The SEC once again reached a settlement with the ICO issuer through a fine of nearly 10 million US dollars.

Earlier, the SEC filed a temporary restraining order to freeze the assets of Reggie Middleton and its two entities, Veritaseum, Inc. and Veritaseum, LLC (collectively known as Veritaseum). These assets include personal and project funds from Reggie Middleton's traditional financial institutions such as Bank of America, Citigroup and JPMorgan Chase, as well as his accounts on the cryptocurrency exchanges Gemini, Kraken, Coinbase, and 15 addresses on the Ethereum blockchain. .

The SEC accused Reggie Middleton and Veritaseum of selling 51 million unregistered digital currency VERI through ICO and raising 69,000 Ethereum (valued at $14.8 million at the then ETH price), in violation of the US Federal Securities Act. Registration and anti-fraud regulations.

The SEC also accused Reggie Middleton of inducing retail investors to purchase their VERI tokens by disseminating misleading information. In addition, he was suspected of raising the price of VERI by brushing and promising high returns. The price of VERI was pulled up by about 315% in one day. Reggie Middleton has said that it will attract more investment by continuously publishing the volume or price of growth. Reggie Middleton is suspected of misappropriating $520,000 in investor funds for personal consumption and transferring investor assets.

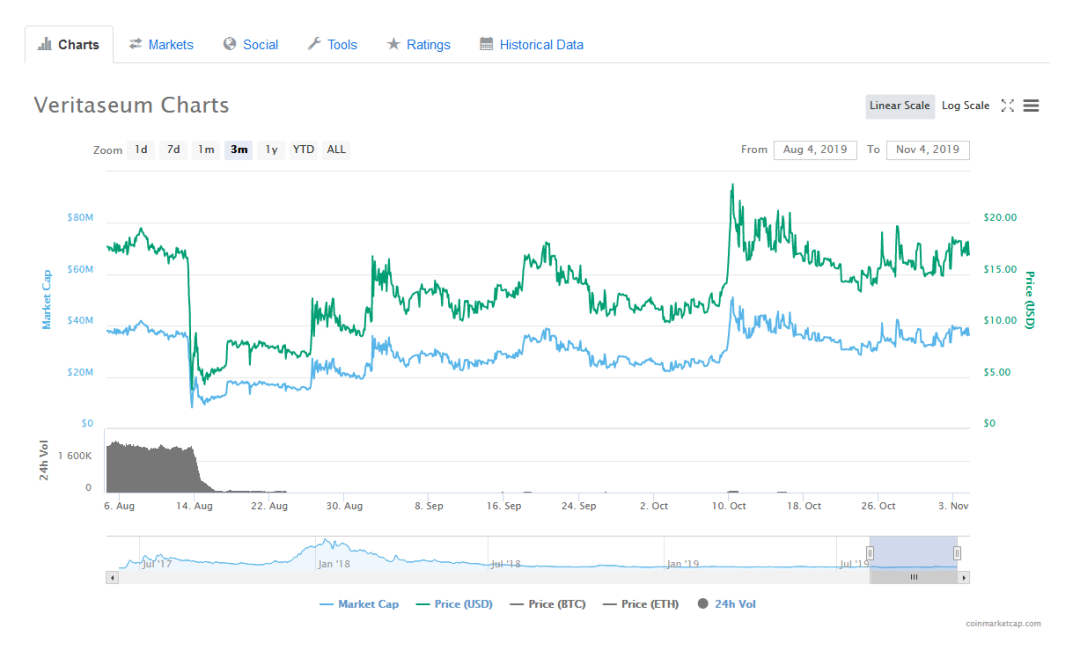

When the SEC announced a temporary restraining order against Reggie Middleton and Veritaseum in August this year, VERI's currency price fell from a minimum of more than 18 US dollars to 3.99 US dollars, and then the currency price rebounded, and now rises to 16.95 US dollars, but the market trading volume is sluggish.

- From the market distribution of DAI stable coins, see the behavior patterns of DeFi users

- Economic Daily Review Blockchain: Embracing the real economy

- Weekly | Bitumn suddenly "coup", Jia Nan Zhizhi submitted a prospectus to the SEC

Since August of this year, the SEC has settled with a number of blockchain-related companies through fines. In this case, the suspect Reggie Middleton can settle the fine and reach a settlement with the SEC without acknowledging and denying the SEC's allegations and abandoning the appeal.

On August 9, blockchain project PlexCorps (aka PlexCoin) paid $4.56 million in fines and $350,000 in interest to settle the settlement with the SEC. In addition, PlexCorps project sponsors Lacroix and Paradis-Royer were fined $1 million. Under the settlement agreement, Lacroix and Paradis-Royer agreed not to participate in securities sales.

In December 2017, the SEC filed a lawsuit against the PlexCorps project and its sponsor, Dominic Lacroix, in the federal court in Brooklyn, New York, alleging that both sold securities named PlexCoin to investors in the US and elsewhere on the Internet, claiming PlexCoin investors. It will generate 1,354% of profits in one month. The SEC also said that Labrix partner Sabrina Paradis-Royer is also related to the plan.

On August 21st, cryptocurrency rating agency ICO Rating agreed to pay $269,000 to settle a settlement with the SEC. The SEC has alleged that ICO Rating did not disclose the compensation paid for the rating recommendation of the cryptocurrency project party.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How to provide funding for Bitcoin developers under the open source financing mechanism?

- Research: A giant whale suspected to be the behind-the-scenes pusher of the 2017 bitcoin bull market

- Jingdong's blockchain experiment: trace cooperation with more than 700 merchants

- The encryption technology used by malicious people has become one of the worst attack software in 2019?

- Getting started with blockchain: Iceberg commission for big deals, find out

- Network effects in blockchain games: content is still king

- All are talking about DCEP, what is the relationship between the central bank digital currency and you?