US Presidential Dollar, a scam against the banner of the campaign?

Guide

The presidential currency earned a gimmick, would it be a scam under the banner of the campaign?

Summary

- How to design a token economic model? Start with a meaningful goal

- “Friends Circle” expands the speed of the Banking Department and continues to dig deep into the blockchain potential

- Babbitt column | SEC's supervision on the sniper war against Telegram

Topic:

On October 10th, the Chinese presidential candidate Yang Anze’s campaign, The Andrew Yang Coin (MATH), will be officially released, which means that MATH will become the first presidential campaign. Yang Anze is an encryption supporter. Since 2018, he has repeatedly expressed his friendly attitude towards blockchain and digital pass. At present, the official website of Yang Dividend has not been officially launched, and the white paper has not been released. The information about the project side and MATH is relatively limited. Yang Dividend can only be approximated by official and official blogs. According to Yang Dividend's official blog, Yang Dividend is an organization that supports Yang Anze's presidential campaign, helping Yang Anze to campaign campaigns, and launching the MATH project to promote the popularity of encryption and certification. The organization has been studying MATH since August 2019 and has released smart contracts in September 2019.

While causing widespread concern, MATH has not yet revealed its mysterious veil to the public. Although it describes a beautiful vision and the project party has already registered in Wyoming, there are still too many questions to answer, one of which Is this another blockchain scam? Of course, it is only the beginning. It seems to be too early to talk about, but the encryption world has already staged too many scams. Similar things are happening every day. For investors, in the face of any investment opportunities, we should treat the benefits rationally. Objectively assess risk.

Quotes: The decline is high and the short-term resistance is strong. The total market value of digital certificates this week was 227.7 billion US dollars, up 2.1%; the average daily turnover was 57.1 billion US dollars, up 13.8%; the average daily turnover rate was 25.1%, up 2.6%. The current price of BTC is 8322 US dollars, an increase of 1.4%; the average daily turnover of BTC this week is 16.5 billion US dollars, and the average daily turnover rate is 11.0%. The current price of ETH is 182.6 US dollars, an increase of 3.4%; the average daily turnover of ETH this week is 7.7 billion US dollars, and the average daily turnover rate is 38.6%. This week, the exchange's BTC balance was 864,400, an increase of 0.29 million; the exchange's ETH balance was 9.45 million, an increase of 100,000. In the BICS secondary industry, the market value of physical assets and the number of certificates have both declined.

Output and heat: BTC mining difficulty and computing power increased significantly. The difficulty of mining this week is 13.0T, which is 0.25 T from last week. The average daily power of this week is 98.42EH/s, up 6.90EH/s from last week. The difficulty of mining this week is 2474, which is 88 more than last week. The average daily power is 188.7TH/S, which is 2.9TH/S lower than last week.

Industry: New progress has been made in industry regulation. The US Internal Revenue Service updated the tax certification guidelines for encryption; several companies withdrew from the Libra Association; the US Securities and Exchange Commission issued a temporary restraining order for Telegram; the Swiss National Bank and the BIS Innovation Center worked together to study the central bank digital pass.

Risk warning: regulatory policy risk, market trend risk

text

1 Topic: US President's Coin, a scam against the banner of the campaign?

On October 10, according to Yang Dividend official news, the Chinese presidential candidate Andrew Yang (Yang Anze)'s campaign certificate The Andrew Yang Coin (MATH) will be officially released, which means that MATH will become the first presidential campaign.

1.1 Support for encrypted presidential candidates

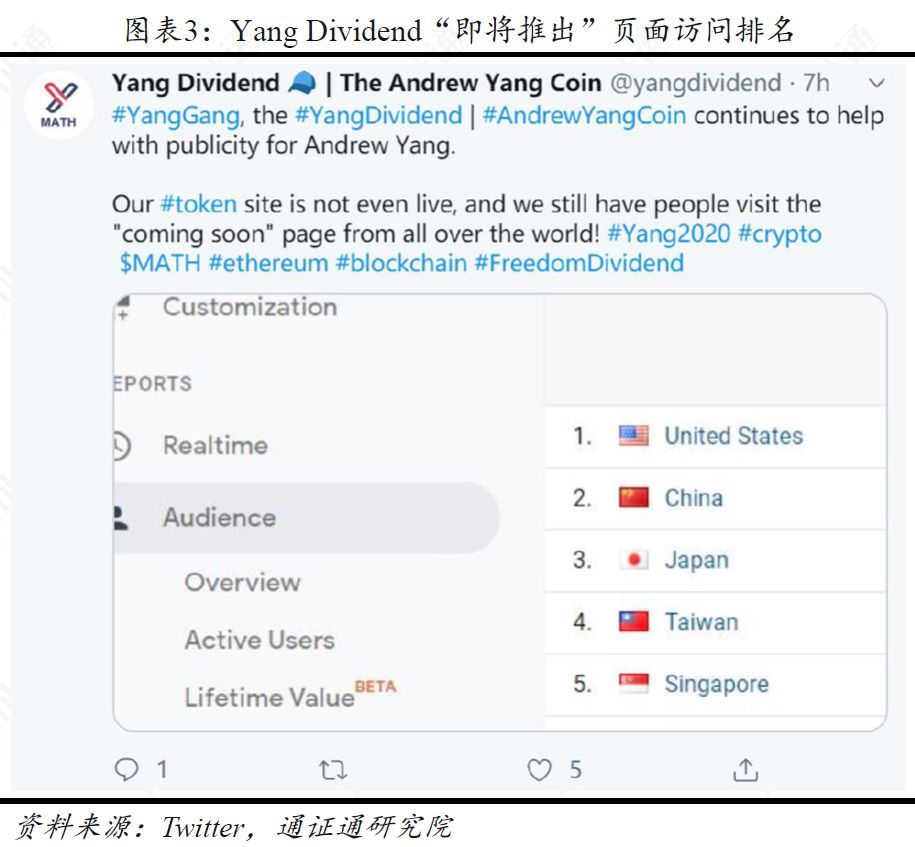

Yang Anze has gone from being unknown to being ranked sixth in the entire Democratic presidential candidate. Even if he immediately withdraws from the election, he has already broken many political campaign records of Asian Americans and American Chinese.

At present, the average number of R&D surveys of Yang Anze has risen to sixth place, and the donations raised in the third quarter of 2019 have rapidly increased from $2.8 million in the previous quarter to $10 million. Therefore, although Yang Anze's mainstream media coverage is only ranked 11th, the ranking of polls and the increase of up to 255% of the donations are enough to illustrate the strength and potential of Yang Anze.

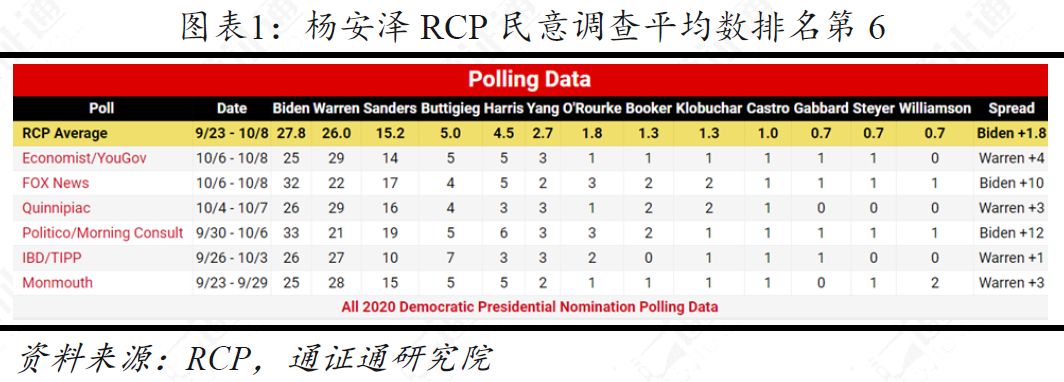

Yang Anze is an encryption supporter. Since 2018, he has repeatedly expressed his friendly attitude towards blockchain and digital pass.

1.2 Where is Yang Dividend sacred?

At present, the official website of Yang Dividend has not been officially launched, and the white paper has not been released. The information about the project side and MATH is relatively limited. Yang Dividend can only be approximated by official and official blogs.

According to Yang Dividend's official blog, Yang Dividend is an organization that supports Yang Anze's presidential campaign, helping Yang Anze to campaign campaigns, and launching the MATH project to promote the popularity of encryption and certification. The organization began researching The Andrew Yang Coin in August 2019 and launched a smart contract in September 2019.

On September 26, 2019, Yang Dividend officially released the first tweet, according to the official release:

On September 28, the project white paper has been completed and is undergoing legal review;

On October 4th, the project white paper has been released and has been airdropped;

On October 5th, the postponement was postponed;

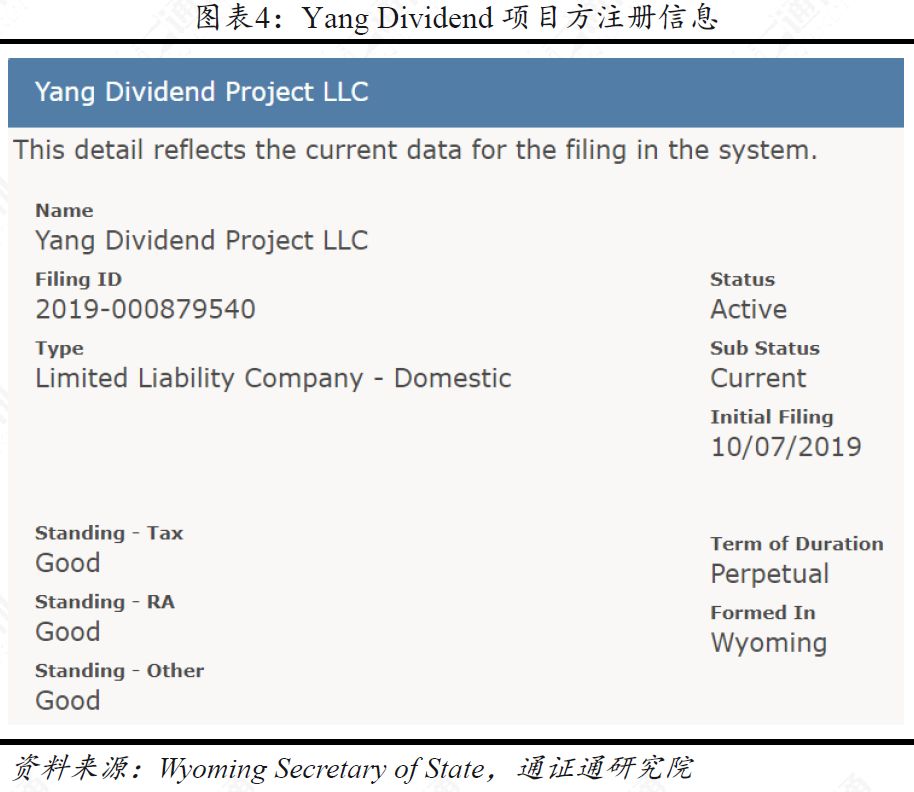

On October 10th, it was officially registered in Wyoming, and the project will be online soon.

1.3 Presidential currency, a new scam?

According to the smart contract address disclosed by the project party, the total number of MATH is 3,141,592,653. The project's article on Medium lists seven reasons why MATH deserves:

(1) The clear goal of the MATH Pass is to identify Yang Aize's supporters and serve as a “souvenir” to support Yang Anze's campaign (as can be seen from the creation time and date of the pass);

(2) MATH will distribute 100% instead of being reserved for founders and employees like other projects;

(3) The Yang Dividend project is registered in Wyoming, the most friendly encryption certificate in the United States;

(4) The MATH Pass is like the "free bonus" and can only be divided into two decimal places;

(5) If Yang Anze is successful in the presidential election, the number of MATH assigned to each holder will be increased… The longer Yang Anze is in the presidency, the longer the distribution time will be;

(6) MATH will only be distributed in the manner determined in the white paper, although other projects may change the qualifications and criteria over time, and MATH will adopt a fixed distribution ratio and distribution system throughout its life cycle;

(7) After the distribution activity, all undistributed MATH will be destroyed, which is combined with the MATH grant method to promote the wide distribution of the certificate.

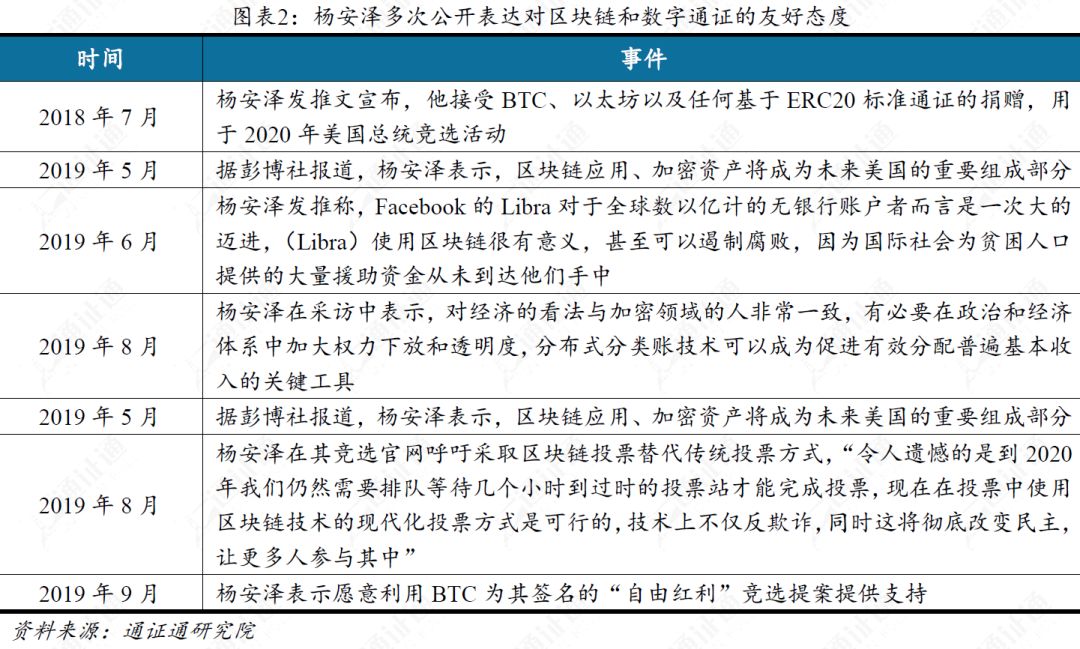

For a long time, as the Chinese president, the president of mathematics, and the president of the encryption, Yang Anze has received widespread attention around the world. The launch of the presidential currency has also earned a gimmick. Yang Dividend officially said that the website is not yet officially launched. The page still has visits from all over the world, no accidents, the top ranked among these visits except the United States is mainly Chinese.

While causing widespread concern, MATH has not yet revealed its mysterious veil to the public. Although it describes a beautiful vision and the project party has already registered in Wyoming, there are still too many questions to answer, one of which Is this another blockchain scam? Of course, it is only the beginning. It seems to be too early to talk about, but the encryption world has already staged too many scams. Similar things are happening every day. For investors, in the face of any investment opportunities, we should treat the benefits rationally. Objectively assess risk.

2 market: high and low, short-term resistance is strong

2 market: high and low, short-term resistance is strong

2.1 Overall market:

In exchange for both hands to grow

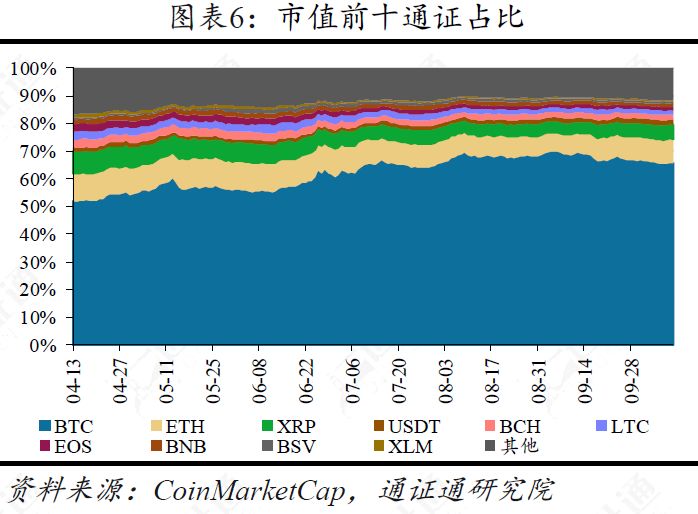

This week, the total market value of digital certificates was 227.7 billion US dollars, an increase of 4.7 billion US dollars last week, an increase of about 2.1%.

The average daily trading volume of the digital pass market was US$57.1 billion, up 13.8% from last week, and the average daily turnover rate was 25.1%, up 2.6% from last week.

This week's exchange BTC balance was 854,400, an increase of 0.29 million from last week. The exchange's ETH balance was 9.45 million, an increase of 100,000 from last week. The exchange's BTC and ETH balances have risen, and the selling pressure on the market has increased.

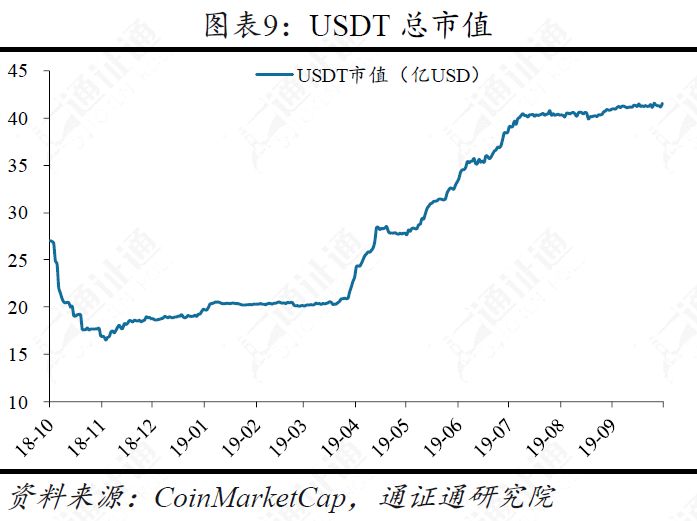

The USDT market value was $4.16 billion, an increase of $14.42 million from last week. The enthusiasm for the entry of funds has rebounded, and the USDT premium has increased significantly.

2.2 Core Pass: Rise back, volatility up

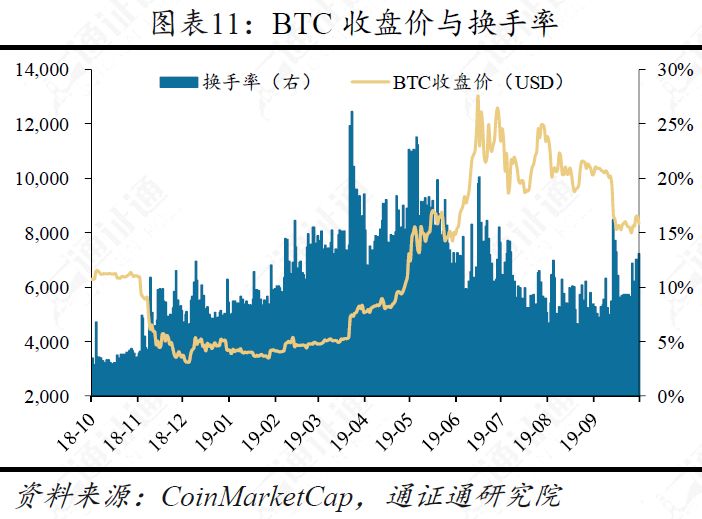

The current price of BTC is 8,322 US dollars, with a weekly increase of 1.4% and a monthly decline of 18.2%. The average daily trading volume of BTC this week was 16.5 billion US dollars, and the average daily turnover rate was 11.0%. The BTC failed to attack this week and there was a significant decline.

ETH is currently trading at $182.6, a weekly increase of 3.2%, and a monthly increase of 2.2%. The average daily trading volume of ETH this week was 7.7 billion US dollars, and the average daily turnover rate was 38.6%. ETH's performance this week was weaker than the main circulation certificate.

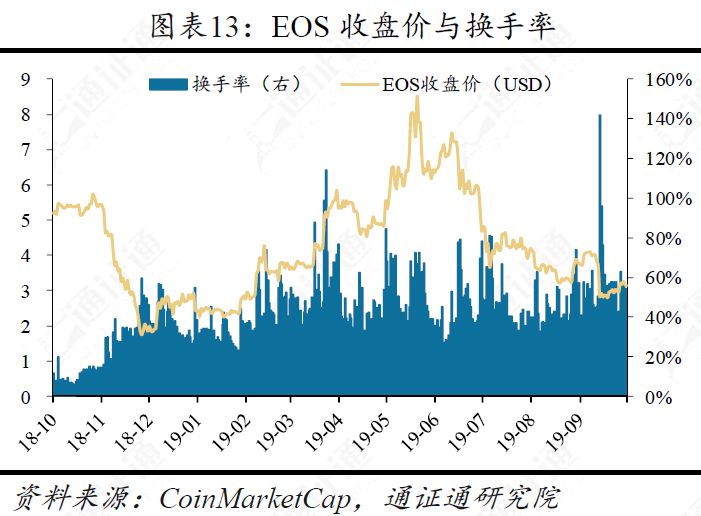

EOS is currently trading at $3.140, a weekly increase of 3.8%, and a monthly decline of 16.6%. The average daily trading volume of EOS this week was 1.5 billion US dollars, and the average daily turnover rate was 51.0%.

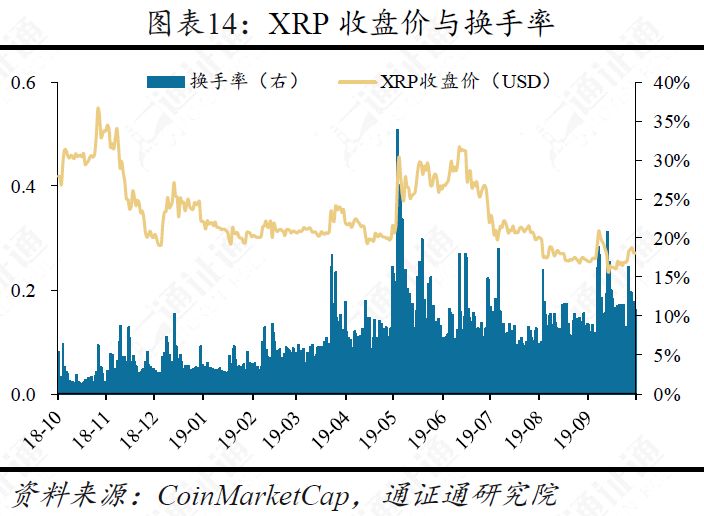

The current price of XRP is 0.27 US dollars, with a weekly increase of 6.8% and a monthly increase of 5.9%. The average daily volume of XRP this week was 1.37 billion US dollars, and the average daily turnover rate was 11.7%.

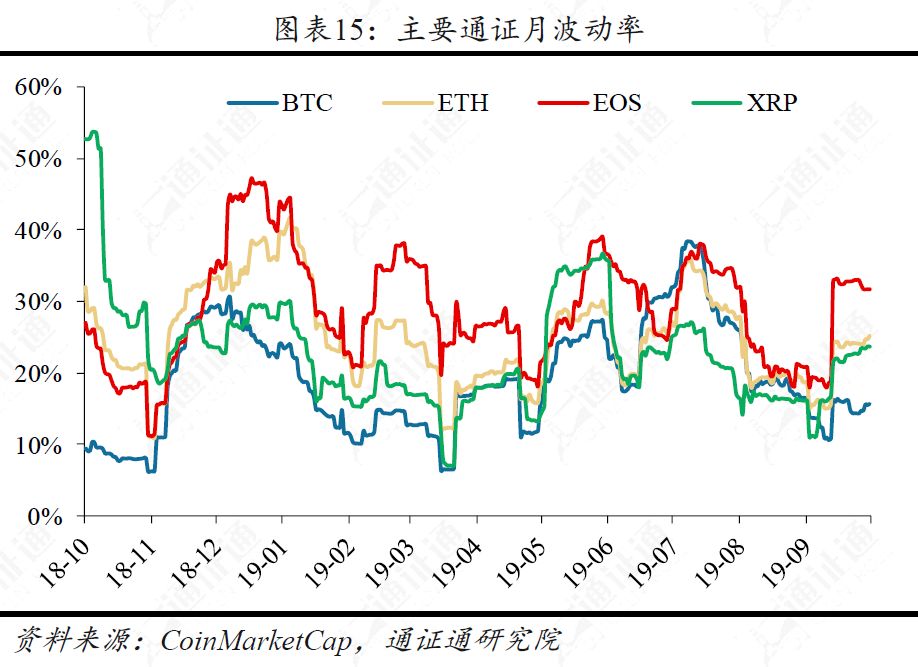

The monthly volatility of the main pass this week rose. The monthly volatility of BTC was 15.6%, up 1.3% from last week. The ethical volatility was 25.3%, up 0.4% from last week. The EOS monthly volatility was 31.6%. Last week, it rose by 1.1%; XRP monthly volatility was 23.7%, up 1.0% from last week. This week, the market's BTC volatility has declined, and the volatility of other major circulation certificates has risen.

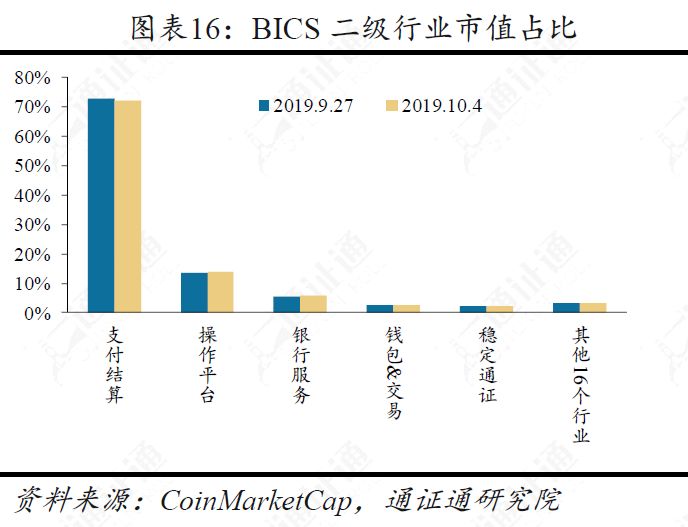

2.3 BICS industry: the market value of physical assets and the number of certificates have dropped significantly

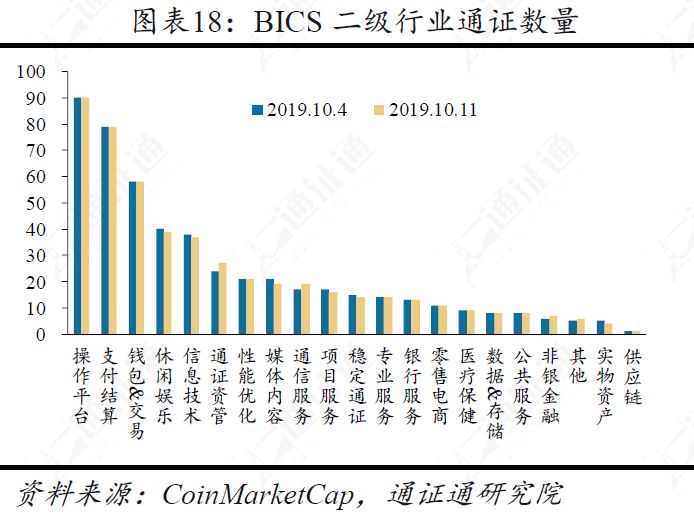

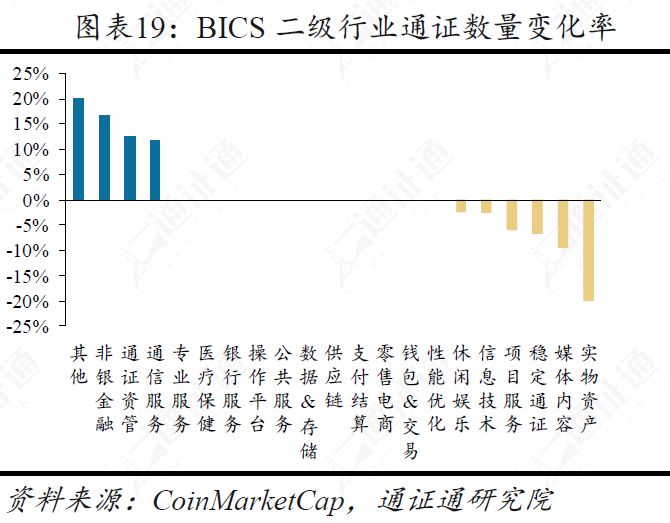

In the secondary industry of BICS (Blockchain Industry Classification Standard), the market value of the payment and settlement industry decreased from 72.6% to 72.1%. From the perspective of the rate of change in market capitalization, the market share of the project service industry grew at a higher rate, up 23.3% from last week; the decline in the value of market value of physical assets was more obvious, down 10.8% from last week.

The BICS secondary industry with more obvious increase in the number of passes this week is other, non-bank financial and pass-through assets, which increased by 20.0%, 16.7% and 12.5% respectively compared with last week. The number of passes in this week has decreased significantly. The secondary industries of BICS were physical assets, media content and stability certificates, which were down by 20.0%, 9.5% and 6.7% respectively compared with last week.

2.4 Market View: Strong short-term resistance

After the main circulation certificate surged this week, there was a large decline. The upper resistance was strong. Although it did not create a new low, it was still in the short-term uptrend channel, but it may enter a wider range of shocks.

In the long run, BTC production is near, and the market's recent bad news has been digested. Our judgment on the early stage of BTC in the bull market has not changed, and investors can do a good job of asset allocation based on their own situation.

3 Output and heat: BTC mining difficulty and computing power increased significantly

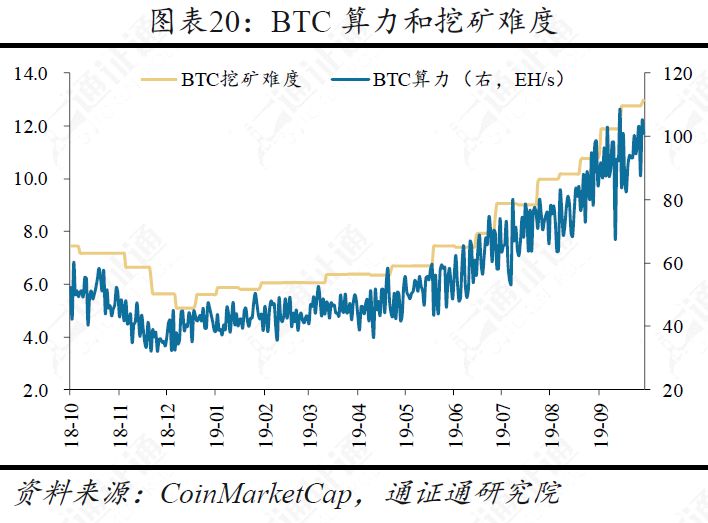

The difficulty of mining this week is 13.0T, which is 0.25T higher than last week. The average daily power of this week is 98.42EH/s, up 6.90EH/s from last week. The difficulty of mining this week is 2474, which is 88 more than last week. The average daily power is 188.7TH/S, which is 2.9TH/S lower than last week.

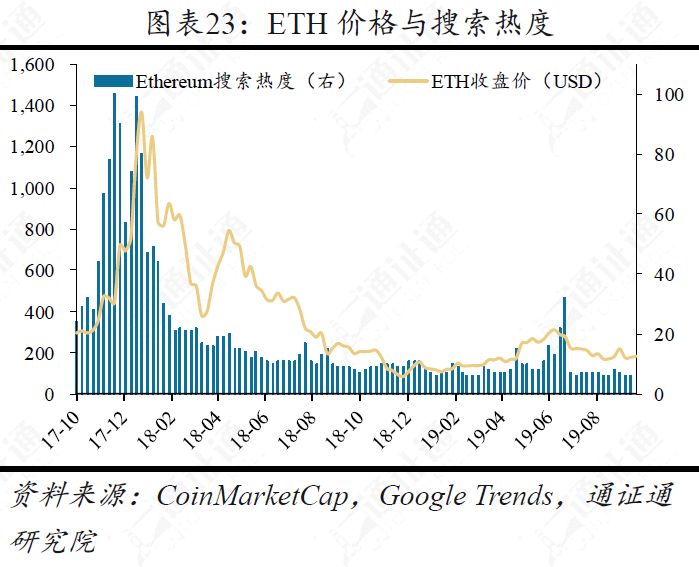

This week, Google Trends's Bitcoin entry search heat is 10, no change from last week, Ethereum entry search heat is 6, no change from last week.

4 Industry Highlights: New Progress in Industry Supervision

4.1 US Internal Revenue Service updates tax certification and tax guidelines

The US Internal Revenue Service issues additional guidance on tax treatment for cryptographic vouchers, including a new tax bureau stipulation and FAQ, which is designed to provide taxpayers with a tax break on a cryptographic pass. Tax operators solve common problems

4.2 Multiple companies withdraw from the Libra Association

Following Paypal's withdrawal from the Libra Association, Visa, Mastercard, Strible, Mercado Pago and eBay have announced the abandonment of the project.

4.3 US Securities and Exchange Commission issues a temporary restraining order against Telegram

The US Securities and Exchange Commission (SEC) announced a temporary restraining order for the ongoing digital certificate issuance activity of Telegram Group Inc. and its wholly-owned subsidiary TONIssuer Inc.

4.4 Swiss National Bank and the Bank for International Settlements Innovation Center to study the central bank digital certificate

The Swiss National Bank and the Bank for International Settlements have signed an agreement to jointly develop the central bank digital pass. The first three innovation centers of the Bank for International Settlements will be located in Switzerland, Hong Kong and Singapore.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Research Report|Can blockchain technology effectively solve the high-risk problem of inclusive finance?

- An article to understand edge computing and blockchain

- Mining from entry to proficiency (eight) mining industry ecology – peripheral services

- Hard core! 360 senior security expert Peng Brewing takes Zcash as an example to talk about the security and privacy issues of zero-knowledge proof

- Q3 cryptocurrency market value plummeted 100 billion US dollars, mainly due to investors' concerns about the blocked institutions entering the market

- The giant digital currency may be the most valuable asset left by this wave of blockchains.

- The new blockchain law will enter into force in Liechtenstein