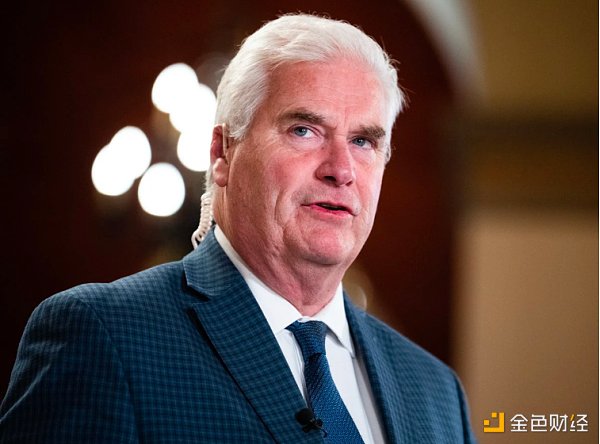

Who is Tom Emmer? Majority Whip in the US House of Representatives active in the cryptocurrency field.

Tom Emmer is the Majority Whip in the US House of Representatives and is active in the cryptocurrency field.The Ripple case that lasted for three years has finally come to an end. XRP has responded with a rise, with a 24-hour increase of over 65%. The price of the coin briefly rose to 0.94 USDT and its market value climbed to fourth place, second only to BTC, ETH, and USDT. Following this, various exchanges have opened trading for XRP, with Coinbase, Upbit, BitGo, and others announcing the listing of XRP. The daily average spot trading volume on exchanges has increased by nearly $4 billion after the ruling.

In addition to XRP, the entire cryptocurrency market is in a celebratory mood, with BTC and ETH breaking new highs at 31,550 USDT and 2,000 USDT, respectively.

All of this is not only due to the relentless resistance of native cryptocurrency enthusiasts against the US SEC, but also the support from “crypto-friendly” legislators. Today, Odaily Star Daily will introduce a man who has been active in the cryptocurrency industry, Tom Emmer, the Majority Whip of the United States House of Representatives, who introduced bills such as “The Securities Clarity Act,” “The SEC Stability Act,” and “The Blockchain Regulatory Clarity Act.”

- Official Interpretation of UniswapX and How Does UniswapX Work

- The growth of RWA is driven by US Treasury Bonds.

- Venus 2023 Q2 Report Reasons and Outlook Behind Revenue Growth

According to public information, Tom Emmer, born in 1961, holds a Bachelor’s degree in Political Science and a Juris Doctor degree. He joined the United States House of Representatives in 2015 and is a member of the House Financial Services Committee and the House Republican Steering Committee. He was recently elected as the Majority Whip for the 118th Congress.

After the conclusion of the XRP case, Tom Emmer posted on social media, stating, “The Ripple case is a milestone development that establishes the independence and distinction of tokens from investment contracts, regardless of whether the tokens are part of an investment contract. Now, let’s make it law.“

Tom’s mention of “making it law” refers to May 18, when he and Congressman Darren Soto announced the bipartisan “Securities Clarity Act.” This bill asserts that the existing securities laws do not differentiate between assets and the contracts they may or may not be securities. Many cryptocurrencies may initially be issued as part of a securities contract. However, once the project is fully developed and decentralized, the tokens may belong to different categories, such as commodities.

If assets and securities contracts are not distinguished, token projects that need to raise funds for early development will be unable to escape the securities framework once they become decentralized, which hinders the use of these tokens and harms the interests of token holders.

The “Securities Clarity Act” introduces a new key term, “investment contract asset,” into existing securities laws. This will enable cryptocurrency projects to fully realize their potential in a compliant manner and allow the United States to participate in global competition in the next generation of the internet. This legislation is crucial for ensuring robust domestic innovation and maintaining America’s global competitiveness.

In Tom’s eyes, “the strong regulatory actions taken by the SEC towards cryptocurrencies are playing political games.” As early as March 16, 2012, Tom accused the SEC of abusing its power to investigate cryptocurrency companies and sent a letter to SEC Chairman Gary Gensler on behalf of the two parties in the United States, requesting that the SEC publicly collect standard procedures and ensure that these investigations do not violate the provisions of the “Paperwork Reduction Act,” which limits the federal government’s burden and investigative power over private enterprises and individuals.

Institutions like Coinbase have been calling for clarity in regulatory legislation in the United States, and Tom has been committed to this as well. In addition to the Security Clarity Act mentioned earlier, on March 23, 2023, he and Darren Soto reintroduced the Blockchain Regulatory Certainty Act to Congress. This bill ensures that blockchain developers who do not custody consumer funds, as well as non-custodial service providers (including miners, validators, and wallet providers), should not be considered money transmitters and should not be subject to the same level of regulation as cryptocurrency exchanges that provide custody services.

It is understood that the Blockchain Regulatory Certainty Act was initially proposed on August 17, 2021, but did not further progress.

On June 6, the SEC filed a lawsuit against the cryptocurrency exchange Coinbase in the U.S. District Court in New York. On June 13, Tom Emmer and Representative Warren Davidson introduced the SEC Stability Act, which aims to remove Gensler from his position as chairman of the SEC and reform the SEC.

“American investors and the industry deserve clear and consistent oversight, not political games,” said Tom Emmer in a press release. “The U.S. SEC Stability Act will make common-sense changes to ensure that the priority of the U.S. SEC is the investors they are responsible to protect, not the whims of its reckless chairman.“

Although the process of “regulatory clarity” in the crypto market is arduous and lengthy, it is precisely because of the unwavering support of individuals like Tom Emmer that we may one day usher in a spring of regulation, no longer enduring years of litigation or forced settlements, but rather thriving cryptocurrency development under legitimate regulation.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Morning News | Aave’s USD stablecoin GHO surpasses a market value of $2.5 million within 48 hours

- LD Track Weekly Report ETH Staking Rate Breaks 20%, Layer2 TVL Breaks $10 Billion

- Ethereum EthCC officially opens, conference highlights (continuously updated)

- Lens V2 version details are revealed Which features are worth looking forward to?

- The Disaster of Fantom’s Pool Fish How Big Are the Vulnerabilities? Can It Save Itself?

- Internal strife, coincidences, mistakes, and being arrested for carrying cash the untold story behind the Euler Finance hacker.

- Multichain official confirms that the founder has been taken away, and funds have been transferred by their relatives.