Blockchain Industry Weekly Report | When production cuts come, opportunities or challenges?

Guide

2020 is an important year of production reduction in the development history of digital tokens, and multiple main circulation certificates represented by BTC will usher in production reduction.

Summary

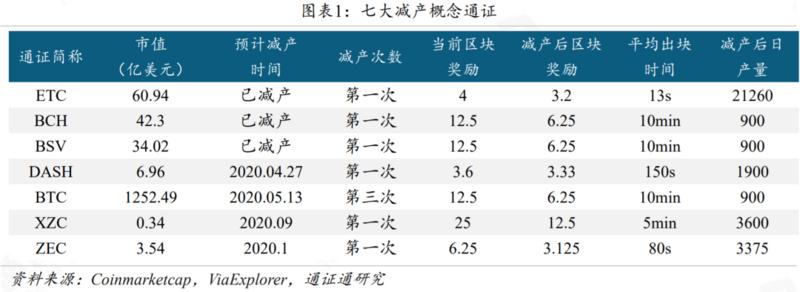

Topic: Opportunities or challenges as production cuts come? In 2020, the seven major circulation certificates of ETC, BCH, BSV, BTC, DASH, XZC, and ZEC will successively usher in production reduction. At present, ETC, BCH, and BSV have successively completed production reduction. Since BTC has experienced a huge bull market after halving the previous times, the market has strong bullish expectations for the reduction of the main circulation certificate. The market may usher in the bull market again with this round of production reduction, which will bring huge profits to miners. With the uncertainty of BTC price increase, miners also face huge risks. However, BCH and BSV experienced a loss of computing power after halving the block reward.

Quotes: Production cuts are coming and the market continues to fluctuate upward. The total market value of digital tokens this week was 200.28 billion US dollars, an increase of 6.82 billion US dollars from last week, or an increase of about 3.5%; the average daily turnover rate was 64.7%, up 0.5% from last week. The current price of BTC is USD 6685.49, a weekly increase of 2.0%, and the average daily trading volume is USD 38.5 billion. The current price of ETH is $ 158.41, a weekly increase of 11.5%, and the average daily turnover is $ 16.6 billion. This week's exchange BTC balance was 683,000, an increase of 4,895 from last week. The exchange's ETH balance was 14.978 million, an increase of 118,000 from last week. Among the BICS secondary industries, the proportion of project service industries has increased significantly.

- Viewpoint: Google search volume for "halving bitcoin" has soared this year. Maybe nothing will happen after the halving?

- Coinbase: DeFi ’s high interest rate will be compressed, and the stabilizing currency bridge function will be more efficient, making DeFi mainstream

- Arbitrage in a plunge: Coinbase discovered these 3 unusual methods

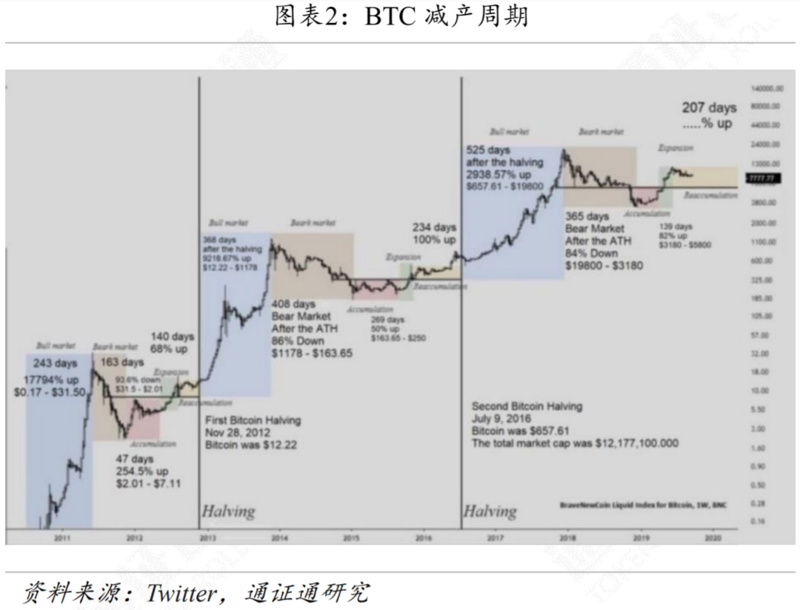

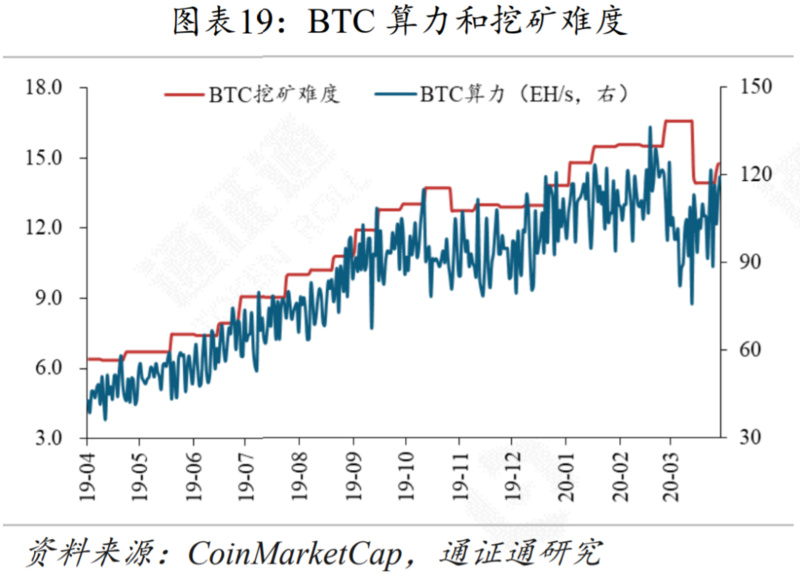

Output and popularity: BTC's computing power has increased significantly. The mining difficulty of BTC this week is 14.72T, which is 0.8T higher than last week, and the average daily computing power is 109.9EH / s, which is 8.1EH / s higher than last week. The average daily computing power is 174.8TH / S, which is 2.3TH / S lower than last week.

Industry: Industry standardization is inevitable. "Bitcoin Evolution" is using members of the British royal family to commit fraud; Kraken business development director: after halving, the BTC network security model may need to be adjusted; the British company suffered ransom attacks and paid hackers nearly 2.3 million BTC.

Risk warning: regulatory policy risk, market trend risk

text

1 Opportunities or challenges come as production cuts come?

2020 is an important year of production reduction in the development history of digital tokens, and multiple main circulation certificates represented by BTC will usher in production reduction.

The reduction of production, that is, the halving of block rewards, is a measure taken by Satoshi Nakamoto when designing the economic model of BTC to reduce the number of block rewards by halving every 210,000 blocks in order to control the total circulation. This mechanism is not only inherited by BTC's forked tokens BCH, BSV, etc., but also followed by many PoW consensus tokens.

1.1 Production reduction = increase?

In 2020, the seven major circulation certificates of ETC, BCH, BSV, BTC, DASH, XZC, and ZEC will successively usher in production reduction.

On March 17, ETC took the lead in reducing production, and the block reward after reduction was reduced from 4 ETC to 3.2 ETC; on April 8, BCH ushered in production reduction, and the block reward was reduced from 12.5 BCH to 6.25 BCH; on April 10, BSV completed the production reduction, and the block reward was reduced from 12.5 BSV to 6.25 BSV.

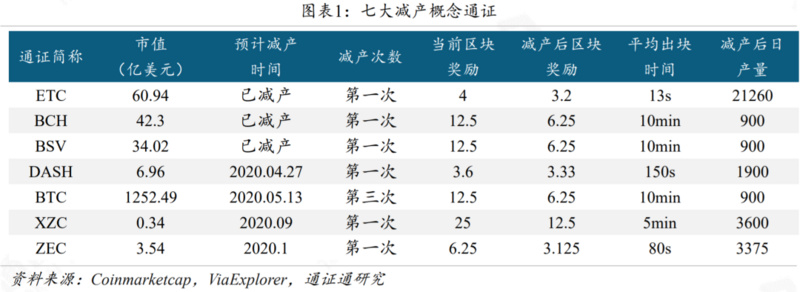

The market has strong bullish expectations for the reduction of the main circulation certificate, due to the turbulent bull market after the halving of BTC. Taking BTC's four-year production reduction cycle as a cycle, BTC's market can be divided into four stages: overheating period, recession period, recovery period, and expansion period.

As shown in the picture above, blue, brown, pink and green represent four different stages. BTC prices tend to rise rapidly after halving and enter an overheating period. BTC rose 92.19 times in 368 days after the first production cut and 29.39 times in 525 days after the second production cut. Before the production cut, it was a period of recovery and expansion. The market emerged from the shadow of a bear market and rebuilt confidence.

At present, ETC, BCH and BSV have successively completed production cuts, and there is still about a month before BTC production cuts. Earlier, due to the New Crown epidemic and other reasons, the market has undergone a downward adjustment to build the bottom, the market may once again usher in a bull market with this round of production cuts.

1.2 Loss of computing power due to production cuts

Block reward production reduction means that miner's income will decrease under the condition that the token price and cost remain unchanged, so the miner will also adjust the distribution of computing power according to market conditions.

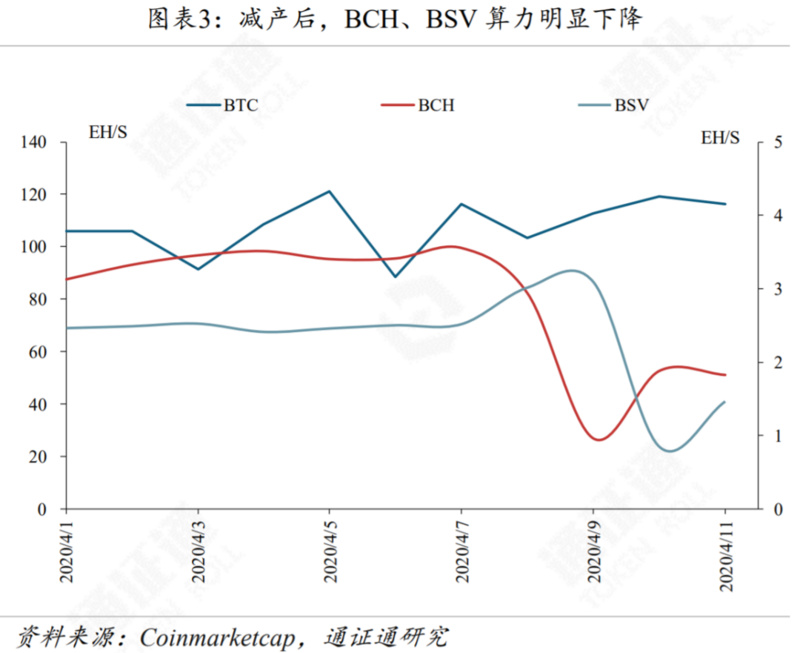

After BCH and BSV halved the first block reward in history, the block reward was reduced from 12.5 to 6.25. For the miners, under the condition that the price and cost of the token remain unchanged, the revenue is cut, so it appears The loss of computing power.

On the next day of BCH production reduction, the computing power decreased from 3.51 EH / S to 2.97 EH / S, and the lowest was once reduced to 0.96 EH / S. During the period, the computing power of BTC and BSV network increased gradually; the next day of BSV production reduction, the computing power decreased from 3.09 EH / S drops to 0.85 EH / S, while the BTC network-wide hashrate continues to increase.

However, due to the perception that the market halved, that is, good, the price of BCH rose nearly 20% and the price of BSV rose more than 30% the week before the production cut. The short-term increase in the price of the token has reduced the loss of miners to some extent. When BTC has not been halved, some flexible miners have chosen to switch their computing power to BTC, using the halving of BTC and the time difference of nearly a month to obtain more block rewards.

1.3 Opportunities and challenges faced by miners

After the halving of BTC, there has been a huge bull market. In 2020, the crypto asset market will usher in many tokens to reduce production, or it will push the market to usher in the long-lost bull market again, thus bringing huge profits to miners.

At the same time, miners are also facing huge risks. Because the halving is coming, there is uncertainty about the rise of BTC prices, but the decline in mining block rewards after the reduction of production is certain.

The mining industry is a capital-intensive industry with high fixed costs and high operating leverage. When the block reward is halved, the mining machine mining revenue will decrease. When the daily mining income of the mining machine is less than the variable cost (electricity + operating expenses), the mining machine will be shut down. The profit of the mining machine is severely squeezed, which directly leads to a significant increase in the price of the mining machine. At the same time, the payback period of the mining machine will be extended. Some mining machines will not even be able to pay back the cost.

2 Quote: The production cut is coming, the market continues to fluctuate upward

2.1 Overall market: production cuts are coming, the market continues to fluctuate upward

This week the ChaiNext Digital Asset 100 Index closed at 627.07 points, up 3.4%. The ChaiNext Digital Asset 100X Index closed at 1677.29 points, up 6.9%.

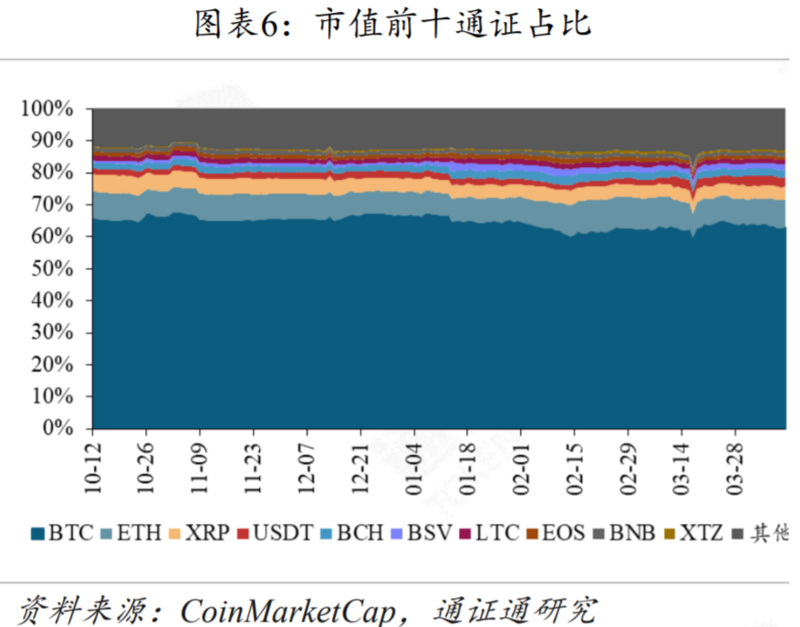

The total market value of digital tokens this week was US $ 200.28 billion, an increase of US $ 6.82 billion from last week, or about 3.5%.

The average daily trading volume of the digital token market was 133.37 billion US dollars, up 11.9% from last week, and the average daily turnover rate was 64.7%, up 0.5% from last week.

This week's exchange BTC balance was 683,000, an increase of 4,895 from last week. The exchange's ETH balance was 14.978 million, an increase of 118,000 from last week.

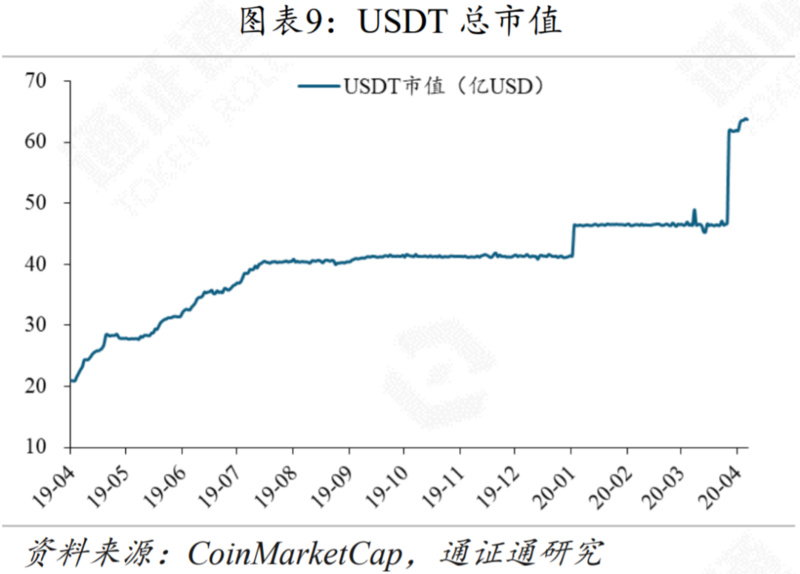

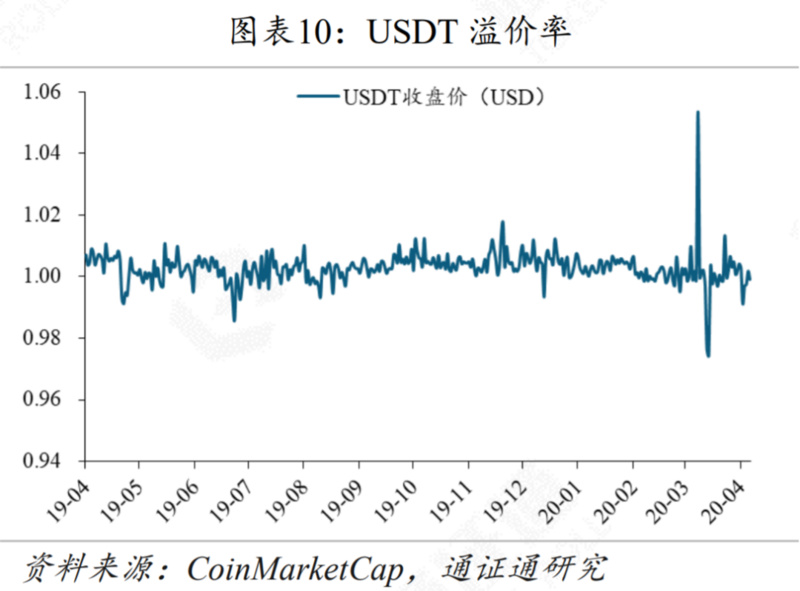

The market value of USDT is US $ 6.37 billion, an increase of US $ 189 million from last week, and the premium rate of USDT relative to the US dollar has increased.

2.2 Core Token: Main Circulation Pass Continues to Call Back

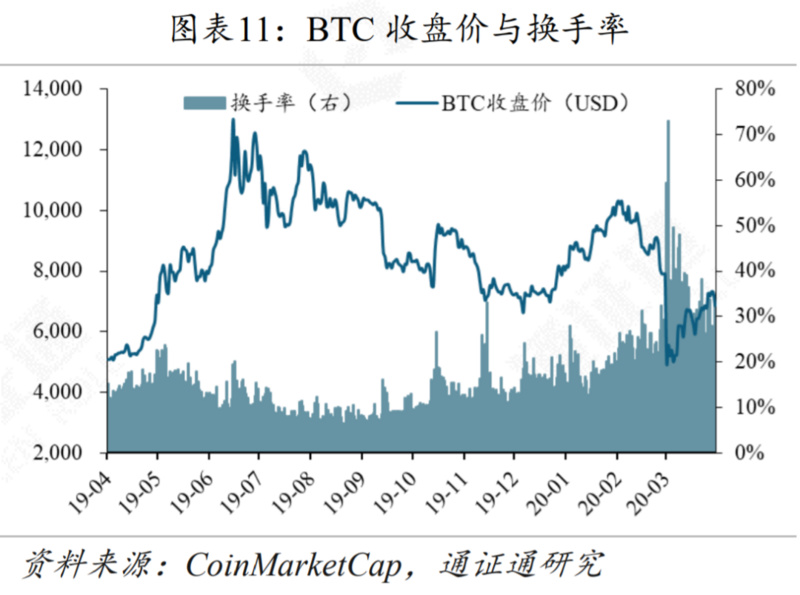

The current price of BTC is USD 6685.49, with a weekly increase of 2.0% and a monthly decrease of 13.2%. The average daily turnover was 38.5 billion US dollars, and the average daily turnover rate was 29.7%.

The current price of ETH is $ 158.41, with a weekly increase of 11.5% and a monthly decrease of 18.7%. The average daily turnover was 16.6 billion US dollars, and the average daily turnover rate was 93.1%.

The current price of EOS is $ 2.50, a weekly increase of 6.8%, and a monthly decrease of 18.3%. The average daily turnover was 3.36 billion US dollars, and the average daily turnover rate was 140.6%.

The current price of BCH is 233.09 US dollars, with a weekly decline of 1.2% and a monthly decline of 12.7%. The average daily turnover was US $ 4.04 billion, and the average daily turnover rate was 88.3%.

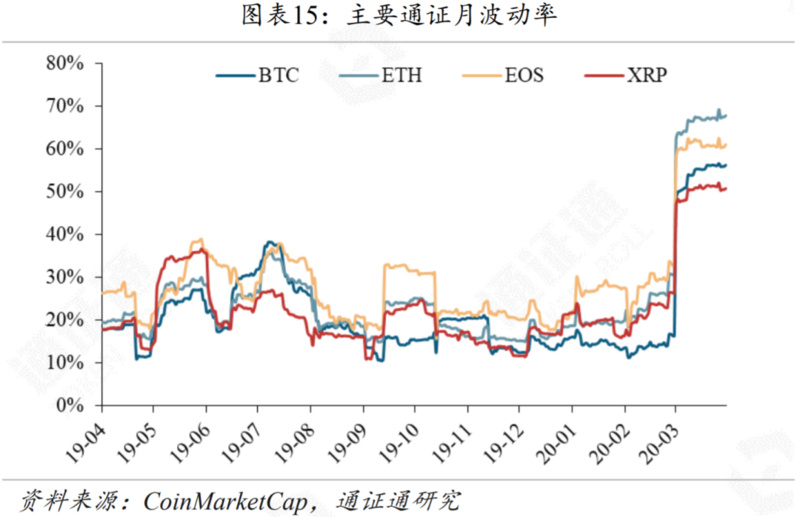

This week, the monthly volatility of major tokens remained basically the same, and price volatility remained relatively large.

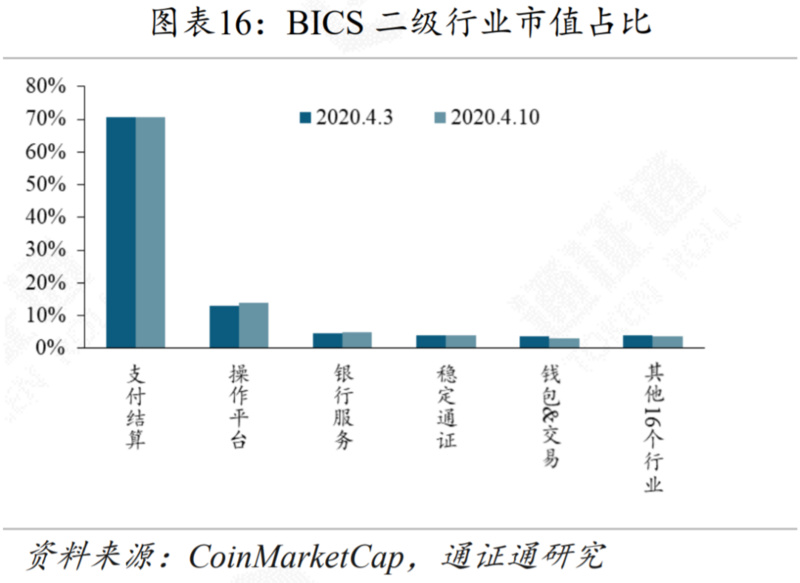

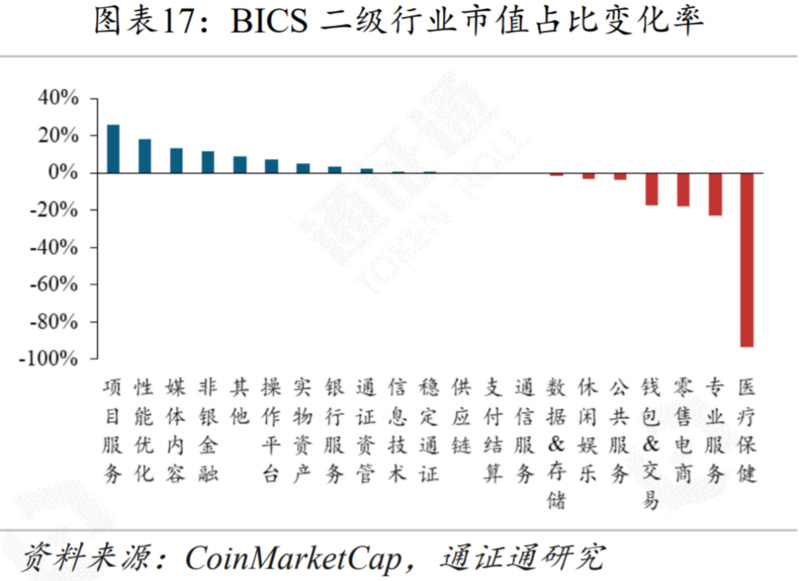

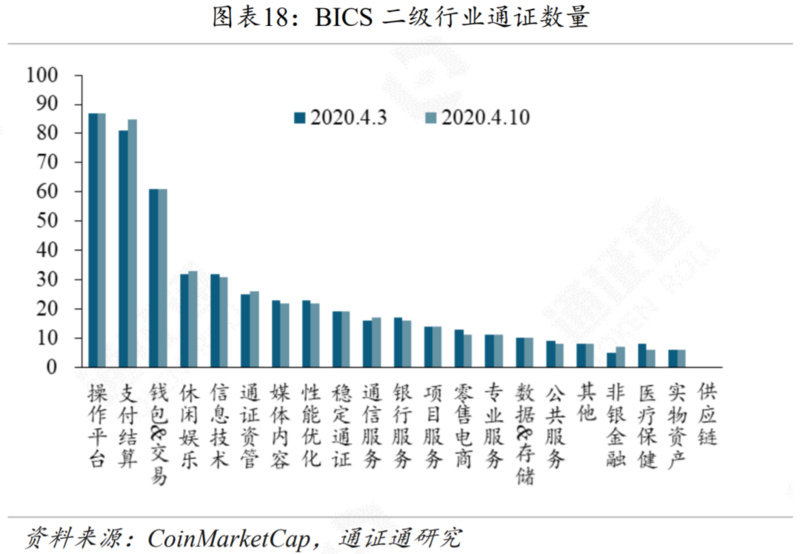

2.3 BICS industry: the proportion of project service industry increased significantly

Among the top five BICS (Blockchain Industry Classification Standard) secondary industries in terms of market value, the market value of the project service industry has increased significantly; the market value of the healthcare industry has declined significantly.

This week, the BICS secondary industry with a significant increase in the number of tokens is payment and settlement, leisure and entertainment, and the decline is more obvious in information technology and medical care.

2.4 Market View: The market went down after the production cut and ended the rebound

This week, the BTC hard fork BCH and BSV fell sharply after the reduction of production, and at the same time, the overall main circulation certificate fell, which ended the previous rebound. At the same time, it will drive the Byzantine generals question whether the encryption token can change the 51% attack theory and cause market speculation.

It may bottom out in the short term, but the market turbulence still requires attention to control positions. The halving of BTC market is approaching. The recent turbulent market provides investors with a more suitable price. It is still a good time to invest in digital assets such as BTC. Long-term currency holders can consider fixed investment or buying on dips.

3 Output and popularity: BTC computing power has increased significantly

BTC computing power has grown significantly. The mining difficulty of BTC this week is 14.72T, which is 0.8T higher than last week, and the average daily computing power is 109.9EH / s, which is 8.1EH / s higher than last week. The average daily computing power is 174.8TH / S, which is 2.3TH / S lower than last week.

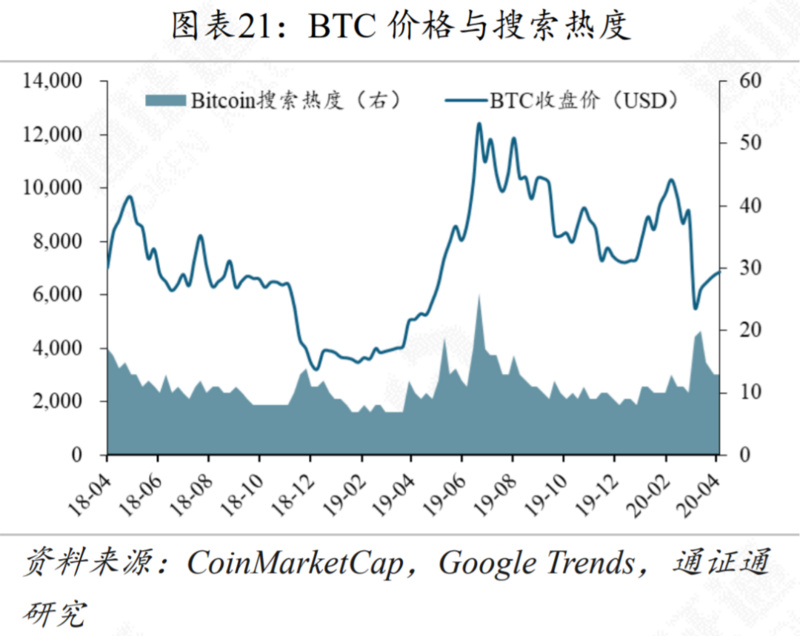

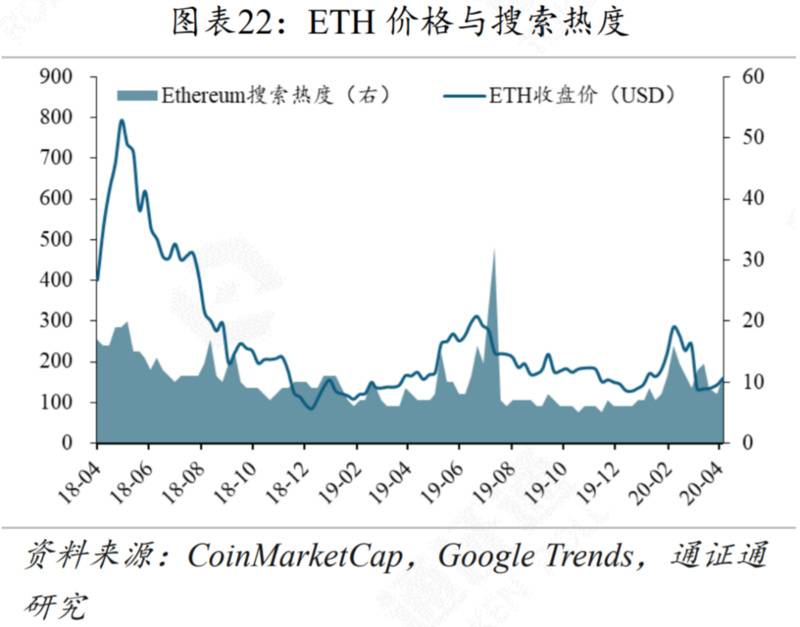

This week, Google Trends counted 13 Bitcoin search hits and Ethereum term search hits were 11.

4 Industry News: Industry standardization is inevitable

4.1 "Bitcoin Evolution" is using members of the British royal family to commit fraud

According to Cryptoglobe, a new BTC scam has emerged, using a fake report by the BBC based on Prince Harry and Meghan Markle to implement its crypto token fraud scheme. The advertisement claimed that the royal couple discussed a "wealth loophole" on a TV show, which could "turn anyone into a millionaire in three to four months." They are using cryptographic tokens to achieve "financial independence" and withdraw from the duties of royal members. The advertisement induces users to enter a crypto trading program called "Bitcoin Evolution" and tells investors that they can "become the next millionaire."

4.2 Kraken Business Development Director: After halving, the BTC network security model may need to be adjusted.

According to AMBCrypto, Dan Held, business development director of Kraken Crypto Token Exchange, said that in the next 30 days, BTC will experience the third block reward halving, which may have an impact on security. He pointed out: "In the long run, the security of BTC is the most important, and its security model can withstand attacks. One of the core parts is to focus on block rewards, which consists of block subsidies and transaction fees. We should Examine whether transaction fees will replace block subsidies in a meaningful way and whether they are sufficient to ensure the security of the network. "Held emphasized that when it comes to BTC and encrypted tokens, users will always turn to a more secure blockchain.

4.3 British company paid hackers nearly $ 2.3 million in BTC after being blackmailed

According to Cointelegraph on April 9, London-based Travelex paid hackers nearly $ 2.3 million in BTC after being ransomware attacked on January 11. Travelex confirmed the attack to the media shortly after the incident. However, they did not disclose that a ransom of about 285 BTC was paid after the system went offline for several weeks. The attack, called Sodinokibi (or "REvil"), is a malware attack that began leaking stolen data from multiple companies such as CDH Investments and the aforementioned London company earlier this year. Earlier on January 8th, Travelex was infected with ransomware, and hackers demanded $ 6 million worth of BTC.

Note:

For some reasons, some of the noun labels in this article are not very accurate, mainly such as: tokens, digital tokens, digital currencies, currencies, tokens, Crowdsale, etc. If you have any questions, you can call us to discuss.

For the original report, please refer to the research report released by "Tongzhengtong Research": "Certain production cuts, opportunities or challenges?" ——Blockchain Weekly Report 200412

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column | Why advise ordinary people not to make contracts?

- Mu Changchun, Di Gang: Supply Chain Finance Analysis Based on Blockchain Technology

- Viewpoint: After halving, the Bitcoin network security model may need to be adjusted

- Viewpoint | Why is Ethereum a true representative of open finance?

- Popular Science | Auditable security and approximate activity of Casper FFG

- Is the crypto lending market a time bomb?

- Micro-fiction | Economic Reversion and Human Brain Mining Machine in 2049