Bitcoin halved: everything you need to know

The number of bitcoins created every 10 minutes is reduced by half every four years.

This is called halving bitcoin. The next halving will be the third halving of Bitcoin, which will be implemented in May 2020. At that time, the block reward of 12.5 bitcoins per 10 minutes will be halved to 6.25 bitcoin.

Given that Bitcoin's maximum supply limit is 21 million, halving the block reward means that all bitcoins will take longer to get into circulation.

But it also means that as time goes on, the number of new Bitcoins will become less and less, and due to its limited supply, Bitcoin will continue to become scarcer, and scarcity will increase value.

- Calm before the storm? Bitcoin volatility is the lowest in four months

- The oversold rebound has been blocked, and the main force can attack again.

- Lightning Network first faced the vulnerability, Lightning Labs stressed no update or risk of losing money

Historically, the halving of Bitcoin has proven to be an important catalyst for pushing Bitcoin into a new bull market.

In fact, Bitcoin tends to have a new round of bull market for at least a year before halving.

But what is the impact of halving bitcoin on the price of bitcoin ?

This article will explore the following issues:

- How did the previous two bitcoin halving affect the bitcoin price?

- Are there any recurring trends in these effects?

- How will the third halving of the upcoming Bitcoin affect the price of Bitcoin?

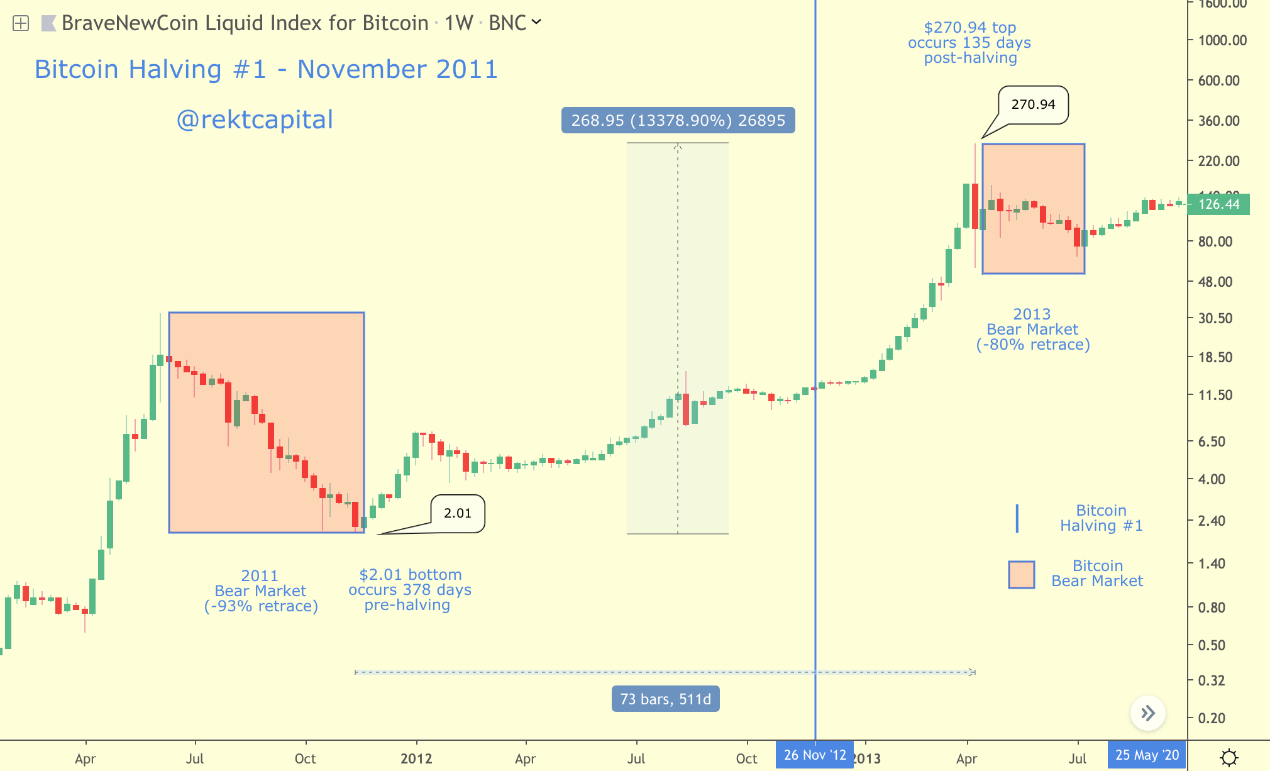

Bitcoin halved #1 – November 2012

The price of Bitcoin after the first halving

The first halving of Bitcoin took place at the end of November 2012.

Bitcoin took about 513 days to rebound from the bottom of $2.01 to the top of the market cycle of $270.94, an increase of more than 13,000%.

The halving of Bitcoin for the first time is a key catalyst, driving significant growth in Bitcoin and opening a new bull market cycle.

When the bitcoin price fell below the peak of $270.94, the bear market in 2013 began, and the price of bitcoin fell by 80%. This bear market lasted for about 87 days.

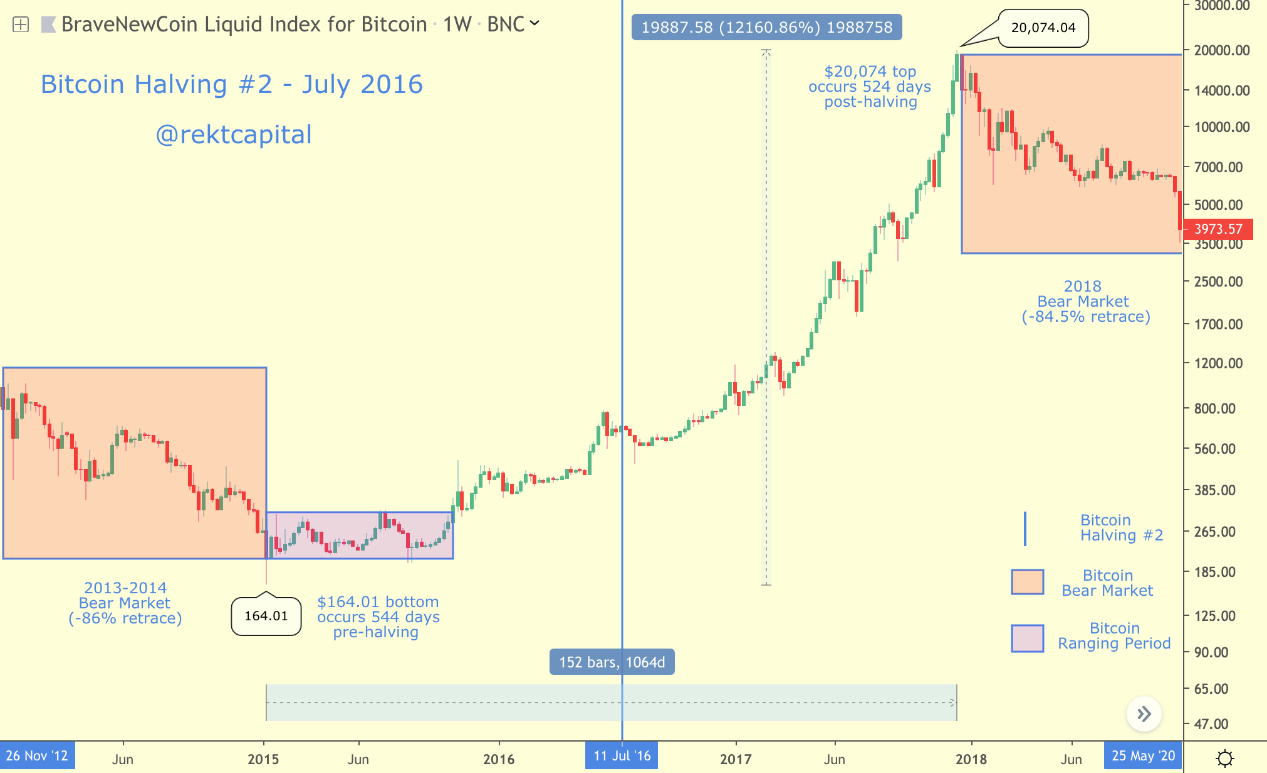

Bitcoin halved #2 – July 2016

Bitcoin price in the second halving background

The second halving of Bitcoin took place in early July 2016.

Bitcoin rebounded from the bottom of $164.01 to the top of the $1074 market cycle, which lasted 1,068 days, an increase of more than 12,000%.

After the peak of $2,074, Bitcoin entered a 51-week bear market and bottomed out in mid-December 2018.

After comparing the two parts, we came to the key conclusions:

1. Bitcoin halving is a key catalyst for a new round of bitcoin bull market

Historically, the halving of Bitcoin has been a key catalyst for pushing Bitcoin into a new bull market.

Bitcoin prices will rise before and after halving.

In fact, the price of Bitcoin has reached a record high due to halving. But this new high appeared only a few months after Bitcoin was halved.

2. So far, the price of Bitcoin has increased by 12,000 -13000% after each halving .

In both cases, bitcoin price increases have similarities.

Let us first consider the first halving.

It took 513 days for Bitcoin to rebound from the bottom of $2.01 before halving to the top of $270.94 after halving, an increase of 13304%.

Let us now look at the second halving.

Bitcoin spent 1068 days, rebounding from a minimum of $164.01 before halving to a top of $2074.04 after halving, an increase of 12168%.

The similarity between the two is that Bitcoin rebounded from the bottom of the bear market by about 12,000 -13000%, reaching the top of the bull market after halving.

But a key difference is that Bitcoin takes twice as long as the first halving period in the second halving period (1067 days, and the first half-life is 513 days).

How do these insights compare to the upcoming third halving of bitcoin we know?

Bitcoin halved #3 – May 2020

Bitcoin halved for the third time

The third halving of Bitcoin is expected to occur on May 17, 2020.

As of this writing, Bitcoin has spent more than 260 days rebounding from the bottom of $3,152 in mid-December 2018 to more than 340%.

This means that the price of Bitcoin bottomed out about 519 days before Bitcoin halved for the third time.

This is very interesting because there are some key similarities between Bitcoin and the second halving.

Here is the second halving of Bitcoin:

Bitcoin prices bottomed out 544 days before the second halving.

Bitcoin rose 383%, reaching its highest point before the second halving.

For now, the price change before Bitcoin's third halving is very similar to the price change before Bitcoin's second halving.

This is a powerful recurring theme, so let's further break down the price of Bitcoin and halve it.

Let's divide the price of Bitcoin into two stages: “pre-half” and “post-half” in an effort to discover any trends or topics that may reappear. These trends or topics may help us to the upcoming A halving of 3 bitcoins has a more comprehensive understanding.

Bitcoin halved #1 and #2 – detailed analysis

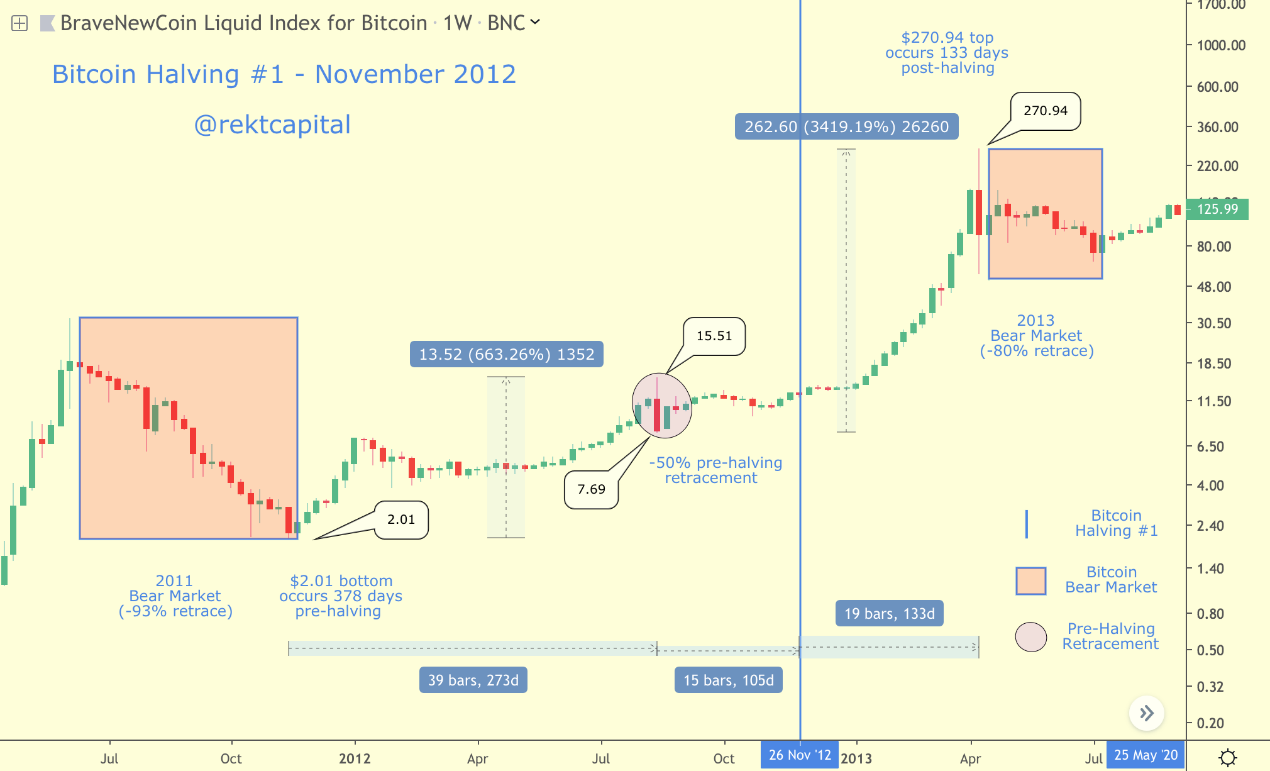

Bitcoin price before and after the first halving

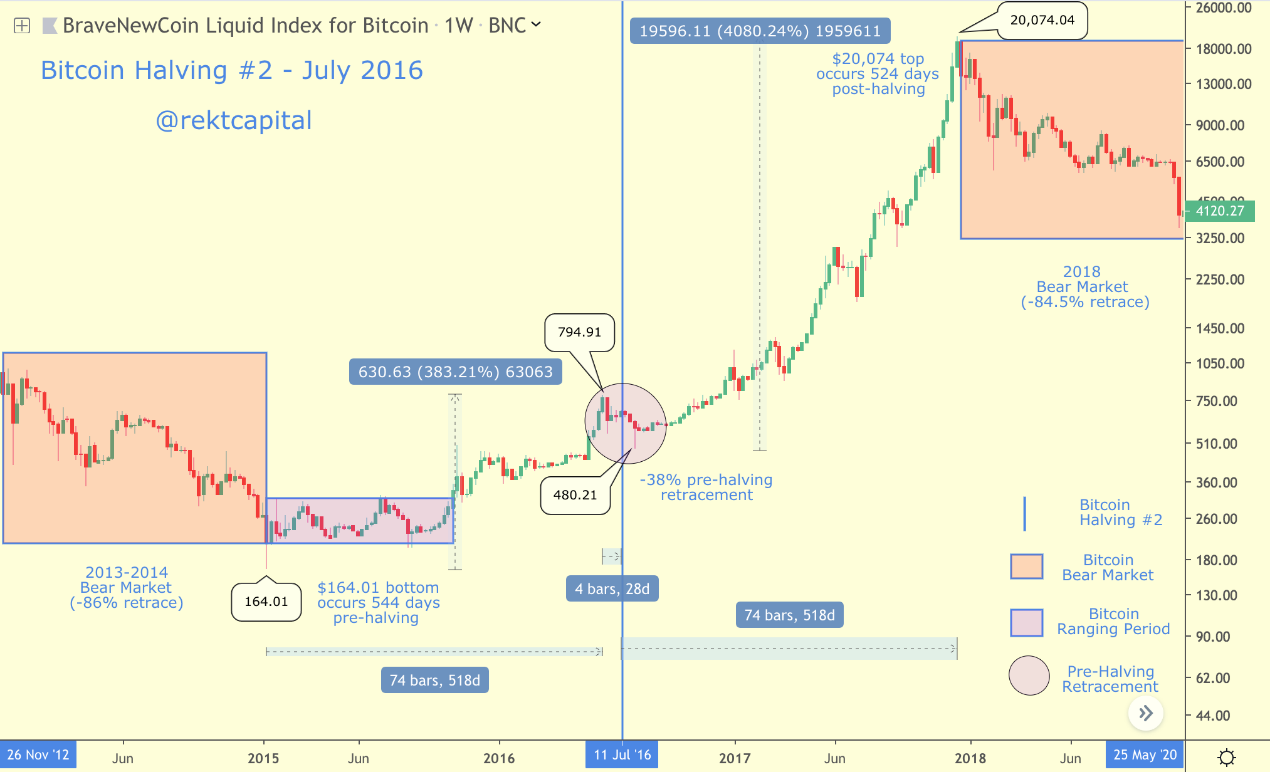

Bitcoin price before and after the second halving

Key trend # 1

The exponential growth in bitcoin prices has mostly occurred after halving .

Bitcoin rose 663% to a high of $15.51 before Bitcoin halved for the first time.

Once Bitcoin bottomed out after falling 50%, Bitcoin rebounded more than 3400% after halving, reaching a market cycle high of $270.94.

Bitcoin rose 383% to the high of $794.91 before Bitcoin halved for the second time.

Bitcoin rose 4080% in 524 days, reaching a market cycle high of $2074.

to sum up:

In halving #1, the growth after halving is more than five times the increase before halving.

In halving #2, the growth after halving exceeded the 10.5 times increase before halving.

Obviously, the exponential growth of bitcoin prices has mostly occurred after halving.

In fact, Bitcoin has successfully achieved a record high after every halving.

After reaching a record high, Bitcoin will enter the bear market after the bull market, and bitcoin will fall at least 80%.

Key trend # 2

Before the first halving , bitcoin prices experienced stronger and faster growth than the growth rate before the second halving .

Before the first halving, bitcoin prices rose nearly two-fold (663%) to a high of half before halving. Before the second halving, bitcoin prices rose by 383%, also reaching a high point before halving. In fact, compared with the rise time before the second halving, the increase before the first halving was almost half the time.

to sum up:

In the first halving, Bitcoin rose by 683 percent in 273 days, reaching its highest point before its first halving.

In contrast, in the second halving, Bitcoin rose by 383% in 518 days, reaching the high point before the second halving.

Key trend # 3

If Bitcoin rebounds less before halving, it will bounce more after halving.

Bitcoin rose 663% before the first halving, but after halving, Bitcoin rose another 3400%.

Bitcoin rose by 383% before the second halving, but after halving, Bitcoin rose another 4080%.

Key Trend # 4

There is always a pre-half turbulence period (callback) .

In the past, this pre-half callback has been a bear trap for many investors.

Many investors will sell bitcoin to record their profits, while others will withdraw their investment by selling bitcoin for fear that bitcoin prices will fall sharply.

In any case, both types of investors will miss the future index uptrend.

As long as you know this trend, it is possible to help investors avoid the fate of Bitcoin's third halving – if history is repeating itself, this retreat will occur again.

That's why it may help us further dissect these callbacks and compare them to each other to help us understand.

Let's first look at the callback before halving #1

Callback before halving #1:

a) occurred more than 100 days before halving,

b) 50% down

c) lasted only 2 days.

This is enough to get quite a few investors to withdraw their bitcoin position (although in the first halving, Bitcoin has almost completely recovered its short-term valuation during the callback process).

Once Bitcoin bottomed out after a 50% fall in the benchmark, Bitcoin rebounded more than 3400% after halving, reaching a market cycle high of $270.94.

Reduce the callback before #2

Before the second halving, it took 521 days for Bitcoin to rebound from the bottom by 383% to a local high of $794.91 (interestingly, after halving, Bitcoin spent the same amount of time – About 524 days – only to reach the top of $20,000.)

This #2 pre-half callback is quite different from the #1 pre-half callback:

a) occurs 24 days before halving,

b) a drop of 38%

c) lasted for 44 days,

d) Continue for 20 days after halving.

to sum up:

- The pre-half #1 callback occurred about 100 days before the halving, a drop of 50% for 2 days.

- The pre-half #2 callback occurred 24 days before the halving, a drop of 38% for 44 days. In the 20 days after the halving, this retreat continues.

While there isn't any significant commonality between these callbacks, it's still important to understand the details, even if it's just to manage expectations, what might happen during the third halving of Bitcoin.

Key Trend # 5

The pre-half high point before the callback has been the highest pre-half price point in Bitcoin history, but not enough to set a new all-time high .

Bitcoin prices tend to accelerate before Bitcoin is halved, and then there will be a callback.

As it turns out, from the previous two halving market conditions, every time the bear market bottoms out, whether it is the high of 15.51 US dollars before the first halving or the high of 794.91 US dollars before the second halving, it is just right. It is the highest point before Bitcoin is halved. However, this price point did not exceed the previous historical high.

The price of Bitcoin has always hit a record high several months after halving.

Overall summary

- The exponential growth in bitcoin prices has mostly occurred after halving.

- The price of Bitcoin will hit a record high every halving.

- If Bitcoin rebounds less before halving, it will bounce more after halving. (and the duration will be longer).

- There is always a callback every time you halve.

- The pre-half high point before the callback has been the highest pre-half price point in Bitcoin history, but not enough to set a new all-time high.

How will Bitcoin's third halving affect the price of Bitcoin?

So far, we have discovered many different compelling trends in bitcoin price movements as bitcoin prices have halved.

At this stage, the question is whether we can use this information to infer the impact of the upcoming third bitcoin halving on bitcoin prices.

People tend to use historical market data to infer trends and infer these data as potential future trends.

Although historical price movements can be used to predict future trends, future price movements will never completely mimic historical data.

Based on the historical trend before and after Bitcoin halved, we can only guess how the price of Bitcoin might behave due to the halving of the upcoming third.

Having said that, let's examine the most important trends from the perspective of historical price data and see how the third halving of Bitcoin will affect the future price movements of Bitcoin.

Using the previous bitcoin halving data to predict the "half effect" of bitcoin prices

1. So far, every time Bitcoin has halved, its price has risen by 12,000 – 13300%.

The first halving of bitcoin stimulated 13378% of bitcoin price increases, while the second halved stimulated 12160% of price increases.

Based on the above data, from the bottom of the bear market of Bitcoin 3,150 US dollars in mid-December 2018, if the rebound is 12160%, Bitcoin will appreciate by about 385,000 US dollars. By the same token, a 13378% increase will cause Bitcoin to rise to $425,000.

The $385,000 bitcoin is interesting because it means that the market value of Bitcoin ($189 billion at the time of writing) will exceed the current gold market value ($7.8 trillion).

This event will truly consolidate Bitcoin's status as “digital gold”.

2. New market cycle highs tend to occur before Bitcoin is halved , but it will not exceed historical highs

Since mid-December 2018, Bitcoin has risen more than 340%, which is very similar to the 383% increase in Bitcoin before the second halving.

If Bitcoin rose by 383% as it did before the second halving, it would reach a new market cycle high of about $15,000, which is higher than the current encryption market high of $13,900.

The shift in this situation will be in line with the historical trend of setting a new market cycle before halving, but will not set a record high.

In turn, this will also satisfy another key trend: if Bitcoin bounces less before halving, it bounces more (and lasts longer) after halving.

If this trend reappears, this would mean that the probability of a bitcoin rising more than 13,000% would be higher than the 12000% probability.

However, on the other hand, if Bitcoin's rise is similar to the top-ranked 663%, this means that Bitcoin's price will reach nearly $24,000 before the third halving.

Of course, this has led to a new historical high, in violation of the above historical trends.

It is for this reason that the price movements of Bitcoin today may continue to be very similar to the price movements at the second halving.

If this is the case, Bitcoin will take longer to manage its price increase after halving (after all, Bitcoin spent more than 500 days managing the new path up more than 12,000% after the second halving. ).

If the growth trend of Bitcoin after the third halving is similar to the growth rate after the second halving, then Bitcoin may hit within 500 days after the third halving (ie, the fourth quarter of 2021). A new high in history.

3. After a new market cycle high is set, the callback will occur before halving

The callback is likely to happen before halving, which is a financial opportunity for traders and investors.

4. The price of Bitcoin will hit a record high after halving

Historically, bitcoin has hit a record high every time it is halved.

Regardless of the historical maximum price of Bitcoin, this new record is likely to appear several months after the price has been halved.

in conclusion

Halving is an event that ensures reasonable scarcity. The exponential rise in bitcoin prices proves a very important principle in financial markets – scarcity increases value.

What is important is that we must be aware of the historical significance of the halving effect of Bitcoin prices and have the ability to appreciate it. After all, the historical price movements of Bitcoin suggest that halving bitcoin is a unique event that often makes investors make money – not only before halving, but also after halving months.

Halving bitcoin is a simple statement with a high probability of profitability.

Of course, past performance does not guarantee future results.

But with regard to history, it is safe to say: History doesn't lie (history does not lie).

In the words of Mark Twain:

"History doesn't repeat itself — but it often rhymes". (History won't repeat itself, but it will always be amazingly similar)

Author: Adam White

Compile: Sharing Finance Neo

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The trend of automation is getting more and more obvious, can bitcoin over-the-counter trading be more powerful?

- Is it good for institutional funds to flood into CME bitcoin futures trading?

- Analysis: Buy BTC at any price, hold up to 1335 days, and be 100% profitable

- Survey: Apple App Store Cryptographic Search Results Rankings

- Bitcoin Wild History | No bitcoin in 2008 (on)

- Report | Uncovering the currency circle to quantify team operations

- Bakkt physical bitcoin futures contract is launched soon, trading margin requirements surfaced