Official Interpretation of UniswapX and How Does UniswapX Work

UniswapX Official Interpretation & FunctionalityAuthor: Uniswap blog; Translator: LianGuai0xxz

Since the launch of the first version of the Uniswap protocol in 2018, on-chain transactions have grown explosively, with support for millions of users, hundreds of use cases, and $1.5 trillion in trading volume on Uniswap alone.

To further develop on-chain transactions and improve self-custodial swaps, Uniswap is pleased to announce the launch of a new permissionless, open-source (GPL), Dutch auction-based protocol for trading across AMMs and other liquidity sources.

On July 17, 2023, we introduced an optional test version of the UniswapX protocol on the Uniswap Labs interface, which is applicable to the Ethereum mainnet and will be expanded to other chains and Uniswap wallets in the future.

- The growth of RWA is driven by US Treasury Bonds.

- Venus 2023 Q2 Report Reasons and Outlook Behind Revenue Growth

- LianGuai Morning News | Aave’s USD stablecoin GHO surpasses a market value of $2.5 million within 48 hours

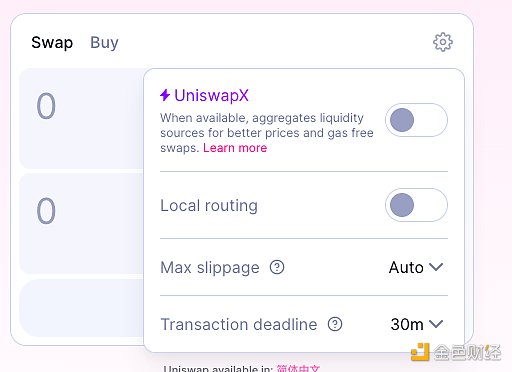

UniswapX is optional in the settings

UniswapX will improve swaps in multiple ways:

-

Get better prices through aggregated liquidity sources

-

Gasless swaps

-

Prevent MEV (Miner Extracted Value)

-

No cost for failed transactions

-

In the coming months, UniswapX will expand to gasless cross-chain swaps.

Aggregation at the next level

On-chain routing is an increasingly important and complex problem. Innovations in on-chain transactions have led to explosive growth in liquidity pools. New fee tiers, new L2 solutions, and more on-chain protocols will result in fragmented liquidity.

In the future, it is expected that thousands of custom pools will be designed and built on Uniswap v4, making routing more challenging. However, as liquidity sources grow, providing competitive prices requires manual integration and extensive ongoing maintenance and work.

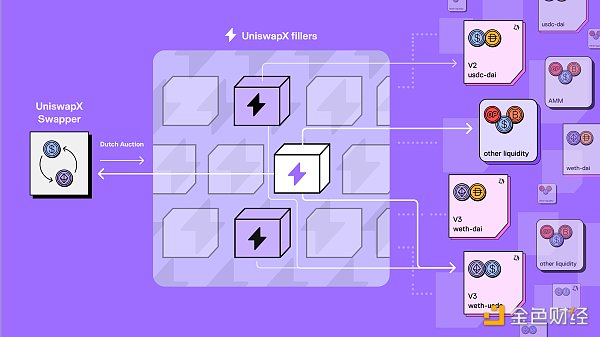

UniswapX aims to address this problem by outsourcing routing complexity to third-party fillers (note: anyone can become a third-party filler for UniswapX swaps), who then compete using AMM pools or their own private inventory of on-chain liquidity to complete swaps.

With UniswapX, swappers will be able to use the Uniswap interface without worrying about getting the best prices, and transactions will always be transparently recorded and settled on-chain. All orders are supported by the Uniswap smart order router, which forces Swap Fillers to compete with Uniswap v1, v2, v3, and future v4.

Understanding how UniswapX works in one graph

Gasless Swaps – No cost for failed transactions

With UniswapX, the swapper signs a unique off-chain order, which is then submitted on-chain by the filler who pays the gas on behalf of the swapper. Because the swapper does not need to pay for gas, they do not need the native network token of the chain (such as ETH, MATIC) to trade or pay any fees for failed transactions. The filler includes the gas fee in the swap price but can lower transaction costs by competing for the best price through batching multiple orders.

In certain cases, users still need to pay gas, such as the initial token approval for Permit2. In addition, native network tokens need to be packaged when sold, which consumes gas fees.

MEV Protection

MEV is one of the biggest problems faced by on-chain exchanges today, leading to worse prices for traders.

With UniswapX, MEV that could have been captured through arbitrage trades is returned to traders by increasing the price. UniswapX also helps users avoid more explicit forms of MEV extraction: orders executed using the filler inventory cannot be sandwiched in the middle, and the filler is incentivized to use private transaction relays when routing orders to on-chain liquidity venues.

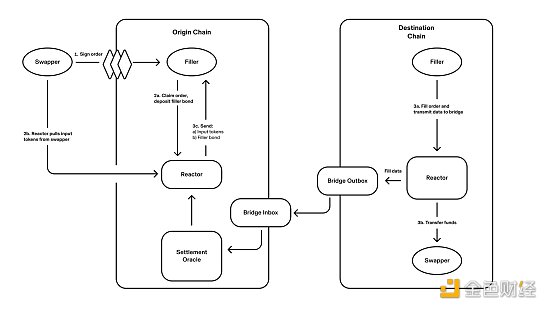

Future: UniswapX’s Move Towards Cross-Chain

A cross-chain version of UniswapX will be launched later in 2023, combining exchange and bridging into a seamless operation. With cross-chain UniswapX, traders will be able to swap between chains in a matter of seconds. Traders will also have the option to receive assets on the target chain, rather than specific bridge tokens.

Illustration of cross-chain transactions on UniswapX, Source: UniswapX Whitepaper

Launching UniswapX on the Uniswap Labs Interface

UniswapX brings the ideas and models of DeFi and digital markets into a new system, built on the same principles of security, self-custody, and community that have made Uniswap a trusted brand in DeFi.

UniswapX is an immutable smart contract that is fully permissionless. No one, including Uniswap Labs, can modify or pause the contract. The earliest fillers are on standby to ensure proper auction start prices and fast order execution, and the Filler network is expected to rapidly expand with user adoption.

In line with Uniswap’s commitment to security, the code has undergone extensive testing and auditing by ABDK and offers bug bounties. Traders always maintain self-custody of their funds. Assets are only transferred out of their accounts once orders are executed and they receive trading profits.

Like the Uniswap protocol, UniswapX includes a protocol fee switch that can only be activated by Uniswap governance (Uniswap Labs does not participate in this process).

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LD Track Weekly Report ETH Staking Rate Breaks 20%, Layer2 TVL Breaks $10 Billion

- Ethereum EthCC officially opens, conference highlights (continuously updated)

- Lens V2 version details are revealed Which features are worth looking forward to?

- The Disaster of Fantom’s Pool Fish How Big Are the Vulnerabilities? Can It Save Itself?

- Internal strife, coincidences, mistakes, and being arrested for carrying cash the untold story behind the Euler Finance hacker.

- Multichain official confirms that the founder has been taken away, and funds have been transferred by their relatives.

- JPMorgan Chase Ripple wins legal battle against SEC, which may benefit Coinbase.