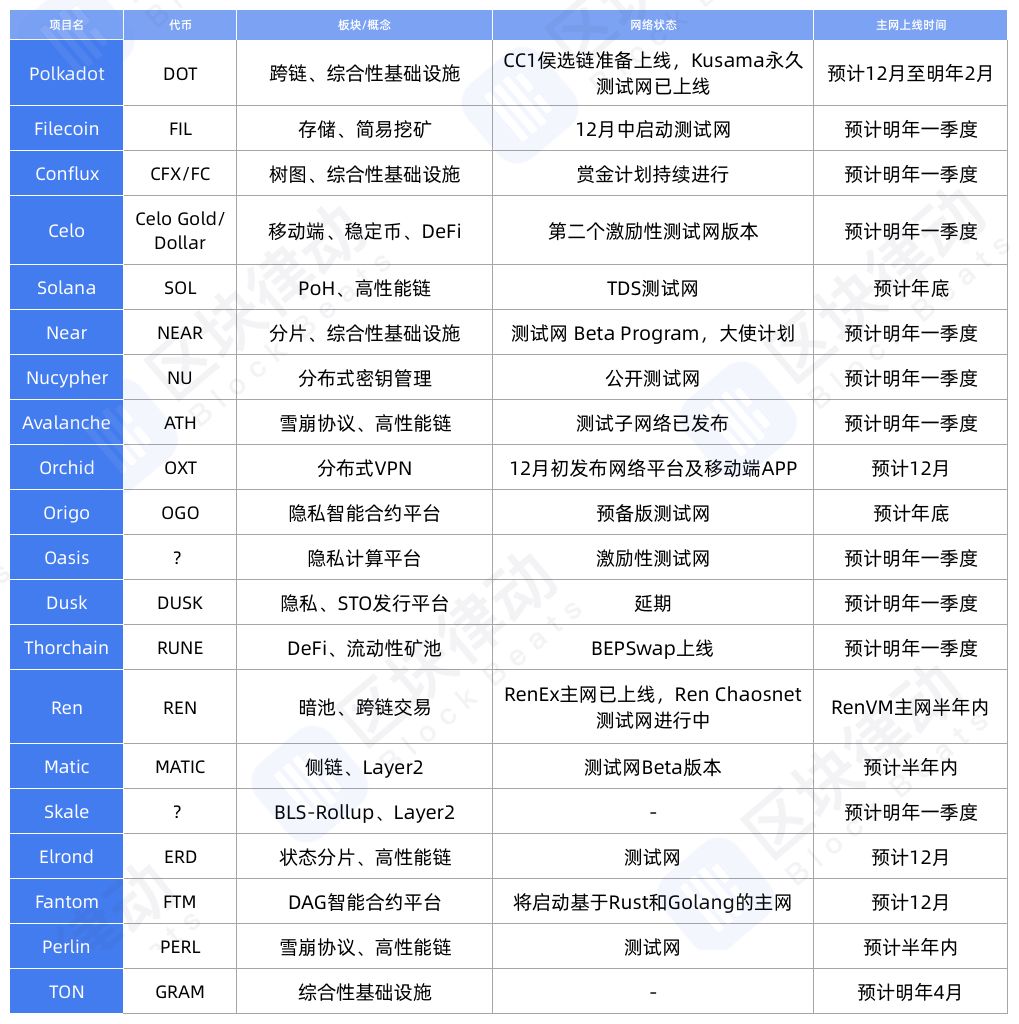

What are the impacts of these 20 upcoming mainnet projects on the blockchain industry?

Author: 0x22

Source: BlockBeats

These two weeks are not easy for cryptocurrency enthusiasts.

With the tightening of regulatory policies and the guidance of pessimism, the price of bitcoin fell to US $ 6,500, refreshing a low of nearly 30 weeks, and altcoins generally plunged substantially. Although the market has picked up in recent days, market sentiment has still fallen to freezing point.

- Interview with Zheng Zhiming, Academician of the Chinese Academy of Sciences: Blockchain is a relatively mature and reliable evaluation system built for the first time in human history

- Viewpoint: A blockchain without a community is just a database, a community without a charter is not a community at all

- From quantum computing to blockchain: frontiers, trends, and challenges

In this case, we might as well look to the future. BlockBeats has sorted out the blockchain projects that have been officially announced in the next six months.

Polkadot

It is no exaggeration to say that Polkadot, which aims to connect with Wanchain, is the most eye-catching project this year. Gavin Wood, which bears many auras such as Ethereum, Parity, and Web3, is also more and more well-known in the industry.

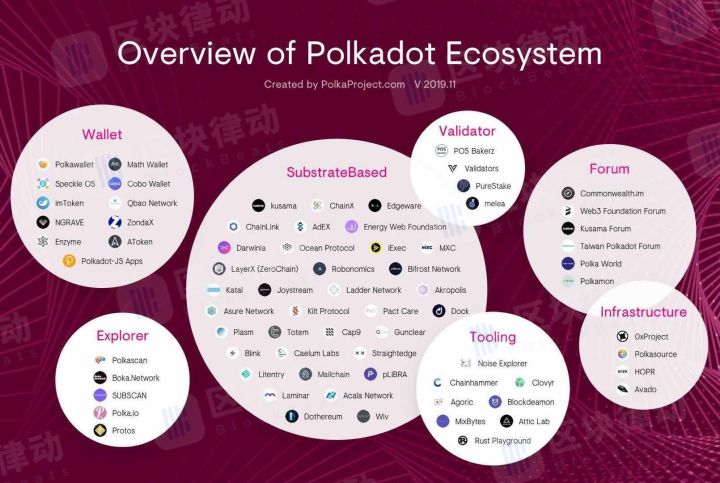

Before the line went live, BlockBeats found that according to data released by PolkaProject.com, there were 37 Substrate-based projects and more than 20 related tools and infrastructure projects. Ecological projects are the opposite.

After the ecological projects ChainX and Edgeware became popular and the permanent test network Kusama was officially switched to PoS, Polkadot's main network was also on the agenda. In the community, Gavin Wood said that Polkadot is undergoing a final audit. If everything is normal in Kusama and no fatal problems are found in the audit, the candidate chain of the final mainnet of "Polkadot CC1" should be launched in December. After that, DOT tokens can be circulated on Polkadot CC1, and nodes can staking, but transaction transfers cannot be performed for the time being.

Like the Cosmos mainnet, the IBC protocol was not immediately deployed. Most projects borrowed the Tendermint consensus and SDK. Polkadot may not be flawless at the beginning, but investors can still pay close attention to Polkadot's cross-chain and parallel Progress in blockchain issuance, etc., to see if the driving force of Ethereum's ecological migration of Boca will change.

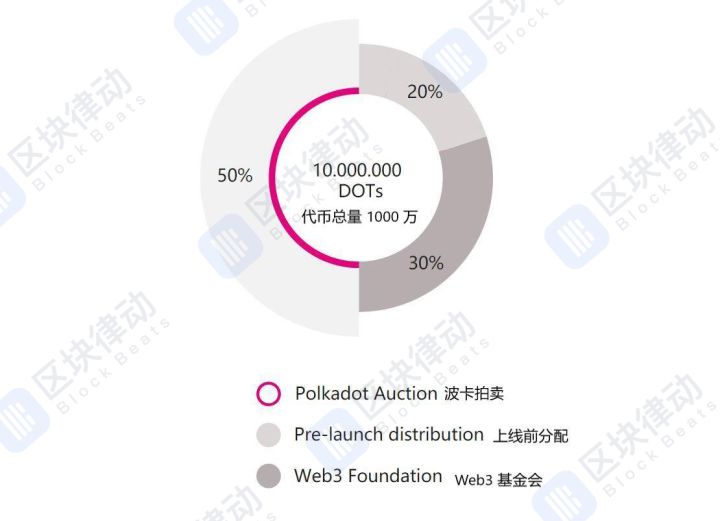

BlockBeats learned that Polkadot completed a round of token crowdfunding in October 2017 with an average price of about 1DOT = 0.109ETH = 35USD. Currently, according to the futures quoted price of the BiHODL exchange, the price of the DOT token is around $ 97, which is more than 150% higher than the initial price.

At the same time, Polkadot completed the second round of ten-million-dollar financing this year, transferring 5% of 500,000 DOT tokens, and a post-investment valuation of $ 1.2 billion, led by the early-dollar fund IOSG. It is reported that Continue Capital, a cryptocurrency investment agency, also raised $ 5 million in Boca this year.

In a time when good projects are stretched, project valuation and quality no longer seem to be perfect.

Interestingly, when BlockBeats interviewed some well-known overseas project parties and asked the other party's most anticipated projects or industry vision, the other party's answers often mentioned Polkadot and Substrate. Polkadot's mainnet is indeed worth looking forward to.

Filecoin

Which project has repeatedly bounced tickets but still gets the attention and support of the public? It must be Filecoin.

The reason is very simple, Filecoin is regarded as the best token incentive layer of the IPFS protocol, and the idea of algorithmizing and blockchainizing the cloud computing market is brightening. IPFS provides a new infrastructure for data storage and has been researched and applied by hundreds of Internet and blockchain projects. This is also an important reason why IPFS / FIL is favored by people.

In the past four or five years, there have been many blockchains focusing on the distributed storage market, such as the early storage tokens Sia, Storj, and recently Arweave with the concept of permanent storage. In contrast, Filecoin prevents the cheating and witch attacks of storage miners after using the proof of replication and time and space, and allows the miners to continuously verify the occurrence of storage behavior to the network, greatly increasing its security and completeness.

Just last month, Protocol Labs announced that it is expected to launch the Filecoin testnet in mid-December and officially launch the mainnet in the first quarter of next year, which has sparked heated discussions about Filecoin in the circle. Earliest, Filecoin's mainnet launch date is set to Q2 2018, but because of technical difficulties, it has been delayed for another year and a half. Everyone guesses that Filecoin may really be online this time.

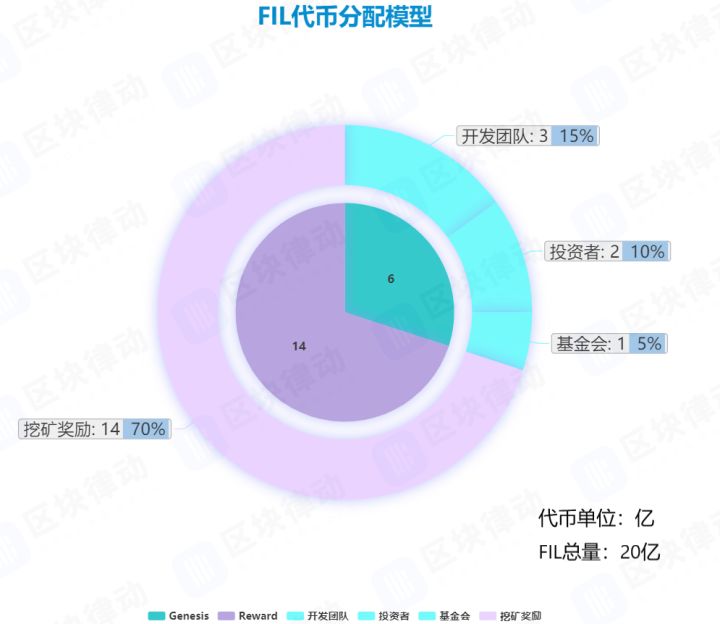

So, is Filecoin expensive from a circulation perspective? BlockBeats organized the Filecoin token distribution scheme as follows. The total amount of FIL tokens is 2 billion, of which 70% is generated in subsequent mining, 100 million foundations, 200 million investors, and 300 million Protocol Labs (Filecoin development team), of which the official share has a 6-year linear lock-up period. The crowdfunding price of FIL tokens is based on the investment round and lock-up period. There are two levels of USD 0.75 (private placement) and USD 1-5 (public placement). The calculated weighted cost is USD 1.29.

Just, can Filecoin really go live this time?

Conflux

"Conflux wants to be an open and secure world server belonging to China and facing the world."

This is the rhetoric of Conflux founder Long Fan in an interview with BlockBeats. Conflux with a background of Yao Ban may start this great vision within six months.

Conflux uses a unique tree graph structure to achieve test network data of 3000 to 6000 TPS without sacrificing decentralization. In the first quarter of next year, the team will release the main network and launch scalable smart contracts. The world's top academic capabilities are beyond doubt. If the mainnet is successfully launched, it will be a feedback on project engineering capabilities.

It is worth mentioning that the Conflux Bounty plan is very bright, mobilizing the enthusiasm of community enthusiasts and developers to participate, and also finding value for the token economy.

Celo

Speaking of Celo, many domestic users in the industry may not yet understand it. In fact, it is already the most popular blockchain project in the Bay Area and DeFi Crypto. It combines excellent stable currency mechanism, mobile-first design concept, and improved PoS. The consensus mechanism has attracted many cryptocurrency enthusiasts.

Projects that simply tell stories in terms of expansion technology are difficult to sustain. Projects that are realistic and reduce the threshold for users and developers will be the future trend.

Celo uses ultra-lightweight clients to reduce the data that needs to be synchronized, so that smartphones can also participate in network connections, and address-based encryption technology allows users to map phone numbers to blockchain addresses, which allows Celo users to communicate with mobile phones Anyone on the contact list makes a transaction transfer.

At the same time, the design of Celo stablecoin eliminates people's concerns about the high volatility of cryptocurrencies, and it can also integrate the advantages of mobile clients to generate more DeFi products.

It is worth mentioning that after MakerDAO, a lot of projects have launched a shock to the stablecoin field, including Basis, the originator of algorithm stability, Terra staking hashing power, Reserve, a strong investment institution, Ampleforth, etc., but these The common problems involving stablecoin projects are often that the white paper does not demonstrate well, and whether their own stability system can be established is more simply deduced with simple logic. And Celo does a good job in this regard. Celo has carried out strict mathematical demonstrations of Celo Gold, Celo Dollar and Vault mechanisms. It has high academic discussion value in itself. Its team has deep thinking in mathematical finance and open finance. See Weizhi.

In terms of engineering capabilities, a closer look reveals that Celo's progress is actually fast. In April of this year, Celo just received a US $ 30 million financing led by a16z crypto and Polychain Capital. Dragonfly Capital also participated in this round of investment. This is Celo's second financing after previously receiving US $ 6.4 million.

In July, Celo opened the first testnet version, Alfajores. Test users can try out the Celo wallet or the Celo CLI (send transactions).

In August, Polychain announced the establishment of an ecological fund for Celo and the release of related SDKs. Celo also became the third Polychain project to launch (cooperatively) an ecological fund after Dfinity and Polkadot.

At the end of October, Celo announced the second testnet version of Baklava's promotion plan. The top 50 teams in the event will have the opportunity to obtain a large number of Celo Gold tokens when the mainnet is launched (the Celo Dollar stable currency and Celo exist in the Celo network). Gold floating equity currency). BlockBeats has explained it in the article "Celo Announces Test Network Baklava Competition Plan, Top Ranking for Mainnet Tokens".

Solana

"After the node is punished, should the voter also be punished?"

After the proposal by Solana co-founder Eric Williams to impose a 100% Slash penalty on the offending node, there was a heated discussion in the community. Some people think that attention should be paid to assigning risks to more nodes to get votes, and some people think that voters should not be punished and they should learn from Tezos' mortgage mechanism.

Solana, as the first blockchain project to separate time and status, tried to use PoH streams to achieve capacity expansion in the de-sharded state, and was widely used in financial scenarios such as DEX. TOUR DE SOUL is Solana's test network. It attracted the participation of many community enthusiasts, and the TPS data exceeded 100,000.

According to ICO Analytics data, Solana is expected to be launched on the mainnet at the end of December this year, and the performance data and application scale will become a highlight after the launch.

Near

There are many projects that claim to be comparable to Ethereum 2.0, but there are few real ones. Near Protocol is one of the most powerful competitors.

This is not a word of mouth, but the view of Vitalik, the founder of Ethereum. At the Dragonfly Summit that ended recently, V God bluntly said: "Near is doing very well and it makes me anxious." This is the second time that V God is public after Osaka Devcon5 calls Near as the most powerful competitor of Ethereum 2.0. The project was praised on the occasion.

BlockBeats previously introduced the project in the article "NEAR Protocol: Creating a Public Sharding Chain Available to Everyone | Project Introduction". The fragment design scheme named "Night Shadow" in Near Protocol is widely regarded as the most comprehensive fragmentation scheme at present. In addition to excellent protocol design and engineering capabilities, Near places great emphasis on "friendliness" for developers and users, and has created a complete set of easy-to-use online smart contract compilers and user wallets.

In the recent state explosion that has entered the public eye, Near has also considered it and made adjustments to the Ethereum GAS mechanism.

"Of all the public chain solutions, Near's technology is the best, but I don't know if it can be done." An investor with many years of blockchain investment experience told Block Rhythm BlockBeats. Anyway, according to the project roadmap, Near will launch the mainnet in Q1 next year, and what the effect of the online community is expecting from community fans.

Maybe 2020 will be a battleground for star projects like Near, ETH2.0, Polkadot, etc.

Nucypher

When it comes to Nucypher, everyone always thinks of the so-called "Four Bloomberg Kings", that is, the four "middleware" projects that commercial writer Aaron Brown listed on the column earlier this year, including Cosmos, Polkadot, Nervos and Nucypher.

In fact, the first three are all highly comprehensive blockchain projects, and Nucypher, which is structured on the Ethereum privacy layer protocol, is relatively single, focusing on distributed key management, and the project promotion is also more low-key.

In October this year, BlockBeats reported that NuCypher announced the launch of a public test network, including the staking network stress test. The staking operators participating in this test include Figment Networks, Staked, Bison Trails, Polychain Labs, Hashquark, etc. NuCypher expects to launch an incentive testnet by the end of this year, and its mainnet is expected to go live in the first quarter of 2020.

Avalanche

How did you learn about the Avalanche avalanche agreement?

Someone learned from the blockchain academic alliance IC3 (the radiation project includes the well-known BloXroute, Thunder, Aeternity, etc.), some people learned from the concern of the project founder, Professor Emin Gun Sire of Cornell University, and others are Known from the news that ETH holders will get the friendly fork network Athereum ATH tokens for free.

Obviously, this is a "hardcore" "academic" project. BlockBeats pointed out in the Avalanche Protocol AVA: A Platform for Building Platforms with Third Generation Consensus | Introduction to New Projects that asynchronous consensus algorithms for distributed systems originated in Paxos, and based on the consideration of perpetrators, the BFT system was developed. Algorithm, Tendermint sacrifices partial decentralization to improve performance, and Avalanche avalanche consensus is to balance high performance and non-access characteristics through a concept called "metastable collapse".

According to the previous analysis of BlockBeats, the AVA Labs team is trying to make the AVA network into a two-tier structure. The underlying PoS network will be provided with AVA tokens for security and governance, and holders of AVA tokens will be involved The permissions of all sub-networks. The sub-network can be any custom chain. It can be Athereum or any existing mainstream public chain using avalanche consensus fork, such as EOS, or even the alliance chain.

In theory, any sub-network will be able to interact with the main network, so AVA is also called "platform of the platform".

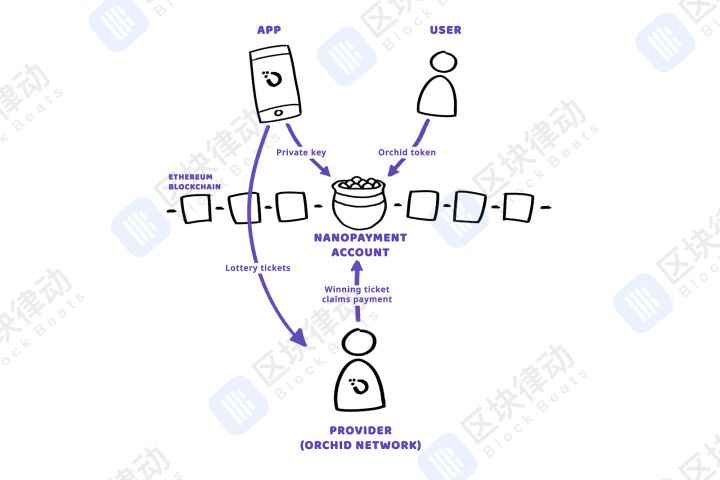

Orchid

Orchid Protocol (Orchid Protocol) is not a public chain project, but a distributed virtual private incentive network.

Last week, Orchid officially announced that it will launch the Orchid network and generate OXT tokens in the first week of December this year, and also release iOS and Android applications, which means that users can use OXT tokens to pay bandwidth fees to node operators. Orchid had 5-10 node providers at the initial launch, including participants from the traditional VPN world and new entrants from the crypto space.

It is interesting that the Orchid protocol for distributed virtual networks has also been innovative in the Layer 2 payment and expansion scheme. BlockBeats previously appeared in "Blockchain Pay-As-You-Go?" Interpretation of Orchid payment technology. Orchid's original Layer 2 solution is called Probabilistic micropayment / nanopayment by the team. As the name implies, Orchid also solves the payment problem on the blockchain through "probability".

Take a transaction that pays $ 1 as an example. Through probabilistic payments, this would be equivalent to a 1% chance that the consumer would send $ 100. Orchid took this to the extreme, splitting it into one thousandth, or even smaller, forming "small lottery tickets" one by one. All lottery tickets are sent off-chain, and only when the lottery ticket is redeemed due to winning, it is necessary to cash on the chain. Since the recipient cannot know in advance which lottery will win, all lotteries have an implicit value.

In this way, Orchid not only improves the transaction speed, but also allows users to pay as they go, changing the previous annual subscription and monthly subscription system.

"Orchid hasn't run yet, it's going to be online!" These good news revived the long-lost Orchid community enthusiasts.

Origo

Origo Network, which has received world-leading crypto capital investments such as Polychain Capital, Arrington XRP Capital, 1kx, etc., is a project dedicated to the privacy protection of smart contracts. Origo enables users to create and execute smart contracts without revealing any sensitive information.

Origo believes that most of the current smart contracts disclose detailed information, which makes it difficult for real-world enterprises or individuals to experience the friendliness and convenience of blockchain and Web 3.0. On the Origo platform, it can use a compiler to automatically generate an encryption protocol, so developers can build privacy-protected smart contracts and applications without knowing the encryption technology, and the privacy of users is also guaranteed.

BlockBeats has stated in the article "We have experienced 5 privacy PApps on Origo and reached the following conclusions." The Origo Network's privacy DApp (PApp) is currently in the preliminary DEMO stage, and its functions are relatively monotonous. Users can only use the test. The online token is simply tested, but the inspiration it brings to the privacy blockchain platform is worth thinking about, because the simpler, practically applicable privacy DApp may be the first to land.

Origo officially announced the activation of a second testnet at the end of last month. It is reported that this is a preview version of the mainnet. The Origo mainnet is expected to be launched by the end of this year. The official announcement of a total of about 240 million OGO mainnet mining reward.

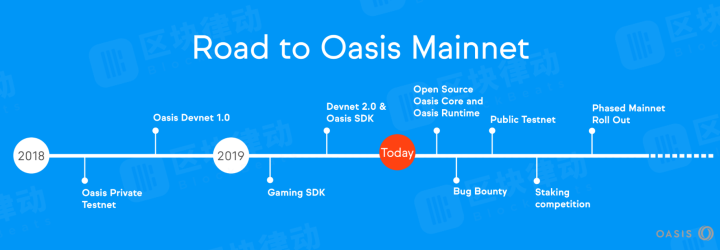

Oasis

Similar to the orchid agreement, investors who have waited for two years finally have news.

In October this year, Oasis, a blockchain privacy computing platform, released the first testnet and allocated 1% of the total tokens to test users. BlockBeats has analyzed that Oasis Lab can effectively bundle testnet nodes, developers and other participants to the mainnet line through incentives such as "mortgage contests". According to the previous mainnet voting precedent, the rewarded mortgage tokens were mortgaged to the nodes by the team, and the nodes enjoyed the additional issuance income but could not obtain the control of the tokens.

Although Oasis Lab did not officially disclose the mainnet launch date, according to data disclosed by ICO Analytics, Oasis is likely to launch the mainnet in Q1 2020.

"Today, companies use user data as a product and monetize it. If users can maintain control over data and earn revenue from it, the world could be very different." Oasis Lab founder, California, USA University of Berkeley professor Dawn Song said this when he accepted Craig S, a former Times reporter.

This is the vision of Oasis and the vision of Web3.

Dusk

In November 2018, Dusk Network, which focuses on the concept of privacy blockchain and STO issuance platform, was the first project to be pre-sold in advance on the Ethfinex & Bitfinex token sales platform, and it bucked the trend of US $ 8.1 million in the then tumbling environment.

This year, because the project was supported by the Web3 Foundation and Polkadot / Web3 started to fire, Dusk community enthusiasts found themselves a better meme-Web3 privacy, the privacy chain of the Polkadot ecosystem. In July, Dusk also successfully launched the Binance Master Station, the largest overseas cryptocurrency exchange.

However, as the project progressed, some community enthusiasts began to waver. Some people on Twitter and Telegram questioned whether Dusk could go online on the main network as scheduled at the end of this year. In response, Dusk officials hinted at the delay of the mainnet, but said that there are still opportunities to issue STO in the fourth quarter.

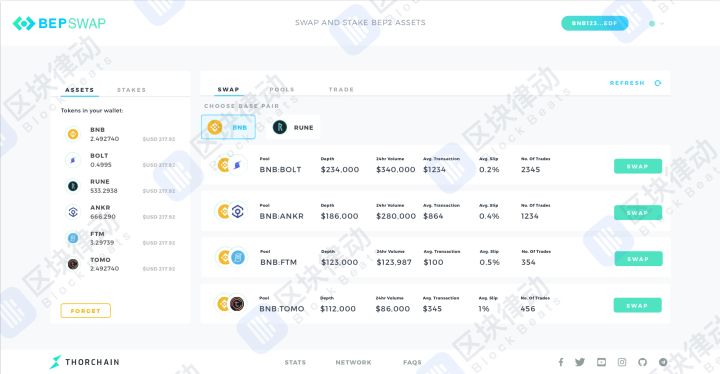

Thorchain

If you do not close Binance DEX, then you must not understand the recent hotness of Thorchain.

Thorchain's RUNE token has IDO (similar to the Raven Protocol) on Binance DEX, and the price soars 5 times after going online. So what exactly is Thorchain's project?

Thorchain aims to build a cross-chain digital asset liquidity market. Users can pledge assets in the liquidity pool to earn expenses, and can also exchange assets at open market prices, or borrow and lend various digital assets.

To put it plainly, Thorchain is to make a better Uniswap, a DEX market formed by liquidity without limit order. In addition, Thorchain will mainly work on Binance Chain and is committed to becoming the leader of Binance Chain DeFi. This is because the first product BEPSwap released by Thorchain has been able to mortgage and trade BEP2 assets based on Binance Chain.

DeFi occupies most of the country in Ethereum. EOS has not been able to shake its position in the financial field before. Is there a chance for Binance Chain?

Ren

The concept of dark pool trading comes from the traditional stock market, and institutional investors need the anonymous pairing for block trading. In this way, you can hide the transaction information of your large order to be closed, avoid major changes in the secondary market price, and avoid the intention of high-frequency transactions to analyze large funds using the market.

BlockBeats learned that the current dark pool transaction volume has accounted for more than 15% of the entire US stock market. In the foreign exchange market, many dark pools process hundreds of billions of transactions daily. In the cryptocurrency market, the demand for dark pool transactions is on the rise. Aite Group's report shows that 8% of crypto trading volume is already being conducted through dark pools in 2019. This data accounted for only 5% in 2017 and not in 2014. Dark pool appears.

What Ren (Republic Protocol) wants to do is a decentralized dark pool transaction protocol, while supporting interoperability. Initially, Ren DEX will support dark pool transactions between BTC, ETH, ERC 20, USDT, and ZEC. After product iterations, the SDK of the RenVM virtual machine can be used as a plug-in for other DeFi, providing cross-chain liquidity and protecting privacy transactions. service.

If you agree with the "middleware" investment logic, and recognize that "universal plug-in" projects like Chainlink are more attractive than public chains or applications, then Ren is very worthy of attention.

Ren has released a preliminary network called Chaosnet (after the testnet and before the mainnet version), users can exchange tokens between BTC, BCH, ZEC, DAI (SAI) in Chaos DEX, and can also flow Inject funds into the sexual pool to obtain income, and also be able to mortgage 10,000 REN to run Darknode (that is, the node of the dark pool DEX) on Chaosnet to share commission revenue.

If the above language is difficult to understand, then we use the two simplest formulas to explain: REN = dark pool + cross-chain transaction + Uniswap, REN ecological role = transaction user + liquidity miner + DEX node + REN investor + RenVM SDK user.

From the official website roadmap, the main SubZero version of RenVM is under development and is expected to be online within six months.

Matic

The project focused on expansion has almost made the market aesthetically tired, but Matic has still become a monster coin in the crypto market in 2019. In a bear market environment, Matic still maintains an IEO return of about 8 times and a secondary market yield of 2.5 times.

Is this because the improved sidechain technology solution that introduces PoS checkpoints under the Plasma framework is more complete? Or is it because of the highly sticky community of Ethereum in India? Or is there support behind Coinbase and Decentraland?

Maybe for a reason. And, on the sidechain track, when the market's attention has shifted away from POA and LOOM, we must always look for a new runner.

In addition, the speed of this new runner does not seem to be slow. After the alpha and beta versions of the mainnet are successively delivered in Q2Q3 in 2019, the official version of the mainnet is expected to be released at the end of 2019 or Q1 in 2020.

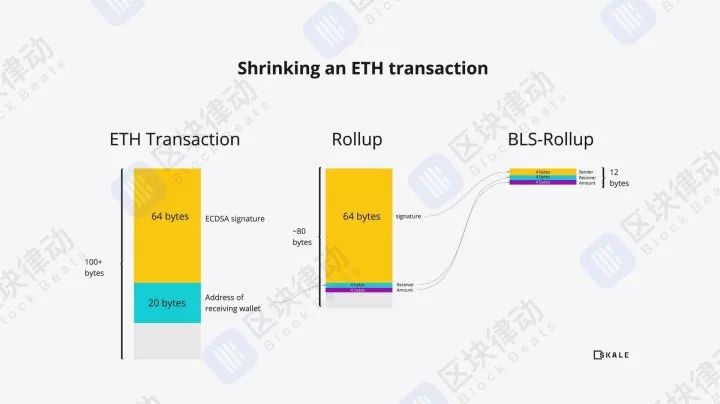

Skale

BLS-ROLLUP is a layer 2 optimization solution that uses the Skale network to accelerate transactions and smart contracts on Ethereum, while retaining the security of layer 1 and storing user funds on the main network. This technique does not require any waiting time, nor does it require a large number of calculations of zk-SNARKS / STARKS.

Half a month ago, Skale Labs formally announced the inclusion of BLS-ROLLUP in the Skale network, and Validator validators can participate in the BLS-ROLLUP process and earn benefits.

Today, with layer 2 solutions such as sidechains, status channels, and Truebit gradually developing, Skale wants to use BLS-ROLLUP to provide a faster and safer infrastructure for Ethereum DApp development and applications. It seems more distinctive, and even Ethereum And Consensys co-founder Joseph Lubin are very optimistic about Skale, saying that it represents the most advanced second-tier capacity expansion technology, which will bring significant improvements to the Ethereum ecosystem.

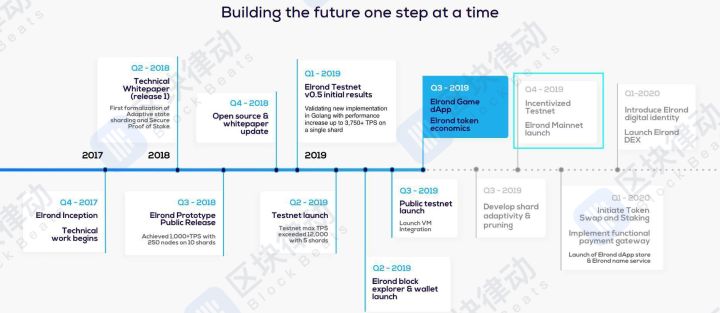

Elrond

Since Zilliqa was born, there have been fresh sharding projects coming online every year, and this year is no exception. Harmony, Elrond (Binance IEO), MultiVAC (KuCoin IEO), etc. are still emerging in the market.

The differences on the segment track are mainly in terms of consensus algorithms, inter-chip communication, and scalability. Judging from the change of the track head valuation project, the consensus algorithm of the sharding project has gradually transitioned from PoW to PoS / PBFT. Difficulties are converging with cross-chain, that is, solving the interoperability problem between tablets. The scalable solution is relatively full of flowers. Elrond chooses a dynamic number of shards, which can be increased or decreased according to the situation.

Like all other sharding projects, Elrond's biggest selling point is also high performance. The testnet 10kTPS and 5s final data have inspired many foreign community fans. According to the official website's roadmap, the Elrond mainnet will be in December. online.

Fantom

In the first half of the year, from KuCoin to Fantom, which was listed on Binance, was also the DAG smart contract platform hotly debated in the market, but the attention dropped in the second half of 2019.

Actually, the Fantom project is very interesting in two points.

The first is Andre Cronje, the core technology and spiritual leader of Fantom. He was previously the chief code analyst of CryptoBrief. He is a relatively influential coder in foreign channels such as 4chan and YouTube. His addition brought the establishment of Fantom consensus. Especially great help.

The second is moving closer to Cosmos. The Fantom Foundation has recently announced that it will issue $ 35,000 in FTM tokens to reward technical teams that use Cosmos SDK and Fantom technology for proof of concept or initial products. Six months after the launch of the Cosmos mainnet, more and more projects have begun to try the Cosmos Sdk / Tendermint consensus. BlockBeats predicts that after Polkadot and ETH2.0 are launched, the competition between the ecosystems will become more intense.

According to Fantom's blog post in September, the official expects to launch a Rust and Golang-based mainnet by the end of this year.

Perlin

If Lianchuang does another new project immediately after the project goes online, will your favorability plummet?

High-performance chain Perlin encountered this situation. Earlier, there were media reports that "Perlin founding team members will issue SGD Mist again." Perlin then rumored that former team colleagues Mirza and Trung had been asked to leave by the Perlin team for false allegations, poor performance and misconduct. The new project promoted by the two, which was reported to be Mist, had nothing to do with Perlin. But judging from community feedback and currency prices, this does not seem to dispel investor concerns. Perlin, which raised $ 53 million, currently has a market capitalization of less than $ 7 million.

BlockBeats earlier in "Perlin: Powering Web3.0, High-speed Ledger Powers Wasm Smart Contracts | Project Introduction" pointed out that Perlin has positioned the project from "the DAG-based distributed computing market" to "Web3 "Infrastructure", the description center of the official website has changed to "combining lightning fast transactions and guiding activation users", which is different from the original vision of the project.

BlockBeats BlockBeats also learned that Perlin created a new DAG distributed ledger structure called wavelet, and borrowed the Avalanche avalanche consensus mentioned above (BlockBeats Note: According to AVA Labs officials, Perlin ’s The implementation of the avalanche consensus has some vulnerabilities), making the testnet data reach 310,000 TPS and 4 seconds of finality. It is expected that the mainnet will be released in December this year or Q1 next year.

Telegram (TON)

Funding of $ 1.7 billion has made Telegram Open Network (TON) a giant in the primary market of the blockchain and the best microcosm of the speculative bubble at the end of 2017.

The TON originally scheduled to be launched in Q3 this year was not smooth. The source of pressure is not internal technological progress, but external tightening.

BlockBeats reported that in October this year, the US SEC filed an "emergency action and obtained a temporary restraining order" against two offshore entities under Telegram's TON ICO. Subsequently, TON initiated voting applications for two rounds of token investors in February and March 2018 to decide whether to refund the investment funds. Most of TON's investors decided not to require Telegram to return their early investment funds, and agreed with TON's previous proposal to delay the launch of the mainnet until April next year.

The healthy development of the blockchain industry requires the development of innovative technologies and the implementation of application scenarios. The bull market of cryptocurrencies will never come earlier simply because of the tilt of funds and policies. The fundamental resonance has always been a necessary and sufficient condition.

It is sad that there are not many essential differences between the current cryptocurrency market and two years ago. The story narrated by the project is similar, killer applications have not yet appeared, and breakthroughs in key technologies have been delayed.

However, it is gratifying that a large number of star projects will be launched on the mainnet or start online in 2020. Whether it is the public chain infrastructure, the second-tier expansion solution, or the privacy solution, everyone is waiting to trigger the industry The singularity of the second outbreak.

(Block Beats reminds that according to the document issued by the Banking Regulatory Commission and other five departments in August 2018 on "Precautions against Risks of Illegal Fundraising in the Name of" Virtual Currency "and" Blockchain "", please the general public to treat the block rationally Chain, do n’t blindly believe in the promise of smallpox, establish the correct currency concept and investment concept, and effectively raise the risk awareness; you can actively report to the relevant departments about the illegal and criminal clues.)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Featured on Twitter | Unlocking 1 billion XRP? You misunderstand Ripple too much

- AI chip giant NVIDIA launches blockchain + AI computing platform, 3D model analysis time reduced from hours to minutes

- New Credit Card SBC Wallet Cards Built-in Cryptocurrency Hot and Cold Wallets, SoftBank Card 3.0 Goes Live

- Growth of network scale creates the illusion of sustainability, Lightning Network is "irrational" and has privacy issues

- Lightning Network receives support from Bitfinex exchange, stablecoin will be ushered in next step

- Tracking the top 10 currencies from market sentiment

- Figure Technologies Raises $ 58 Million, Morgan Creek, DCG Participated