When the wind starts again, which is the central bank's digital currency?

Recently, the central banks of the United Kingdom, the United States, Canada, Singapore, Japan and other countries have successively established digital currency research institutions, and the People's Bank of China has also reported that it is conducting research and development of central bank digital currency. For a time, the central bank's digital currency once again became the focus of the industry.

Perhaps you will be curious about the current level of development of central banks' digital currencies. In this regard, this paper will compare and analyze the digital currency of the central bank that has been issued or is being piloted from the five stages of development stage, R&D capability, scope of application, application scenarios and supporting facilities, and provide a reference for interested readers.

Digital currency overview

Central bank digital currencies (CDBC), in simple terms, are the digital form of central bank currency, but are different from the reserves and settlement accounts held by commercial banks in central banks.

In order to introduce the differences more clearly, a currency classification standard is introduced here, that is, the central bank digital currency is discussed together with other types of currencies.

- "The blockchain pyramid sales godfather" Yuhong once again come back, XMX car you dare to go?

- Wisps: The Wonderful World of Create2

- Starting from the account paradigm and the Token paradigm, why is Facebook Libra not a non-nationalization of currency? Platon Zou Chuanwei

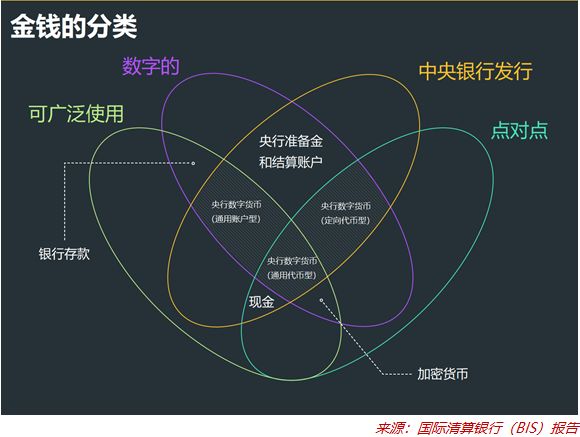

According to the survey report issued by the Bank for International Settlements, the currency can be classified mainly based on the following four factors: whether it is issued by the central bank, digital or physical form, scope of use, and whether it is peer-to-peer.

According to this set of classification criteria, the central bank's digital currency is divided into three types: general token type, targeted token type and general account type.

The universal token-type central bank digital currency can be widely used in trading activities such as daily commodity trading; the targeted token-type central bank digital currency is only open to financial institutions, and is mainly used for targeted payment and settlement transactions in financial markets; Digital currency is a universal account opened by the central bank for all agents.

Although the differences between the three forms are large, they can all be called central bank digital currencies.

Which is the central bank's digital currency?

In order to better understand the general development level of the global central bank digital currency, we have selected 11 typical central bank digital currencies that have been issued or are being piloted, and from the development stage, research and development capabilities, scope of use, application scenarios and supporting facilities. A comprehensive analysis of the dimensions provides a reference for those interested in learning about the central bank's digital currency.

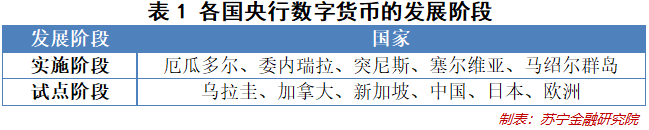

1. Development stage: Leading the third world country

Currently, only the countries that officially launch the legal digital currency in the world are Ecuador, Venezuela, Tunisia, Serbia and the Marshall Islands.

Most countries that are interested in the central bank's digital currency have chosen to stay in the pilot phase.

For example, the Uruguayan central bank decided not to continue using electronic money after the six-month peso digitization pilot and canceled all issued digital pesos.

In addition, a few countries that are cautious about the central bank's digital currency are still at the conceptual stage.

It is worth noting that some of the third world countries have officially issued central bank digital currencies at this stage. Among them, the main purpose of issuing digital currency in Ecuador and the Marshall Islands is to achieve de-dollarization and change the status quo of the US dollar as its main currency; Venezuela, Tunisia and Serbia are trying to reverse the domestic economic difficulties and complete financial reforms. The cash system turned to digital currency.

It can be seen that the main reason why these small countries can directly introduce the central bank's digital currency in the short term regardless of the risk is that their domestic financial environment is not optimistic and they have to make some new attempts.

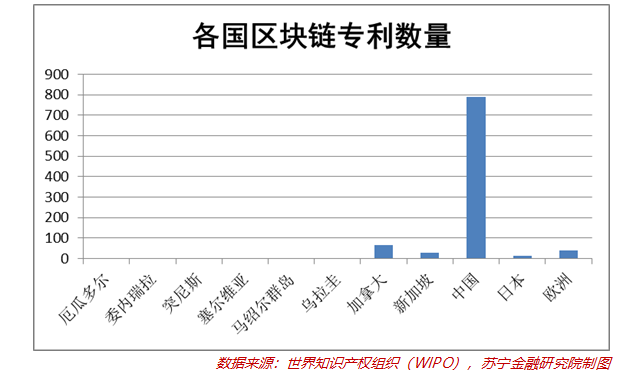

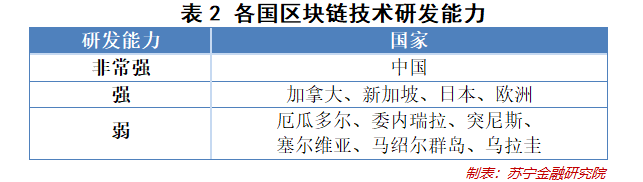

2. Research and development capabilities: China's patents top the list

Through the number of blockchain patents, we can understand the current level of blockchain technology research and development in each country.

According to the World Intellectual Property Organization (WIPO) website, the number of blockchain patents in China is currently ranked first, and Canada, Singapore, Japan and Europe are also among the highest in the world, while Ecuador, Venezuela, Tunisia, Serbia, Marshall Islands, Countries such as Uruguay have weak R&D capabilities and have not yet applied for patents that have been successfully applied.

This raises the question: How do countries with insufficient blockchain technology research and development capabilities launch their own central bank digital currency?

In general, these countries will choose to take advantage of the technological advantages of other national technology companies. For example, Tunisia introduced the technology of the Swiss software company Monetas in the national digital currency eDinar.

Most countries with strong blockchain R&D capabilities choose to develop or cooperate with each other. For example, the Bank of Canada and the Monetary Authority of Singapore have jointly completed the cross-border payment experiment of the central bank's digital currency for the first time.

3. Scope of use: Most word currency is only for nationals

Generally speaking, the wider the circulation and use of money, the greater its influence, but at the same time, the more challenges the central bank faces. Therefore, the digital currency introduced or studied by most central banks is only for citizens in the country and surrounding areas. Only a small number of central bank digital currencies do not impose any restrictions on the nationality of investors.

Of the countries discussed in this article, only Petro Coin of Venezuela and Sovereign (SOV) of the Marshall Islands have adopted ICO issuance methods for financing worldwide, and other central banks' digital currencies are only available for circulation within their countries.

4, application scenarios: the country with a high degree of early release or digitization is dominant

The central bank's digital currency can only be reflected in its actual situation. In this regard, the central bank's digital currency, which was issued earlier, tends to have an advantage.

For example, the Tunisian eDinar issued in 2015 and the Ecuadorian currency issued in the same year have a number of practical applications. Currently, people can use these central bank digital currencies to make online and offline payments or transfer directly to bank accounts.

In addition, countries with a higher degree of digitization will also have an advantage. For example, compared with other countries, the penetration rate of electronic payment and the network and informationization level of offline shops are at a relatively high level, and the Internet infrastructure is relatively perfect. Therefore, the system transformation required to introduce digital currency and Staff training is less work. Once the Chinese central bank officially issues the legal digital currency, simply connecting the digital currency system to the existing electronic payment system can quickly realize the application of the central bank's digital currency online and offline full-scenario payment field.

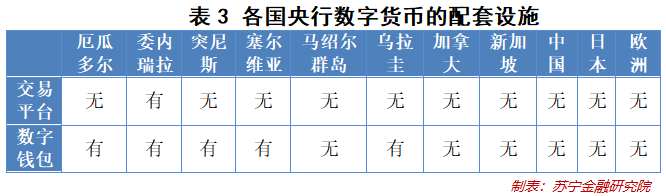

5, supporting facilities: digital currency trading platform and digital wallet must have one

Supporting facilities are also essential for digital currency. Behind every popular digital currency is inseparable from the support of major digital currency trading platforms and digital wallets, even the central bank digital currency issued by the state is no exception.

The digital currency of the central bank, which has been officially launched or publicly piloted, is basically equipped with a mobile digital wallet. The digital peso like Uruguay and the eDinar of Tunisia must be used after the mobile phone is used to open a central bank digital currency account.

In addition, there are very few global central bank digital currencies that have cooperated with trading platforms. For example, Venezuelan oil coins are purchased in addition to the country's encrypted remittance platform Sunacrip, as well as 16 digital currency exchanges such as Cave Blockchain and Cryptia.

Of course, the vast majority of central bank digital currencies that are still in the research phase or internal pilot phase are not equipped with any corresponding software applications because the project has not been made public.

Conclusion

Taken together, the central banks' digital currencies that have been issued or are being piloted can be roughly divided into three echelons. The first echelon is China, Japan and Europe; the second echelon includes Tunisia, Uruguay, Canada and Singapore; the third echelon is Ecuador, Venezuela, Serbia and the Marshall Islands. (names not listed in order)

Of course, the author will inevitably be subject to subjective factors in the process of evaluation, but it is certain that compared with other countries and regions, the research of the three echelons on the central bank's digital currency has been at the forefront of the world.

Source: Suning Financial Research Institute

Author: Institute of Finance researcher Su Ning Jing Tao Hong

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin breaks into a new high in the year, and billions of funds are on the market.

- How to technically enhance the privacy of Ethereum?

- Babbitt column | Libra currency system is a 100% reserve full reserve banking system

- The power plant harvested miners army: the bull market rose freely, the miners were forced to sell the mine

- Why is this bull market different?

- Conversation | Libra needs to deal with three issues toward an unlicensed network

- The Fed’s monetary policy or assists with God, BTC’s next stop of $100,000?