Messari Friend.tech has over 300,000 users, with a daily revenue exceeding Opensea’s by 6 times, but is it sustainable?

Messari Friend.tech has 300k+ users and daily revenue 6x higher than Opensea. Is it sustainable?Author: Ally Zach, Messari analyst; Translation: LianGuai0xxz

1. Does Friend.tech’s growth, which has accumulated over 300,000 independent users since its launch, sustainable?

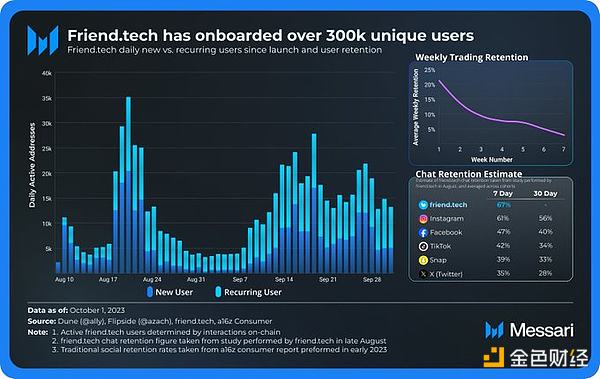

2. Although there have been fluctuations shortly after its launch, Friend.tech’s user activity has stabilized, with an average of 6,000 new users and 9,000 existing users daily. However, the average weekly transaction retention rate has decreased over time from 22% to slightly below 5%…

- Only by integrating the metaverse with industries can it have a future.

- OpenAI, which wants to change everything, is being changed.

- After a 90% plunge in its stock price, BC Technology’s shares doubled in February. Is it a comeback against the wind with the help of the cryptocurrency exchange OSL, or just a speculative play?

3. This may be due to Friend.tech not being suitable for passive content consumption (lurkers). The current state of discoverability through chat is ineffective, as users need to spend money to test chats, pay a 10% tax upon entry, and an additional 10% if the chat is unsuccessful.

4. However, Friend.tech’s estimated 7-day chat retention rate actually surpasses that of traditional social platforms. Although user transactions may not be consistent, perhaps they are finding chats they like, reducing the need for further transactions.

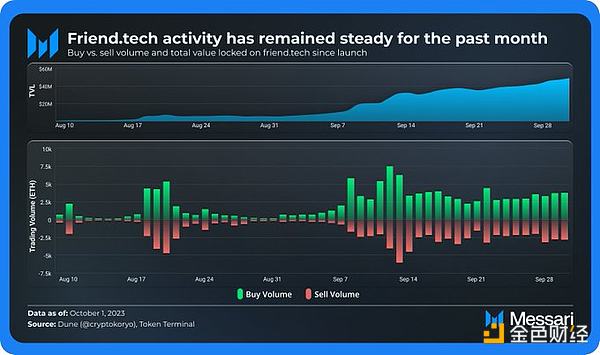

5. Despite some retention challenges, transaction activity on Friend.tech has stabilized in September, and the platform’s Total Value Locked (TVL) has reached a new high of $50 million. Taken together, these indicators serve as metrics for platform health and its potential for sustained growth.

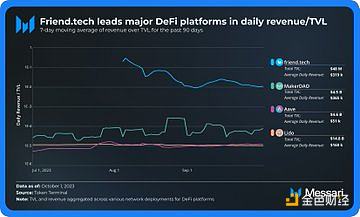

6. Friend.tech’s average daily revenue is approximately $320,000. From some perspectives, this is 6 times the daily revenue of OpenSea.

7. From a broader perspective, since its launch, Friend.tech’s daily revenue/total revenue ratio has exceeded that of DeFi giants like Lido, Maker, and Aave by over 100 times.

8. The revenue/TVL ratio not only indicates a well-executed business model optimization but also serves as a predictive indicator of the platform’s ability to generate sustainable revenue.

9. Although Friend.tech has a high revenue/TVL ratio, does this truly indicate the long-term sustainability of its attractiveness and fee model? Or does it suggest that Friend.tech is just getting started and has yet to address upcoming scalability and sustainability challenges?

10. Friend.tech’s revenue structure is based on a 10% transaction fee, with half of it going directly to content creators on its platform. So far, creators have earned a total of 11,000 ETH, approximately $18 million, through user purchases of their keys.

11. Expenditure on a per-user basis has significant variability, with a median of 0.04 ETH and a maximum value of about 250 ETH.

12. Unlike traditional platforms where content pricing is essentially guesswork, Friend.tech allows the market to dynamically determine value, potentially bringing fairer compensation to creators. However, this also presents challenges for creators accustomed to traditional subscription models.

13. The average monthly subscription fee for entry-level creators ranges from $5 on platforms like Substack, LianGuaitreon, Twitter, and Twitch, to $10-14 on OnlyFans. For these creators, according to the current joint curve, migrating to friend.tech will result in most of their subscribers being excluded after 7 keys.

14. Concerns about the future airdrop of friend.tech persist. Although current engagement and financial data look promising, maintaining this momentum is crucial.

15. The platform faces a dual challenge: effectively establishing its own position in the social networking field and continuously incentivizing high-quality creator content. Both are crucial for ensuring sustained user engagement and income stability.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can Web3 membership card connecting restaurants bring more repeat customers, with Blackbird invested by a16z?

- Coinbase discloses its own case How hackers penetrated layer by layer through social engineering

- 2023 Cryptocurrency Industry Hot Narratives and Current Situation (II) Inscriptions, Meme

- a16z Leading investment of $24 million in Blackbird when restaurants meet Web3

- 1kx Exploring the Design Space of Dynamic NFTs

- Web3 Weekly Financing Overview (9.25-10.1)

- Meng Yan ‘Reflection on the Blockchain Industry’—How can trust be generated and disseminated without relying on authority in the past decade?