OTC market research: the “paradise” of money launderers?

Overview Overview

Bloomberg reported that according to TABB Group research, the daily over-the-counter market (OTC) in April 2018 was between $250 million and $30 billion. In contrast, according to Coinmarketcap's data, the cryptocurrency exchange's daily transaction volume is about $15 billion.

However, due to the lack of real and effective statistics, the number of reports varies greatly. Bravecoin.com reported in April 2018 that the daily volume of OTC transactions was three times the size of the exchange. TABB Group estimates that the daily trading volume of the OTC market is $12 billion, while Digital Asset Research claims that the daily trading volume of the OTC market is $250 million.

It is widely believed that the amount of off-exchange daily trading of cryptocurrency is much larger than that of exchanges, but given the opacity of the market, this part of the information cannot be fully confirmed. So, what exactly is this mysterious OTC trading market?

- Another country announced that it will be on the blockchain legal digital currency, it will not be the last one

- Bitcoin | Inbound capacity issues in lightning networks

- Bitcoin's power and difficulty are rising, and high-coin prices are rising, attracting new influx

Report report

What is the OTC market?

The over-the-counter market (Over-the-Counter), also known as the over-the-counter market or the OTC market, refers to transactions that take place outside the exchange. The OTC market originated in the US securities market in the early 20th century. At that time, many investors in the United States had bought and sold these securities through the counters of banks or brokerages, and the counter transactions were named after them. In the 1980s, the OTC market for financial derivatives rose rapidly. In the 1990s, over-the-counter trading of energy-led bulk commodity derivatives was gradually developed.

Source: Medium

Source: Medium

Further, the OTC definition of the bitcoin market is much simpler. In a word: in addition to the bitcoin transactions on the exchange can be called OTC transactions.

OTC trading is not just a few transactions that are occasionally carried out by a small number of people. The real market transaction volume is already very impressive. According to Forbes statistics, at least tens of thousands of bitcoins are traded in OTC every week, not only between individuals and individuals. Trading, even professional organizations often participate in OTC transactions, and over-the-counter transactions by the ItBit Company of the New York Bitcoin Exchange reach thousands of BTCs per week.

Why is there an OTC market?

The main existence of OTC is mainly due to the following reasons

The exchange lacks liquidity – the liquidity of orders on cryptocurrency exchanges is low. Over-the-counter trading is good for pushing big trading orders to find market liquidity. According to industry sources, the top ten market makers in China basically control 90% of the exchange liquidity. The mainstream Bitcoin exchange trades only 0.6 times per second. In other words, there is only one bitcoin transaction every two seconds.

Price protection and anonymity – Over-the-counter trading is good for moving large orders and avoiding price impacts such as 1000 BTC. The order depth will not be displayed as it is on the exchange. In addition, the exchange's strict real-name certification allows some gray bitcoin demand to only seek over-the-counter transactions. Some US users need to use Bitcoin to gamble on underground websites, buy prescription drugs or even black market transactions, and do not want their own bitcoin source to be Tracking, these requirements will eventually be released through OTC trading.

Avoid exchange trading restrictions – Most cryptocurrency exchanges have trading restrictions. For example, Coinbase limits daily purchases to less than $25,000. Kraken only allows users to withdraw $2,500 a day and withdraw $20,000 per month. The withdrawal limit specified by Circle is $3,000 per week.

On the other hand, OTC brokers provide a free paradise for money launderers by addressing liquidity, price protection and anonymity, and bypassing transaction restrictions.

Then the problem comes, because the transparency of the public blockchain, bitcoin transactions are not perfectly hidden. In fact, almost no cryptocurrency on the market today hides identities when sending, receiving, and consuming cryptocurrencies. But why do money launderers still exist through the OTC market, and how does the OTC market help money launderers to bypass regulation? Before discussing this, we need to introduce the OTC trading model to figure out how they are drilling.

OTC trading mode

Major buyers and sellers

The main players in the current Bitcoin OTC market are:

- Hedge funds, some small asset management companies, family offices

- miner

- Regular broker regulated by regulations

- Exchange's OTC department

- Transnational criminal organization

means of transaction

Chat rooms through private, public and brokerage companies

- Secure chat room hosted by Broker.

- IRC chat room

- Skype chat room

- Telegram

- Linkedin (reported by Forbes)

- Dark net

Through the off-exchange broker

- iTBit OTC Exchange

- HiveEx OTC Exchange

How does OTC work?

The first step in any OTC transaction is to find a counterparty for the transaction. It is common to pass an off-exchange broker.

The second step is to negotiate trade terms. For example, if Xiao Ming is looking to buy a BTC, he will specify the following:

- The number of BTCs you want to buy

- When you want the transaction to happen

- Wanted price

Although, in the process of block trade, both buyers and sellers do not want to reveal their identity, the purchaser needs to provide their funds flow certificate to the seller to ensure that the source of funds is legal. The seller will then give a quote for the transaction, usually expressed as a percentage point higher than the best reference price for the mainstream exchange (for example, exchange ABC + 1%). Of course, the specific negotiation process will vary depending on whether Xiao Ming is a buyer or a seller, the medium used to arrange the transaction, the size of the transaction, and whether Xiao Ming has any influence. The influence can be, for example, an ultra-high net worth customer or a large number of bitcoin holders, then Xiaoming’s bargaining power will be stronger.

Once the price is agreed, the buyer sends the bank transfer to the seller to pay the purchase price, and the seller sends the corresponding amount of cryptocurrency or token to the buyer. Depending on where the parties are located, they may also need to complete KYC (know the customer) due diligence on each other to ensure they meet legal requirements.

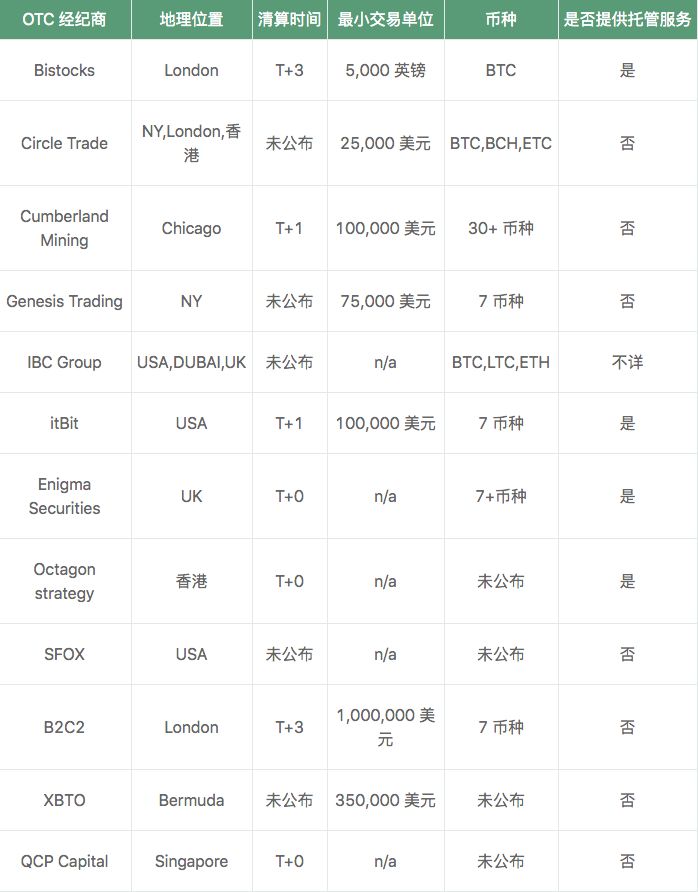

OTC service provider

OTC Exchange – a paradise for money launderers

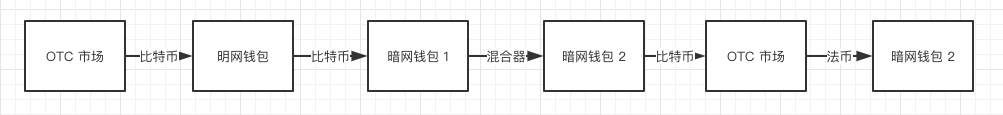

The money launderer completes the cryptocurrency cleaning activity by going back and forth between different addresses through a “bitcoin mixer” and then reassembling it into the full amount via a bitcoin wallet on the dark network. This method is a bit cumbersome to use and certainly not free (the standard fee will vary from 1% to 3% of the mixed cryptocurrency).

To do this, we first need a bitcoin wallet that resides on the Mingnet (also known as the general Internet), which is used by money launderers to buy bitcoin through the OTC market. In addition, we should register two or more bitcoin wallets running on the dark.

First, Bitcoin is sent from a Ming wallet to a Tor wallet hidden in the dark. This type of transaction is called "jumping" and can be traded multiple times on the bitcoin address in the dark network. Each "jump" adds a layer of difficulty to the tracing transaction. At this time, Bitcoin is stored in a dark wallet. At this time, we need to put the Bitcoin into the Bitcoin Mixer. The mixer automatically splits Bitcoin into multiple transactions and sends them at random intervals to enough Bitcoin addresses hosted in Tor, eliminating the possibility of linking these transactions together by tracking addresses. Sex.

Once the cleaning is complete, these bitcoins should be "clean" enough to not be tracked. At this time, you can continue to deposit into the OTC exchange in exchange for other cryptocurrencies, even fiat money.

Bitcoin cleaning process

Source: Standard Consensus

Source: Standard Consensus

Bitcoin is easy to launder money through unregulated exchanges. Unregulated cryptocurrency exchanges (those with no KYC and anti-money laundering (KYC/AML) procedures) can also be used to “clean up” bitcoin, even if the cryptocurrency hybrid service is not used beforehand. Such OTC service providers are ubiquitous in countries where cryptocurrency regulations are not strict. This is achieved by trading Bitcoins multiple times in different markets. For example, users can deposit money into unregulated exchanges and convert them into various mainstream currencies.

Each time a trader exchanges cryptocurrency for another currency, they are adding a certain degree of privacy and difficulty finding, similar to the "jump" between wallet addresses. However, this operational behavior depends to a large extent on the exchange's monitoring technology, so this may not be a completely credible solution.

What's more, users can extract their cryptocurrencies into an external cryptocurrency wallet through other anonymous exchange accounts they have. Depending on the exchange, they can convert it into a “clean” legal tender, but unregulated exchanges are hardly recognized by the legal currency market and are often short-lived.

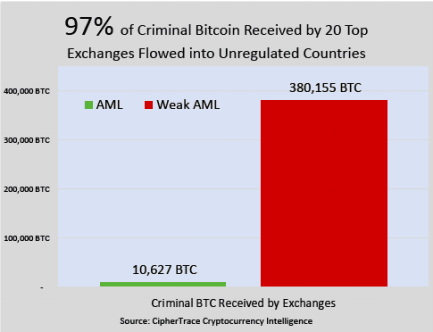

However, a few months ago, researchers found that unregulated cryptocurrency exchanges received the vast majority of "dirty" bitcoins on the Internet. More exaggeratedly, in countries where there are few anti-money laundering regulations, the exchange's bitcoin obtained from money launderers is actually 36 times that of exchanges under the regulatory system.

According to industry sources, money laundering in the OTC market is the mainstream. Bitcoin is increasingly being used by OTC Bitcoin brokers who use this market for high-risk bitcoin transactions related to Chinese capital flight and money laundering. These high-risk OTC Bitcoin brokers may use foreign bitcoin wallet hosting services and exchanges.

These exchanges do not correctly or negligibly conduct KYC or anti-money laundering monitoring of bitcoin purchases. Over-the-counter Bitcoin brokers primarily attract two types of customers:

- Those who want to use Bitcoin to transfer funds out of the country.

- Those who want to convert a lot of cash into bitcoin.

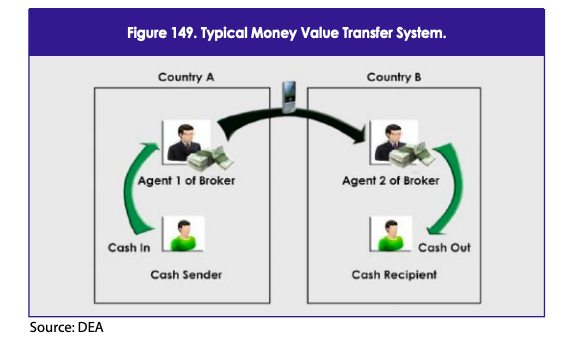

According to the report of the US Drug Enforcement Administration and the Interpol report, in view of China's restrictions on capital flows, cryptocurrencies have become quite popular due to circumvention of laws. Money brokers at China Underground Banking Systems sell bitcoin to drug traffickers to obtain cash (usually US dollars) that these drug traffickers sell in the US, Australia and Europe. The drug is then sold to Chinese citizens in exchange for bitcoin that Chinese citizens use to transfer their asset prices outside of China. Because OTC Bitcoin brokers are able to transfer millions of dollars of bitcoin abroad, as part of the capital flight plan, more and more OTC Bitcoin brokers are intertwined with the criminal money laundering network of capital flight. Many Chinese companies that produce goods for the TBML (transaction-based money laundering) program are now more willing to accept bitcoin. Bitcoin is very popular in China because it can be used to transfer value overseas to anonymity, bypassing China's capital controls.

Money laundering system

Source: US Drug Enforcement Agency

Source: US Drug Enforcement Agency

According to the Interpol report, the Transnational Criminal Organization (TCO) is currently facing US bank censorship when it sends money from the US to Chinese manufacturers. However, if the TCO purchases bitcoin through an authorized money service company (MSB), it will not trigger a warning, and it will not face further review when transferring Bitcoin to China. Many TCOs can also purchase Bitcoin from individuals who do not have an MSB license. As a result, many TCOs will be able to convert the cash they need to clean into bitcoin and buy Chinese goods without fear of being supervised by formal financial institutions.

Source: CipherTrace

Source: CipherTrace

Today, despite the significant improvement in anti-money laundering (AML) regulatory enforcement, anti-money laundering operations have largely turned to cryptocurrencies. Of the bitcoins directly received by cryptocurrency exchanges, 97% went to countries with weak anti-money laundering laws, CipherTrace Cryptocurrency Intelligence wrote in its “Q3 Third Quarter cryptocurrency anti-money laundering report”. In countries with weak anti-money laundering regulations, nearly 5% of cryptocurrency exchanges come directly from crime.

Conclusion

The OTC market provides a wonderful hotbed for money launderers. The regulated OTC market provides money launderers with a large amount of access to Bitcoin. They use the Bitcoin Mixer service to pass cryptocurrencies from the OTC market. The transaction jumps to clean up the original transaction record, thus "cleaning up" the cryptocurrency. The unregulated OTC market can directly provide money launderers with access to "clean" French currency, which is why the OTC market can be called a paradise for money launderers.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column | Ren Zhengfei talks about "coin" for the first time, the world has no confidence in the dollar

- Dry goods | Central Bank Digital Currency Events

- Sudden! OKEx Korea will remove 5 kinds of anonymous coins, or related to the new FATF regulations.

- Viewpoint | Bitcoin Volatility Misunderstanding: Volatility does not mean that it cannot be a good means of storing value

- QKL123 Quote Analysis | Black Swan Event, Helping Bitcoin Quotes (0916)

- How does Vitalik evaluate Ethereum Eco-Privacy, DeFi and Ethereum 2.0?

- A picture to understand the world currency and market