Why is the central bank's blockchain patent ranked first in the world's central bank?

A few days ago, the Digital Currency Research Institute of the People ’s Bank of China reported in the article “Development and Management of Blockchain Technology”: “At present, the People ’s Bank of China has applied for a number of blockchain patents, ranking first in the world ’s central bank. Chain platform, as of December 17, 2019, there were 38 banks participating in the promotion and application of the platform, and the business volume exceeded 87 billion yuan. "

DC / EP: Central Bank Digital Currency

The People's Bank of China's Digital Currency Research Institute (SDI) is a direct institution established by the People's Bank of China in January 2017. It undertakes the central bank's digital currency (DC / EP) and financial technology in accordance with the national strategic deployment and the overall work arrangement of the People's Bank of China. R & D and standard planning.

According to SooPAT data, the Institute has published 65 patent applications, mainly involving digital currency payments and wallets. The central bank defines DC / EP as "a payment instrument with value characteristics". Unlike account-based payment transactions, mutual transfers between users do not need to go through the binding of the account. In a network-free environment through mobile devices The transaction is completed.

- Blockchain Industry Weekly Report | Central Bank Officially Releases "Technical Specifications for Financial Distributed Ledger Security"

- Eighth issue: insight into the major changes in financial infrastructure in the next 10 years (on)

- Financial giant Credit Suisse joins, Paxos launches blockchain-based securities settlement service

The issuance of DC / EP will inevitably have a profound impact on the pattern of international financial markets, but what is most relevant to us is the change in the shape of the currency. As the Swedish Central Bank, which recently piloted digital currency (e-krona), said, cash usage in Sweden has fallen sharply over the past decade, and the public has no national digital currency available.

According to the Statistical Report on the Development of the Internet in China, as of June 2019, China's Internet inclusive rate reached 61.2%, of which 621 million were online payment users, accounting for 73.4 of mobile Internet users, and DC / EP was used as the digitization of banknotes. Form, and its issuance will further expand financial inclusion.

In the "Development and Management of Blockchain Technology", the Digital Research Institute pointed out that "the payment service provided by the central bank cannot leave the centralized account arrangement and must be built on a centralized system. This is the decentralized nature of the blockchain. Conflicts. Therefore, it is currently not recommended to transform traditional payment systems based on blockchain ", that is, the use of the underlying technology of DC / EP is not blockchain technology. But at the same time, the Institute also said that it maintains technological neutrality, that is, it does not preset the DC / EP technical route. DC / EP is first wholesaled to commercial institutions by the central bank, and then issued by the commercial institutions to the public. In the process, commercial institutions can design and issue exchange technologies on their own.

Technical Specification for Financial Distributed Ledger

On February 23, the People's Bank of China officially released the Technical Specification for Financial Distributed Ledgers. This standard was proposed and drafted by the Digital Currency Research Institute of the People's Bank of China. The Department of Science and Technology, Industrial and Commercial Bank of China, Agricultural Bank of China, China The Bank, China Construction Bank, China Development Bank and other units participated in the drafting, aiming to standardize the application of distributed ledger technology in the financial field and improve the information security guarantee capabilities of distributed ledger technology.

The "Standard" specifies the security system of financial distributed ledger technology, including basic hardware, basic software, cryptographic algorithms, node communication, ledger data, consensus protocols, smart contracts, identity management, privacy protection, regulatory support, operation and maintenance requirements, and governance. Mechanism, etc. This standard is applicable to institutions engaged in the construction or service operation of distributed ledger systems in the financial field.

As early as June 2017, the Central Bank issued the "Thirteenth Five-Year Plan for the Development of Information Technology in the Financial Industry of China", stating that it will strengthen the research on basic blockchain technology and conduct research on the application of blockchain technology in the financial field. It also advocates the establishment and improvement of the financial industry standard system, the development of key standards, and the development of mandatory standards related to financial security. Establish a financial big data standard system, and study and formulate standards for the application of information technology such as cloud computing, big data, blockchain, and artificial intelligence in the financial industry.

In August 2019, the Central Bank released the "FinTech Development Plan (2019-2021)", which clarified the need to formulate distributed database financial application standards and specifications, and clarify management requirements in terms of technical architecture, security protection, and disaster recovery. Ensure that distributed databases are securely applied in the financial sector. For the application of information technology in the financial industry, establish and improve a unified national certification mechanism, further strengthen the security management of fintech innovative products, promote the implementation of financial standards, and effectively improve the quality and security of financial services.

The establishment of the "Standard" will guide the standardized and orderly development of the blockchain industry, which will help maintain market order and financial stability, and promote the healthy and orderly development of the industry. In addition, the Institute has also actively participated in the development of relevant rules of international financial standard-setting organizations such as the International Bank for Settlement (BIS) and the Financial Stability Board (FSB), and also participated in the International Organization for Standardization (ISO) and the International Telecommunication Union (ITU). Such as the development of blockchain standards, China's right to speak internationally and develop rules in the field of financial blockchains is enhanced.

Central bank digital bill trading platform

The blockchain has the cost of synchronous storage and co-calculation of a large amount of redundant data, sacrificing system processing efficiency and some customer privacy, and is not yet suitable for high-concurrency scenarios such as traditional retail payments. However, blockchains have been widely used in areas that require high levels of trusted information sharing and low concurrency requirements, such as transaction settlement, trade finance, and property rights transfer. In addition to the central bank's digital currency, which has received much attention, the Institute also actively promotes the application of blockchain technology in financial fields such as transaction settlement and trade finance.

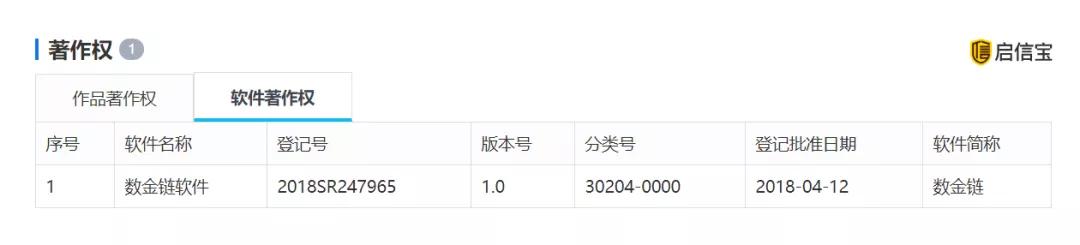

In 2017, the Shanghai Stock Exchange (XIE) and the Digital Research Institute jointly led the work related to the construction of a digital note trading platform based on blockchain technology. The platform was successfully launched on the YEX on January 25, 2018. And test run. According to Qi Xinbao's public data, the Institute of Digital Applications applied for a software copyright named "Digital Golden Chain" on April 12, 2018.

Subsequently, the chairman of the ticket exchange in Song Hanguang's article "Application of Blockchain in Digital Bills" pointed out: "The experimental production system of digital bill trading platforms uses SDC (SmartDraft Chain) blockchain technology. Cryptographic algorithms such as state encryption and zero-knowledge proofs are used for privacy protection. Consensus is implemented through the practical Byzantine Fault Tolerance Protocol (PBFT), and data monitoring is provided through the see-through mechanism. "According to this, it is known that the digital bill trading platform is established in the Institute of Digital Research Institute Blockchain application platform on the chain "Several Gold Chain".

The ticket circulation involves many participants, and there are phenomena such as "empty tickets", "counterfeit tickets", and "fake lists". The distributed and non-tamperable nature of the blockchain makes this technology and the upgrade and optimization of the ticket market and Its fit. Compared with paper bills and electronic bills, digital bills are more secure and transparent, improving the lack of credit and distortion of information in the bill market.

In the transaction of digital bills, various institutions use digital currencies for settlement. When the digital bill platform was launched, ICBC, Bank of China, SPDB and Hangzhou Bank successfully completed digital bill issuance, acceptance, discount and rediscount services based on blockchain technology on the digital bill trading platform using DC / EP digital currency. The successful implementation of the whole process of digital bills marks the successful application of digital currency and blockchain technology in real bill transaction scenarios.

Yao Qian, former director of the Institute of Digital Research, said: "The construction of digital bills with the help of blockchain is essentially an alternative to the construction of existing electronic bills and realizes point-to-point transfer of value. If digital currency can be used in the alliance chain, it can be achieved On-chain clearing, the participants complete the payment operation by sending central bank digital currency to counterparties. If the offline physical currency funds are still used for settlement, the advantages based on the blockchain can be greatly reduced. "

Di Gang, the deputy director of the Institute of Digital Data, published a paper in "The Chinese Financier" that the new blockchain-based digital bill platform enhances business transparency and enhances regulatory efficiency, and can support business within the scope of the bill law and related systems. Pilot innovation. At the same time, he pointed out that similar to other technologies, blockchains need long-term evolution in technological progress and development, and will gradually improve with the deepening of applications. With the development of cross-chain technology, it will help the digital bill business to interconnect with other blockchain platforms in the future and build a new infrastructure for the digital economy.

Central bank trade finance blockchain platform

At the financial level, the central bank has also applied blockchain technology in the field of supply chain finance. The central bank launched a central bank trade finance blockchain platform jointly created by a number of listed companies. It was officially launched in Shenzhen on September 4, 2018. Create an open and shared trade and financial ecology facing the country and the world.

Small and micro enterprises contribute more than 60% of China's GDP, more than 50% of tax revenue, and 80% of urban employment. They are an important part of our economy. However, for a long time, the problems of difficult and expensive financing for small, medium and micro enterprises in China have not been fundamentally solved. The difficulty of financing small enterprises lies in the fact that in the early stage of development of small and micro enterprises, financial management and other aspects are not very standardized. For financial institutions, the credit accumulation of small and micro enterprises lacks data and has low credibility. And banks need to spend a lot of time verifying the authenticity of trade information, and they need to consider the risk of repeated financing of the same material between different banks. The non-communication of information between banks also greatly increases the cost of supervision and inspection.

With the immutability and traceability of the distributed ledger technology of the blockchain, the central bank's trade finance blockchain platform effectively avoids data fraud and arbitrage, establishes a credible financing environment between banks and small, medium and micro enterprises to reduce financing costs and improve financing efficiency. The central bank's trade finance blockchain platform records the core documents and key processes of trade financing, "reliably" connecting all aspects of trade together, realizing full-course supervision and traceability, and ensuring the transparency and security of trade financing.

A person in charge of Ping An Bank's Transaction Banking Division said: "In the past, a small amount of financing for small and medium customers could reach 7% -8% in a trade financing. Now, under this model, the price may drop to 6%, or even 5.5%. In addition, "In the past, a loan lasted 2 to 3 weeks, and now it can be done within days." If the information is complete, it takes only about 20 minutes from the time the customer submits the loan application to the bank to complete the loan, which greatly shortens the financing time and improves This improves financing efficiency and reduces financing costs for SMEs.

Different from traditional banks' independent trading platforms, the central bank's trade finance blockchain platform is an open system that allows different banks to implement data circulation and query on the same platform and reduce the cost of collaborative communication between banks. As of December 17, 2019, there were 38 banks participating in the promotion and application of the platform, and the business volume exceeded 87 billion yuan.

Di Gang, Deputy Director of the Institute, said: "The central bank's trading platform is positioned as a financial infrastructure that provides public services for trade finance. It is neutral, professional, and authoritative. It can provide financial institutions with real trade finance protection and reduce data. Obtain the threshold. As the official platform for the application of blockchain technology, it has been widely recognized by financial institutions and enterprises. "

In the field of blockchain finance, the transformation of blockchain technology to traditional finance is reflected in reducing costs, improving efficiency, and monitoring security. The central bank's digital bill trading platform and trade finance blockchain platform have significant benefits in financial innovation. According to business analysis, blockchain technology is used in financial scenarios with low transaction frequency and low turnover rate, and DC / EP in the payment field. There is currently no blockchain technology involved. Not all projects require a blockchain. At this stage, blockchain technology is still immature, and at the same time faces multiple challenges such as performance, security, standards, and compliance. Enterprises should consider blockchain and business before using blockchain. Scenario fit and compliance issues, using blockchain technology in practice. The central bank's forward-looking layout in the field of blockchain is both policy-oriented and the actual market demand.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Sweden starts testing digital currencies! Can the central bank digital currency become a "killer" application of the blockchain?

- CCB was shortlisted for the Forbes Global Blockchain Top 50 for the first time and has already operated 9 blockchain projects

- NFT: another path for blockchain to land

- Getting Started with Blockchain | How does the technology-less "coinless blockchain" add icing to the Internet?

- Digital asset custody company BitGo enters the digital securities field through acquisition of Harbor

- Viewpoint | Incremental decentralization, decentralized and gradual approach

- Blockchain weekly developments of listed companies (2.10-2.14): 5 companies have made progress