Twitter Featured|Encryption Investors: Say the whales manipulate the big bull market in 2017, which is the performance without industry experience.

Bloomberg Crypto reports that two American scholars say that Bitfinex's "big whale" (whale: super big) means that it is likely to manipulate the 2017 bull market, as their research found that every time Bitcoin falls by a certain amount At the time, the purchase of BTC on Bitfinex increased.

According to Bitfinex's general counsel, scholars' research has fundamental flaws because they do not collect enough data.

Alistair Milne, a cryptocurrency entrepreneur and investor, has a clear opposition to the above statement. He said:

- DCEP vs Libra: Digital Currency Competition in the Context of Globalization

- ETH 2.0 is coming online, what are the main changes?

- “Agriculture + Blockchain”: from farm to table, from sowing to inclusive finance

Anyone who writes "single whales" or TEDA's manipulation of bitcoin clearly has no contact with any company in the bitcoin industry in 2017.

Every bitcoin-related company I invested in has a growing user and volume of transactions in 2017.

In November 2017, the Coinbase Exchange added 100,000 new users per day. The Coinbase exchange usually also has a USDT premium.

Here's a statistical table that I added to my Twitter account every month (the table shows a significant increase in followers in 2017.) Did this whale create 10,000 Twitter accounts?

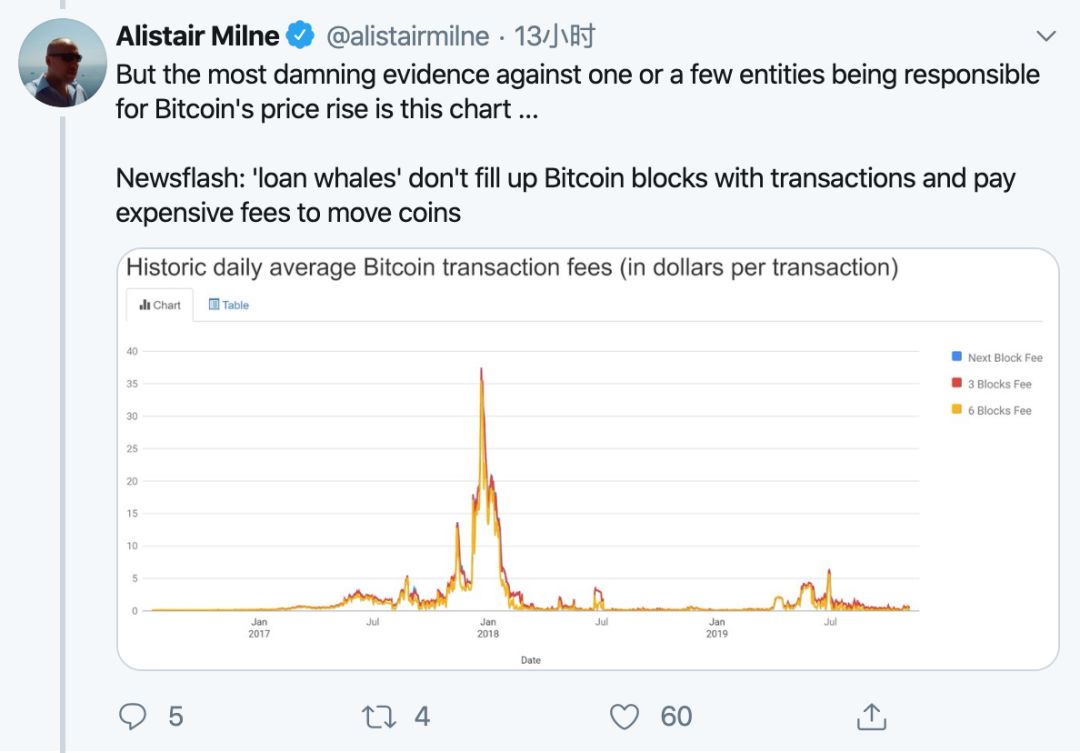

But the more important rebuttal of the evidence that a few people manipulate bitcoin prices is this form….

Whales will not initiate a transaction to fill the Bitcoin block and pay a fee to transfer Bitcoin.

According to MakerDao's release of the migration risk warning, on November 18th, the Maker agreement will be upgraded to a multi-mortgage Dai version (MCD version) as planned. The current single mortgage Dai (SCD version) will run in parallel for a while. (Note: At present, the stable currency Dai can only be generated by mortgage ETH. The Makerdao team plans to upgrade the agreement on the 18th of this month to change the single mortgage into multiple mortgages. The first supported token is BAT, and other alternative tokens include OMG. , GNT, ZRX, etc.)

By then, the MakerDao community will be responsible for managing two Dais, two stable currency rates and two system management. This brings various risks to the Maker agreement. After the upgrade, the single-backed version of Dai will be called "Sai", and the multi-mortgage version of Dai will be called "Dai."

According to Cointelegraph, due to the severe regulatory environment of cryptocurrency in the United States, Firecoin will ban global users from using the Firecoin platform. Firecoin will provide users with a grace period until November 13, and users can refund and mention account assets. All US user accounts will be frozen.

It is reported that the fire currency will not completely withdraw from the US market, the fire currency will follow the currency, and the regulated fire currency US (HBUS) will be launched to serve the US users.

It is reported that the fire currency will not completely withdraw from the US market, the fire currency will follow the currency, and the regulated fire currency US (HBUS) will be launched to serve the US users.

In addition, the fire currency is also opening up the legal currency of the countries. At the end of the year, the Turkish Lira will be introduced to the French currency, allowing Turkish users to obtain USDT stable currency by wire transfer to the country's legal currency (Lila).

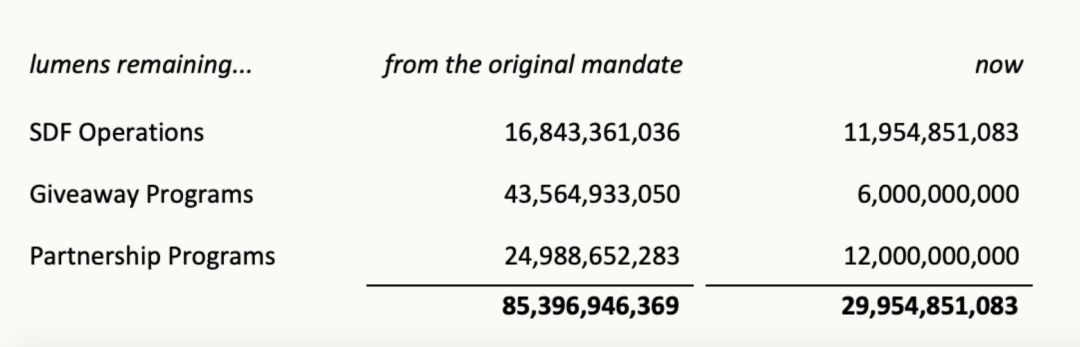

1. Stellar announced that it has destroyed 55 billion XLM tokens (of which 5 billion were destroyed in the operation plan and 50 billion were donated to the plan), and the cumulative destruction was about 50%.

The current total number of tokens in Stellar is 49.95 billion (of which 20 billion are in the market and another 29.95 billion in the hands of the Stellar Development Fund (SDF).)

2. According to The Block, the People's Bank of China Digital Currency Research Institute and Huawei signed a strategic cooperation agreement on financial technology. The cooperation on financial technology (fintech) has not disclosed more details.

—— End ——

Turn around every day and see the big coffee point of view, bringing you the freshest and most interesting points. Welcome message, forward!

On this issue: March only hope Source: No public wildflowers say

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Nakamoto is coming again, this time he has blonde hair and 250,000 bitcoins.

- Ethereum Enterprise Alliance, in conjunction with Microsoft, IBM, etc., launched a general classification of standards to promote cross-platform transactions

- People's Daily Ye Hao: Promoting the safe and orderly development of blockchain

- The Fed is hiring digital currency executives, and the “Join Refund” plan has been forced to restart?

- Data: Bitcoin has outperformed gold for 10 consecutive years. How about 2020?

- Monthly News | SEC Deterrence: October IEO, STO financing amount is 0, ICO fell by 95%

- BTC tested the upper resistance in the early morning, and the disk gradually stabilized.