Silicon Valley vs Wall Street: Libra is just the beginning of a long bloody battle

Ma Yun once said: "If the bank does not change, we will change the bank."

In fact, in the past few decades, the technology industry has been researching and analyzing the lack of technological progress and inefficiency in the financial industry, and has led to the emergence of a new industry new word, “FinTech”. Financial technology is an ecosystem that can be supported by both the financial and technology industries. Technology companies can explore diverse financial services, and financial companies can use technology to fill gaps in user experience.

Now, this combination of "financial" and "technical" industries has seen many successful cases, such as:

1. Apple and Goldman Sachs launched in the United States;

- Inventory: 58 terms that have to be known to chat with the chain people

- Social media and ICO false publicity

- The third milestone in the history of blockchain: Libra

2. Transferwise (International Remittance Service Provider) and BPCE Groupe, the second largest bank in France, launched a low-cost international money transfer service in Europe;

3. Google is also working with HDFC and ICICI Bank, two of India's largest banks, to accelerate the expansion of its Google Pay service coverage in Asia.

In addition, in the past few years, many well-known banks have become more and more generous, investing in many financial technology startups, such as:

1. Financial technology startup Plaid completed a $250 million financing with a valuation of $2.7 billion, including Goldman Sachs and Citibank;

2. The instant messaging service platform Symphony has received support from a number of financial giants such as Goldman Sachs, JPMorgan Chase, Wells Fargo, Bank of America, Citigroup, Credit Suisse, Deutsche Bank, etc., to “confront” Bloomberg terminals;

3. Goldman Sachs, Citigroup and JPMorgan Chase also invested in blockchain startups including Circle, Axoni, Chain, Cobalt and R3.

However, these investment cases and the entire industry need to pay attention to the financial industry Big Finance. Given its political and financial influence, large financial companies use Google Pay, Apple Pay, Apple Card, Amazon Card, etc. The products show great patience and tolerance, they even “greet each other” with respect and humility, and try to build partnerships. Why is this? The answer is simple, because the previous financial technology products did not touch the core interests of large financial companies.

Libra directly stimulates the business model of large financial companies – currency flows

Most of the revenue of banks (at least consumer finance) comes from credit card transaction fees (usually at 2-6%), international remittances, and fees charged to merchants during shopping. With the advent of Libra and the sheer size of Facebook itself, it will undoubtedly pose a threat to all banking institutions, so Facebook, PayPal, Lyft, Spotify and Uber have been doing this for so many years: not charging consumers Any transaction fees. Doing so can fully improve the product conversion rate, because by canceling the transaction fee, consumers can pay less, and then attract more users to use the product to stimulate the increase in demand. When the cost of sales is constant, the technology companies will be allowed. increasing income.

Before Facebook launched Libra cryptocurrency, Google and Apple both tried to fight against large financial companies through Google Pay and Apple Pay, but everything they did did not touch the core interests of the bank, just want to evade, Or bypass transaction costs to cut bank profits. As a result, bank-authorized credit cards are still in use and “must” be supported by the Visa and Mastercard networks. Even Ripple, one of the world's largest blockchain companies, is actually interdependent with financial institutions to speed up international remittances and efficiency without cutting transaction costs.

Facebook is completely different from Google and Apple.

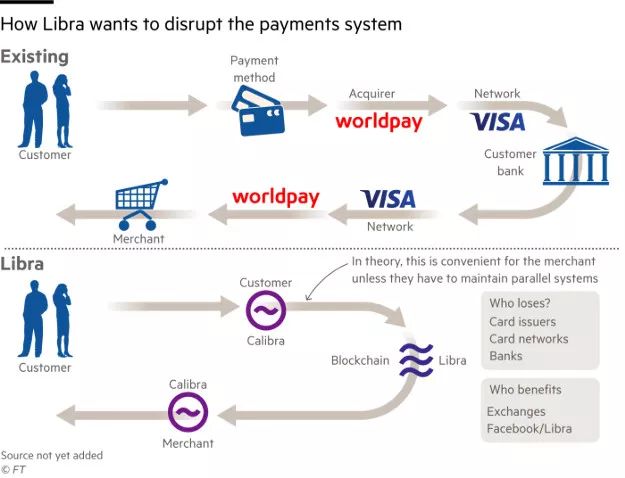

Facebook's launch of Libra cryptocurrency is the first time a technology company has attempted to circumvent bank transaction costs, which clearly poses a serious threat to the bank's entire business model. The picture below explains how Libra will overturn traditional payments, from which you can see that once Facebook's Libra starts working, the losses will be: card issuers, bank card networks, and banks; the benefits will be: exchanges and Facebook/Libra.

The Libra Association's original 27 founding members will need to provide $10 million to become a Libra cryptocurrency network node, but you will find that there are no banks in the 27 founding members, including Visa, MasterCard, PayPal, etc. Financial institutions are paid because Libra still needs credit card network infrastructure providers to support their transactions.

In fact, the bank has started to fight back.

ING Bank of the Netherlands had previously contacted Facebook, but they quickly decided to oppose Libra cryptocurrency; Citibank said it had never had any interaction with Facebook before the Libra white paper was released. Traditional financial giants such as Citigroup or Goldman Sachs basically believe that Facebook's Libra cryptocurrency is a crazy idea because they feel that Facebook wants to make Libra a cryptocurrency that competes with the dollar and the euro.

So how will the bank fight back? Some insiders suspect that banks may do the following:

1. First, banks will immediately spend huge sums of money to find some government lobbyists. As long as Libra tries to issue in which country, they will lobby the country's regulators to set strict regulatory rules to stop Libra;

2. The bank will also form a “combination” and reach a partnership, and establish a banking organization that competes with the Libra Foundation/Libra Association. At the same time, banks will invest in blockchains to gain more “control” over cryptocurrency and blockchain systems;

3. Banks will closely monitor the cryptocurrency trends of other consumer technology participants, such as Google, Apple and Amazon, to predict whether they will be able to launch Facebook-like products that cut transaction costs in the future.

4. Banks will benefit from their own power and influence to create “conflicts” that harm large technology companies, such as increasing the transaction fees paid through Apple Pay or Google Pay, or making it more difficult to transfer funds in global public and private markets.

There is no doubt that the transfer of power from financial giants to technology companies has taken place. Libra is just the beginning of this long bloody battle. Will large financial companies regain their "iron throne" or succumb to the power of technology giants? Let us wait and see.

This article comes from Medium, original author | Akshit kawatra

Translator | Moni

Produced | Odaily Planet Daily (ID: o-daily)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Study blockchain to Tsinghua, or go to Peking University? ——College entrance examination blockchain volunteering report guide

- YOOSourcing Xu Jianhai: Chatting about the new block of "blockchain + global trade" | Chain node AMA

- Blockchain Security | How do hackers steal your encrypted assets from their mobile phones?

- Bitcoin in India: the premium is over $600, the more banned the more "crazy"

- More “coin days” than the chain trading volume indicator, more able to reflect the flow of funds

- Interpretation of Libra: A revolution covering 2.7 billion people? Still a whimsical girl

- Awards for Call for Papers | Celebrating the first anniversary of the PlatON Cloud Map release!