Can Web3 membership card connecting restaurants bring more repeat customers, with Blackbird invested by a16z?

Can Web3 membership card boost customer retention, with a16z investing in Blackbird?Editor’s Note:

Recently, Web3 restaurant loyalty application Blackbird announced the completion of a $24 million Series A financing round, led by a16z Crypto, with participation from QED, Union Square Ventures, Shine, Variant, and multiple restaurant groups. This round of financing brings Blackbird’s total funding to $35 million, and the company plans to use this capital to expand its business. Blackbird focuses on establishing direct connections between restaurants and guests through loyalty and membership services. In addition to collecting customer dining preferences, it also rewards sign-ins with cryptocurrency. According to previous reports, in October last year, Blackbird completed a $11 million seed financing round, led by Union Square Ventures, Shine Capital, and Multicoin Capital, with participation from Variant, Circle Ventures, and IAC.

This article was first published after Blackbird completed a $11 million seed financing round.

- Coinbase discloses its own case How hackers penetrated layer by layer through social engineering

- 2023 Cryptocurrency Industry Hot Narratives and Current Situation (II) Inscriptions, Meme

- a16z Leading investment of $24 million in Blackbird when restaurants meet Web3

We have been actively entering the Web3 field. Although decentralized finance and digital art applications in Web3 are well-regarded, in real life, there are still many people who do not recognize or understand Web3, and do not know how Web3 can be integrated into their lives.

When we talk about the Web3 community, community activity and cohesion are widely recognized as the most promising areas. Therefore, we can consider recognition relationships in the mainstream application field of Web3 in the integration with real life. In our real life, the concept of “points” has become an important consideration factor for consumers using credit card payments. The Web3 approach has the opportunity to make “points” more seamless, more interoperable, and more valuable to consumers.

Today, I want to introduce a Web3 application called Blackbird, a payment, loyalty, and membership platform designed for restaurants. Its purpose is to solve a mainstream and even particularly challenging problem in the industry: how to deepen the relationship between restaurants and guests. This is because a stronger and more personalized relationship means greater loyalty. And loyalty translates into higher customer lifetime value, which means generating a large number of positive reviews and repeat customers.

There is currently very little information available about this startup, and it is planning to launch a trial version in 2023. The reason it has attracted attention is because the platform is founded by Ben Leventhal, who is a well-known figure in the foreign restaurant industry.

For the past 20 years, Ben Leventhal has been dedicated to building the future of the restaurant industry through technology. He is the co-founder and former CEO of Resy, an online restaurant reservation service company. Under his leadership, Resy was named one of Fast Company’s “Most Innovative Companies” in 2017 and 2019. Earlier, he co-founded and led Eater.com, a restaurant network website and brand under Vox Media. Whether you are a professional in the restaurant industry or a layman, Eater will provide you with comprehensive guidance, introducing you to the latest restaurant openings, each restaurant’s signature dishes, and analyzing restaurants with declining performance.

The products made by Ben Leventhal have always been well recognized in the industry. Eater was acquired by Vox in 2013, and Resy was acquired by American Express in 2019. As an entrepreneur, strategist, investor, and connoisseur, Ben continues to collaborate with chefs, restaurant brands, hotel management companies, and technology startups from around the world, while providing consulting for American Express’s global dining strategy.

About Blackbird, Leventhal said, “The focus should be on rewarding users for their dining frequency, dining expenditure, and loyalty-related aspects.” “Finally, we believe that these things will increase the lifetime value of individual consumers, and Blackbird will improve the entire restaurant business.”

The technology stack of Blackbird is still undecided, but Leventhal expects that Web3 components need to be abstracted to attract mainstream consumers.

“For the local audience of Web3, we hope that their enthusiasm for encryption can guide them to restaurants with specific use cases like Blackbird,” he added.

Other competitors in the industry

A few days ago, Blackbird raised $11 million in seed funding, led by Union Square Ventures, Shine Capital, and Multicoin Capital. As part of the investment, Fred Wilson, a partner at Union Square Ventures, will join the Blackbird board of directors. Other investors in this round of funding include investment firm Variant, the venture capital arm of USDC issuer Circle, and the digital products group IAC.

In fact, the combination of the restaurant industry and Web3 is not the first use case for Blackbird. For example, there have been several attempts:

-

FriesDAO

FriesDAO has raised millions of dollars through NFT sales. The DAO hopes to use it to purchase or invest in a fast food restaurant, but progress has been slow in actual execution.

-

Bored & Hungry

Bored & Hungry is a cryptocurrency-centric restaurant. Restaurant operator Andy Nguyen decided to use his Bored Ape #6184 as the central character to create a restaurant themed around bored apes. The restaurant is still in operation, although there have been some reports that the restaurant has stopped accepting cryptocurrency payments. Nguyen called these reports “fake news” and said that the restaurant continues to thrive (even occasionally seeing Snoop Dog).

-

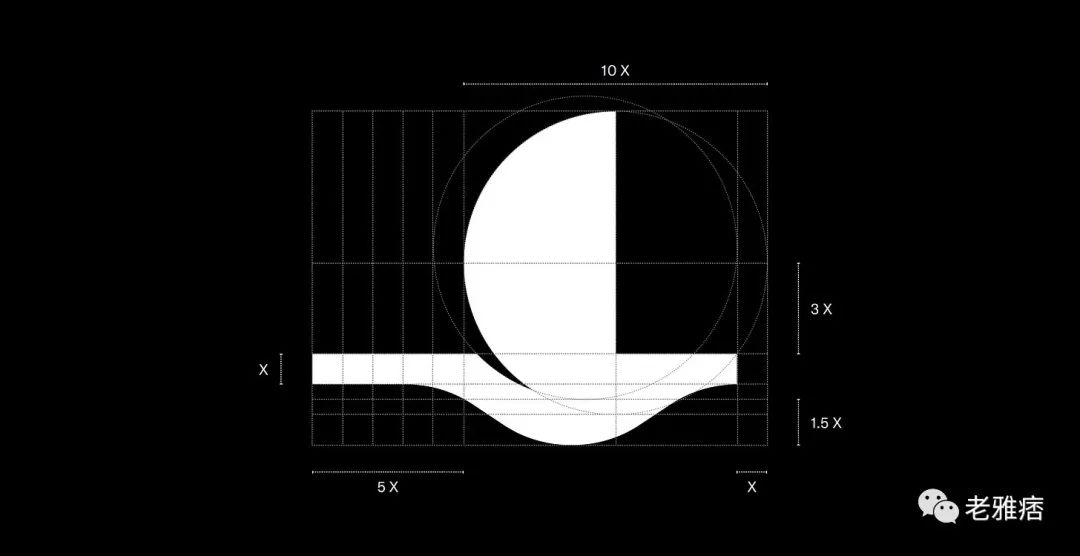

BurgerDAO

Last year, BurgerDAO was launched with the hope of building a burger shop that is completely centered around Web3. The idea is to raise funds through a treasury and collaborate with a kitchen operator. BurgerDAO was initially launched as a virtual restaurant, with the long-term plan of creating a physical BurgerDAO location.

However, these are all individual restaurants. Blackbird is more like a “companion” restaurant that aims to become a Web3 restaurant platform, bringing together multiple restaurants instead of being a single store. Devour is a Web3 platform similar to Blackbird.

Devour itself is not a restaurant concept but rather a collective that allows restaurants to attract customers, reward employees, and develop their brand through Web3 solutions. Its goal is to bring the restaurant world into Web3, creating its own blockchain token called DevourLianGuaiY. It aims to become the preferred token in the food and beverage industry and has launched a series of membership NFTs to put the most enthusiastic fans at the center of its customer engagement strategy, catering to the younger generation who value unique experiences rather than traditional promotions and discounts.

What does it mean for the food and beverage industry to embrace Web3? Simply put, it means harnessing the power of blockchain to attract and reward customers, accept payments, and collaborate with other vibrant Web3 communities. Through the use of NFTs and tokens, which are part of the encrypted industry’s loyalty system, this also means community membership that serves as a passport for customers to access unique experiences that a restaurant may choose to offer. By connecting restaurants with customers through membership and loyalty programs, it can create a closer relationship between consumers and restaurants and generate more transactions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 1kx Exploring the Design Space of Dynamic NFTs

- Web3 Weekly Financing Overview (9.25-10.1)

- Meng Yan ‘Reflection on the Blockchain Industry’—How can trust be generated and disseminated without relying on authority in the past decade?

- Is something with no elasticity in supply not suitable to serve as currency?

- Web3 Social Resurgence Who will be the next phenomenon-level application among friend.tech, Telegram, and others?

- Tether CTO reveals the truth about stablecoin reserves

- Vitalik’s New Article Explained in Detail Why ‘Adding Off-Protocol Functionality’ Is an Extremely Important Consideration Factor