Top Warehouse Research Report Chain Game Guild Yield Guild Games

Top Warehouse Research Report Chain Game Guild Yield Guild GamesYield Guild Games (YGG) is a decentralized gaming guild built on ETH and Polygon. It pioneered the scholarship model, driving the rise of blockchain gaming guilds. Currently, its investment portfolio covers a wide range of games and types, which is beneficial for its future development in the Gamefi sector. Additionally, its community is one of the leaders in the industry, demonstrating a strong foundation.

Project Overview

YGG operates in the blockchain gaming guild sector.

Due to the rise of Gamefi in 2021, the popularity of Axie Infinity sparked a wave of blockchain players seeking economic opportunities. However, for many low-income gamers in developing countries, the cost of acquiring a $600 pet and the additional cost of three pets to engage in battles is unaffordable. In this context, the emergence of gaming guilds greatly reduces the entry barriers for players to participate in play-to-earn (P2E) games. Yield Guild Games, with its scholarship system, has led the rise of gaming guilds. The funding amount in this sector has seen significant growth in both 2021 and 2022.

- Generative Manufacturing Transforming Code into Physical Objects

- FriendTech Explosive Opportunity Aggregation of Content, Liquidity, and Account Information

- What is Bastion, the encryption product that received a $25 million seed round lead by a16z?

Yield Guild Games (YGG) is a decentralized gaming guild built on ETH and Polygon. It pioneered the scholarship model, driving the rise of blockchain gaming guilds. However, due to the current lackluster state of the gaming guild sector, the limitations of the scholarship model have gradually become apparent. As a result, YGG has shifted its development focus towards investing in high-quality games rather than solely P2E games.

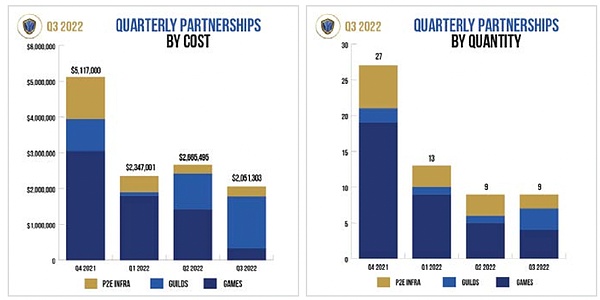

As of the third quarter of 2022, YGG has partnered with 55 Gamefi projects. Its investment portfolio covers a wide range of games and types, positioning it well for future growth in the Gamefi sector.

In addition to investing in game assets, YGG is committed to developing its community. Through the establishment of SubDAOs, suitable channels for communication and marketing are found in each country to expand influence and establish exclusive communities. This strategic approach has given YGG a significant advantage in terms of overall community scale compared to other guilds in the sector.

It is worth noting that YGG’s game asset investments experienced significant depreciation throughout 2022. Its investment style has gradually become more cautious. With fewer gold farming games in the current blockchain gaming landscape, investment income will be an important source of treasury revenue. Continued observation of changes in the treasury is needed to determine whether the project can weather future bear market phases. Additionally, if the development of the gaming guild sector is unfavorable, it will greatly limit the project’s growth potential.

1. Overview

1.1. Project Introduction

Yield Guild Games (YGG) is a decentralized autonomous organization (DAO) whose function is to invest in assets or tokens based on virtual worlds and blockchain games, optimizing the value of its community’s assets and achieving maximum utility.

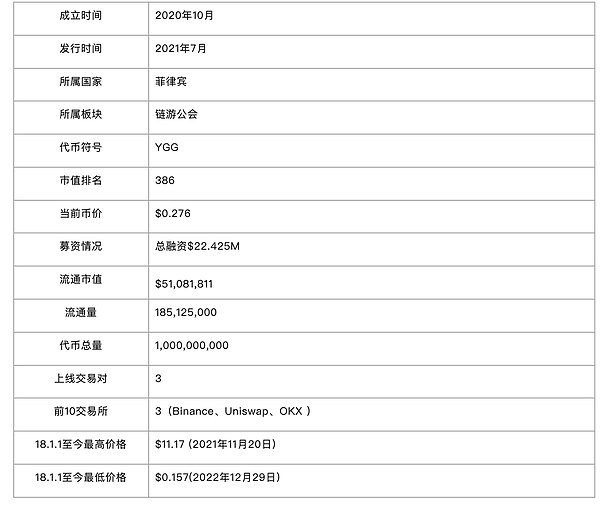

1.2 Basic Information

2. Project Details

2.1 Team

According to its official report, the YGG team consists of 48 people. From the background of its team members, most of them have backgrounds in blockchain and traditional gaming, and most of them are active participants in the Axie Infinity ecosystem.

Gabby Dizon, one of the CEOs and co-founders of YGG. He has been involved in mobile gaming since 2004 and entered the blockchain industry in 2018. In 2014, Gabby founded Altitude Games, a game studio based in Manila, which released the blockchain game Battle Racers in 2019. Gabby Dizon is an active member of the Axie Infinity and Yearn Finance communities and a board member of the Blockchain Game Alliance.

Beryl Li, one of the CFOs and co-founders of YGG. Beryl Li graduated from the University of Cambridge and has been involved in the blockchain industry since 2014. She served as the president of the University of Cambridge Cryptocurrency Association in 2016 and worked at BlackRock Asset Management. She is also a co-founder of CapchainX (acquired by SMKG OTC US) and a certified advisor to financial institutions.

Owl of Moistness, one of the CTOs and co-founders of YGG. He entered the blockchain industry in 2018. Owl of Moistness has developed breeding algorithms for Axie Infinity and many bots on its Discord, written smart contracts to integrate the Discord tipping system, wrapping contracts for deflationary tokens, and mining strategy contracts that comply with yVaults standards.

Alexei Udall aka Sarutobi, the partnership lead at YGG. He entered the blockchain industry in 2017 and has over 5 years of experience in SaaS sales and partnerships.

Nolan Manalo aka Nate, the gaming operations lead at YGG. He entered the blockchain industry in 2016 and is an active member of the Axie Infinity community and the head coach of YGG’s esports teams on various platforms.

Advisory Team:

Anil Lulla, co-founder and COO of Delphi. Anil has a good reputation in the research and technical consulting of cryptographic assets. Delphi oversees the token design of YGG, and Anil will also provide guidance and effective fund management until full decentralization.

Eric Arsenault, partner at Metacartel Ventures. Since 2018, Eric has been a leader in the DAO field. He is a partner and investor at Metacartel Ventures and the head of the Rarible DAO ecosystem. Prior to this, he worked at DAOstack, providing consulting services to many leading DAO projects in the industry. Eric will provide advice to YGG on DAO structure and the transition to decentralization.

2.2 Funds

YGG has conducted four rounds of financing so far, with a total amount of $22.425M, as follows:

Table 2-1 YGG Financing

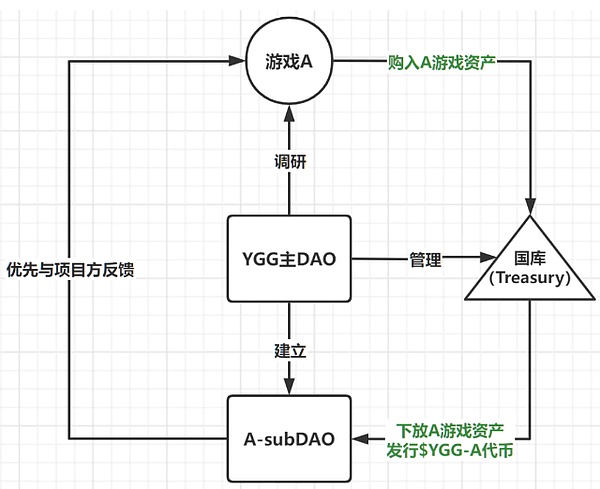

According to the statistics of the on-chain treasury assets provided by YGG, the financial situation of YGG’s treasury is as follows. Based on YGG’s current team size, its overall funds are expected to support the DAO through this bear market.

Table 2-2 YGG Treasury Assets

2.3 Code

The YGG code repository is not open source.

2.4 Product

Yield Guild Games (YGG) is a decentralized gaming guild built on ETH and Polygon. It pioneered the scholarship model to drive the rise of blockchain gaming guilds. However, due to the current sluggishness in the blockchain gaming space, the limitations of the scholarship model have gradually emerged. YGG has started to shift its development focus towards investing in high-quality games rather than purely play-to-earn (P2E) games. At the same time, it enhances its community influence through various strategies to expand the community. Therefore, we will mainly introduce the project from YGG’s investment landscape and its community structure.

2.4.1 YGG Scholarship Model

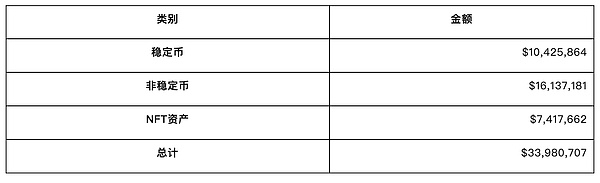

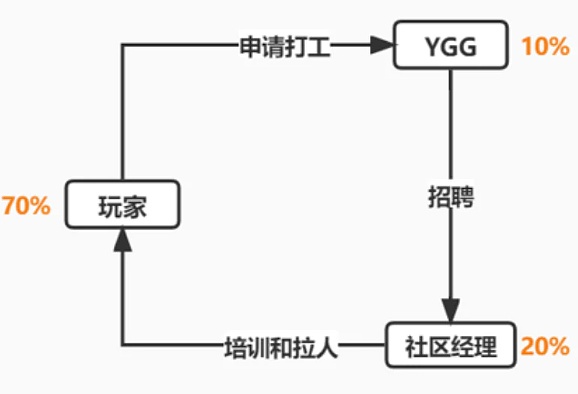

As shown in the following figure, the scholarship system created by YGG is operated by three parties: for players who lack NFT assets required to enter the game, they can apply for work in the guild on Discord, borrow NFT assets, and spend time earning in-game token rewards; for the guild, they need to purchase a certain quantity of NFT assets to lend to approved players; for the community managers, they need to recruit, screen, and train qualified gold farmers. The tokens earned by players need to be shared with the guild and community managers. Currently, YGG’s revenue sharing ratio is 7:2:1, which means players can receive 70% of the tokens, community managers can receive 20%, and the guild can receive 10%.

Figure 2-1 Scholarship System Business Process

The scholarship mechanism essentially helps bring more gold farming-oriented players to GameFi. This group of players can help attract attention and expand the game community in the early stages. However, once in the middle and later stages, in the current situation where the token models in the blockchain gaming space are generally immature and the death spiral trap is prevalent, the damage caused by a large number of gold farmers to the game itself is extremely serious and will accelerate the collapse of the GameFi economic model.

This means that the operation of the scholarship system is difficult to sustain in a single Gamefi. The guild needs to constantly search for profitable Gamefi in order to obtain profits. However, during the bear market, profitable Gamefi are very rare, which may result in the guild having no income for a long time.

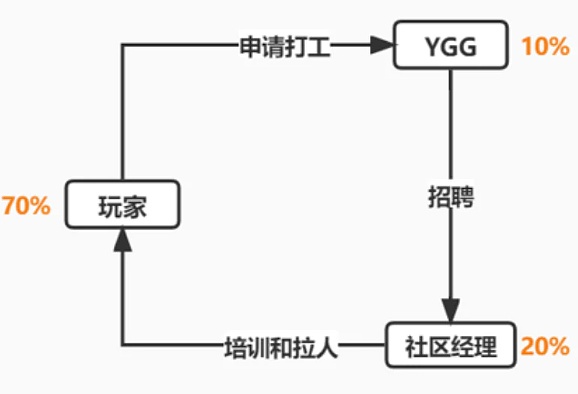

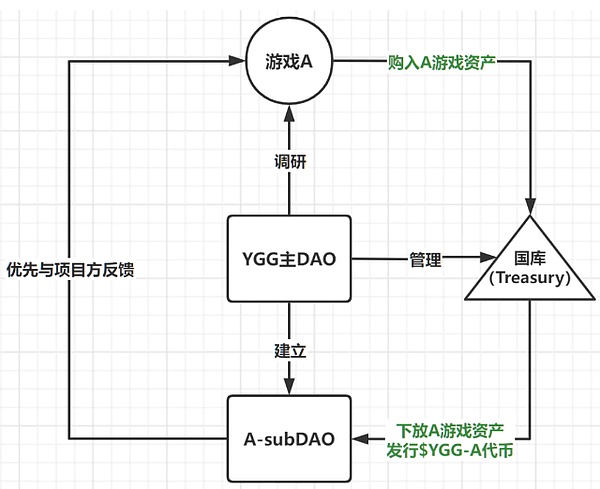

2.4.2 Operation Mechanism of YGG DAO

The treasury assets of YGG DAO (tokens, NFTs, virtual land) are managed by the YGG Treasury Department, currently supervised by the three co-founders of Yield Guild. These assets can only be used when two of the three co-founders sign a transaction or when the DAO community initiates a proposal to deal with the assets.

Another major mechanism of YGG is the creation of different SubDAOs based on different regions and games. SubDAOs are DAOs that focus on specific games or specific regions. Each SubDAO can have its own governance rules. SubDAOs allow guilds to operate locally. When a SubDAO is created, YGG will first conduct research on the game, then buy NFT assets within the game and put them in its treasury wallet, and finally appoint managers for the SubDAO and transfer the NFT assets to a smart contract wallet controlled by the SubDAO;

At the same time, YGG will issue tokens for SubDAOs, such as YGGLOK, which is created by YGG for League of Kingdoms. After the token issuance of the SubDAO, YGG will reserve a portion of the SubDAO’s tokens for future governance participation; SubDAO token holders can vote on governance issues specific to that SubDAO, giving them a say in its operations.

Functionally, as the main DAO, YGG will be more inclined to cooperate with more game developers, invest, and manage its treasury assets; most of the work related to incubating and attracting users for specific games will be carried out by SubDAOs; for regional SubDAOs such as YGGJaLianGuain and YGGSEA, which focus on games in Japan and Southeast Asia respectively, YGG will invest and build communities. SubDAOs will recruit local talents for management, regularly organize activities in the local area, and strive to develop guild localization and expand YGG’s influence in various regions.

Figure 2-2 SubDAO Establishment Process Diagram

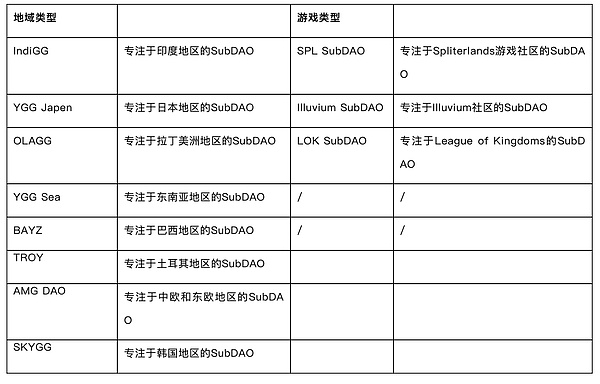

Currently, there are a total of 12 SubDAOs under YGG, as shown below:

Table 2-3 SubDAOs under YGG’s Territory

From the table above, it can be seen that the total number of members in all SubDAOs under YGG has exceeded 350,000. The following are the main SubDAO introductions:

YGG SEA: YGG SEA is YGG’s first regional SubDAO, aiming to provide community services to Southeast Asian countries other than the Philippines. By the end of 2021, YGG SWA had raised a total of $15 million in funding. In the past year since its establishment in November 2021, it has organized over 1,000 online events and participated in over 500 speaking events (including AMAs, interviews, podcasts, etc.). It has held 4 large-scale live events in Indonesia, Vietnam, Thailand, and Malaysia, and conducted more than 20 roadshows in Indonesia and Singapore.

YGG JaLianGuain: YGG JaLianGuain is a SubDAO focused on the Japanese region. This DAO received a $2.8M investment led by Animoca Brands in July 2022. Currently, the DAO mainly focuses on providing development and marketing support for blockchain games driven by various IPs in Japan.

BAYZ: BAYZ is a SubDAO focused on the Brazilian region. This DAO was invested $4M by YGG DAO in July 2022. The DAO expands its community influence by launching a dedicated cryptocurrency-related education and content platform website and creating and spreading the concept of Play-to-Earn (P2E) on channels such as Twitch and TikTok. Currently, the DAO has more than 40 content creators, and its share of viewing time on Web3 game Twitch in Brazil exceeds 70%.

IndiGG: IndiGG is a SubDAO focused on the Indian region. This DAO builds communities using offline and online nodes, which are described as micro-influencers or sub-communities within their guild. Offline nodes include various colleges and university campuses within the IndiGG network, while online nodes are mini-communities of 5,000 to 15,000 Discord users.

Ola GG: OlaGG is a SubDAO focused on Spanish-speaking countries such as Mexico, Colombia, and Argentina. The founder of this SubDAO is a partner in a family office that manages over 20 billion in assets. The DAO raised $8M in June 2022.

AMG DAO: AMG DAO is a SubDAO focused on Central and Eastern Europe. Currently, the members of this DAO are distributed across 11 European countries, making it the largest game guild in Central Europe. In addition, Troy and SKYGG are SubDAOs dedicated to Turkey and South Korea, respectively.

Figure 2-4 YGG’s SubDAO Map

2.4.3YGG‘s Investment Map

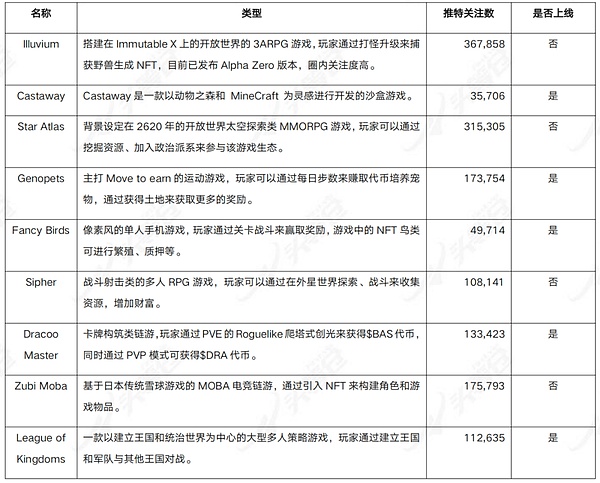

As of the third quarter of 2022, according to the YGG Q3 community report, YGG has partnered with 55 GameFi projects. Below is a list of its main investment projects:

Table 2-4 YGG Cooperation Project List

2.4.4YGG Community Operations

YGG expands its community and enhances community cohesion through the launch of the Guild Advancement Program (GAP), promoting collaboration between community members and cooperative games. Participants need to complete achievement tasks officially released by YGG, such as reaching a certain duration in cooperative games, recruiting a certain number of players to join YGG, and hosting high-quality streaming content, to receive YGG token rewards and corresponding NFTs. This program is one of the key directions for YGG’s current development.

Guild Advancement Program Season 1 (GAP): Most of the achievement tasks in Season 1 were created by the game operations managers and community marketing managers in YGGDAO. There were a total of 45 achievement tasks in Season 1, with over 500 participants. A total of 102,160 YGG tokens and 1,030 corresponding achievement proof NFTs were distributed. The program ran from April 2022 to July 2022, lasting for 3 months.

Guild Advancement Program Season 2 (GAP): In addition to the game operations managers and community marketing managers in YGGDAO, the YGG ambassadors also participated in creating achievement tasks for their respective games. There were a total of 116 achievement tasks in Season 2, involving 13 partner games. The scope of achievement tasks in Season 2 was broader, including tasks related to game collaboration, content creation, community tool building, instructional video recording, and other skill-based tasks. Season 2 had 603 participating wallets, and a total of 225,226 YGG tokens and 2,063 corresponding achievement proof NFTs were distributed. The GAP program for Season 2 started in September 2022 and ended in December 2022, lasting for 3 months.

Figure 2-5 YGG Achievement Task Plan Interface

In addition to earning YGG token rewards through the GAP program, community members can also participate in the Reward Vault of partner games launched by YGG to incentivize players who hold guild badges to stake $YGG and receive related token rewards from partner games. The second phase of the Reward Vault is currently open.

Reward Vault Phase 1: Lasted for 90 days, opened for staking on July 28, 2022, and rewards were released starting from August 1. The Reward Vault included two projects, Aavegotchi and Crypto Unicorns. Stakers could receive token rewards ($GHST and $RBW) from both projects. Over 3.5 million YGG tokens were staked in total after the event ended.

Reward Vault Phase 2: Lasted for 90 days, opened for staking on November 13, 2022, and rewards will be distributed until February 12, 2023. Users who hold YGG guild badges can stake YGG tokens on the Polygon Reward Vaults and receive token rewards from League of Kingdoms and Thetan Arena ($THG and $LOKA).

Summary:

As the pioneer of blockchain gaming guilds, YGG’s main focus in 2021 was on promoting Axie Infinity and its scholarship program. However, with the downturn of the blockchain gaming sector in 2022, YGG started to gradually invest in high-quality games, transitioned to a fund model, and worked on incubating games and expanding its community to attract cooperation from future games.

It can be seen that by establishing SubDAO, suitable dissemination and marketing channels can be found in each country to expand the popularity and influence of YGG and blockchain games, thereby establishing exclusive communities in different countries. This strategic planning step is beneficial for YGG to quickly expand its community size when Gamefi explodes in the future.

3. Development

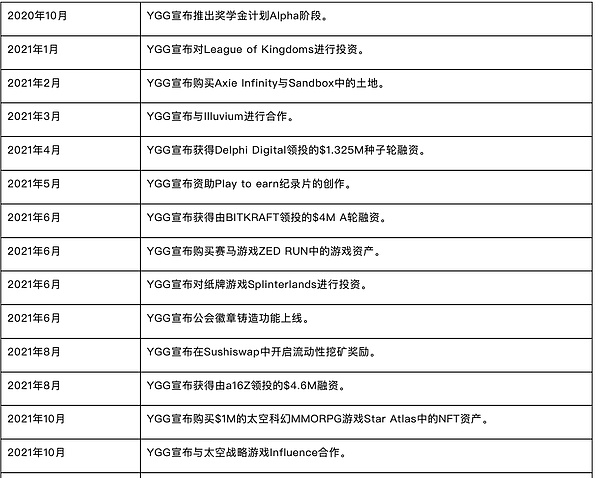

3.1 History

Table 3-1 YGG Major Events

3.2 Current Situation

3.2.1 Operational Data

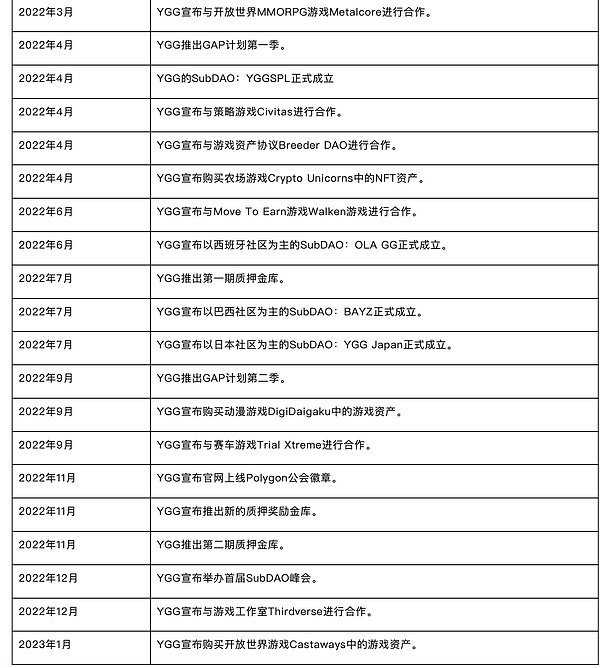

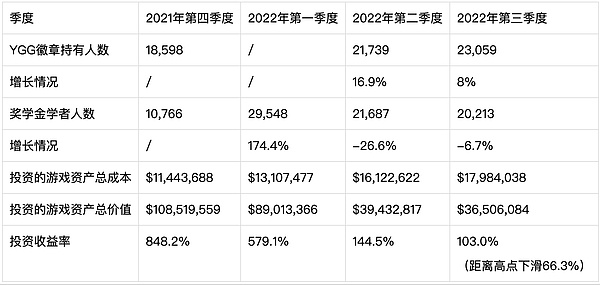

Table 3-2 YGG Community Data and Investment Asset Changes

From the above table, it can be seen that the number of badge holders in YGG is showing a slow increase, indicating that the number of community members is also slowly rising. However, the number of scholarship recipients has declined over two quarters, mainly because the P2E model did not produce popular games in the second half of 2022, resulting in no rewards to attract new players to join the scholarship program. As for YGG’s investment situation, the total value of its investment assets has dropped from over 100 million in the fourth quarter of 2021 to 30 million in the third quarter of 2022, a decline of 66.3%. It can be seen that the bear market has caused a significant retracement in its overall assets. However, in terms of profitability, the decline is mainly in terms of profits, and its investment portfolio as a whole is still profitable.

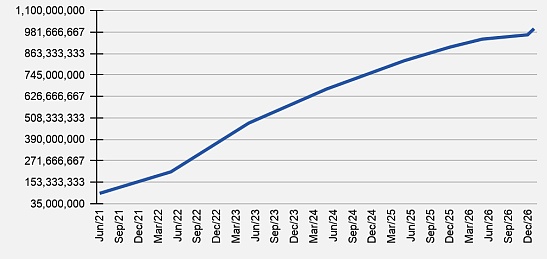

Figure 3-1 YGG Scholarship Program Scholar Count

Figure 3-2 YGG Investment Situation

From the above images, it can be seen that the number of scholarship recipients in YGG has been declining since 2022, but due to the expansion of SubDAO, the overall number of scholarship scholars has maintained a certain level of stability in the following months, but it has also shown a downward trend since mid-2022. As for the number of YGG’s investment and the amount of investment, both the quantity and amount have shown a downward trend throughout 2022, indicating that YGG’s investment style in games has gradually shifted towards caution during the bear market.

3.2.2 Social Media Scale

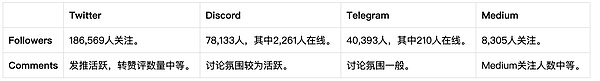

Table 3-3 YGG Social Media Data

3.3 Future

Currently, YGG has not disclosed its roadmap.

Summary:

YGG’s community size has been slowly increasing during the bear market period, but its invested gaming assets suffered significant losses throughout the entire year of 2022. Its investment style is gradually becoming more cautious. With fewer gold farming games in the current blockchain gaming market, investment income will be one of the important sources of treasury income. It is necessary to continuously observe the changes in its treasury to determine whether the project can survive the future bear market phase.

4. Economic Model

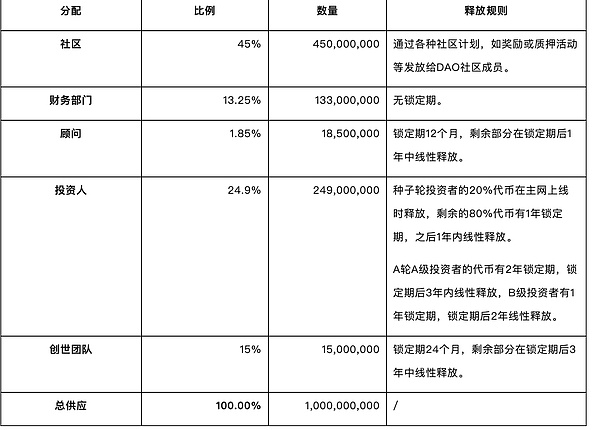

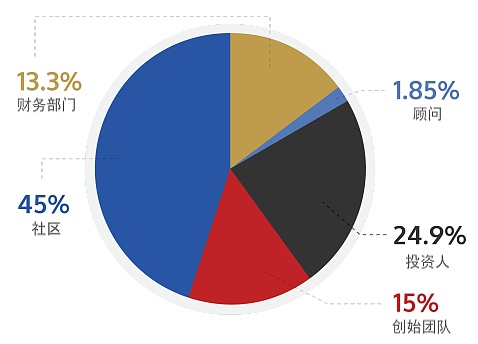

The native token of Yield Guild Games is YGG, with a total supply of 1,000,000,000 tokens.

4.1 Token Distribution

The distribution of YGG tokens is as shown in the following table:

Table 4-1 YGG Token Distribution

Figure 4-1 YGG Token Distribution Details

Figure 4-2 YGG Token Unlock Schedule

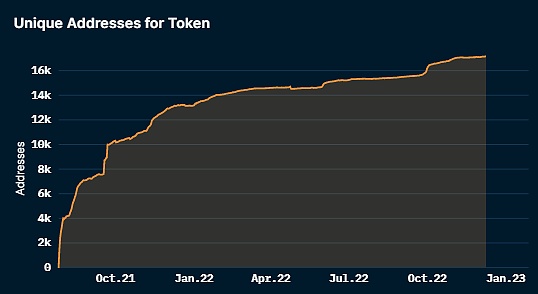

4.2 Holder Address Analysis

According to data from the Ethereum browser, as of January 16, 2022, there are 18,726 YGG holder addresses on the Ethereum network. The top 10 addresses hold 91.86% of the YGG tokens, and the top 100 holder addresses account for 98.59%. Most of the top 10 addresses are contract and exchange addresses. If we exclude the tokens held by contract and exchange addresses, the top 10 on-chain addresses hold about 4.52% of the tokens, indicating a relatively low concentration of holdings.

Figure 4-3 YGG Holder Address Distribution

Figure 4-4 YGG Holder Address Changes

Looking at the Nasan coin address data, the number of YGG holder addresses had a rapid growth rate before 2022 and has been maintaining a slow growth trend since the second half of 2022.

4.3 Token Utility

Currently, YGG tokens serve the following purposes:

1. Staking tokens can earn rewards in the form of sub-DAO tokens or tokens from cooperating game projects;

2. DAO members holding YGG tokens can initiate proposal voting on the website, including but not limited to the following topics: 1) technology; 2) products and projects; 3) token distribution; 4) governance structure.

5. Competition

5.1 Industry Analysis

YGG is in the blockchain gaming guild track.

5.1.1 Industry Overview

In the traditional gaming industry, game guilds are formed to allow players to gather and cooperate, conquer dungeons or collectively defeat bosses. For example, in World of Warcraft, top guilds often compete for the first dungeon clear or boss kill. In addition to this cooperative aspect, traditional game guilds also focus on player socialization and content sharing, becoming the community hub for the game.

In Web3, with the rise of the Gamefi track in 2021, the success of Axie Infinity sparked a frenzy among blockchain players. However, for many gamers in low-income countries, the cost of acquiring the required NFT assets for gameplay, such as a $600 pet that often requires three to start battles, is unaffordable. In this environment, the emergence of blockchain gaming guilds has greatly reduced the barriers for players to enter Play-to-Earn (P2E) games, with the scholarship system pioneered by Yield Guild Games leading the rise of these guilds.

The scholarship system is one of the important mechanisms in blockchain gaming guilds. As shown in the diagram below:

For players who lack the necessary NFT assets to enter the game, they can apply to the guild for work, borrow NFT assets, and spend time earning in-game token rewards. For guilds, they need to acquire a certain number of NFT assets to lend to approved players. For community managers, their role includes recruiting, screening, and training qualified players. The tokens earned by players are shared among the guild and community managers. Currently, the revenue sharing ratio in YGG is 7:2:1, where players receive 70% of the tokens, community managers receive 20%, and the guild receives 10%.

Figure 5-1 Scholarship System Workflow

Due to the significant profits generated for players in the first half of 2021 by Axie Infinity, the profit model of blockchain gaming guilds under this system has been proven feasible. With the growing YGG community, more guilds are emerging to tap into the potential of blockchain gamers. The chart below shows the significant increase in funding for blockchain gaming guilds in 2021, with a monthly funding amount of over $40 million in December 2021, indicating exponential growth. However, the funding situation for blockchain gaming guilds in 2022 is relatively average.

Figure 5-2 Funding Situation of Blockchain Gaming Guilds in 2021-2022

5.1.2 Characteristics of Chain Game Guilds

In addition to reducing the entry barrier for players, game guilds also play an important role in guiding games to acquire new users. For example, in the scholarship system, community managers will train players on how to create wallets, how to use wallets, and how to trade in basic cryptocurrency knowledge in DEX. Through this method, traditional gamers can quickly get started and expand the user base of blockchain games.

With the development of chain game guilds over the past year, the following characteristics have gradually emerged:

1. Limitations of the scholarship mechanism: The scholarship mechanism essentially helps Gamefi bring in more players who focus on gold farming. This group of players can help attract attention to the game and expand the game community in the early stages. However, once it enters the middle and later stages, in the current situation where the token models in the chain gaming track are generally immature and the death spiral dilemma is prevalent, the damage caused by a large number of gold farming users to the game itself is extremely serious and will accelerate the collapse of the Gamefi economic model.

This means that the operation of the scholarship system is difficult to sustain in a single Gamefi. Guilds need to constantly search for profitable Gamefi in order to make profits. However, during bear markets, there are not many profitable Gamefi, which may result in periodic income for the guild;

In addition, the current ordinary scholarship mechanism of chain game guilds only applies to P2E games. However, it is uncertain whether P2E games will continue to exist or decline in the long run.

As the Gamefi track continues to mature, more and more Gamefi are starting to have their own leasing systems, such as Starshark and Pegaxy. The emergence of leasing systems will also squeeze the target players of the scholarship system. Once more players choose to use leasing systems instead of using dividend scholarship systems like YGG, the income of such guilds will decrease significantly.

2. Regional nature of guilds: Currently, mainstream guilds are mainly distributed in Southeast Asia. For example, the largest guild in this track, YGG, has its main community players in the Philippines. GuildFi, which is dedicated to developing Gaas (Guild-As-a-Service), has its main community located in Thailand. The largest chain game guild in Vietnam is Ancient8.

3. Future development shows fund and functional characteristics: After the success of the scholarship model, guilds began to look for the next “Axie Infinity”. Therefore, current guilds generally participate in the early NFT presales of chain game projects and work to obtain a certain number of NFTs through cooperation in preparation for the game’s launch in the later stages;

In addition to NFTs, guilds may even serve as early investors in many chain game projects, transforming their roles from NFT leasing intermediaries and player communities into investment funds for the chain game track;

In addition to the direction of fund development, guilds are also exploring other development directions, such as providing data services, community services, and traffic services for cooperative projects, as well as providing systematic management services for guild scholarship systems and income systems, towards functional development.

4. Highly dependent on the development of the blockchain gaming track: Regardless of whether the revenue of the blockchain gaming guild is dependent on the deduction mechanism of the scholarship system or the return on investment in Gamefi, both are based on the development of the blockchain gaming track. The blockchain gaming track is still in its early stage, and there is great room for growth in the future. For a gaming guild, whether it can grow with this track and ensure the continuous profitability of its investment portfolio is crucial.

5.2 Track Projects

As shown in the figure below, the top 1000 projects in terms of market value in the blockchain gaming guild track include Merit Circle, Yield Guild Games, and GuildFi. Since the mechanism of Merit Circle is similar to YGG but not as complete, the following comparison will mainly focus on Yield Guild Games and GuildFi.

Figure 5-3 Market value ranking of blockchain gaming guilds

5.3 Comparison of competitive factors

5.3.1 Competitive project mechanisms

Yield Guild Games (YGG): YGG is the largest blockchain gaming guild in the cryptocurrency field, founded by three founders who have deep roots in the mobile gaming industry and the blockchain gaming industry. YGG has a complete scholarship system and SubDAO system. If players want to join YGG, they need to mint the YGG Guild Badge, which is the guild emblem and the tool for players to enter the YGG website portal. Players need to have this badge to register for scholarships, view their achievements, and participate in SubDAO token sales.

Figure 5-4 YGG official website page

In addition to the scholarship system introduced in 5.1.1, another major mechanism of YGG is the creation of different SubDAOs, or subsidiary guilds, based on different regions and different games. When a SubDAO is created, such as a game-based SubDAO, YGG will first conduct research on the game, then buy NFT assets within the game and put them into its treasury wallet, and finally appoint managers for the SubDAO to transfer the NFT assets to the smart contract wallet controlled by the SubDAO.

At the same time, YGG will also issue tokens for SubDAOs, such as YGGLOK for the SubDAO created for League of Kingdoms. After the token issuance for the SubDAO, YGG will reserve a portion of the SubDAO’s tokens to participate in its governance in the future.

Functionally, as the main DAO, YGG will be more inclined to cooperate with more game developers, invest, and manage its treasury assets. Most of the work related to incubating and attracting traffic for specific games will be handled by SubDAOs. At the same time, for regional SubDAOs such as YGGJaLianGuain and YGGSEA, which target Japan and Southeast Asia respectively, they will focus on game investments and community building. SubDAOs will recruit local talents for management, organize regular activities locally, and strive to develop guild localization and expand the influence of YGG in various regions.

Figure 5-5 SubDAO Creation Process Diagram

In addition, SubDAO will have autonomous asset management rights and scholarship commission mechanisms, which means it can independently determine the scholarship distribution ratio for the games it manages. The token of SubDAO essentially represents the underlying value of its treasury assets. If the games managed by SubDAO generate a large amount of revenue, the main YGG DAO will benefit from holding the tokens of its SubDAO. In other words, the value generated in SubDAO can eventually accumulate into the governance tokens of YGG.

Currently, YGG has a total of 11 SubDAOs, as shown in the table below:

Table 5-1 SubDAOs under YGG’s Territory

5.3.2 Business Data Comparison

Table 5-2 Number of Collaborative Gaming Projects

|

Name |

Quantity |

Details |

|

Yield Guild Games |

55 |

Its collaborative project map covers most well-known blockchain games. |

|

GuildFi |

21 |

Collaborative projects with well-known blockchain games are relatively fewer compared to YGG. |

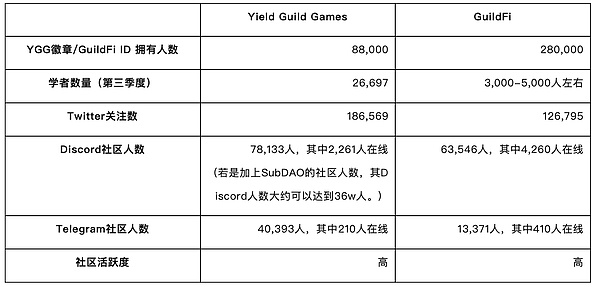

Table 5-3 Community Data

From the above table, it can be seen that YGG’s collaborative projects are both in greater number and higher quality compared to GuildFi. One reason is that YGG’s development direction leans more towards the investment and community side, while GuildFi leans more towards the functional side. In terms of community data and community size, the number of YGG scholars is much higher than that of GuildFi. In terms of community size, YGG has a larger overall ecosystem community size due to the better development of regional SubDAOs. In terms of community activity, both communities are at a high level.

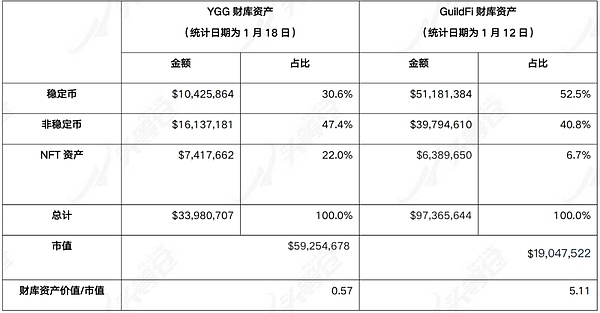

Table 5-4 Treasury Asset Comparison

From the above table, it can be seen that the majority of YGG’s treasury assets are non-stablecoin assets, with YGG tokens being the main component, accounting for over 80% of the non-stablecoin assets. Therefore, the overall value of YGG’s treasury assets is greatly influenced by the price of YGG tokens. On the other hand, nearly half of GuildFi’s assets are stablecoin assets. In the face of a bear market in the cryptocurrency market, YGG’s treasury assets may face significant shrinkage compared to GuildFi due to this asset allocation.

Summary:

The scale of the blockchain gaming guild track is not large at present, and the community scale is even smaller than the user scale of popular blockchain games. The entire track has a large room for growth. After nearly a year of development, blockchain gaming guilds are beginning to show trends towards fundization, functionalization, and localization;

Among them, the leading project in this track, YGG, is committed to investing in and cooperating with early-stage high-quality blockchain games. It creates different SubDAO organizations based on different regions and game projects to expand its ecosystem. In addition to cooperating with blockchain game projects to build communities for user acquisition, GuildFi is also committed to developing in the direction of functionality. It aims to become a guild service platform by developing tools such as scholarship management systems, cooperative game data panels, and guild discovery. This forms two different development paths with YGG;

In terms of business data, YGG currently has a slight advantage over GuildFi in terms of both community scale and the quantity of high-quality cooperative games. In terms of community scale, YGG has a greater advantage, and the high-quality blockchain games that YGG is deploying may further benefit its development in the future. However, in terms of financial situation, GuildFi’s treasury is slightly better than YGG’s. The competition pattern in this track is not fierce at present, and there may be multiple guilds that divide market share together with different advantages in the future.

6. Risks

1) Track Risk: This track is highly dependent on the development of the blockchain gaming track. The income of blockchain gaming guilds is based on the scholarship mechanism and the return on investment in Gamefi, both of which are built on the development of the blockchain gaming track. If the development of the blockchain gaming track is not good, it will greatly limit the upper limit space of this track.

2) Financial Risk: YGG’s treasury assets have shrunk significantly in the second quarter. In the current situation of fewer gold farming games in the blockchain gaming industry, investment income will be an important source of treasury income. It is necessary to continue observing the changes in its treasury to judge whether the project can survive the future bear market phase.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Evening Must-Read | How AI Reshapes the Cryptocurrency and DeFi World

- LianGuai Morning News | Musk considers charging all Twitter users

- Rollups are competing fiercely. Will a monopolistic Rollup emerge from the competition?

- Ethereum Merger One Year Anniversary What Changes Have Occurred in the MEV Supply Chain

- Lawsuit tug-of-war escalates, SEC requests investigation into Binance.US assets

- Celebratory Token2049 and Serene Singapore

- Rollups are competing fiercely, will a monopolistic Rollup be emerged as a result?