Where did the “money” of TEDA’s additional is going? 100 million USDT additional issuance

Regarding the field of digital currency, some people say that it is full of chaos, and some people say that it is also full of hope. Like the pioneering era in the western United States, it seems that there are ghosts here, but it has also become a financial testing ground, which has given birth to many interesting phenomena.

For example, USDT, for it, people in the field of digital currency are too familiar with the "excellent representative" of stable coins, and frequent customers of various conspiracy theories in the currency circle. In fact, the emergence of the so-called stable currency itself has its profound motivation and solid demand. In the field of digital currency, from Bitcoin to Ethereum to various XX coins, it forms a similar exchange rate, and around this price comparison. Related transactions. However, although almost everyone in the circle is dressed as a "currency standard", most of them still have to calculate their own income in the form of legal currency such as the US dollar and the renminbi. In many cases, investors also have the need to drop bags for security or short positions. And because of the laws of various countries, as well as the efficiency of related transactions, the cost problem, if the "empty position" is only to avoid risks in a phased manner, and there is still a need for market transactions in the long run, in this new situation, take the OTC trading channel, and then High-frequency switching in the digital currency and the legal currency system is obviously too costly.

As a result, the demand for stable currency has emerged. In fact, everyone hopes to have a stable "general equivalent" like the highly recognized legal currency in the world, and at the same time open up with the world of digital currency transactions, so as to achieve stability under the legal currency system. Maintain a high degree of liquidity under the digital currency system. In the real world, the US dollar obviously has such a position. Therefore, in the field of digital currency, the stable currency with the dollar as the anchor unit has become the biggest demand, and the USDT issued by TEDA has become the most popular stable currency. Although in theory, TEDA's stable currency should be anchored with US dollars 1:1 (the USDT's terms of service were modified in March 2019 to anchor the rules, causing an uproar), that is, its USDT issued in the digital currency world, There should be a corresponding amount of dollar anchoring, but TEDA has been unable to produce a corresponding third-party audit report and is suspicious. At the same time, as a highly recognized stable currency, USDT has also become the main currency for buying bitcoin. That is, its supply has been logically related to the bitcoin price, and the conspiracy theory about TEDA's manipulation of bitcoin prices has never stopped.

- QKL123 Quotes | The main upside is suppressed, and the short-term downside risk is increased (0708)

- Director of the Central Bank Research Bureau: The central bank's digital currency helps to improve the effectiveness of monetary policy

- Christina Lagarde is nominated by the ECB President. Can her support for cryptocurrencies help?

As a technology company, here we certainly don't want to delve into the depth of the water here, but we know that in the field of digital assets, the flow of data on the chain is the circulation of digital assets, and there are deep motives behind it, which will also generate Or small or big influence. Therefore, we have been striving to serve the industry in the field of data traceability and analysis in the chain. In May of this year, Beijing Chainan released the “White Paper on Bitcoin Transaction Traceability Technology”, which expressed our technology with the circulation of 110,000 darknet bitcoins. View. In addition to data tracing in the bitcoin chain, last week, for the recent two-round IPO of TEDA, Beijing Chainan also traced back, which aroused the enthusiastic response of the media and industry.

In this article, we will do a phased analysis of Zhou Taida's first wave of USDT issuance on the Ethernet network and the distribution process of these USDTs.

Beijing time on July 2 at 1:13.35 am (UTC time July 1st 05:13:35 PM, for convenience of description, we are all based on Beijing time), TEDA has issued 100 million pieces to its Ethernet address tether treasure USDT. In the process, TEDA played a similar role as the Fed and issued a new batch of currency, which can be said to be a kind of liquidity injection into the market. Of course, if the USDT has been hovering at this address, the injection of this liquidity has not yet been completed because it has not flowed. Further, it needs to “distribute” these USDTs to key nodes of market liquidity, allowing investors to trade in USDT. Obviously, the exchange is currently the most active liquidity node.

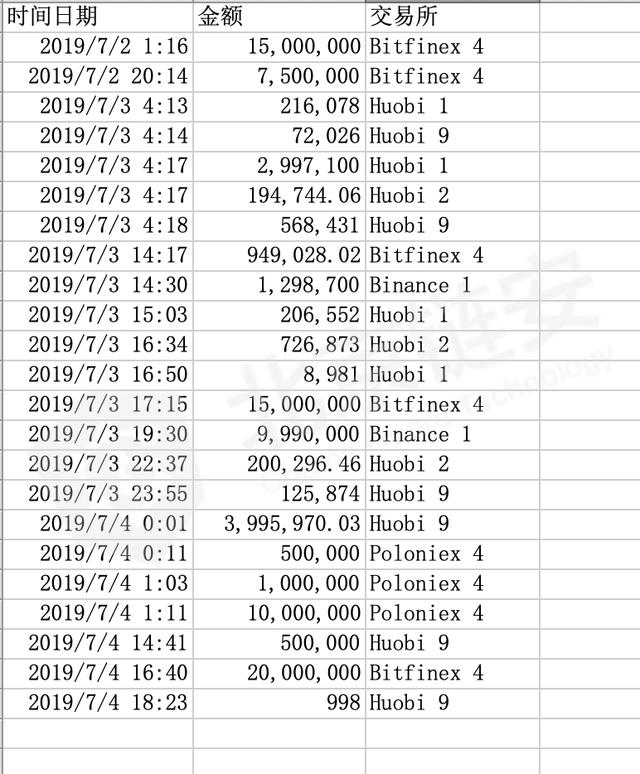

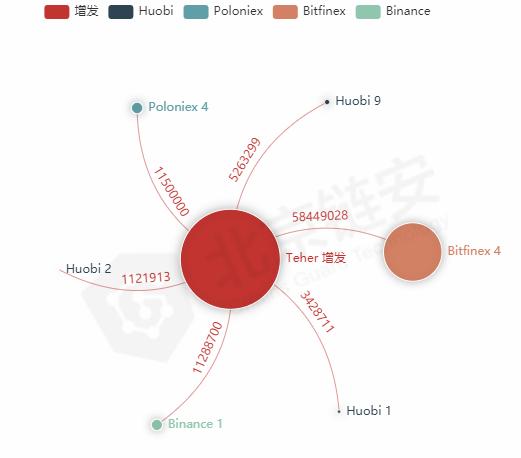

So, next, the address carried out a series of transfer operations, mostly based on large transfers, or direct transfer, or through the relay address jump, distributed to several major exchanges, we will be able to confirm The target exchange transfer process is listed below:

We turn these to the USDT summary of the different wallet addresses of each exchange and graphically display them further:

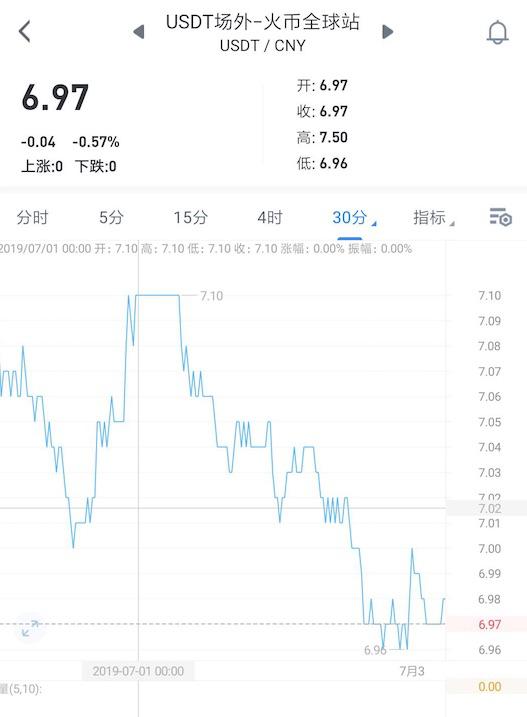

So, what impact does this have on the market? Let us first put down the conspiracy theory. One background of the USDT issuance is that the bitcoin price has started to rise after a continuous surge, and the market has returned to a highly volatile state. At this time, investors who want to sell BTC, or investors who want to bottom out, have generated huge demand for USDT. Some small and medium-sized exchanges even appeared in the OTC market where USDT was sold out and could not continue to provide liquidity. Sexual embarrassing situation. In this case of a shortage of USDT, the off-market USDT began to show a substantial premium. In this context, the process of TEDA's issuance of USDT and distribution to the market is also objectively an operation to increase supply.

We can see that with this process, the price of USDT trading outside the global site of the Firecoin has indeed begun to decline, and the high premium has eased.

Just about an hour and a half after the final distribution of 16:40:42 on July 4, TEDA re-issued 100 million USDTs on Ethernet. In fact, the additional issuance on July 2 is 10 days away from the last additional issuance interval. The latest two USDT issuance intervals in Ethernet are less than 3 days. This is because the USDT still cannot meet the market needs, or The Bitfinex CTO of the TEDA-linked exchange is just doing the USDT adjustment to the USDT on the bitcoin network. Or for another reason?

In this regard, I believe that the industry will have a variety of perspectives, we will continue to trace the trend of these data, and further manage and analyze these data and other data, present data to the industry, and inject value into the data!

Source: Beijing Chain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Remember the darknet "Silk Road" five years ago? The dark market is never absent

- ECB raises regulatory warning on Facebook's encryption project Libra

- Dry goods | Deterministic gadgets: used in Taifang 2.0 for 1.0 additional certainty

- A16z crypto partner: the charm and challenge of blockchain

- Babbitt Column | How to create a new stable currency that competes with Libra

- Babbitt Column | Discussion on Blockchain Technology as a Model of "Business Secrets" Protection

- A paper on the history of cryptography, working principle, zero-knowledge proof and potential impact