. We signed a new investor last week. We are very excited to invest in outstanding early projects. Their tokens are already listed and traded, but we got a discounted price.

We believe that the cryptocurrency market has a 60% chance of returning to the level before the new crown epidemic in the fourth quarter of this year, and 40% may face a longer recovery path.

Remember, when everyone is afraid, that ’s the best time to invest. Moreover, never use leverage in the cryptocurrency market! It may continue to be more unstable than we thought, and being forced to close positions is something that no one wants to see!

Thanks to the support of the following media and community, check the QR code below to view the complete program video.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The secret history of bitcoin: exchanges where 120,000 bitcoins have been stolen can still survive to this day

- The number of BTC in the lightning network hit a new high of 9 months, and the throughput is faster than Alipay. Will it completely solve the bull market congestion?

- Blockchain Industry Weekly Report | When production cuts come, opportunities or challenges?

- Viewpoint: Google search volume for "halving bitcoin" has soared this year. Maybe nothing will happen after the halving?

- Coinbase: DeFi ’s high interest rate will be compressed, and the stabilizing currency bridge function will be more efficient, making DeFi mainstream

- Arbitrage in a plunge: Coinbase discovered these 3 unusual methods

- Babbitt column | Why advise ordinary people not to make contracts?