USDT issues more than 10 billion in six days. In a bear market environment, stablecoins become the biggest winners

The avalanche of the crypto world has caused a lot of wealth to evaporate instantly, and the shortage of money in the currency circle is obvious. The surge in trading volume after the crash is calling for more stablecoins to enter the trading market.

In this context, Tether "printed" as much as 1.575 billion USDT in 30 days, which is in line with the needs of the crypto market. USDK, USDC, GUSD and other stablecoins have also entered a blowout development, printing money faster than the Fed.

So, in the context of a bear market, why can stablecoins develop so quickly? Why is the cryptocurrency world so dependent on stablecoins.

1. 480 million USDT added in six days, Tether prints money faster than the Federal Reserve

The latest data from Tokenview shows that from March 25 to March 30, Tether issued a total of 4 USDTs, each with 120 million U.S. dollars and a total of 480 million U.S. dollars. Changed the previous practice of issuing up to $ 60 million each.

- Free and Easy Weekly Review | "House N" Reflects the Weakness of Privacy and Sees How the "Sky Eye" of the Chinese Academy of Sciences Breaks the Game

- Discussion on anti-counterfeiting, anti-intrusion and tampering, and blockchain technology to improve the security of drone operations

- Super Planet Token GDP Price "Zeroed" Issuing Convertible Bonds With Annual Interest Rates Up To 250%

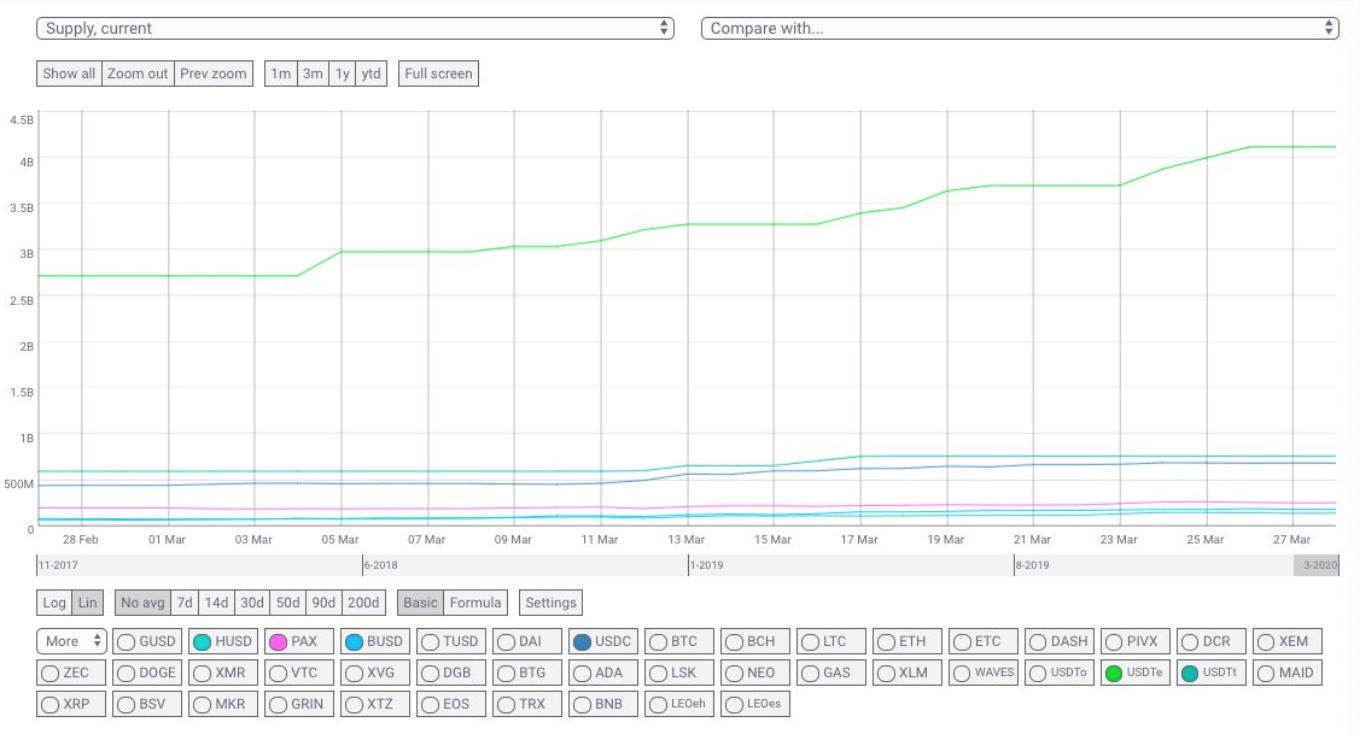

In the past month, Tether has newly issued $ 700 million. Market website Coingecko data shows that the current USDT market value exceeds 4.2 billion U.S. dollars. In just one month, the total market value has increased by 22%, and Tether can print banknotes faster than the Fed.

In fact, the rapid market value increase is not only USDT, but also other stablecoins.

At present, the total market value of 7 digital currencies including USDT, USDC, PAX, TUSD, DAI, GUSD, and BUSD has soared from USD 5 billion at the end of 2019 to the current USD 7 billion, a growth rate of 40%. Among them, most of the market value comes from USDT.

In contrast, the total market value of more than 5,000 cryptocurrencies worldwide has fallen from 350 billion U.S. dollars at the end of 2019 to the current 182 billion U.S. dollars, a drop of more than 40%. The market value of the seven stablecoins can "head up", which fully illustrates the market space and huge potential of stablecoins.

So why does the market need so many stablecoins, and where are these newly issued stablecoins?

2. Where did the printed money go?

In the real world, the fiat currency issued by the central bank is distributed to enterprises and residents through many commercial banks to expand reproduction and consumption investment. The central bank adjusts the size of commercial banks' deposits and loans through the deposit reserve ratio. The money that enters the market through commercial banks is collectively called M2.

So, who is playing the role of "central bank" and "commercial bank" in the cryptocurrency world? Before answering this question, let's analyze a set of USDT token circulation data.

From March 12 to March 22, the USDT issued additional tokens on Ethereum for analysis. As a whole, at least 17 business entities ’wallets participated in the distribution process during this period. Of these business entities, exchanges accounted for the bulk of the transactions and lending platforms accounted for a small portion, including Bitfinex, Okex, Nexo, RenrenBit and other well-known exchanges or institutions.

The stablecoins that entered the exchanges and institutions entered the hands of financial investors through exchanges and loans .

From this point of view, in the crypto world, stablecoin issuers are equivalent to central banks; exchanges and lending platforms are equivalent to commercial banks; cryptocurrency investors are equivalent to consumers in the traditional financial world. It shows that the cryptocurrency world still follows the traditional financial laws.

It can be seen that TEDA, which plays the role of central bank, mainly issues a huge amount of USDT to be connected with institutions, and then injected into the market through institutions. Just like the Fed, except for extreme cases like the New Crown epidemic, they will not directly send money to US citizens, but will inject liquidity into the market through means such as national debt.

It is worth mentioning that, due to the problem of USDT spam, each time Tether issued additional USDT, it will be violently attacked. However, the recent criticism seems to be much less. The fundamental reason is the increase in market demand.

Especially after March 12, after Bitcoin experienced an epic plunge, the market's wealth has evaporated and the entire market is extremely short of money, resulting in a shortage of USDT supply and a USDT premium of up to 6%. Under this background, Tether Company continued to issue additional USDT to meet the market demand, and the USDT premium decreased accordingly, reducing transaction and investment costs, which was naturally welcomed by investors.

If you compare this phenomenon to the traditional financial world, it is not difficult to understand the reasons behind it. In the traditional financial field, once a liquidity crisis occurs in the market, the central bank often reduces deposits by reducing deposit interest and deposit reserve ratios, and at the same time increases the motivation for bank lending, thereby solving the liquidity crisis in the financial market.

However, in the crypto world, although Tether plays the role of "central bank", it does not have functions similar to the Federal Reserve's QE and reduce the interest on deposits. Real Gold Platinum-USDT.

At present, Tether not only speeds up printing money, but also has a wider way of printing money. In addition to the Omni protocol, the Ethereum network, and TRON, Tether is also developing a token issuance path based on the BCH network and the Algorand public chain.

3.Continuously explore new channels for printing money

On March 30, Algorand officially announced that USDT on the Algorand blockchain has been officially launched, and 1 million USDTs were issued on the Algorand blockchain. Become a new member of the Tether Token Issuance Network.

Since then, other blockchains supported by Tether include BCH, EOS, ETH, Omni, and T RON, etc. Tether's money printing channels are constantly increasing. So why did Tether choose so many public chains to issue tokens?

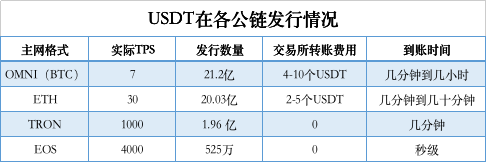

At present, the most widely used channels of USDT are the Omni protocol and the ETH network. There are two main defects, namely

Slow transfer speeds and high transfer fees.

In terms of transfer speed, the Omni version is used as an example. Because it is based on the development of the Bitcoin blockchain, the on-chain processing speed is slow and the confirmation time is long. As a result, transfers usually take a lot of time.

In terms of transfer fees, the Omni version transfer requires a minimum of 4 USDT, and a transfer during a bull market even costs hundreds of USDT, which is not what any traders would like to see. In this regard, although ETH has improved, due to congestion in the ETH network, transfer fees are not low.

Therefore, it is necessary to develop a token issuing network such as EOS, TRON, BCH, Algorand.

Comparison of different versions of USDT

Take the EOS network as an example.

In terms of transfer speed, the actual TPS of EOS can currently reach 3000-4000, and theoretically can reach tens of thousands. The EOS block production speed has gradually changed from the original few minutes to the current 0.5 second, so that USDT transfers can be confirmed in seconds.

In terms of transfer fees, transfers in the EOS system require EOS tokens to lease CPU, RAM, and NET system resources. Although the RAM (memory) fee is spent during the transfer process, it can be almost ignored, so it can be said that "transfers are free."

In late March, Tether issued a stablecoin USDT on BCH through a simple ledger agreement. In response, Tether Chief Technology Officer Paolo Ardoino said that our latest cooperation with Bitcoin Cash will provide Tether with various benefits. This cooperation will also Supporting more applications on the Bitcoin Cash chain, Tether will facilitate payment for these applications.

At present, the main advantage of Tether is not only in terms of market value, but also the diversity support of different networks is also reducing the USDT systemic risk rate.

In the crypto market, there are more than a dozen stablecoins, and these stablecoins have also developed rapidly during the recent bear market.

4. Prosperous stablecoin market

According to the latest news from Theblock, stablecoin ushers in a strong start in 2020. Although 90% of the total value of the stablecoin still belongs to Tether, USDC grew at the same rate as Tether (33%) in the first quarter of 2020 and was close to $ 1 billion. Tether's value on the Ethereum chain is now over $ 4 billion and has risen by more than 75% year-to-date.

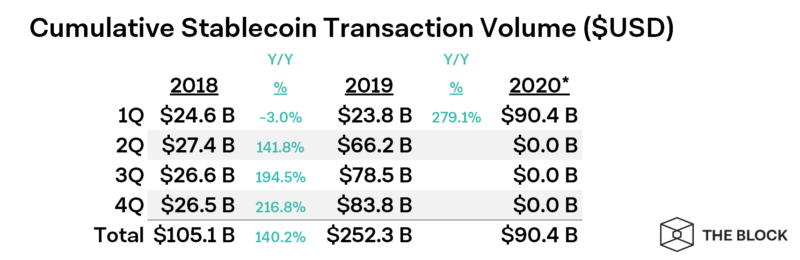

The cumulative transaction volume of stablecoins exceeded US $ 90 billion for the first time in a quarter, an increase of 8% over the fourth quarter, and in the first quarter of 2019, the figure was only US $ 23.8 billion, a year-on-year increase of 280%.

The latest data from Coinmetrics shows that in the past month, stable coins are pouring in on the Ethereum chain, among which BUSD has increased by 186% in 30 days, USDC has increased by 55.4%, USDT has increased by 51.5%, PAX has increased by 26.5% .

The development of the stablecoin market in 2020 can be described as prosperous.

In response to the continued issuance of USDT for Tether, the market value of stablecoins has continued to soar. Dr. Omer Ozden, chairman of Shimu Capital, said that USDT is the most popular stablecoin in the world and has the widest application range. I call this year the "year of stablecoins" because we see that on the one hand stablecoins have been more widely used, on the other hand some stablecoins have also received regulatory approval, and Libra has issued a white paper. The issue of Tether is also part of this trend. Some additional offerings are also related to the use of USDT as a loan in the market.

In fact, the prosperity of the stablecoin market has far-reaching significance.

Cryptocurrency rating agency Weiss Ratings posted on Twitter that with the creation of negative US interest rates, it is no longer a good option for people to deposit money in banks. The stablecoin is pegged to the US dollar 1: 1. Holding stablecoins makes more sense than holding dollars. The original financial system is showing its flaws.

What role can the stablecoin market play in this increasingly volatile financial market? As stated by OKLink Rabbi during the live broadcast of Hotbit, facing stable changes around the world, stablecoins will play a significant role in improving liquidity, maintaining stability and ecological layout.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Former CFTC Chairman: Satoshi Nakamoto's white paper does not include concepts aimed at breaking away from government or regulatory networks

- Coins Story | Do you still love Bitcoin after the plunge?

- Foreign media: Binance plans to acquire well-known data service provider CoinMarketCap for $ 400 million

- QKL123 market analysis | Crude oil broke $ 20 in the intraday market, the smoke-free smoke war spread to the capital market (0331)

- Lightning Labs launches digital authentication method based on Lightning Network, users do not need to enter a password to log in

- JD Blockchain traceability data is disclosed for the first time! Traceable product sales increase by nearly 30%

- Vitalik: ETH 2.0 multi-client test network expected to go live in April