Analysis: What opportunities, challenges and risks will be brought by blockchain technology for digitalization of securities?

Digital securities are an exciting use case for blockchain technology, such as the new Codefi (a suite of products for next-generation business and finance) from ConsenSys. Blockchain companies like ConsenSys are facing a major challenge – how to use decentralized finance to digitize and democratize financial instruments. However, to navigate the complex and deep-rooted system of securities and financial instruments requires a deep and detailed understanding of current securities and financial instruments.

The following sections cover a number of areas that will address the current state of securities custody and the opportunities, challenges and risks of securing securities through blockchain technology.

Digital hosting challenge

Traditional custodians hold assets on behalf of the ultimate beneficiary. The custodian is a trusted third party that performs fiduciary duties on behalf of the beneficiary.

The custodian appears because the beneficiary is neither willing nor able to maintain personal assets at CSD (for cost reasons and legal reasons), and the beneficiary does not trust his broker to hold securities on their behalf. In particular, the custodian is designed to help clients protect their securities from losses in the event of bankruptcy of their brokerage company.

- Stable currency analysis: Most stable coins will not be used for large transactions except USDT

- Exchange Real Volume Report (on) | TokenInsight

- Gartner reports: Blockchain business is facing a test, the industry is still dark

The services provided by the custodian are as follows: Central depository institutions around the world keep deposit slips, track company behavior, and provide balance sheets and tax reports.

The custodian is the core of fund management. The fund manager manages the portfolio of securities purchased by investors through the subscription, so that investors can access a diversified portfolio.

Fund characteristics:

· Fund shares can be sold through brokers or sold directly to customers

· Cash can be exchanged for fund shares (either the customer bank's cash account or the brokerage company's cash account can be used to exchange fund shares)

· The subscription and liquidation of the fund shares are recorded by the custodian, who records the subscription and liquidation of the fund shares based on the records of the registered ownership of the transfer agent.

· The fund manager uses the new net cash price to purchase new securities to the fund (if the liquidation exceeds the subscription, the fund manager sells the securities)

· Transfer agent records ownership registration. The transfer agent will reconcile with the asset custodian and asset manager. But the cost of reconciliation is extremely high and the reconciliation work is extremely error prone.

Transfer agent

• The transfer agent retains the ownership record, including the contact information of the issuer's shareholder.

· The broker keeps a record of the beneficiary shareholders.

The services that the transfer agent can provide are as follows:

· Transfer (for example, recording one or more funds ownership exchanges)

· Issuance (issuance of initial fund and new fund shares)

· Cancellation of issuer stock

· Assisting shareholders in completing equity transfer

Other core services of the transfer agent include:

· Share dividends

· Tax declaration

· Annual meeting service

· Direct stock purchase / dividend reinvestment plan management

· Circumventing and losing shareholder search and report filing

· Additional new shares

· Issue stock options

· Restrict stock transfer

· Communicate on behalf of the issuer and the shareholder, including submission of materials: entrustment materials, statements of shareholding or transaction details, tax return forms, letters confirming other transactions (eg confirmation of address changes)

• Transfer agents can also provide other services to shareholders and issuers, such as online account access, employee benefit compensation services, and corporate actions (company shareholder decisions) services.

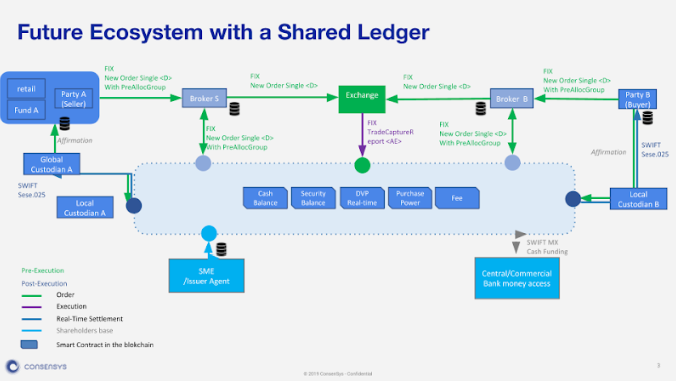

What is the stock custody function of the future application blockchain technology?

· The blockchain registration form retains the ownership record of the issuer's registered shareholders (including contact information)

• The broker does not need to retain the record of the beneficial shareholders: when the beneficial ownership changes, the registration form will be updated through the smart contract.

· The functions of the automatic transfer agent registration form may include:

• Transfer (for example, a shareholder can convert one fund to another with a certain fee; the automatic agent will exchange the transfer request of the shareholder.

· Issuance (original issuance records and tokenization of existing assets. The tokens that can be issued are as follows: tokens representing the underlying assets, tokens representing the total assets held by the fund assets or strategies, and tokens representing the fund shares. Cash tokens (such as stable coins) can be issued to facilitate the use of automated payment/payment processes to facilitate customer shopping.

· Cancellation of the issuer's stock

Other core features offered through smart contracts:

· Share dividends

· Tax declaration

· Direct stock purchase / dividend reinvestment plan management

· Additional new shares

· Issue stock options

· Restrict stock transfer

· Submit information to shareholders on behalf of the issuer: statements of shareholding or transaction details, tax return forms, letters confirming other transactions (eg confirmation of address changes)

· Record investor-initiated net subscriptions, liquidation/redemption and transfer

· The share class and attribute and revenue record are sent to the server

· Track company behavior and ensure that revenue is correctly distributed

· Registered shares of beneficial ownership

· Communicate to shareholders about voting, earnings, company behavior, and reporting information

· Tax declaration

• Reconcile fund shares against net subscription/liquidation based on the fund's periodic net asset value (NAV).

Hosting of digital securities

Shareholder rights are determined by records of digital signature exchanges and equity redistribution in the chain, so the custodian's traditional functions (protecting assets for the benefiting owner) are taken over by blockchain technology.

That is, even though the core registry function has been taken over by blockchain technology, many useful features have been added:

· Capture share-level stock inflows and outflows and verify holdings (this feature is also implemented in multiple chains representing different markets or asset classes. This feature on multiple chains is like today's global custodians, requiring cross Multiple custodians for total customer holdings)

· Independently verify the company's behavior and confirm the beneficiary attribution (eg, smart contracts are designed to ensure that the benefit distribution is correct)

· Can notify shareholders of activities, such as elections, voting or other voluntary activities

· Create regulatory and tax reporting on behalf of BO (Many beneficial owners may not want to create their own tax and regulatory reports, and don't want to know about the latest hosting. Logically, the service can be outsourced to trusted third parties)

Key escrow, key storage, key retrieval (benefit the owner wants to securely store their own key and ensure that the key is lost and the key can be retrieved)

· Maintenance and upgrade of wallet function (outsourcing requires wallet service update to the latest state)

· Security audit and testing

· Compliance testing (from the applicable, qualified, risk three standards to test company behavior) (independent third-party verification compliance function has been implemented)

Regulatory issues

Recently, US regulators have focused on the challenges faced by digital asset custodians. Traditional escrow companies allow broker dealers to comply with regulatory standards established under the Customer Protection Rules.

In order to protect the rights of customers, broker dealers must prove that assets are independent under the ownership or control procedures and avoid the risk of theft, fraud or brokerage dealer bankruptcy. Recently, FINRA compared the success rate and encrypted theft and transfer rate of the Customer Protection Rules for 50 years:

“In a nutshell, the Customer Protection Rules stipulate that broker dealers protect client assets and separate client assets from company assets, thereby increasing the chances of returning client securities and cash when broker dealers go bankrupt.”

What digital asset custodians need to address is to ensure that keys, digital signatures, and other measures to protect digital assets are implemented in current escrow agencies, leaving a separate point of control for customers.

The problem with digital assets is how to control assets through keys. Most of the time, transactions are encrypted by address and key transactions, rather than by combining customer escrow agreements and broker dealer orders. If the key is copied or destroyed, the encrypted asset is transferred. If the key is lost, the asset can no longer be accessed and the resulting lost asset benefits all investors.

If you combine technology and programmatic solutions, you can solve asset control problems perfectly. For example, the user is allowed to store the shared key and the escrow key in different organizations, provided that the anonymous subscription protocol is signed, and the key cannot be combined without the participation of the key owner. Or use a double-entry escrow key so that the hosting provider can access the key only if authorized by the key owner, for example by biometric technology or other special authentication methods.

This is not to say that this solution is not feasible. Only regulators will continue to work with broker dealers to determine alternatives to digital asset custody, but there are currently no industry standards that meet the requirements of the Customer Protection Rules and are easy to implement. The benefits of being recognized as securities are increased capital turnover, reduced trading friction, and increased efficiency, making cryptocurrency a major area of the future. The company that first solved this challenge will have a first-mover advantage in the encryption field.

One solution that has been explored is hardware security modules (HSMs) such as Intel SGX. However, hardware security is also limited: the HSM solution itself is relatively fragile. If a security hole is discovered, hardware may need to be replaced, and more logistics services are required than software patches.

Securities custody considerations

· Institutional customers who focus on risk prevention value security more, followed by convenience. Asset security is a top priority, but security measures should not be too complicated, otherwise it will affect fast transactions and settlement. This is also the pain point of cold storage and multiple independent security defenses.

· Diversified solutions. Often asset owners and custodians try to trade different security measures and are more likely to work with broker dealers to add a second hacking line to their assets.

In some cases, a hoster can try to use both a hot wallet and a cold wallet: a hot wallet is used to provide transactional liquidity and rapid deployment, and a cold wallet prevents catastrophic loss when a hot wallet is hacked. The customer's capital flow requirements and trading patterns affect the account balance or UTXO volume in both wallets.

· Prevent catastrophic loss of hot wallets when hacked. The customer's liquidity requirements and their trading patterns will affect the balance or UTXOs stored in each type of wallet.

· When transferring assets, any blending scheme is not used. Many hackers attack when they send money in their wallets.

· Control points: Broker dealers can access digital securities? Is it possible to transfer or redistribute digital securities without the affirmation of the key owner (by key exchange or digital signature)? Can I copy the key? Since high-efficiency control in traditional models is equal to full control, it is different from the design of most current important programs. It will not be successfully promoted until the key ownership issue is resolved. Otherwise, this problem will persist until the promotion of digital securities that protect investor rights.

· Is the transfer agent removed? If the transfer of the key ownership requires authorization by the key owner and the transfer is only one time and cannot be repeated, the transfer agent can be removed. But to achieve this, we face major technical challenges.

risk

• The hosting company in the traditional securities market assumes several important risk management functions for asset owners. These risk management functions need to be replaced by the equivalent functions of digital token assets:

· Counterparty risk

· Loan risk (mortgage and re-mortgage risk)

· Mixed assets and traceability

In addition, the hosting company may be exposed to risks other than smart contracts and digital securities:

· Theft or theft of the key

· Key loss

· Burst logical path and coding errors

Challenge success

In addition to addressing the above risks, there are many core functions that require certain certainty and assurance until the regulatory authority's authorization criteria are met. Each type of cryptographic assets must not only develop independently, but also achieve a certain integration to form a coherent and coordinated whole.

These challenges include:

· Identity and participation issues. How do you identify the unique identity of a participant and the digital signature of the binding participant? How do I determine the address and distribution node?

· How to improve governance and resolve disputes? Which consensus mechanism and voting mechanism are used to guide the market? How to determine the voting weight? How to resolve the dispute?

· Legal compliance and enforcement issues. How does the smart contract logic of digital securities agree with regulatory laws? How to determine the differences in interpretation? How to code the difference pool, whether to refer to separate legal provisions for each smart contract?

How does a managed network communicate with other networks, such as non-distributed ledger markets and exchanges? What messaging standards and technology solutions are needed (such as guaranteed delivery or broadcast channels)?

How to keep automated solution designers in sync with changing legal standards and existing business logic? Will the integration of current unilateral business logic into complex multi-party logic systems accelerate the evolution of new logic systems?

How do solutions based on atomic switching technology and real-time settlement adapt to the liquidity advantages of deferred settlement and netting? How to best support lending and mortgage models?

· Does the digital asset meet the definition of SIPA securities?

• If a digital asset has the ability to add value in the future or increase cash flow, then such digital asset is likely to be classified as a security. The value of a practical token is the service and utility it finances, and the power to access these services and utility functions. It may not be a digital security or a SIPA (Securities Investor Protection Act) definition.

Is it possible to determine the power of a broker dealer to own or control digital securities?

How to protect the key? Can I copy the key? How to host a key? Does the access key require two-factor authentication?

Is the distributed ledger an authoritative record of share ownership?

• Is the ledger the only recording system or is there another way to record ownership? If the original digital securities have been certified by the complete chain since the creation, the traditional assets of the tokens are not authoritative records. For example, if an asset is tokenized, rematerialized, and then re-denominated, the complete transaction record cannot be retained. Therefore, traditional assets of tokens must also prevent double payment.

In this case, the token issuer will be obliged to prove that the asset cannot be removed from the escrow institution if the asset is associated with the corresponding token. Otherwise, there may be cases of equity duplication and double payments.

• Should the broker dealer or the trading executive should use the transfer agent as a tentative “control point” to comply with the possession or control requirements under the Customer Protection Rules? For example, (whether mandatory or not) when the issuer or transfer agent maintains a traditional list of large holders of securities, but at the same time politely, using distributed ledger technology to publish owner records?

Translator: First.VIP Tracey, Cathrine

Source: first class warehouse

Please indicate the end of the message.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bakkt also can't impact traditional cryptocurrency futures trading? – Coin, OKex, Matcha, and the same station

- Market Analysis: Bitcoin rebounds infinitely, still a short world

- Let’s listen to Jiang Zhuoer and Lu Haiyi’s understanding of the relationship between bitcoin price and computing power, as well as the price trend of this round.

- Is there a loophole in the Ethereum FAIRWIN smart contract? Detailed technical analysis is here

- Decentralized "short" agreement dYdX's hope and hope

- Ant Block Chain Yunqi Conference: 2020 to use the blockchain to serve 100 million Chinese

- We have forgotten that Bitcoin does not yet have a globally recognized story.