Viewpoint | Economic Considerations for Ethereum 2.0 Migration

As a follower and supporter of Ethereum, I always strongly support constructive discussions around network development and upgrades. The purpose of this paper is to discuss in depth the current economic advantages of the Ethereum 2.0 migration design (ie, the transfer of Ethereum through a one-way chain bridge ) and the challenges it faces.

In my opinion, Ethereum has always been half technology, half finance, and indispensable; as the Ethereum 2.0 migration approaches, it is crucial to consider technical and economic challenges, and they need to be given equal weight.

From a technical point of view, the comparison between one-way bridging and two-way bridging has been fully expressed and demonstrated ; however, discussions on the advantages and challenges of migration design at the economic level are still insufficient, and so far, one-way migration There has been no progress in the economic review.

What opinions have been made so far?

At present, the Ethereum developer community has reached a consensus: to transfer Ethereum on Ethereum 1.0 (current “ workload proof ” chain) to Ethereum 2.0 (“ Equity Proof ” chain) through a one-way chain bridge.

- B is bitcoin B! Foreign brothers launch blockchain preschool book popular

- Anonymous coin "dead" countdown, where should privacy go?

- The volume and price match is not ideal, and the rotation type is not far behind.

In addition, there are supporters for the two-way bridging scheme , and preliminary discussions around potential native integration will be conducted in the future, but given the current technical specifications , this paper aims to discuss the economic considerations of one-way bridges and introduces what I believe to be in the implementation of this method. Some key economic incentives.

What is the one-way bridge migration?

The so-called one-way bridging scheme, that is, the existing Ethereum 1.0 Ethereum holders can burn their currency in exchange for the equivalent amount of Ethereum 2.0 Ethereum (also known as beacon Ethereum, or "bETH" ). It can be understood that bETH will be generated and locked in the margin contract of the equity proof main network ("beacon chain"). This migration plan will begin during the Devcon V period in October 2019 , and in January 2020, the Ethereum 2.0 and Phase 0 main networks will be officially released.

Why choose one-way bridging?

The following figure shows some of the significant advantages and disadvantages of unidirectional bridges and two-way bridges listed on EthHub . It is worth noting that the advantages of one-way bridges are mostly reflected in the technical aspects, while the shortcomings are mainly concentrated in the economic aspect. That is to say, the choice between one-way bridges and two-way bridges is essentially a trade-off between technical and economic challenges.

| One-way bridging | |

|---|---|

| Advantage | Disadvantage |

| Robust security, margin can only be increased | Early verifiers must bear a high risk of locking (at least about 1.5 years) |

| Less complexity | It is possible to generate two types of tokens through the futures market. |

| Ensure that each chain does not fork | Community (economic system) |

| Two-way bridge | |

| Advantage | Disadvantage |

| Locking risk is small, more margin inflows | High liquidity of the deposit |

| Guaranteed that there is only one ETH coin, not divided into BETH and ETH | Early code has additional code complexity |

| If you add the Eth2.0 circulation, you can also take the initiative to come down. | Although there is no risk of locking, there may be more problems in the early code. |

– Figure 1 – Source –

What is the inflation in Ethereum 1.0 and Ethereum 2.0?

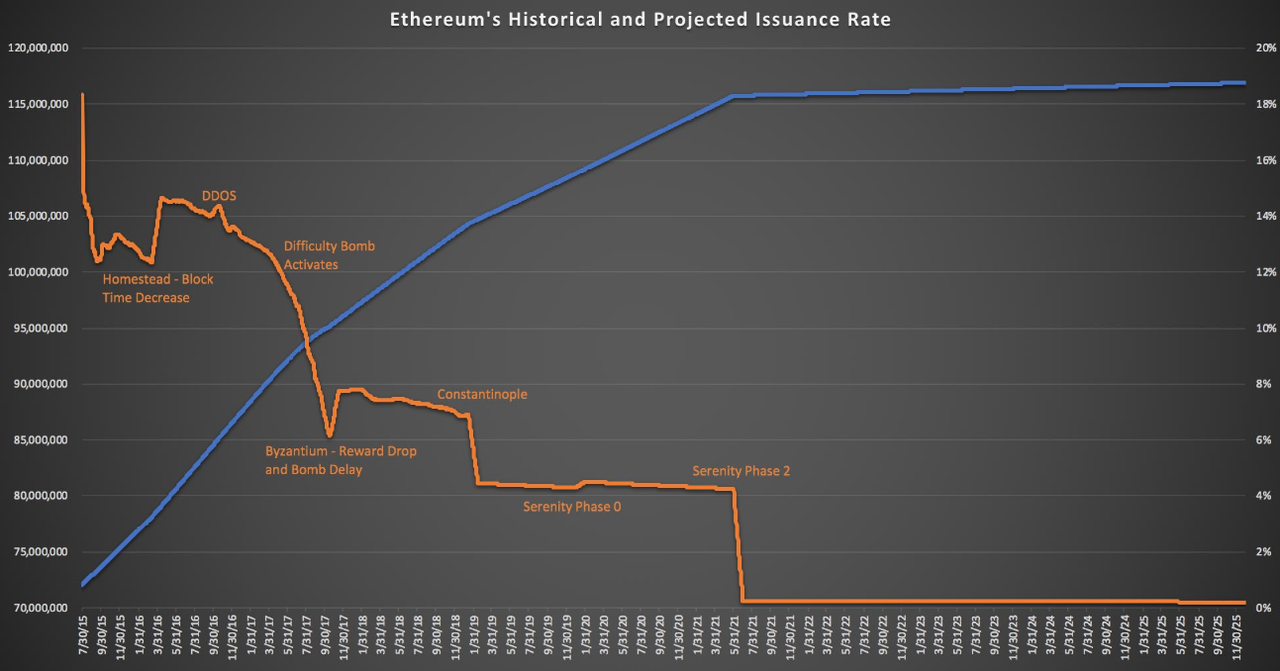

As of January 2019, the block reward for Ethereum 1.0 has dropped to about 2 eth per 15 seconds, and its total volume has maintained a growth rate of 4.8% per year. At some point in the future, the Ethereum 1.0 community will be completely transferred to Ethereum 2.0, bringing its inflation to zero.

– Figure 2 – Source –

The migration of Ethereum 2.0 with its expected impact on inflation is not shown in the above chart. Although it appears that the circulation has increased in the Phase 0 phase, it implies that the currency distributions of Ethereum 1.0 and Ethereum 2.0 will be bundled together.

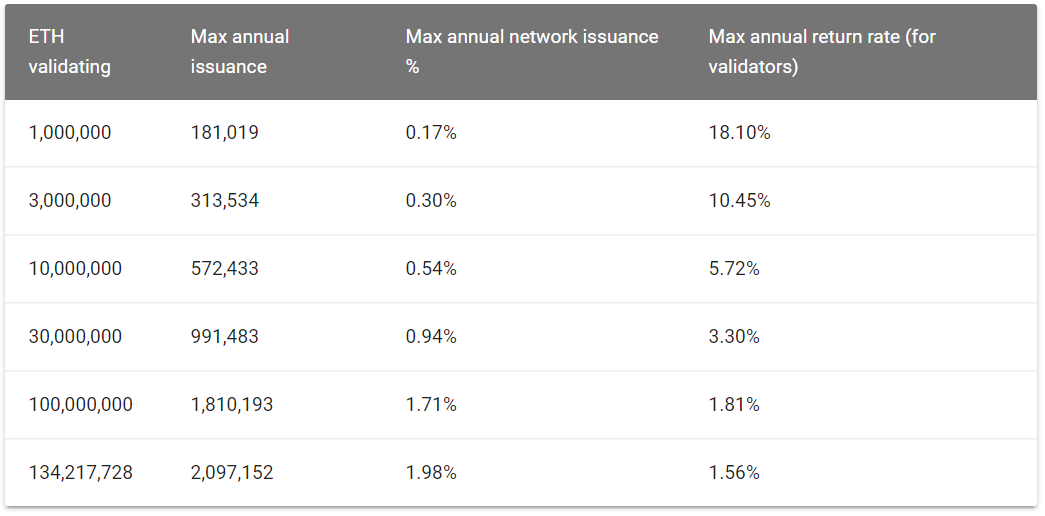

In addition, the picture below is the proposed Ethereum 2.0 block reward design. It is worth noting that the circulation is set in order and depends on the total amount of bETH used to prove the equity. For early verifiers, the incentives will be higher, and as the number of verifiers and bETHs rises, the incentives will gradually decline.

– Figure 3 – Source –

Now let's explain the three design decisions described above separately:

- “Ethernet 1.0's Ethereum will be burned down” – unlike Figure 2, I think: If one-way bridging is implemented, it makes more sense to consider the money supply of Ethereum 1.0 and Ethereum 2.0 respectively. The model of the cast after burning first indicates that there is an inverse relationship between the total supply of Ethereum 1.0 and 2.0 (that is, every time an Ethereum 1.0 Ethereum is burned, an equal amount of bETH is cast). This means that once more than 489,000 Ethereum 1.0 Ethereums have been migrated and burned, their supply will be deflationary; that is, the estimated inflation rate of Ethereum 1.0 ( 4.8% ) will also decrease, with the same rate of decline. . Therefore, if other conditions remain unchanged , the remaining Ethereum 1.0 Ethercoin that has not been burned is likely to appreciate.

- “bETH will be cast and locked ” – bETH will be locked on the beacon chain for about 1.5 years. Therefore, only part of the bETH is liquid and can be used for futures or over-the-counter transactions that are negotiated directly between individual verifiers. Given the limited mobility of bETH, I believe that Ethereum 1.0 Ether will have a liquidity premium over bETH. In other words, since bETH is expected to be locked for 1.5 years, the price of Ethereum 1.0 Ethereum will be higher than bETH. For Ethereum 2.0 verifiers who choose to accept liquidity risk and execute risk, returns are provided as bETH yields (see Figure 3). However, it is not a good investment for early verifiers to burn Ethereum 1.0 Ethereum and hold bETH, depending on the exchange rate of bETH and Ethereum 1.0 (the closer the one to one is better) and the bETH obtained as a verifier interest. The price of bETH may be lower than ETH for a long time (if ETH 2.0 development is slow or the two chains cannot be combined completely). Due to its liquidity limitations, some bETH packages may be returned to the ETH1.0 chain (wrapped-bETH, also known as wbETH) for higher liquidity and utility.

- “BETH locked in an equity account will earn interest.” – It is worth noting that the Ethereum 2.0 certifier reward will be denominated in bETH. When rational cryptocurrency holders evaluate how to optimally allocate their assets, not all channels generate the same interest rate. Here's a decision for the holder: Option 1, configure DAI on Compound and earn a 14.8% annualized floating rate provided by DAI (measured in DAI); Option 2, pledge bETH and earn 1.56% from bETH Annualized floating rate to 18.1%. Because the pricing method and risk are different, the interest rates in Option 1 and Option 2 cannot be directly compared. For example, DAI faces smart contract risk, while bETH faces liquidity and execution risk. The key issue is that the interest on pledge bETH may not be high enough to make early verifiers willing to bear the associated risks. After all, they can configure ETH on the 1.0 chain to earn interest in a variety of ways.

In summary, I think the main problem faced by the one-way bridge in the Ethereum 1.0 to 2.0 migration process is that the value of one Ethereum 1.0 Ethereum is not equal to one bETH, which may be for Ethereum 1.0 and 2.0 Such a developing system brings a ripple-like effect and may have an unexpected impact on the community.

Ultimately, we want to create a healthy economic environment for Ethereum 1.0 and 2.0 so that both can achieve the right incentives, but in an economically isolated system, Ethereum 1.0 Ethereum holders and bETH hold There may be unexpected competition between others. Ideally, there should be some kind of economic incentive to coordinate the communities on both chains.

Futures as a price stability mechanism

In the end, I would like to mention that, in view of the fact that Ethereum 1.0 has a certain probability of completely migrating to 2.0 in the future ( planned so), I derived the conclusion from game theory.

I think this probability is neither 100% nor 0%, but a value of either. Even if the probability of completing a full migration at some point in the future is only 10%, this will limit the volatility between Ethereum 1.0 Ethereum and bETH, but I am not sure how this will be reflected in the market.

Example 1 : In the analogy of stocks , I think proposed merger is a good example: if company A bids for company B's issued shares at $1 per share and the probability of merger success is 99%, then the market The stock price of Company B will be close to US$1 (market pricing can reflect this probability).

Example 2 : In the analogy of decentralized finance , I think a good example of the above balance is MakerDAO's Global Settlement as a stability mechanism for DAI: For DAI holders, the DAI price is stable at around $1. One reason for this is that at some point in the future, DAI will be repurchased by a global clearing asset worth $1. If you buy (or sell) DAI for less than $1, then when the global liquidation occurs, you are profitable (loss). Similarly, if there is a reasonable possibility that Ethereum 1.0 will be migrated to Ethereum 2.0, then bETH should be traded at a price similar to Ethereum 1.0. Any change reflects only the risk of Ethereum 2.0, or a liquidity premium/non-liquidity discount.

Reserve's analysis of the MakerDAO protocol

The analogy of equity mergers and MakerDAO may not be perfect (Ethereum 2.0 is not a company and is not a collateralized stable currency system), but it may be a good explanation of the dynamic relationship between bETH and Ethereum 1.0 Ethereum.

Questions for the community:

In the one-way bridge migration model, what economic incentives can be added to better coordinate the Ethereum 1.0 and Ethereum 2.0 stakeholders?

I hope this article will help advance the discussion about the upcoming migration and look forward to hearing from others in the community. thank you very much!

Original link: https://medium.com/coinmonks/ethereum-2-0-migration-economics-90b83da68213 Author: Aaron Hay translation & proofreading: Jin Zhou & A sword

(This article is from the EthFans of Ethereum fans, and it is strictly forbidden to reprint without the permission of the author.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Digital currency promotes financial innovation, and which areas will benefit?

- The market oscillated and washed the car, ETH continued to lead the test for $200

- Chief Economist of CITIC Securities Research: Implications for the People's Bank of Digital Currency

- Analysis | After 2028, bitcoin prices will never be less than $100,000

- Blockchain Weekly | Industry Weekly Financing 9, National Supervision Continues to Voice Libra

- Looking at the blockchain application from the Shanghai Blockchain International Week Demo Day

- France prevents Libra from doing business in Europe; Coinbase is expected to launch the IEO platform