Founder Interview Why did Eclipse Architecture choose SolanaVM, Celestia, and Ethereum?

Why did Eclipse Architecture choose SolanaVM, Celestia, and Ethereum?Author: Thor Hartvigsen, DeFi Analyst, Translation: LianGuai0xjs

Last week, I had the opportunity to interview Neel Somani, the founder of Eclipse, an upcoming Ethereum Layer2 solution. Eclipse is different from other Ethereum Rollups because it adopts a modular approach. I asked Neel about these design choices and various other topics such as mainnet launch, fee structure/value capture, and native tokens.

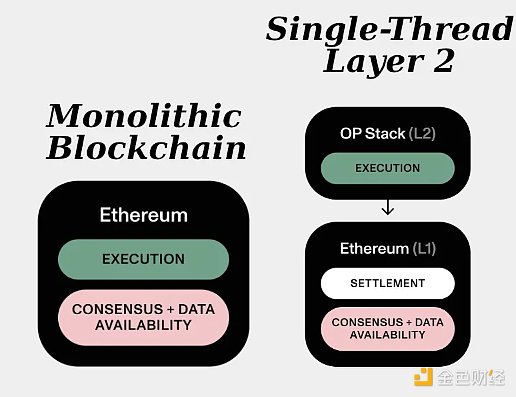

Before diving into the interesting conversation with Neel, let’s briefly introduce the components of a blockchain. A blockchain consists of 4 layers:

-

Execution Layer – handles user transactions and provides an environment for dApps.

-

Data Availability Layer – nodes receive a block from block producers and check if the data is publicly available.

-

Consensus Layer – determines the order of transactions.

-

Settlement Layer – determines the state of the blockchain (finality).

An integrated blockchain handles all these components, meaning it includes all four layers. A modular blockchain, on the other hand, only includes one or several (but not all) of these layers.

Here are some examples of these different architectures.

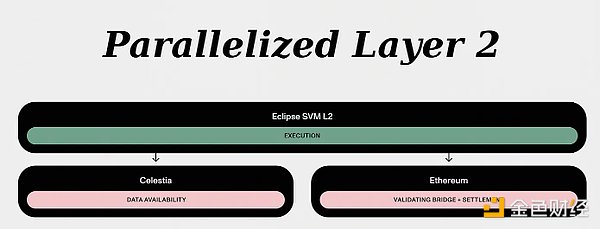

Eclipse adopts:

Eclipse adopts:

-

Solana Virtual Machine (SVM) as the execution layer.

-

Celestia as the data availability layer.

-

Ethereum Mainnet as the settlement and consensus layer.

The interview is as follows:

Let’s start with the execution layer. What made you choose to run the Solana Virtual Machine instead of the EVM as the execution environment? You mentioned concepts like parallelism and native fee markets on your website – are these the main advantages?

“This is definitely the biggest advantage. You can think of it this way, if you have 100 people sending transactions to an EVM chain, all of these transactions have to wait in line, one transaction being serviced at a time, and there is no way to get around it. Whereas on Solana, for Solana Virtual Machines, they can actually be in different queues, and they can service all of them at the same time. So, throughput is much higher than an EVM chain, of course, you are limited by the number of cores that the main executor runs on and some hardware constraints, but the throughput is much higher. And they also optimize it by reducing block time and making single-threaded execution very fast. That’s the main reason we chose it.”

Are there any trade-offs?

“The downside is how to determine which queue each person should be in. If you have 100 people in line trying to get serviced, it means they have to specify some additional information in advance. So, they have to say, I want to read this part of the state, or I want to write to other parts. They have to specify what they want to do in advance. That’s not the case for EVM transactions. You can just say, I want to run this transaction, and it can run however it wants. That’s one of the reasons why EV is slower than M. But it’s also very convenient.”

Can you talk about the composability of Eclipse? I think it would be easier for Solana/Rust developers to build on SVM. Can Solidity developers or protocols on Ethereum mainnet or other L2 easily integrate into Eclipse?

“These are actually new features, but yes, we can support Solidity through a project called Solang. There is also a product called Neon, which allows you to use the MetaMask wallet. Drift has also built MetaMask Snap, which is a new extension of MetaMask that allows you to use your wallet with SVM code. For Rust contracts, developers can use Seahorse, and they can write their smart contracts in Python, which can also work with Eclipse. So, we support various different languages at this point.”

Regarding the Data Availability (DA) layer, why choose Celestia instead of Ethereum?

“We will always choose what is best for users and applications. We are not tribalists, even though we are obviously Ethereum L2. If Ethereum DA is not good enough from a cost or bandwidth perspective, we will not try to force Ethereum DA to work. But we are keeping an eye on it. Once it is ready, we can migrate to ETH DA. But for now, Celestia offers larger blocks. Once they launch their mainnet, block space may be empty. So, we will have a lot of bandwidth, and they can increase the bandwidth through governance. They can increase the block size through governance, and I expect they may do that a few times after we deploy.”

Eclipse will use Risc Zero for Rollup proofs. How does this differentiate it from other types of Rollups?

“We have taken an approach that is very different from Optimism or Arbitrum. The reason is because of the virtual machine we use, because it is parallel, it doesn’t have certain primitives, it doesn’t have certain parts, like Merkle trees, for example, Merkle trees are not part of our Rollup. Merkle trees are used in error proofs. So, we have to do error proofs in a different way, and that ultimately requires Risc Zero to do it efficiently. That’s why Risc Zero is in the stack and it will be an important part of our error proofs.”

Next, I would like to ask about value capture. In the case of Arbitrum, when users make transactions, they pay fees to the Rollup, and then the Rollup has to pay a certain percentage to Ethereum validators as settlement costs, but essentially can keep the remaining fees. How does this work on Eclipse? Which parts of this modular stack will capture these fees? Will Eclipse have any remaining balance?

“So, right now we haven’t decided whether to allocate some amount to Eclipse, and how much that would be. If there is some amount, it would be just to compensate for the risk. In other words, the way we calculate fees is by looking at Layer 1 and saying, how much does it cost to publish on Ethereum, how much do we have to publish there? Then we look at Celestia, we do the same thing, and then we add all that up, and that’s the fees we pass on to users. But the risk is that when users pay the fees, and then a few seconds pass, right? Then we publish to Layer 1. Maybe the fee has increased. So, as a result, it might be wise to charge a little more to hedge against this risk. That’s the reason for it.”

The two participants involved are Ethereum and Celestia. From the perspective of regular costs, the fees paid by users are actually paid to Ethereum and Celestia. Each transaction published to Eclipse incurs fees for Celestia. If a write transaction occurs, we must publish about 200 bytes to Celestia, and Ethereum will be paid on an hourly basis. Or it may be even less frequent.

Then there are some other participants that we need to pay regularly, at regular intervals, weekly (Risk Zero). Even if nothing happens, we still run Risk Zero error proofs. Just to show that it is still valid, basically the reason for paying a little more than the cost of publishing slash plus Ethereum fees.”

What is the strategy for attracting applications and developing the ecosystem in the early stages?

“We have some DApps from Solana that are undergoing multi-chain development, so they will be deployed to Eclipse separately. We have incubated some projects. We supported some projects through our solar accelerator program. We provide funding for developers, we can provide guidance, break it down into milestones, and provide all the resources they need. Currently, we are still in discussions with Solana DApps. We will soon expand to Solidity DApps.”

Will there be an Eclipse token in the future, aimed at decentralized Rollup and introducing governance?

“Maybe, this is something we haven’t considered enough to comment on because we are very focused on building the mainnet, and there are many things to consider for the mainnet. In order to even consider something like a token, we have to understand how we view governance and what the complete governance framework is. It takes months of effort to really think about it. So we haven’t considered it yet.”

When will Eclipse go live on the mainnet?

“We already have a development network, which is the network that people are actively developing on for the mainnet. Once we freeze the code and go through the audit, then we will make it open-source so that people can review the code themselves and use it. This is the plan for launching Eclipse on the mainnet. Basically by the end of the year, we will take these steps, ideally assuming Celestia is stable, assuming nothing else, no other infrastructure missing, then we will proceed with the mainnet release.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- After a 90% plunge in its stock price, BC Technology’s shares doubled in February. Is it a comeback against the wind with the help of the cryptocurrency exchange OSL, or just a speculative play?

- Can Web3 membership card connecting restaurants bring more repeat customers, with Blackbird invested by a16z?

- Coinbase discloses its own case How hackers penetrated layer by layer through social engineering

- 2023 Cryptocurrency Industry Hot Narratives and Current Situation (II) Inscriptions, Meme

- a16z Leading investment of $24 million in Blackbird when restaurants meet Web3

- 1kx Exploring the Design Space of Dynamic NFTs

- Web3 Weekly Financing Overview (9.25-10.1)