The secret history of bitcoin: exchanges where 120,000 bitcoins have been stolen can still survive to this day

Source: Hash Pie

Author: LucyCheng

At the end of February 2014, Mt. Gox was forced to suspend all trading activities due to the disappearance of 850,000 bitcoins. As a result, the price of bitcoin directly fell by 36 percentage points; two years later, the scale was almost comparable to the hacking incident Once again, the Bitfinex exchange discovered a security breach that caused the platform 119756 BTC to be stolen, causing Bitcoin to fall by more than 25% that day. Nowadays, Mt.Gox has been permanently loaded into history, but Bitfinex, which has also been hit hard, is still active in mainstream exchanges.

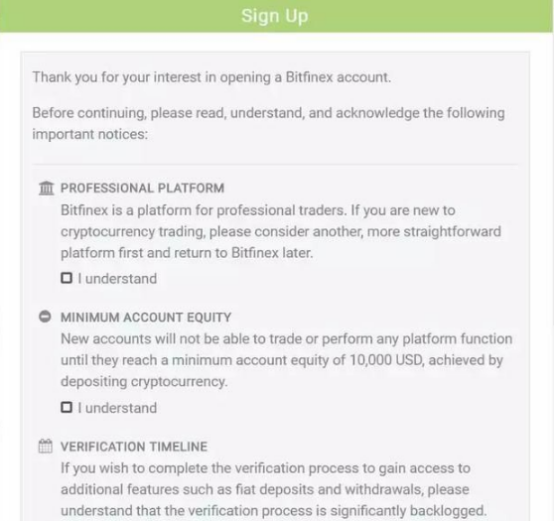

Instructions popped up when registering a Bitfinex trading account (screenshot from: Bitfinex official website)

- The number of BTC in the lightning network hit a new high of 9 months, and the throughput is faster than Alipay. Will it completely solve the bull market congestion?

- Blockchain Industry Weekly Report | When production cuts come, opportunities or challenges?

- Viewpoint: Google search volume for "halving bitcoin" has soared this year. Maybe nothing will happen after the halving?

Unlike other trading platforms that are committed to pulling users and attracting traffic, Bitfinex has a relatively high barrier to entry at the beginning. Not only does it give you a "warning of dismissal" as soon as you come up-the platform certification is very slow, if you want to deposit and withdraw, the certification will take six to eight weeks to complete; it also has certain requirements for the user's admission funds and activity . According to the advice on the official website, users must have at least 10,000 US dollars to enter the transaction; in addition, if they do not carry out the transaction after registration, an inactive fee will also be paid.

But even with these stringent requirements, Bitfinex still attracts a large number of users. Before 2018, the platform almost monopolized the entire emerging bitcoin trading market. Some trading experts believe that this is the result of providing P2P margin trading services. But behind this extremely popular exchange, there are also a lot of controversy and black materials.

First, there were two large-scale piracy incidents in the early years. The hacker attack mentioned at the beginning of the story caused more than 70 million US dollars of losses at the time, equivalent to nearly 36% of the assets of platform users. But then Bitfinex skillfully resolved the crisis by issuing a debt token called BFX. Although at the beginning, many people questioned that the token compensation was only a delay, Bitfinex did not intend to compensate; but half a year after the token was issued, the exchange successfully redeemed all BFX tokens and completely discharged the debt of this incident. crisis.

Screenshot from: Coinmarketcap

However, the hacking of hackers is just the tip of the iceberg in Bitfinex's dark history. Its frequent fiat currency channels and ambiguous relationship with USDT have also brought many thunderstorms to the field. In 2017, Bitfinex was accused by anonymous netizens of issuing coins out of thin air and manipulating the market. In 2018, the platform repeatedly reported that the cooperation relationship with traditional banks was interrupted. In 2019, Bitfinex was directly brought to court by the New York Attorney General's Office, saying that it used Tether The funds secretly make up for the loss of $ 850 million on the platform. But just like the previous stolen incident, Bitfinex seems to be able to turn around and return to life every time; under the dark material and infamy, it continues to issue platform currency LEO, actively enters the 1EO market and continues to be active in the cryptocurrency trading market.

However, after experiencing so many crisis moments, some users' trust in Bitfinex has dropped significantly; according to official data, during the early period when the New York Attorney General's Office sued Bitfinex, platform users withdrew at least 30,000 from the exchange Bitcoin and 1 million Ethereum. And as the exchanges in the field become more competitive, Bitfinex's ranking on the global trading platform has fallen to 50.

On the surface, Bitfinex's influence on the market has greatly diminished; but don't forget that there is a self-evident close relationship between USDT and Bitfinex, which currently account for more than 65% of global trading volume.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Coinbase: DeFi ’s high interest rate will be compressed, and the stabilizing currency bridge function will be more efficient, making DeFi mainstream

- Arbitrage in a plunge: Coinbase discovered these 3 unusual methods

- Babbitt column | Why advise ordinary people not to make contracts?

- Mu Changchun, Di Gang: Supply Chain Finance Analysis Based on Blockchain Technology

- Viewpoint: After halving, the Bitcoin network security model may need to be adjusted

- Viewpoint | Why is Ethereum a true representative of open finance?

- Popular Science | Auditable security and approximate activity of Casper FFG