Tracking: Where did most of the assets of Plustoken go?

Original title: Huobi's involvement in the PlusToken Ponzi scheme

Source: The Block

Author: LARRY CERMAK

Although the fund project PlusToken collapsed in June this year, billions of assets were involved in it, and countless people lost their money. However, the question of how many assets are involved and how many have been sold by the project side is still hazy.

- Opinion: Three major issues to be addressed by DeFi

- Comment: When Ding Crab meets PlusToken, is it possible to invest in metaphysics?

- Babbitt Column | What is Digital Transformation?

The collapse and impact of this scam has attracted a lot of attention, but different institutions and researchers have different research results on the incident.

According to the tracking of blockchain analysis company Chainalaysis, a total of 180,000 BTC (about 1.3 billion U.S. dollars), 6.4 million Ethereum (about 814 million U.S. dollars), and 111,000 USDT entered the PlusToken wallet.

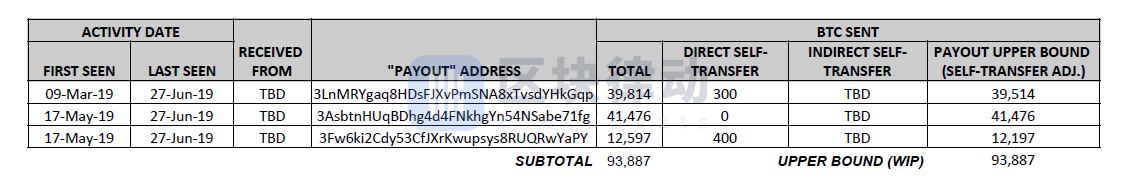

Elementus, another analytics firm, estimates that PlusToken collected nearly 10 million Ethereum from approximately 800,000 participants. According to independent researcher ErgoBTC, it traced as many as 93,900 BTCs related to the address of Plustoken, and these BTC parts have been sent to the trading platform.

However, how many assets are returned to PlusToken users and how many assets are retained by the PlusToken organizer. The analysis company and researchers have not reached an agreement, but from the information disclosed, many trading platforms have been involved. Huobi is one of them.

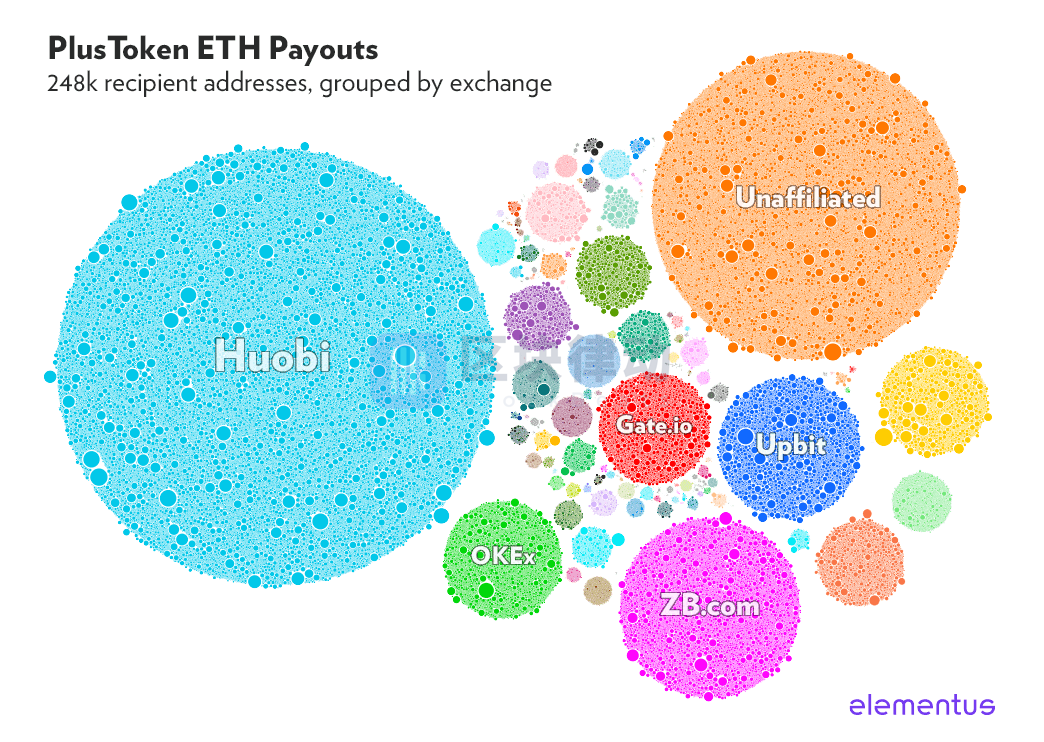

Elementus found that 48% of all ETH withdrawn from the PlusToken wallet was sent to Huobi. In addition, ZB.com, Upbi, OKEx, Gate.io and other trading platforms are one of the transfer destinations.

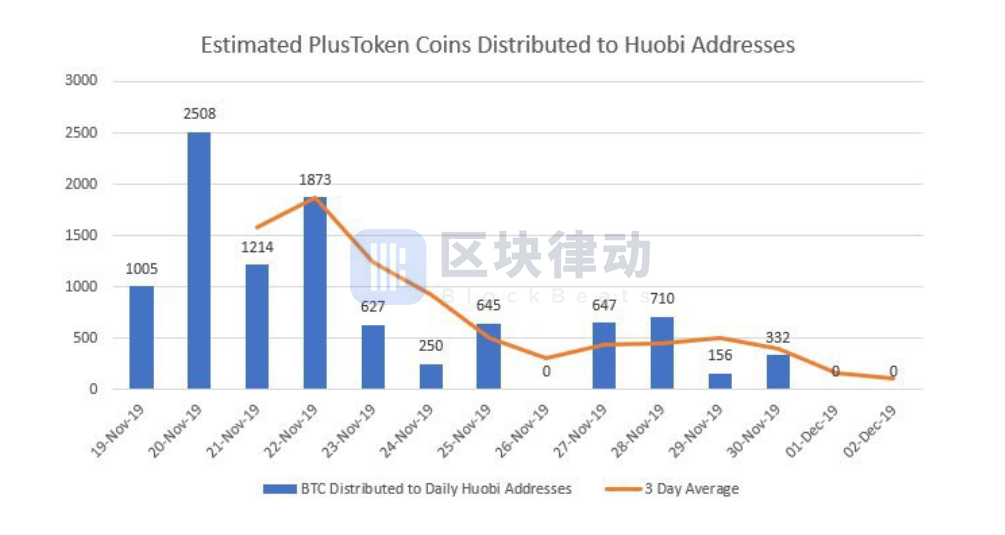

According to the analysis of ErgoBTC, from the figure below, it can be found that on the day of November 20, 2,508 BTC were sent to the address labeled Huobi, and on November 22, 1873 BTC were sent to the address labeled Huobi. Although the transactions sent to the Huobi platform address continue, the speed has dropped significantly from mid-November to early this month.

In addition, Chainalysis's analysis also found that "almost all funds" were transferred to the address of Huobi Global's OTC broker. Although this part of the OTC broker has been operating independently, this part of the address can still be marked out.

A report caused a slump

On December 17, bitcoin plunged below $ 6,900 in the early morning, and some traders said that the reason for the plunge was triggered by a Chainlysis report on PlusToken.

According to Coindesk, Chainalysis's report was released on Monday, and the report states that 20,000 Bitcoin and 790,000 Ethereum are still under the control of people associated with the PlusToken scam. Traders believe that this conclusion caused a panic in the market, which led to the plunge.

Original link: https://www.theblockcrypto.com/genesis/51084/huobis-role-in-enabling-plustoken?li_source=LI&li_medium=recommended-articles

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- One article goes through: Is the blockchain a database?

- We use these ten sentences to pay tribute to the 2019 Chinese blockchain | Year-end inventory

- Chen Yulu, deputy governor of the central bank: Global stablecoins will impact the currency sovereignty of a country, and may replace the current currency nationwide or even globally

- Eight members of the U.S. Congress sent a letter to the IRS asking for clear cryptocurrency tax laws

- Meng Yan: Digital assets are the core of the digital economy upgrade. Its eight advantages promote the digital economy upgrade and flourish.

- Nanfengfen: Is there any play for digital currency to replace sovereign currency?

- ECB President: Stablecoin is not stable, it will be regulated as a payment system